Gold is without doubt one of the oldest property in existence and one which “can’t be hacked, erased or degraded”. Whereas its value retains breaking data, few could know that its treasured metallic cousin silver has been mined extra all through historical past – by tenfold.

Some 154,000 tonnes of gold have been mined since data have been stored, in comparison with 1.5 million tonnes of silver.

In response to Our World in Knowledge, within the yr 1681 solely 6 tonnes of gold was mined – in 2015 that rocketed to three,100 tonnes. The World Gold Council says complete gold provide in 2023 elevated 3% year-on-year as mine provide and recycling each posted progress – to complete 4,898.8 tonnes.

Whereas silver has taken among the shine off gold in current months (as reported by Mining.com.au) at 1,037 tonnes bought, 2023 represented the second straight yr central banks added greater than 1,000 tonnes to complete reserves.

The yr 2022 marked the best report in many years, with central banks buying 1,136 tonnes of gold value US$70 billion, in response to The World Gold Council.

The gold value yesterday slipped to its lowest degree in about two weeks but all through historical past, the dear metallic has been an unparalleled long-term retailer of worth.

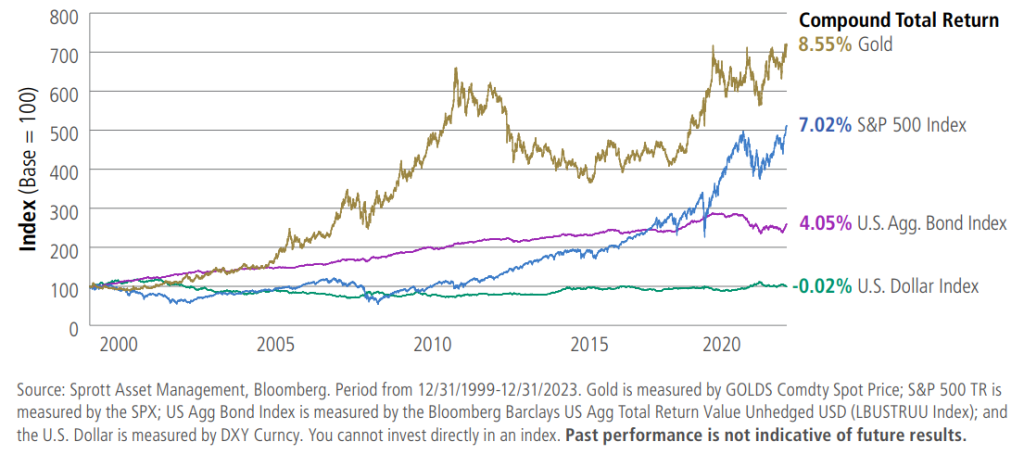

Sprott Asset Administration says gold has outperformed main asset lessons over the previous 23 years particularly, “traditionally enhancing returns and growing diversification”.

Within the wake of rampant geopolitical tensions, financial uncertainties, lingering inflation, and a heavily-anticipated US election, gold has continued its standing because the image of security and reassurance.

Earlier this month, this information service reported because the starting of 2024, the brilliant and dense metallic surpassed earlier report highs, ending the first quarter at about US$2,232 ($3,409.55) per ounce. Initially of the second quarter, gold reached a brand new all-time excessive of $3,511 on 3 April.

Simply when the dear metallic gave the impression to be dropping its shine, the value shot up for a 3rd time. On 20 Could, it was sitting at $3,650 per ounce, representing a 2% enhance in comparison with April.

As Alchemy Assets (ASX:ALY) CEO James Wilson informed Mining.com.au: “Gold is doing what gold does finest — performing as a barometer of uncertainty.”

Certainly, gold has been a secure haven throughout financial and political instability. Sprott Asset Administration says buyers search out gold for its secure haven high quality during times of financial and political instability.

“Most lately, gold outperformed shares and bonds in 2022, which was marked by the Russia-Ukraine struggle, and gold outperformed in the course of the peak of the COVID-19 pandemic disaster,” Sprott says.

“In response to the World Gold Council, gold’s efficiency during times of disaster has risen to grow to be the ‘prime purpose for central banks to carry gold’. Gold has all the time served as a retailer of worth.”

Gold has stored up with inflation and its buying energy has elevated. Comparatively, the US greenback has misplaced worth and buying energy together with it.

Buying energy

Sprott Asset Administration offers the clearest instance of gold’s buying energy.

In 1930, one might purchase 2.3 loaves of bread with 1/100oz of gold, whereas US$1 might purchase 11 loaves of bread. In 2023, 1/100oz of gold might purchase 10.2 loaves of bread whereas US$1 can purchase simply one-half a loaf of bread.

Most Western currencies have been backed by gold till disgraced former US President Richard Nixon ended the gold commonplace in 1971 as inflation started to rise and a gold run was on the horizon.

As soon as the gold commonplace ended, overseas governments have been not in a position to trade their {dollars} for gold; successfully the worldwide financial system had pivoted right into a fiat system.

Principally, Nixon enacted a plan that ended greenback convertibility to gold and applied wage and value controls, bringing an finish to the Bretton Woods system. After World Battle II, the worldwide financial system was dubbed Bretton Woods after 44 nations agreed to maintain their currencies fastened (but adjustable in distinctive conditions) to the greenback, which was fastened to gold.

The nations then settled their worldwide balances in {dollars}, and the US {dollars} have been convertible to gold at a set trade fee. As such, the US was then accountable for maintaining the greenback value of gold at a set fee and adjusting the availability of {dollars} to take care of confidence in future gold convertibility.

Greater than 50 years later, amid rising rates of interest, central banks have tried to fight inflation that has been greater than authorities targets, which in flip has undermined confidence in authorities reserve currencies.

As Sprott Asset Administration notes, gold has served as a retailer of worth and medium of trade all through historical past on account of its fastened provide, broad adoption, and secure haven-like traits.

“Fiat currencies, such because the US greenback, are additionally extensively used as a medium of trade however might be printed on the will of governments. Rising cash provide and inflation can imply that over the long term, fiat currencies could lose relative buying energy,” Sprott reviews.

“Gold is a bodily asset that can not be hacked, erased or degraded.”

Write to Adam Orlando at Mining.com.au

Photos: Our World in Knowledge, Sprott Asset Administration & Tietto