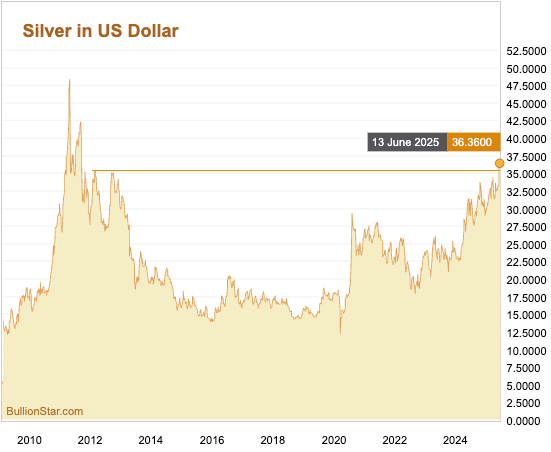

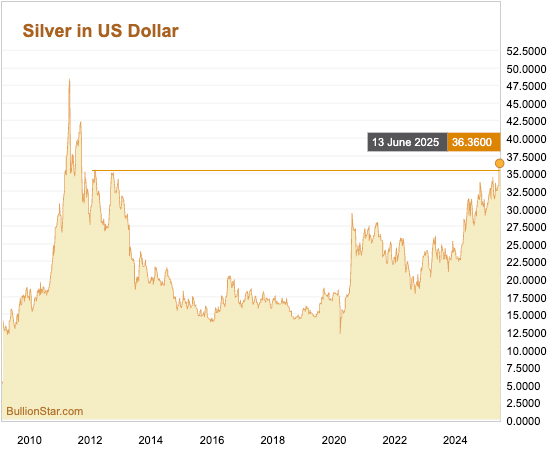

In a current BullionStar interview, Claudia Merkert spoke with Florian Grummes, founding father of Midas Contact Consulting, in regards to the evolving dynamics in valuable metals. With silver not too long ago breaking above USD 35 — a degree Grummes recognized as a part of a 13-year resistance zone — and gold getting into a consolidation part, he laid out a roadmap for traders navigating this quickly shifting panorama.

Silver Surges Above USD 35: A Structural Breakout

Silver has damaged by means of a 13-year resistance zone, climbing quickly in early June. Grummes famous that this breakout got here barely later than anticipated, however the energy of the transfer is critical. On a technical degree, he pointed to an “embedded tremendous bullish stochastic setup on the day by day chart,” suggesting that additional upside is probably going within the close to time period.

Traditionally, such breakouts in silver are likely to unfold over a number of weeks. In response to Grummes, a run towards USD 50 may very well be on the desk — particularly if investor demand accelerates. He acknowledged, nevertheless, that silver stays risky and overbought within the quick time period, and suggested traders to remain alert to any reversal indicators.

What makes this second totally different is the broader macro backdrop. Silver is now in its fifth consecutive yr of provide deficit, and new mining capability stays restricted. This mix of tight provide and rising demand is setting the stage for what Grummes believes may grow to be a multi-year structural revaluation of silver.

He additionally emphasised the psychological part of the market:

“Markets ultimately of the day are mass psychological phenomenons.”

As silver garners extra consideration, institutional and retail traders might start to reprice it extra significantly — not simply as a “poor man’s gold,” however as a key asset class in its personal proper.

