Expensive BoF Neighborhood,

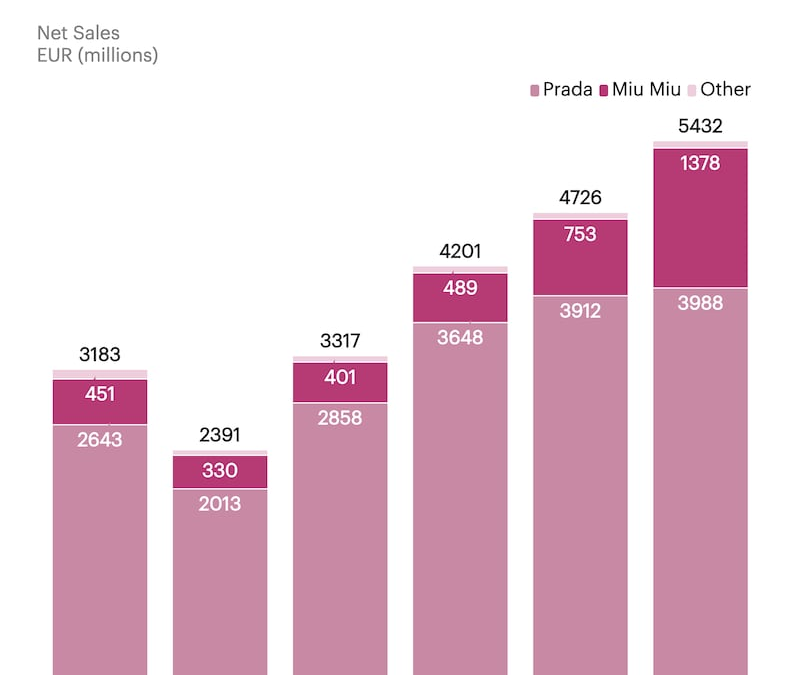

On Tuesday, Prada reported its 2024 outcomes, with web revenues up 18 p.c for the yr ended December 31, beating market expectations by 2 p.c. Gross sales at Miu Miu — as soon as seen as Prada’s secondary, “little sister” model — soared by 83 p.c, with greater than €1.3 billion in web gross sales. The group additionally improved profitability, increasing its EBIT margin to 23.6 p.c, in step with analyst forecasts.

That this sturdy efficiency was delivered amid a difficult luxurious market is much more spectacular, reflecting the continuing professionalisation of the group below the management of CEO, Andrea Guerra, in addition to the constant artistic power of Miuccia Prada and Raf Simons, her co-creative director on the Prada model, which has now managed to rework its trend authority into enterprise success.

Issues couldn’t have been extra completely different just some years in the past. Whereas Prada was extremely revered by trend insiders for its creativity, its enterprise efficiency lagged the broader luxurious sector, rising web gross sales at solely 3 p.c between 2017 and 2018. With EBIT margins of 10 p.c, Prada lagged the large French teams LVMH and Kering, whereas the Miu Miu model was sub-scale and didn’t have a transparent and distinctive market positioning versus Prada.

Since then, the enterprise has gone by a big overhaul that has made it the envy of the business. Sensible succession planning with the arrival of Raf Simons and Lorenzo Bertelli, son of Mrs Prada and her husband Patrizio Bertelli, helped the market to imagine within the long-term way forward for the model. Since Guerra’s arrival in 2023, he has constructed trusted relationships with the model’s house owners and likewise helped to carry strategic and operational self-discipline to the enterprise.

May Prada Group now carry the identical artistic and business magic to Versace?

One of many actually untapped icons of the Italian luxurious sector, Versace has been a part of Capri Holdings since 2018 when the American group acquired the enterprise for €1.8 billion (about US$2.1 billion on the date of the announcement) with the acknowledged aim of rising the enterprise from $850 million to $2 billion in annual gross sales.

However seven years later, Capri is reeling after its proposed merger with Tapestry was blocked by the US Federal Commerce Fee final yr, and Versace has simply barely breached the $1 billion income mark, having reported a contraction in income in fiscal 2024. Capri has reportedly been attempting to promote Versace and Prada is in pole place to accumulate the model, having entered a interval of unique due diligence on the enterprise at an agreed price ticket of €1.5 billion (about $1.6 billion), in keeping with Bloomberg.

With a lot going proper at Prada, why would the group need to add a troubled model into the combination?

For one, an acquisition might assist to drive development, including about $1 billion in annual revenues to the Prada Group, offering additional scale to compete with the large luxurious teams. Versace’s core maximalist aesthetic with its Medusa brand and iconic prints is complementary to that of minimalist Prada and youthful Miu Miu, so the manufacturers wouldn’t compete with one another.

However Prada has tried and failed to accumulate and scale manufacturers earlier than. In 1999, the group went on a shopping for spree, shopping for controlling stakes in Jil Sander and Helmut Lang, solely to divest of those companies later after they didn’t scale.

