The Federal Reserve has made good on market expectations, reducing rates of interest by 50 foundation factors and igniting a rally in treasured metals. On Friday, gold soared previous $2,600 per ounce, whereas silver surged to over $31 per ounce, as traders flocked to safe-haven belongings.

This fee minimize, the primary since March 2020, alerts a shift in the direction of simpler financial coverage. Decrease rates of interest usually enhance the enchantment of non-yielding belongings like gold and silver, as they cut back the chance price of holding these metals.

With the Fed hinting at doable additional fee cuts, the stage is about for what may very well be an prolonged bull run in gold and silver.

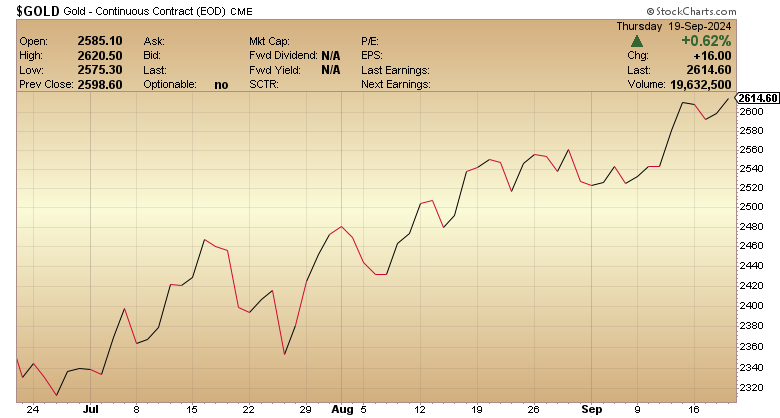

Spot Gold Worth Shatters $2,600 for First Time

On Friday, instantly following the Fed’s fee minimize, the worth of gold climbed as excessive as $2,622 per ounce. Over the previous three months, gold is up over $300.

As international financial uncertainties develop and geopolitical tensions rise, traders worldwide are more and more selecting gold as a safe-haven asset. The weakening U.S. greenback makes gold much more enticing.

For many who have been strategically positioning their portfolios, this fee minimize serves as a robust affirmation of the worth of treasured metals as each a hedge in opposition to financial uncertainty and a possible supply of great returns.

If the Fed continues to decrease rates of interest, holding non-yielding belongings like gold turns into extra interesting. This situation may present extra help for gold costs, probably driving them to new report ranges.

How Samsung’s New EV Battery Tech Might Reshape the Silver Markets

Samsung’s growth of a brand new solid-state battery may revolutionize the electrical automobile (EV) market. These batteries promise important enhancements in vary, cost time, and battery life, probably making EVs extra accessible and interesting to shoppers.

Retired funding skilled Kevin Bambrough lately highlighted on X (previously Twitter) the huge implications this know-how may have on the silver market.

Whereas we do not have official figures but, specialists suppose Samsung’s new batteries may use about 5 grams of silver in every cell. For a typical electrical automotive battery, that would add as much as about 1 kilogram of silver per automobile.

To place that into perspective, if simply 20% of the world’s annual automotive manufacturing (about 16 million automobiles) began utilizing these new batteries, we might want roughly 16,000 metric tons of silver every year only for this function. That is a giant deal when you think about that the world at present produces about 25,000 metric tons of silver yearly.

Bambrough says that these new elevated ranges of demand may result in a major rise in silver costs.

“For me, it’s simply one more reason to anticipate silver markets to tighten up [further] and the worth of silver to take a run at its all-time inflation-adjusted excessive [of] $200/oz will seemingly be seen within the [coming] 10-15 years…”

In accordance with a report by Enrico Punsalang at Experience Aside, Samsung is already collaborating with main automakers like Toyota and Lexus to include its solid-state battery know-how into EVs.

To be taught extra about silver’s essential function in fashionable know-how and trade, try our article ‘Why Silver Is One of many Most Necessary Parts on Earth.’

Mike’s Insights from Limitless Expo:

Navigating the Upcoming Financial Shift

Mike has an replace from the distinguished Limitless Expo in Dallas with essential insights you’ll want to hear. In a compelling change with Russ Gray, Mike outlines the essential state of our financial system.

But, Mike’s message is not one in all doom and gloom. He affords a roadmap for traders, detailing sensible steps to not simply climate the storm, however probably enhance your wealth dramatically in the course of the upcoming financial shift.

Mike says the wheels are already in movement, however you continue to have time to behave. Do not miss his pressing recommendation on positioning your self for the approaching wealth switch.

Watch the total interview now:

Be On The Proper Aspect of the Coming Wealth Switch

That’s it for this week’s GoldSilver Nuggets. We’ll be again subsequent week with extra information and updates.

Greatest,

Brandon S.

Editor

GoldSilver