One other month goes by, and the Fed’s 2% inflation goal stays a distant paradise. Though inflation has truly elevated by some metrics, the Fed has nonetheless fired up the cash printers, revealing it cares extra about political ends than holding costs secure.

The following article was initially revealed by the Mises Institute. The opinions expressed don’t essentially replicate these of Peter Schiff or SchiffGold.

The Federal Reserve is about to decrease the goal coverage rate of interest this week regardless of the truth that worth inflation rose once more in August. The Fed has, for a few years, insisted that it’s equally dedicated to each side of its so-called “twin mandate” of pursuing each “worth stability” and most employment. But, the Fed is more and more displaying that worth inflation isn’t even one of the central financial institution’s chief issues. If the Fed cuts the goal federal funds price on Wednesday, we are going to know that what actually issues for the Fed isn’t worth inflation. What actually issues the Fed is making certain the Treasury has entry to low-cost credit score whereas trying to assist the administration politically by briefly driving up employment numbers with ever larger ranges of financial inflation.

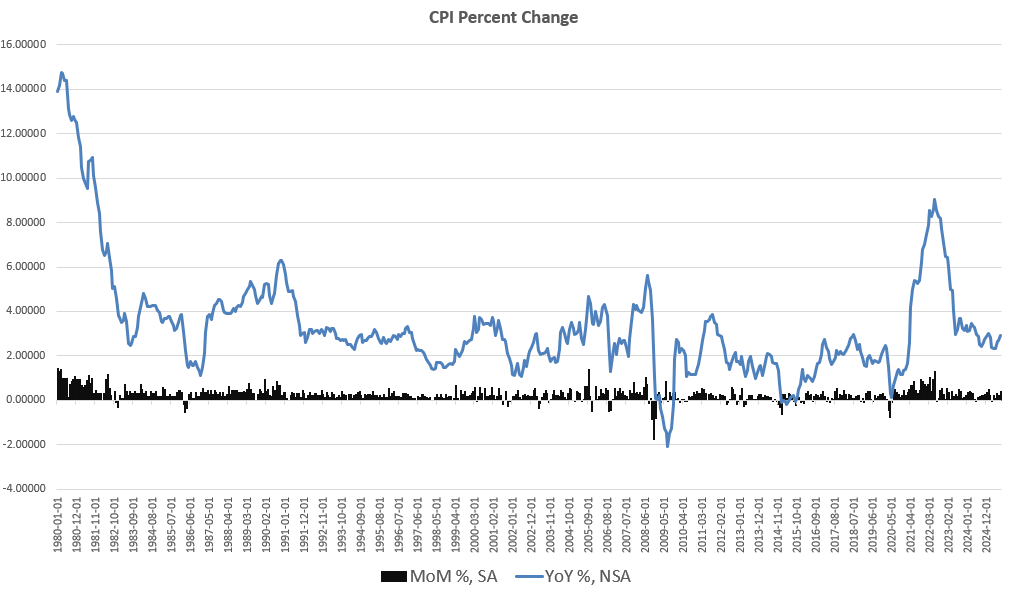

CPI Inflation Rose in August

In response to the newest client worth index (CPI) report from the US Bureau of Labor Statistics, the CPI rose in August by 2.9 p.c, 12 months over 12 months. That’s an eight-month excessive. Throughout July of this 12 months, the CPI year-over-year improve was 2.7 p.c. When put next month over month, the CPI rose in August by 0.38 p.c, which was additionally an eight-month excessive. Month over month, CPI inflation rose in July by 0.19 p.c.

In different phrases, worth inflation accelerated throughout August, coming in on the highest charges since January of this 12 months.

Seeking to core CPI inflation, which excludes risky meals and vitality costs, the state of affairs was no higher. 12 months over 12 months, the CPI rose by 3.1 p.c, a seven-month excessive, and above July’s improve of three.05 p.c. Month over month, the CPI rose in August by 0.34 p.c, an eight-month excessive. This put core CPI even farther from the Fed’s arbitrary goal of two p.c.

