Since 25 November when then US president elect Donald Trump first threatened to impose import tariffs on Mexico, Canada and China ( see “Trump Tariffs will Set off World Commerce Battle, with Gold and Silver Set to Profit“), gold markets in New York and London have been signalling fears that these tariffs would come with gold and silver imports from Mexico and Canada.

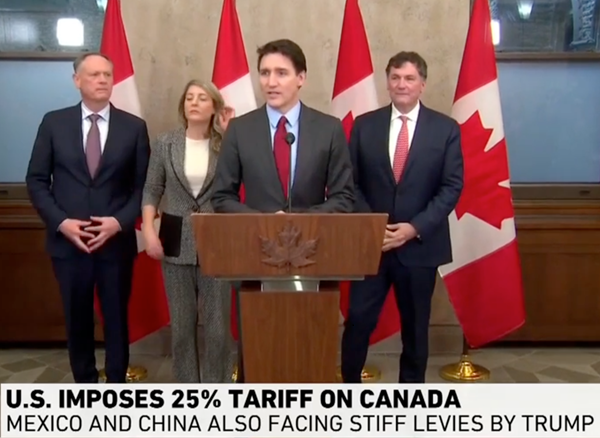

These fears have now been absolutely confirmed, since on Saturday 1 February, Trump has gone forward and signed Govt Orders imposing “a 25% extra tariff on imports from Canada and Mexico and a ten% extra tariff on imports from China”, with the tariff impositions set to return into impact on Tuesday 4 February. Provided that the one concession in these Govt Orders is a decrease 10% tariff for Canadian vitality sources, and with no express exemptions for valuable metals, it’s presumed {that a} 25% import tariff applies to all gold and silver bullion imports coming from Mexico and Canada. That features valuable metals doré and precipitates, and refined bullion within the type of bullion bars and cash.

A 25% tariff on gold imported from Mexico or Canada will due to this fact add $700 per ouncesto the worldwide gold worth, assuming a $2800 gold worth, and go away the ultimate worth put up tariff at a staggering $3500 per oz. All of that is additionally going down in an surroundings wherein gold costs have but once more reached new all time highs, with a highest every day shut and a highest month-to-month shut registered on the final day of January.

Market Reactions to Tariff Expectations

Earlier than wanting on the implications of what the import tariffs will imply for valuable metals going ahead, it’s instructive to take a look at what affect the “anticipation of tariffs” has already induced. Whereas the under seems at COMEX gold, the state of affairs is comparable for COMEX silver.

Following Trump’s late November threats of tariffs, fears of upper import costs triggered a panicked rush to import bodily gold into the US, with merchants on COMEX bidding up gold futures costs to make sure that they had publicity to enough gold deliverable within the US. This surge in worth in flip compelled brief sellers to cowl their positions, all of which drove COMEX costs larger than the LBMA London spot worth. Because the COMEX-London unfold widened, London merchants then additionally scrambled to move extra gold to New York in order to make the most of the arbitrage alternative.

Since late November 2024, practically 400 tonnes of gold has flowed into the vaults of the COMEX in New York and surrounding areas, with whole COMEX gold inventories rising from lower than 20 million ounces to just about 32 million ounces. Since Trump’s tariff threats have been first made public, the COMEX-London gold worth unfold has widened on quite a few events, first notably for a number of weeks in early December, after which once more considerably in January amid renewed issues that the tariffs can be imposed by as early as 1 February. For instance, on Friday 31 January, the COMEX April futures gold worth was buying and selling at $2862, a full $64 above the London spot shut price of $2798.

