The CME Comex is the Trade the place futures are traded for gold, silver, and different commodities. The CME additionally permits futures consumers to show their contracts into bodily metallic via supply. You could find extra element on the CME right here (e.g., vault sorts, main/minor months, supply rationalization, historic knowledge, and so on.).

The info under seems at contract supply the place the possession of bodily metallic modifications palms inside CME vaults. It additionally reveals knowledge that particulars the motion of metallic out and in of CME vaults. It is extremely potential that if there’s a run on the greenback, and a flight into gold, that is the information that can present early warning indicators.

Gold

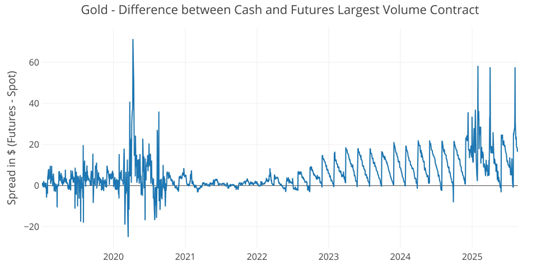

The Comex noticed unprecedented supply quantity in gold after the election as highlighted in earlier articles. This was pushed by an arbitrage between the spot and futures market. That arbitrage has now fallen again to regular, although did see a quick spike on August seventh.

Determine: 1 Spot vs Futures

Consequently, the huge supply quantity has subsided. Nevertheless, the present supply quantity continues to be elevated when in comparison with historical past outdoors of the start of this yr. August has seen 33k contracts stand for supply (~$10B in gold deliveries),

Determine: 2 Current like-month supply quantity

A significant driver this August has been internet new contracts. The variety of contracts opened for fast supply trails solely February of this yr.

Determine: 3 Cumulative Web New Contracts

Through the huge supply surges, the Comex vaults added to their metallic stockpiles in a short time. Nevertheless, for the reason that volumes have come down, the metallic out there for supply noticed a drop earlier than seeing a minor uptick.

Determine: 4 Stock Knowledge

Waiting for the September supply (a minor supply month), gold is definitely trending nicely under the common.

Determine: 5 Open Curiosity Countdown

With the huge surge in stock, the open curiosity relative to bodily shares is even decrease.

Determine: 6 Open Curiosity Countdown P.c

Regardless of this down pattern heading into September, the story shouldn’t be over. Gold costs stay elevated suggesting demand continues to be very excessive.

Silver

Silver is a minor month in August. Much like gold, this August noticed elevated volumes in comparison with historical past, however not in comparison with the newest months.

Determine: 7 Current like-month supply quantity

Web new contracts weren’t a significant driver.

Determine: 8 Cumulative Web New Contracts

Silver eligible inventories gave again the beneficial properties from earlier this yr, earlier than seeing a light rebound.

Determine: 9 Stock Knowledge

Registered stays elevated.

Determine: 10 Stock Knowledge

As we strategy September (a significant month), the silver contract has stayed in a decent vary close to the common.

Determine: 11 Open Curiosity Countdown

On a relative foundation, open curiosity is definitely fairly low due to how a lot the Comex has restocked silver inventories.

Determine: 12 Open Curiosity Countdown P.c

Conclusion

The craziness we noticed earlier this yr has subsided. As a result of arbitrage alternatives and tariff hypothesis, bodily metallic was being flown world wide as astute buyers tried to capitalize on these alternatives. The impact was to drive up the value of gold; nevertheless, after the exercise subsided, gold has held onto its value beneficial properties. Silver has continued to see value appreciation because it catches as much as gold.

Earlier this yr we noticed a glimpse of what would possibly occur if there have been actually a mad sprint to hoard bodily metallic. This time, it regarded managed and was performed particularly for arbitrage, not as a result of individuals feared a collapse of the fiat forex.

That might change very quickly. Trump is enjoying an extraordinarily harmful recreation with the Fed which is already a really harmful establishment. If Trump stacks the Fed and has them doing his bedding over the following 3.5 years, you may anticipate to see an enormous fall in confidence within the greenback, greater inflation, and MUCH greater gold and silver costs. This bull market in treasured metals continues to be unloved and has solely simply begun.

Name 1-888-GOLD-160 and converse with a Treasured Metals Specialist right this moment!