Oct 4 (Reuters) – Gold costs slipped on Friday after a stronger-than-expected U.S. jobs report poured chilly water on expectations for an aggressive charge minimize from the Federal Reserve subsequent month, boosting the greenback.

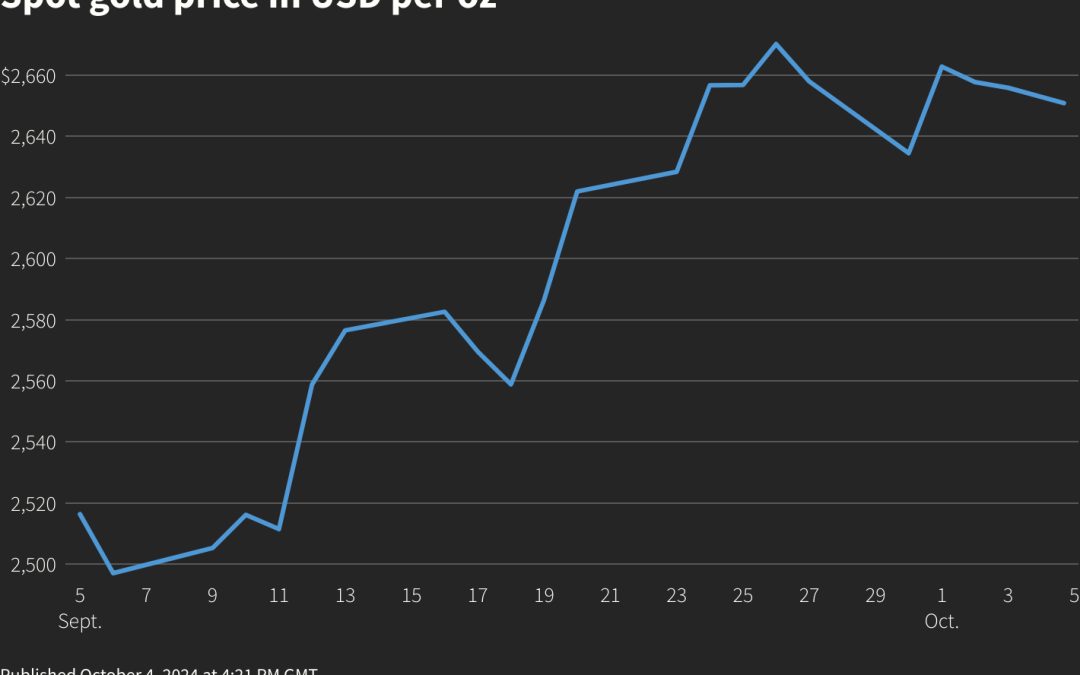

Spot gold was down 0.2% at $2,649.69 per ounce by 01:57 p.m. EDT (1757 GMT), after touching a document excessive of $2,685.42 final week. U.S. gold futures settled 0.4% decrease at $2,667.80.

“Gold stumbles as a robust payrolls report appears more likely to lock in 25 bps in November,” mentioned Tai Wong, a New York-based impartial metals dealer. “Revisions to final month have been greater as properly, which we’ve not seen in lots of months, whereas the unemployment charge ticked decrease whilst participation stayed flat.”

Merchants scaled again expectations for a 50 bp charge minimize in November to nearly 0% from 28% earlier than the payrolls knowledge.

“We’re heading right into a weekend the place geopolitical tensions are at a boil, and that’s actually limiting the scope of accounts which can be prepared to promote gold,” mentioned Daniel Ghali, commodity strategist at TD Securities.

Gold, used as a safe-haven funding throughout occasions of political turmoil, appreciates in a low rate of interest surroundings.

“If geopolitics play a job over the weekend, gold futures might simply speed up again as much as $2,700 and threaten new all time highs,” mentioned Phillip Streible, chief market strategist at Blue Line Futures.

Spot silver rose 0.5% to $32.21, heading in the right direction for a weekly achieve. Platinum fell 0.1% to $989.33 and palladium was regular at $1,000.

Join right here.

Reporting by Anjana Anil in Bengaluru; Enhancing by Shreya Biswas, Kirsten Donvan and Richard Chang

Our Requirements: The Thomson Reuters Belief Rules.