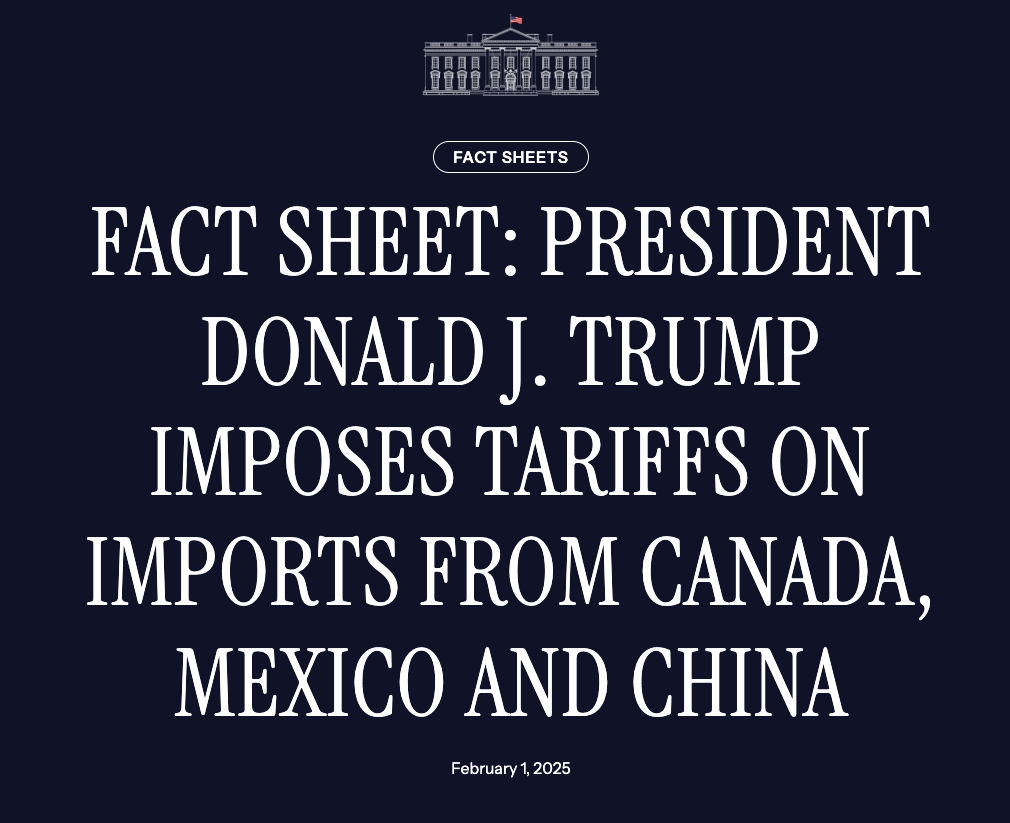

File gold deliveries on COMEX

As an instance the present scramble for bodily gold on COMEX, the newest supply information is eye opening, with the Change seeing the second highest ever variety of contracts transferring to supply on a ‘first supply date’ which was 2,962 million ounces, or 92 tonnes, for the February contract (first supply is Monday 3 February). This implies possession of this steel modifications arms between lengthy contract holders (who take supply) and brief contract holders (who make supply). Of that whole, JP Morgan has to ship 1,485 million ounces (46 tonnes) value over $4 billion.

A file variety of supply transactions on first supply date indicators sturdy bodily demand and a desire for bodily steel over paper positions, since lengthy holders haven’t rolled their contracts, however have determined to attend and get their crammed through supply. The surge in deliveries has additionally continued for “second supply date” (4 February), with one other 11,028 contracts transferring to supply. That’s 40,649 contracts in whole only for the primary 2 days of February, and represents 126 tonnes of gold value $ 11.38 billion.

Whereas gold imported into the US and coming into the COMEX vaults is clear to an extent because it exhibits up on CME gold vault studies, its necessary to do not forget that that is solely a part of the story, since different gold is being imported to the US into non-public vaults that’s tougher to trace.

US importing gold straight from Switzerland and the UK

The US is now hoovering in staggering portions of gold bullion from international locations that it usually exports gold to, pushed by – the now appropriate – expectation of tariff impositions on bullion.

Whereas each Switzerland and the UK had been, as much as lately, by far the 2 largest export markets for US gold bullion, now the flows are stepping into the wrong way, and in far higher magnitudes. In December 2024, Swiss gold exports on to the US surged to 64.5 tonnes, an 11 fold improve on the earlier month, and the very best month-to-month whole since March 2022. Likewise, Swiss gold can also be getting routed to United Kingdom (which actually means London) after which despatched out from London to the US. In December, Swiss gold exports to London additionally surged 14.3 tonnes, from 1 tonne throughout the earlier month.

London Gold Scarcity

On Wednesday 29 January, the London Monetary Instances (FT) broke the information that there’s a scarcity of gold within the London market. In an article titled “Gold stockpiling in New York results in London scarcity” , the FT revealed that the specter of US tariffs and the arbitrage alternative on COMEX has created an excessive gold scarcity the place “the wait to withdraw bullion saved within the Financial institution of England’s vaults has risen from a number of days to between 4 and eight weeks”. What this actually means is that bullion financial institution members of the London Bullion Market Affiliation (LBMA) are struggling to a) borrow sufficient gold from central banks, and b) withdraw this gold from the Financial institution of England in order to fly it throughout the Atlantic ocean to New York.