The most recent CPI numbers additionally replicate the pattern within the Fed’s most well-liked inflation measure: private client expenditures (PCE). August knowledge isn’t but accessible for PCE, however July’s PCE report confirmed the PCE rising by 2.6 p.c, 12 months over 12 months. The core PCE was no higher with a July studying of two.9 p.c, which had accelerated above June’s core PCE progress price of two.8 p.c.

Why has worth inflation been so sticky following 2022-3, which noticed 40-year highs in worth inflation? A part of the reason being the Fed turned dovish lengthy earlier than worth inflation had returned to the Fed’s two-percent goal. Final fall, within the waning days of the 2024 presidential election, the Fed started a sequence of recent cuts to the federal funds price in September, whereas claiming that the US labor market was “strong.” It was extensively suspected that the interest-rate minimize was being executed for political causes, to facilitate financial stimulus to assist the incumbent political social gathering win re-election. To counter these accusations, Fed Chairman Jerome Powell claimed that worth inflation was rapidly returning to the two-percent goal, and the Fed may minimize rates of interest with none hazard of reigniting inflation. The Fed was clearly incorrect. A 12 months later, core CPI inflation is larger now than it was when Powell declared victory over worth inflation.

The Fed Has By no means Been Centered on Combatting Value Inflation

Common readers of mises.org already know, after all, that the central financial institution isn’t now, and has by no means been, truly dedicated to controlling worth inflation. In any case, the central financial institution was created to facilitate financial inflation, and that inevitably results in worth inflation, in the end.

Within the current context, if the central have been dedicated to decreasing worth inflation, it might, on the very least, cease utilizing financial inflation to buy belongings. Since 2008, for instance, the Fed has bought greater than 5 trillion {dollars} in mortgage-backed securities and Treasuries. The Fed did this with newly “printed” cash which means that these asset purchases have, since 2008, created practically one-fourth of all the present cash provide. This has translated into a lot of the value inflation that’s presently making life unaffordable for thus many People. The Fed does this to make sure ongoing asset-price inflation for rich asset house owners and the Fed’s Wall Avenue allies.

The Fed’s minimize to the federal funds price final fall, which was clearly politically motivated, was one other glimpse into one of many Fed’s true precedence: utilizing financial stimulus to favor the ruling regime.

So, it’s protected to say that the central financial institution is actually not dedicated in precept to combatting worth inflation. Nonetheless, if the Fed once more cuts its coverage rate of interest this week, the Fed can be abandoning even its performative opposition to cost inflation during which the Fed claims to be “dedicated” to returning worth inflation to its two-percent aim.

Not solely is client worth inflation accelerating properly above two p.c within the August report, in accordance with the federal authorities’s personal knowledge, however asset costs additionally proceed to surge. As one observer on X/Twitter famous final week, asset costs stay sturdy with house costs, gold, bitcoin, and the S&P 500 all close to all time highs. But the Fed will doubtless go for extra financial inflation at its Wednesday assembly.

A part of the Fed’s ongoing lack of consideration to its alleged two-percent goal is because of important strain from the administration and from financial-sector activists who consider that an extra price minimize will additional gas asset worth inflation and extra employment. For instance, on Wednesday, Donald Trump declared that there was “No Inflation!!!“—by which he meant worth inflation—and demanded one other Fed price minimize. (Trump didn’t have as a lot to say in response to Thursday’s CPI report displaying rising worth inflation.)

What Powell and the Fed Will Say

If Trump and Wall Avenue are profitable in getting their demanded price minimize on Wednesday, we are able to anticipate extra financial inflation and extra upward strain on costs.

If the Fed cuts the goal price, Powell must give you an evidence for why the Fed is embracing less difficult cash whilst the value inflation price is shifting again up close to three p.c. Powell’s acknowledged rationale can be that the Fed is prepared to danger some further worth inflation if that’s what’s “crucial” to maintain the financial increase going. Furthermore, Powell and the Fed will keep that if the financial system is weakening, then it will reduce “inflationary pressures” general and worth inflation will go down in any case.

