Brandon Sauerwein, Editor

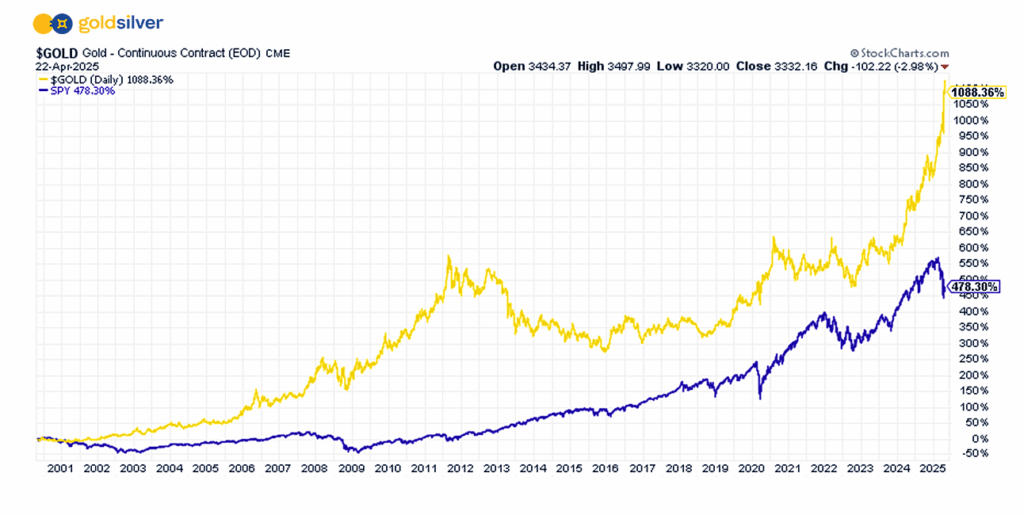

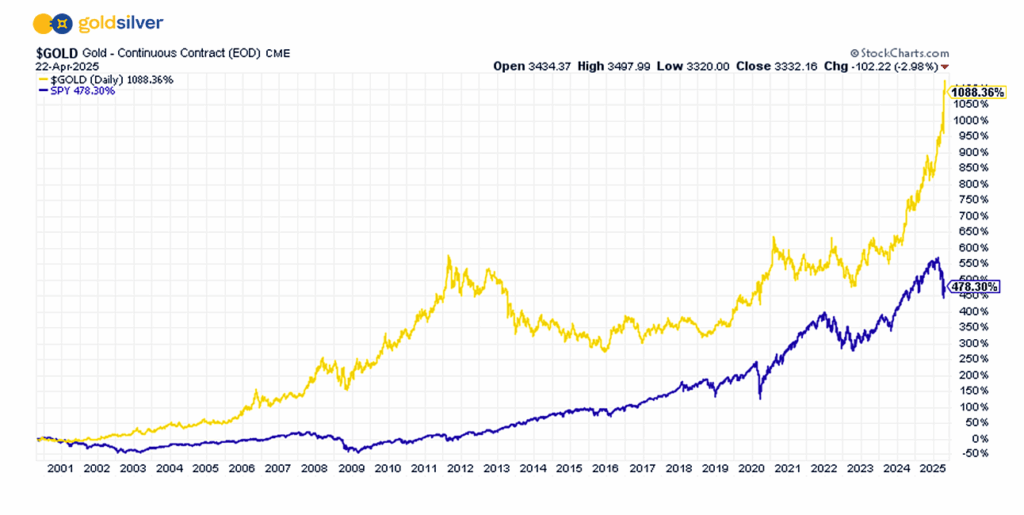

Since 2000: Gold +1,088% Returns | SPY +478% Returns

What we’re witnessing isn’t only a bull run — it’s a reawakening in valuable metals.

In simply the previous month, gold shattered the $3,000 milestone and briefly touched $3,500 an oz. early Tuesday morning — a historic surge that has surprised even veteran traders.

However this transfer isn’t taking place in isolation. An ideal storm is unfolding: escalating tariff tensions, ballooning international debt, surging central financial institution demand (particularly from the East), and a rising international shift away from the U.S. greenback are rewriting the foundations of gold. Conventional forces — like rising actual rates of interest — not appear to carry gold again.

To place this gold rally in perspective:

- Gold is up as a lot as 33% in simply the primary 5 months of 2025 — on tempo for certainly one of its strongest years ever

- Since 2000, gold has gained 1,088%, in comparison with 478% for the S&P 500

- After a number of document highs, gold is now pulling again to round $3,300

Might this be the proper alternative to purchase the dip throughout a raging bull market?

Time will inform — however should you suppose you’ve missed the transfer, think about this: Mike Maloney lately shared his boldest forecast but — a possible gold value of $10,000. It’s a degree he’s by no means publicly projected earlier than, and it’s backed by many years of analysis and a deep understanding of the financial shifts now underway.