In accordance with an nameless gold sector government quoted by the FT, “individuals can’t get their arms on gold as a result of a lot has been shipped to New York, and the remainder is caught within the queue. Liquidity within the London market has been diminished.”

Liquidity here’s a euphemism for availability of gold. Diminished liquidity actually means diminished availability, i.e. a scarcity of gold in London. However why would there even be a queue if the gold within the London market is allotted and has just one proprietor for every ounce? The reply after all is that it’s not 1 proprietor per ounce. The whole system is a fractional-reserve system of artificial gold credit score.

Even in regular occasions, what little bodily gold that’s within the London is ‘spoken for’ by way of central financial institution and ETF holdings, and there’s a very small ‘float of gold’ obtainable for ‘liquidity’ functions. And in irregular occasions, equivalent to now in an surroundings of heightened bodily demand, that gold float is even smaller.

Not surprisingly, the Financial institution of England and the LBMA try to faux there is no such thing as a drawback, and try to go off the London gold scarcity as logistical bottlenecks. In accordance with a Financial institution of England spokesperson quoted final week by Marketwatch “there is no such thing as a scarcity of gold”. There are simply “longer than common wait occasions to get gold transferred out of the Financial institution of England vaults” on account of larger demand. Do the Financial institution of England purchasers really fall for these excuses?

The identical article quotes a spokesperson from LBMA member Bullionvault (a frequent LBMA apologist), who tries to persuade anybody who will purchase it that “digging out bodily bullion bars from massive vaulted stockpiles takes time, manpower, vehicles and transport”. How come this wasn’t an issue when international locations equivalent to Venezuela, Poland, Hungary, Serbia, India and Turkey withdrew 100s of tonnes of gold from the Financial institution of England in recent times and repatriated it to their dwelling international locations?

The Financial institution of England governor Andew Bailey additionally bought in on the denial act, and shockingly, this was in entrance of the UK Treasury Choose Committee on Wednesday 29 January (Full listening to). When requested about US $ 82 billion of gold flowing from London to New York in latest months, Bailey disingenuously prevented the query and responded that “It’s not a giant factor actually … gold doesn’t play the function it used to play”, earlier than saying “I don’t wish to dramatize this story”. Nonetheless, Bailey’s try at downplaying the state of affairs fell flat – his unconvincing efficiency in his testimony on the gold disaster was a case of newbie dramatics, and he actually must go to a greater performing faculty. See clip right here.