These acquisitions turned out to be untimely as a result of Prada’s personal home wasn’t so as. The pondering now could be that the group has a extra scalable infrastructure and platform upon which to scale different manufacturers. It might lend its operational experience in manufacturing, advertising and marketing and retail to show Versace round, similar to it has performed for Prada and Miu Miu.

Nonetheless, a Versace acquisition would nonetheless be very dangerous enterprise for Prada. Whereas Miu Miu is a homegrown model that shares a designer with the Prada model, Versace is a model from the skin with its personal particularities and idiosyncrasies, making a profitable post-merger integration and enterprise turnaround far more difficult.

Income for Versace in the latest quarter of fiscal 2025 was $193 million, down 15 p.c year-on-year and registering an working lack of $21 million. Plus, a lot of Versace’s present income combine will not be from high-quality sources like direct retail, and as an alternative comes from off-price channels and licensing (in denim, eyewear, fragrances, jewelry, watches and residential furnishings) estimated to do $2 billion in retail income.

To additional complicate issues, artistic director Donatella Versace’s contract with Capri is alleged to run out imminently, although sources have advised BoF that Dario Vitale who previously labored because the right-hand to Miuccia Prada at Miu Miu, is taking up a senior design function at Versace, which may very well be a plus.

However Prada’s time, consideration and cash would possibly derive a greater return from specializing in additional rising its personal manufacturers, particularly Miu Miu. A lot of the current development that Prada Group has registered has come whereas holding the variety of shops regular. There’s now a chance to improve current shops and develop the retail footprint whereas different manufacturers within the business are scaling again. Now may be the time to safe some prime places.

Ultimately, the viability of any deal will rely on the worth Prada can safe for Versace. Similar to shopping for a house that requires a critical improve, if Prada can get a very whole lot then it might be well worth the threat to take the time to renovate Versace. However given all of the uncertainty, €1.5 billion seems like too excessive a value to pay.

Make amends for all of our studies from Paris Vogue Week by Angelo Flaccavento and Tim Blanks, together with as we speak’s evaluate of Sarah Burton’s Givenchy, in addition to Haider Ackermann’s debut for Tom Ford, and skim my prime picks from all of our evaluation and reporting from the week passed by.

Imran Amed

Founder and Editor-in-Chief

Listed here are my different prime picks from our evaluation on trend, luxurious and wonder:

1. With Trump’s Tariffs, It’s the Uncertainty That Stings the Most. The brand new tariffs and fixed reversals have knocked international companies off steadiness and left them straining to regulate to a mercurial new actuality.

2. Ackermann and Ford: A Deliciously Harmful Liaison. Haider Ackermann talks in-depth to Tim Blanks about his debut for Tom Ford and the delicate sensuality behind the model’s new path.

3. Sarah Burton’s Givenchy Debut: First Rules Take Flight. Almost 75 years after Hubert de Givenchy confirmed his first assortment in Paris, Tim Blanks talks in-depth to Burton about her goal to revive the home’s fortunes by going proper again to the start.

4. Paris’ Printemps Is aware of What’s Lacking From American Retail. The French division retailer chain will open its debut US outpost in Manhattan’s Monetary District this month, specializing in meals and beverage choices as a lot as garments. ‘We wish individuals to hang around and be misplaced a little bit right here,’ CEO Jean-Marc Bellaiche stated. Will or not it’s sufficient to outlive New York’s aggressive multi-brand panorama?

5. ‘Purchase Canadian’ Turns into a Magnificence Rallying Cry as Trump’s Tariffs Loom. Canada’s export-driven magnificence startup scene is responding to the specter of tariffs with a newfound product patriotism.

This Weekend on The BoF Podcast

The writer has shared a Podcast.You’ll need to simply accept and consent to using cookies and comparable applied sciences by our third-party companions (together with: YouTube, Instagram or Twitter), with a purpose to view embedded content material on this article and others chances are you’ll go to in future.

Born in Sardinia on a crusing boat to self-described “adventurous” dad and mom, Francesco Risso grew up in an setting that fostered independence, spontaneity and a deep must create. After youth at Polimoda, FIT and Central Saint Martins — the place he studied below the late Louise Wilson — he joined Prada, studying firsthand the best way to fuse conceptual exploration with a product that resonates in on a regular basis life.

Now at Marni, Risso continues to embrace a technique he likens to an artist’s studio, championing daring experimentation and surrounding himself with collaborators who push one another to new heights of creativity.

“Creativity is … in the way in which we give like to the issues that we make after which we give to individuals. I really feel I don’t see a lot of that love round,” says Risso. “We have now to inject into merchandise a robust and exquisite sense of creating. That requires craft, it requires abilities, it requires quite a lot of fatigue, it requires self-discipline.”

Risso joins BoF founder and CEO Imran Amed to discover how his unconventional childhood formed his artistic method, why self-discipline and craft stay very important to trend, and the way significant collaboration can broaden the boundaries of what’s doable.