In Mike’s view, we’re not on the finish of this bull market — we’re at the start of one thing historic…

In Case You Missed it — Mike Simply Shared a Uncommon Gold Worth Forecast

Mike Maloney has spent many years educating traders on financial cycles, sound cash, and wealth preservation. And all through that point, he’s prevented making particular gold value predictions.

Till now.

The explosive transfer from $3,000 to over $3,400 in simply weeks isn’t enterprise as typical — it’s the beginning of one thing far larger. In his newest video, Mike breaks precedent to share his boldest forecast ever — together with a clear goal and the timeframe he believes it might occur.

A once-in-a-generation monetary reset could also be underway, and this might be your window to behave earlier than a brand new wave of traders rush in.

The World Capital Rotation Is Underway — Are You Prepared?

Alan Hibbard sits down with Kevin Wadsworth and Patrick Karim of Northstar Dangerous Charts to unpack a seismic shift underway in international markets — what they name the Capital Rotation Occasion: a uncommon however decisive migration of capital out of overvalued shares and into exhausting belongings like gold and silver.

In case you’re impressed by gold’s run thus far, Alan says we haven’t seen something but.

In in the present day’s must-watch interview, you’ll uncover:

- Why gold’s breakout is larger than simply value — it’s taking place throughout a number of key benchmarks (USD, CPI, PPI, S&P)

- How historic patterns sign explosive potential for silver and mining shares

- Why the S&P 500 could not replicate true financial well being — and what to observe as an alternative

This isn’t simply one other chart evaluate. It’s a warning — and a roadmap. Alan breaks down precisely tips on how to place your portfolio in an period the place fiat currencies are faltering, and exhausting belongings are rising to the forefront.

Safe Bulk Pricing on Each Single Gold & Silver Buy

What Else is within the Information?

🏦 Fed Holds Regular as Trump Renews Criticism of Powell

Regardless of mounting political stress — together with renewed calls from President Trump for his removing — Federal Reserve Chair Jerome Powell is holding the road. New York Fed President John Williams confirmed there’s no present case for slicing charges, stating in a Fox Enterprise interview that the central financial institution sees no want to regulate the federal funds charge. Trump, who nominated Powell in 2017 however turned important shortly after, has escalated requires charge cuts because the 2025 election approaches.

📈 Gold Briefly Hits $3,500 Amid Fed Drama

Gold surged to a brand new document of $3,500 per ounce earlier than retreating barely, as traders reacted to political uncertainty and renewed fears about Fed independence. Issues over Trump probably firing Powell drove a flight from shares, bonds, and the greenback — pushing demand for gold as a safe-haven asset. Though Trump has since softened his stance, the episode underscores how fragile confidence is within the present financial setting. Gold remains to be up over 30% year-to-date.

⚠️ Trump Administration Eases China Tariff Stance

In a pointy reversal, President Trump has signaled that tariffs on Chinese language items might be lowered from the present 145% if negotiations progress. This can be a marked pivot from earlier threats of full-scale financial decoupling. Markets interpreted the shift as an effort to stabilize commerce relations — however the lasting impression on inflation and investor confidence stays unsure.

💰Goldman Sachs: $4,500 Gold “Tail Danger” Nonetheless on the Desk

Goldman Sachs has raised its year-end gold value goal to $3,700, citing sustained macro pressures and rising safe-haven demand. In a extra excessive situation, analysts say gold might surge to $4,500 per ounce if the Fed is compelled into an surprising coverage pivot — a “tail threat” that appears extra believable in in the present day’s risky panorama.

🥇 Is Gold Too Crowded? Not Even Shut

A current Financial institution of America survey confirmed 49% of fund managers now see gold because the “most crowded commerce,” dethroning the Magnificent 7 tech shares for the primary time in two years. However the information tells a unique story.

- Gold ETFs characterize simply 2% of all ETF belongings — properly under the 8%+ seen at gold’s 2011 peak

- Gold mining ETFs account for simply 0.25% of inventory ETF belongings, in comparison with 1.5% on the final peak

This means gold is far from overcrowded. In reality, if institutional allocations even start to normalize, the rally might nonetheless be in its early phases.

💬 What GoldSilver Traders are Saying

⭐ ⭐ ⭐ ⭐ ⭐ All the time Nice

“All the time nice. Thanks GoldSilver for serving to me protect wealth, and thanks Travis for assiduous persistence in serving to us with serving to my daughter log in to my account invite.” — J. Grimes

Expertise the GoldSilver distinction:

- Obtain knowledgeable steering from devoted valuable metals specialists

- Entry complete academic sources to grasp your funding technique

- Belief in our industry-leading customer support workforce that places you first

Able to get began?