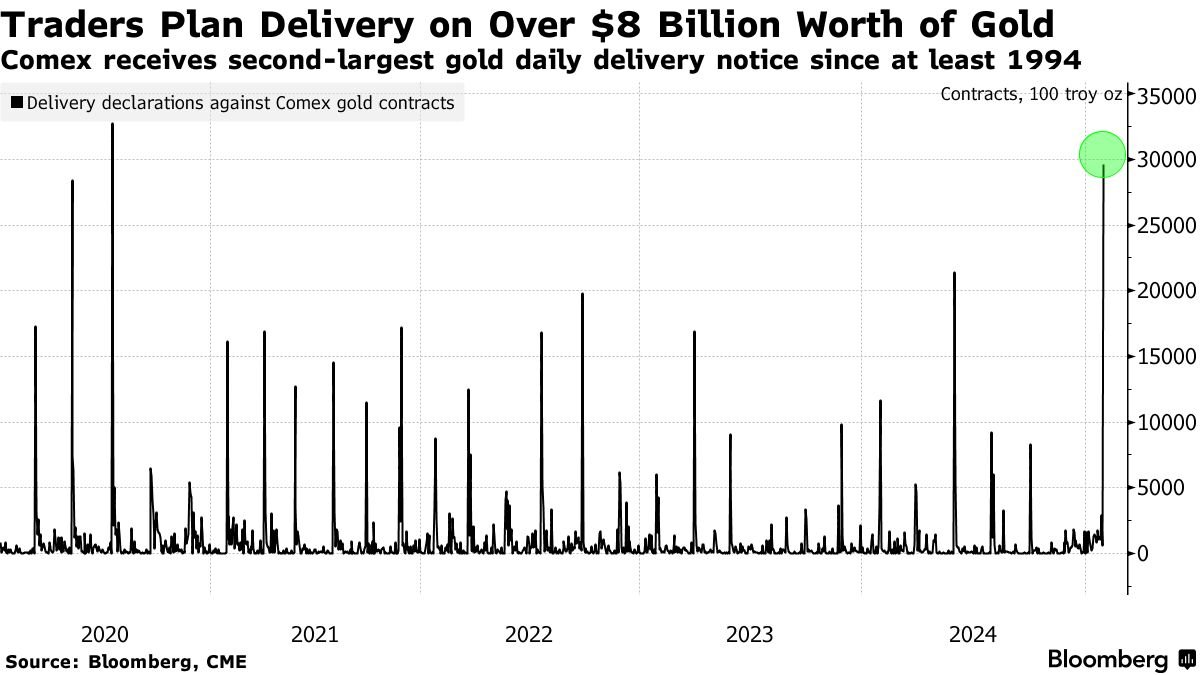

The LBMA additionally advised MarketWatch with a straight face that “London gold market shares and liquidity stay sturdy”, however on the identical time it stated that it was “monitoring and liaising carefully with the CME Group and with U.S. authorities”. Reuters additionally corroborated that the LBMA is discussing the COMEX-London gold premium with the CME and US Authorities.

However why is the LBMA liaising with the CME and US Authorities in any respect, and intervening in a supposedly free market worth setting course of? Is it as a result of:

- The LBMA and COMEX are the 2 main venues for ‘paper gold worth discovery’ they usually don’t need the gold worth to breakout to actual worth discovery?

- And that bodily gold is a strategic financial steel which the non-Western international locations are actually getting ready to convey again to the centre of a brand new future financial system?

Discussions with the US authorities beg the query, which authorities are the LBMA and CME Group speaking to? The CFTC, the US Treasury, the New York Fed, the President’s Working Group on Monetary Markets?

All of this sounds much like 2020, when, throughout Covid financial lockdowns, the COMEX-London unfold blew out, tons of of tonnes of gold moved from Europe to New York, and the LBMA and the CME Group colluded carefully in an try to regulate the gold worth. For background see “Bullion Financial institution Nightmare as LBMA-COMEX Unfold Blows Up Once more” (9 April 2020), “COMEX Provides 730 Tonnes of Gold Since Late-March” (6 July 2020) and “LBMA-COMEX Collusion Intensifies” (24 August 2020)

On an even bigger image foundation, the query must be requested, why is the LBMA even accountable for the worldwide gold market? Within the midst of a gold disaster – which it denies is going on – the LBMA is a) specializing in a pet passion gold bar integrity challenge, b) organising conferences however recovering from getting ripped off by fraudsters, and c) getting sued in London’s Excessive Court docket in a trial which is able to happen in June 2026 – See “Trial of the London Bullion Market Affiliation to go forward on the Excessive Court docket subsequent yr following alleged human rights abuses at African gold mine”.

Is the LBMA even the right entity to be the world gold market’s self-proclaimed “world authority”?

Mexico and Canada are two of the biggest suppliers of gold imported by america, each within the type of doré and precipitates, and refined bullion. For instance, in response to the U.S. Geological Survey month-to-month gold survey for October 2024, of the 12.1 tonnes of gold imported into the US that month, the highest 3 suppliers have been Columbia (25% of the overall), Mexico (24% of the overall) and Canada (13% of the overall). The 25% import tariffs imposed by the US on Canada and Mexico will now critically affect these gold import flows.

US imports of gold and silver from Mexico and Canada

For the reason that US can now not import tariff free gold from Canada and Mexico, the US due to this fact can’t export gold to the UK and Switzerland. This can end in much less gold making its technique to London, thereby additional tightening liquidity within the LBMA market. The one workaround can be for Mexico and Canada to reroute their gold on to refineries in Switzerland or different places, bypassing the US completely. Nonetheless, this might nonetheless create logistical delays and potential dislocations within the world gold provide chain, additional pressuring London’s obtainable gold stock.

silver, Mexico is the world’s largest silver producer, and in response to USGS, Mexico produced 6300 tonnes of silver in 2024 which was 25% of 2024’s whole world silver manufacturing. China is the world’s second largest silver producer, with 3300 tonnes manufacturing in 2024.

