The CME Comex is the Trade the place futures are traded for gold, silver, and different commodities. The CME additionally permits futures consumers to show their contracts into bodily steel via supply. You could find extra element on the CME right here (e.g., vault sorts, main/minor months, supply rationalization, historic information, and so forth.).

The information beneath appears at contract supply the place the possession of bodily steel adjustments arms inside CME vaults. It additionally exhibits information that particulars the motion of steel out and in of CME vaults. It is extremely doable that if there’s a run on the greenback, and a flight into gold, that is the information that may present early warning indicators.

Gold

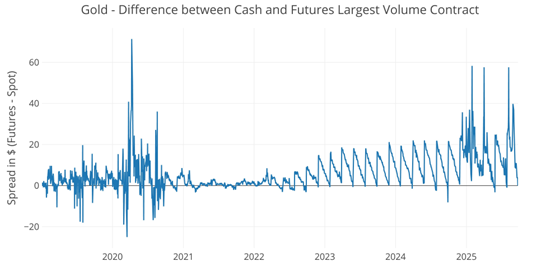

The Comex noticed unprecedented supply quantity in gold after the election as highlighted in earlier articles. This was pushed by an arbitrage between the spot and futures market. That arbitrage has now fallen again to regular, although did see a quick spike on August twenty ninth.

Determine: 1 Spot vs Futures

Consequently, the huge supply quantity has subsided. Nevertheless, the present supply quantity remains to be elevated when in comparison with historical past exterior of the start of this 12 months. September has seen over 8k contracts stand for supply (+$3B in gold deliveries),

Determine: 2 Latest like-month supply quantity

Web new contracts (contracts that open and accept rapid supply) has fallen again according to latest tendencies.

Determine: 3 Cumulative Web New Contracts

Through the large supply surges, the Comex vaults added to their steel stockpiles in a short time. Nevertheless, for the reason that volumes have come down, the steel accessible for supply noticed a drop earlier than seeing one other uptick.

Determine: 4 Stock Information

Looking forward to the October supply, gold is definitely trending above final October. October is a really odd month as a result of it’s neither a real main month (contracts exceeding 300k) or minor month (contracts underneath 20k). It at the moment has 39k contracts excellent with 2 days left for supply. What makes this attention-grabbing is that final October noticed 19k contracts open with 2 days remaining. Because of this this October is seeing double the open curiosity in comparison with an identical time final 12 months.

Determine: 5 Open Curiosity Countdown

With the huge surge in stock, the open curiosity relative to bodily shares is definitely decrease. This exhibits how a lot steel has been added to Comex vaults this 12 months.

Determine: 6 Open Curiosity Countdown %

Backside line, gold costs stay sturdy together with supply quantity.

Silver

Silver is a serious month in September. Whereas supply quantity was beneath March and Could, it’s properly above the quantity in July.

Determine: 7 Latest like-month supply quantity

Web new contracts have been a big driver, exceeding latest tendencies by a large margin.

Determine: 8 Cumulative Web New Contracts

Silver eligible inventories are rebounding to the degrees seen earlier this 12 months as supply quantity stays elevated.

Determine: 9 Stock Information

Registered stays elevated.

Determine: 10 Stock Information

As we strategy October (a minor month), the silver contract has popped because the supply interval approaches.

Determine: 11 Open Curiosity Countdown

On a relative foundation, open curiosity is in a standard vary, however that’s solely due to the elevated stock ranges.

Determine: 12 Open Curiosity Countdown %

Conclusion

The craziness we noticed earlier this 12 months in gold has subsided. As a consequence of arbitrage alternatives and tariff hypothesis, bodily steel was being flown around the globe as astute buyers tried to capitalize on these alternatives.

Whilst these arbitrage alternatives have dissipated, the supply quantity has remained sturdy as has the value.

Each gold and silver are climbing greater day after day, however the technical evaluation is just not displaying a frothy or over-bought market. This can be a stealth bull market which suggests it nonetheless has room to run. If silver slices via its all-time excessive of $50 then it may see one other main leg greater. That top has stood since 1980, was challenged for a single day in 2011 earlier than dealing with a vicious bear market. If it breaks via and holds, it may start a completely new paradigm in silver. Watching the bodily market will present key insights, so keep tuned!

Obtain SchiffGold’s key information tales in your inbox each week – click on right here – for a free subscription to his unique weekly e-mail updates.

Concerned about studying the best way to purchase gold and purchase silver?

Name 1-888-GOLD-160 and communicate with a Valuable Metals Specialist right this moment!