If solely it have been that simple.

First, trying to stimulate job progress with less difficult cash received’t truly produce financial energy. Actual financial energy comes from saving and funding. However, extra financial stimulus will, at finest, merely create the phantasm of accelerating demand as customers and consumers of belongings bid up costs with the additional cash that’s now sloshing round within the financial system. Employers will misread rising costs as financial energy after which rent extra employees. Until the central financial institution injects even extra financial stimulus—and does it repeatedly—it would quickly develop into obvious that there isn’t any financial energy backing up the easy-money fueled short-term demand.

So, why not simply preserve including extra financial stimulus again and again to maintain the financial system going? If financial stimulus truly works to create jobs, why cease doing?

The reply after all is that financial stimulus outcomes on rising costs for each belongings and client costs. We’ve been residing with asset worth inflation for a few years at this level, and it’s why for-sale homes have typically develop into unaffordable for first-time homebuyers whereas the typical age of house owners has been quickly growing. Furthermore, financial inflation in recent times produced the 40-year highs in worth inflation we’ve endured in recent times, with buying energy falling by practically 25 p.c in simply 5 years. This has been particularly devastating for strange savers, these on mounted incomes, and people who don’t already personal belongings.

In different phrases, a coverage of limitless employment stimulus by way of financial inflation is a coverage of mounting worth inflation and a falling lifestyle.

The one resolution to this—and the one method to permit strange individuals to regain a few of their buying energy—is to reject less difficult cash and to permit deflation to happen. Deflation would additionally assist to unravel 20-plus years of easy-money fueled malinvestment and monetary bubbles. Had been this to happen, the financial system would then be rebuilt alongside extra sustainable strains that conform to precise market demand, in distinction to the easy-money financial system of speculative manias that enriches rich asset-holders on the expense of strange individuals.

Sadly, we’re unlikely to see a lot precise deflation, though it’s badly wanted.

As a substitute, the central financial institution will proceed to drive down rates of interest as a part of its simple cash agenda. That is the other of what the central financial institution ought to do, which is to chorus from any additional intervention within the financial system. The Fed ought to cease shopping for belongings of any sort, and permit rates of interest to be set by {the marketplace} as a substitute of by central planners on the Treasury and on the Fed.

Because of this, asset costs would fall considerably, and the costs would quickly develop into extra inexpensive. It might additionally develop into doable once more for strange individuals to earn a good quantity of curiosity on strange financial savings as rates of interest regularly rose. In different phrases, the financial system would—for the primary time in many years—start to swing again in favor or strange savers, younger employees, and first-time house consumers.

Financing Federal Deficits: The Hidden Agenda Behind It All

There’s another excuse why the central financial institution received’t permit deflation and received’t permit rates of interest to rise considerably. Though the Fed by no means publicly admits this, a central objective of the Federal Reserve—and each different central financial institution—is to facilitate low-cost borrowing for the federal government. As we noticed final week, deficit spending in the US continues to mount whereas the overall measurement of the the federal debt speeds towards 40 trillion {dollars}. Furthermore, the US Treasury this 12 months faces a problem of refinancing greater than $9 trillion in US debt through the subsequent 12 months. With Treasury yields now at a lot larger ranges than they have been in recent times, refinancing at present rates of interest will add a large quantity of recent curiosity expense to for the federal authorities, because the dept-to-GDP ratio continues to climb to 120%. The administration actually needs to see the Fed drive brief time period yields again right down to ease the expense of large federal deficits.

The regime in Washington now faces a double menace: a worsening employment state of affairs and a worsening fiscal state of affairs. Washington thinks that the easiest way to deal with that is by way of much more simple cash. Prepare for the Fed to embrace a brand new cycle of financial inflation quickly.

Name 1-888-GOLD-160 and converse with a Treasured Metals Specialist right this moment!