Moreover, Mexico and Canada are the 2 largest suppliers of silver to the US. For instance, in October 2024, which is the most recent USGS information obtainable, the US imported 163,000 kgs of silver from Mexico and 92,500 kgs of silver from Canada. With whole US silver imports that month of 318,000 kgs, Mexico represented 51% of all silver imports and Canada represented one other 29%. So collectively Mexico and Canada accounted for 80% of all US silver imports. It is a staggering determine and exhibits how dependent the US is on silver from Mexico and Canada. Imposing a 25% import tariff on Mexican and Canadian silver imports goes to have an effect on the US silver sector in an enormous opposed means.

US Strategic Gold Stockpiling

With import tariffs now confirmed and about to be carried out, it is going to be fascinating to see how the COMEX – London unfold reacts. If the unfold stays elevated for an prolonged interval, it raises the query of how a lot gold the London market can proceed to produce to New York earlier than inventories can’t take it.

A persistent premium would additionally counsel that this isn’t simply short-term arbitrage however the beginnings of a systemic disaster inside which there’s a bigger strategic accumulation effort by the US authorities underneath the smokescreen of tariffs, probably aimed toward draining gold liquidity from London and consolidating gold reserves inside US vaults, in order to again a US Treasury gold bond, provided that there is no such thing as a proof that the US Treasury has all of the gold it claims to have (because it has by no means been absolutely bodily and independently audited).

If London’s gold shares deplete quicker than they are often replenished, it might additionally set off a provide squeeze, expose weaknesses within the world bullion market, and pressure a dramatic repricing of bodily gold – particularly if different central banks or sovereign entities react by accelerating their very own gold accumulation out of London.

Recall that central financial institution gold shopping for continues to be very sturdy, each from recognized central financial institution patrons, and unidentified central financial institution and sovereign wealth fund patrons. The bodily gold which the US markets try to vacuum up in London and Switzerland additionally has to compete on the margin, with all of those sovereign patrons, together with the Chinese language central financial institution.

BullionStar Inventories

Regardless of obvious shortages of gold within the London wholesale market, BullionStar maintains satisfactory bullion inventories of gold and silver cash and gold and silver bars, and provides an uninterrupted provide of bullion for our clients from the world’s main mints and refineries. We now have not seen shortages on the retail degree, and clients should buy bodily gold and silver with confidence, figuring out that availability stays steady at the same time as world provide constraints come up.

Conclusion

Bizarrely, not one of the trade associations within the world valuable metals markets, together with the the LBMA, World Gold Council, Silver Institute and Worldwide Valuable Metals Institute, have issued any press releases or pubic statements relating to the 25% import tariffs on gold and silver coming into impact from Mexico and Canada. Nor have the CME Group or the CFTC made any public pronouncements. This silence is stunning, and means that these establishments are intentionally avoiding the problem, and leaving market individuals and buyers at the hours of darkness in regards to the implications.

The tariffs on gold and silver imports from Mexico and Canada can have far-reaching penalties:

– Greater home gold and silver costs within the US for bullion bars and cash from tariffed international locations – because of the 25% tariff.

– Depletion of London’s gold shares, tightening liquidity within the LBMA market.

– Potential dislocations within the world gold provide chain, particularly if Mexico and Canada reroute their gold exports.

– Doubtlessly larger prices for any valuable metals miners – since tariffs and retaliatory tariffs by the US, Canada and Mexico might create further prices and frictions for miners are positioned in these jurisdictions.

– Strategic US gold accumulation, probably as a precursor to a future gold-backed monetary system.

These developments mirror the 2020 COVID-era gold disaster, the place gold flowing quickly from London to New York and LBMA-COMEX collusion was evident. However the essential query now could be whether or not the present disaster is only a non permanent dislocation, or the beginning of a bigger shift within the world gold market away from paper and in direction of bodily.

This present scarcity of gold in London can also be additional proof that the London ‘gold’ market is primarily a paper market with very fragile underpinnings. It’s actually an inverted pyramid the place the bodily holdings on the backside underpin the whole gigantic paper edifice. With these bodily underpinnings now being taken away, count on subsidence, and count on the LBMA to be frantically looking for a compliant amount surveyor to log out that each one is okay underneath the foundations of the LBMA home – when in actuality it’s not.