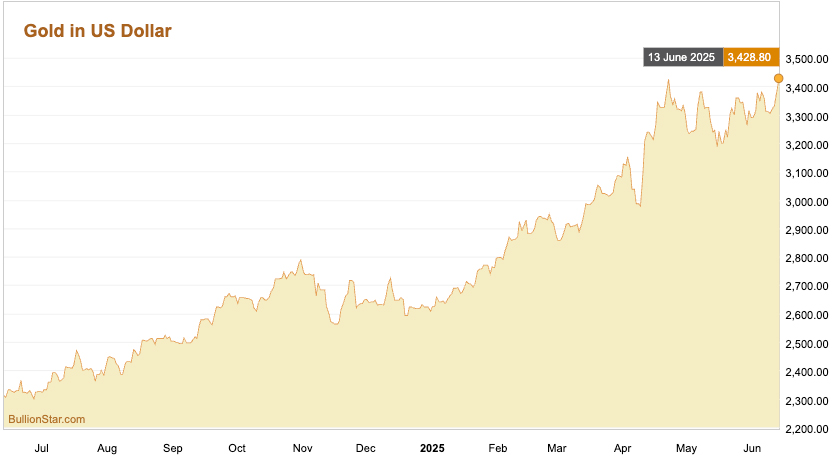

Gold Takes a Breather

Whereas silver is having fun with renewed momentum, gold has entered a multi-week consolidation part after peaking at USD 3,500 in April. Grummes described gold as “a bit bit drained” following a 15-month rally that started with a breakout above USD 2,070 in early 2024.

He famous that this pause is each pure and mandatory, particularly in gentle of seasonality. June and July are typically slower months for gold, and he expects a extra decisive transfer within the second half of the yr.

“We all know that June is a somewhat difficult month for the gold worth. Normally we get an vital turning level someplace in finish of June or throughout early mid July, after which we get a pleasant summer time rally for the steel costs.”

Importantly, Grummes nonetheless sees the general trajectory for gold as upward. He believes the subsequent worth goal of USD 4,000 is activated, and {that a} rally may resume within the coming months if gold can set up a strong base round USD 3,100 to USD 3,150.

Asset Allocation: How A lot Is Sufficient?

For traders questioning the best way to allocate their valuable metals holdings, Grummes provided a take a look at his private technique. He presently holds 50% gold, 40% silver, and 10% platinum throughout the valuable metals portion of his portfolio, which itself makes up about one-third of his whole web value.

His normal steerage for many traders is less complicated:

“Two thirds gold, one-third silver is an efficient rule of thumb, usually talking.”

He cautions in opposition to excessive overexposure, particularly amongst those that deal with valuable metals as the one viable retailer of worth:

“Gold bugs are likely to have the tendency to consider ultimately of the world and mistrust another funding. And then you definately usually see gold bugs having 100% allocation in valuable metals, which I believe is a bit bit questionable.”

That mentioned, he believes overweighting silver within the present surroundings is justifiable, significantly given its potential to catch up.

Don’t Simply Stack — Plan Your Exit

Whereas many traders obsess over timing their entry level, Grummes emphasised that exits are much more crucial to long-term success.

“Folks at all times are centered on the very best entry. However the vital factor is the exit.”

He warns that parabolic strikes in silver could also be short-lived. A fast surge to USD 500, as an example, may simply as rapidly fall again to USD 150. Having a pre-defined exit technique is important to keep away from watching features evaporate.

“Right into a parabolic transfer, you’ll want to have a technique to take exits.”

Grummes recommends scaling out steadily and utilizing market psychology to your benefit, particularly in emotionally charged phases of a rally.

Complementary Belongings: Bitcoin and Gold

Grummes additionally addressed the rising intersection between crypto and valuable metals. He has lengthy adopted the Bitcoin-gold ratio and sees worth in managing publicity to each property.

“In the event you handle throughout these pullbacks to take a seat in gold, great, as a result of then the last word objective is to have extra ounces of gold and extra Bitcoin mixed.”

The important thing, he says, is to not view them as rivals:

“If you’ll be able to see that gold and Bitcoin complement one another, I believe you’re nonetheless far forward of many of the crowd which continues to be preventing that it needs to be both gold or needs to be Bitcoin, which doesn’t make sense.”

Emotional Resilience: The Hidden Ability

Past charts and ratios, Grummes confused the significance of emotional self-discipline. In a risky surroundings, it’s usually the investor’s mindset that determines success.

“Normally ultimately of the day you play the sport with your self.”

To remain grounded, he recommends journaling, time in nature, and meditation. These instruments may also help scale back noise, improve readability, and be certain that funding choices are pushed by technique somewhat than concern or euphoria.

In a market formed by momentum, macro shifts, and psychological strain, Grummes provides a well timed reminder: stack properly, however know when to step off the prepare. The subsequent few years may reshape how the world sees silver — and people ready with a plan will be the ones who profit most.