Gold costs have surged to document highs this yr, pushed by highly effective macro forces reshaping the market. As buyers seek for a dependable gold value prediction 2026, one sign is rising above the noise: institutional buyers overwhelmingly count on gold to proceed its climb.

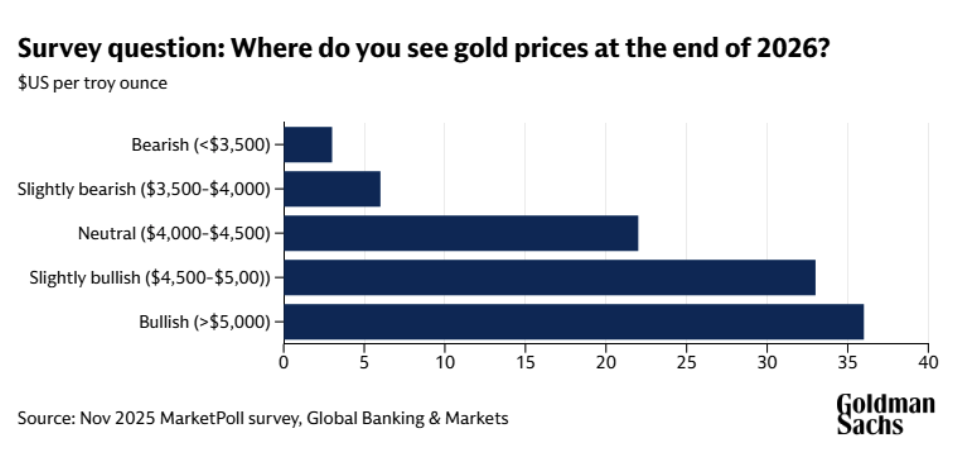

In line with a Goldman Sachs Marquee survey of greater than 900 institutional purchasers performed November 12–14, almost 70% imagine gold costs will likely be larger by the top of 2026. The one largest group—36% of respondents—predicts gold will break above $5,000 per ounce throughout the subsequent yr.

This bullish shift displays a rising recognition that gold’s function is increasing inside trendy portfolios. With central banks absorbing document quantities of steel, actual charges fluctuating, and geopolitical tensions rising, buyers see gold as a resilient asset that thrives when conventional fashions fail. These are the identical gold value drivers which have propelled the steel into uncharted territory all through 2024 and 2025—and so they proceed to construct momentum.

What’s notable is not only the bullishness, however the diploma of confidence. Institutional desks, usually conservative of their forecasts, are actually positioning gold as a core strategic allocation moderately than a defensive sideline.

As we transfer towards 2026, the query for particular person buyers is obvious:

If the world’s largest monetary establishments are getting ready for larger gold costs, is your portfolio positioned for a similar atmosphere?

Why Establishments Are Bullish on Gold

Institutional buyers hardly ever make aggressive projections, which makes their outlook particularly noteworthy. When almost 7 in 10 count on gold to rise over the subsequent 24 months, it means that deep structural gold value drivers are in play—drivers that straight form the gold value forecast 2026 narrative.

1. Gold is behaving otherwise than the previous playbook predicted.

Traditionally, rising actual rates of interest pressured gold. However over the previous two years, gold has damaged this sample. Regardless of aggressive fee hikes, gold has continued climbing.

Establishments have taken discover.

This “decoupling” suggests gold is being pushed much less by Western monetary buyers and extra by world demand—particularly central banks and rising markets.

2. Rising macro uncertainty is now the norm, not the exception.

Markets are navigating:

- Sovereign debt considerations

- Shifting financial frameworks

- Geopolitical battle and fragmentation

On this atmosphere, establishments are reallocating towards property with no counterparty danger. That places gold in a class of its personal.

3. Structural demand now exceeds price-sensitive demand.

Central banks and rising market shoppers are much less price-sensitive than Western ETF buyers. Meaning dips are being purchased rapidly — placing a pure ground beneath the market and reinforcing long-term value stability.

All of those elements mix to create a robust setup: buyers see gold not solely as a hedge, however as an asset with long-term upside pushed by world structural shifts.

Central Financial institution Demand Hits Multi-Decade Highs

One of the vital highly effective gold value drivers at the moment is sovereign accumulation. Central financial institution shopping for is at its highest sustained degree in trendy historical past—and that pattern continues to speed up.

Why are central banks piling into gold?

- Diversification away from USD property

- Safety towards sanctions and political danger

- Strengthening nationwide reserves

- Insurance coverage towards foreign money volatility

- Desire for property with out counterparty danger

Central banks usually are not shopping for gold for short-term features; they’re restructuring their reserve technique. This alone has a serious affect on the gold value forecast 2026, as a result of as soon as central banks purchase gold, they hardly ever promote it.

The numbers proceed to impress:

- Web world purchases have doubled in comparison with pre-2022 ranges.

- International locations like India, Poland, Turkey, and several other Gulf states are aggressively constructing reserves.

This long-term, strategic demand successfully locations a ground beneath the market—and provides upward strain that helps bullish 2026 forecasts.

Investing in Bodily Metals Made Straightforward

Geopolitical Drivers: A World Reordering Round Dangers

One other theme shaping the gold value prediction for 2026 is the rise in geopolitical fragmentation. As world alliances shift and conflicts improve, gold continues to shine as a politically impartial retailer of worth.

1. East–West tensions are reshaping world commerce.

From the U.S.–China rivalry to sanctions, tariff escalations, and “friend-shoring,” the worldwide buying and selling system is being rewired. This creates foreign money volatility and inflationary pressures—each traditionally optimistic for gold.

2. Conflicts and instability improve safe-haven demand.

Warfare in Europe, instability within the Center East, and rising tensions within the South China Sea have all contributed to danger repricing throughout world markets.

When geopolitical uncertainty rises, gold tends to outperform danger property.

3. The rise of BRICS and de-dollarization.

BRICS nations—together with new 2025 entrants—management a big share of worldwide oil, commodities, and progress. Many are overtly diversifying away from USD-based reserves, preferring gold as a impartial settlement asset.

This pattern is long-term, structural, and accelerating.

4. A multipolar world elevates the function of secure, stateless property.

Because the “world order” turns into much less predictable, gold’s attraction grows:

- No political attachment

In a multipolar atmosphere, these traits are priceless.

Inflation, Debt, and Coverage Uncertainty

Whereas not the one forces at work, inflation and debt stay core gold value drivers.

Inflation is proving sticky.

Whilst headline inflation cools, structural inflation (companies, wages, vitality) stays elevated. This erodes buying energy and spurs investor demand for actual property.

World debt ranges are reaching unsustainable highs.

Authorities borrowing has exploded post-2020, and servicing that debt requires unfavorable actual rates of interest over time. Traditionally, such intervals have been extraordinarily supportive of gold.

Financial coverage uncertainty is excessive and rising.

From debates over central financial institution independence to fast coverage reversals, markets are struggling to cost long-term stability. Coverage volatility has traditionally been considered one of gold’s strongest tailwinds.

What This Means for Buyers

When institutional forecasts, central financial institution accumulation, geopolitical realignment, and inflationary pressures all level in the identical course, it creates one of many strongest long-term setups gold has seen in many years.

For buyers, the important thing takeaway is that this:

If the world’s largest establishments and sovereign patrons are positioning for larger gold costs, is your portfolio ready for a similar atmosphere?

The gold value forecast 2026 isn’t nearly the place gold may go—it’s about understanding the forces which might be already pushing it there.

Easy methods to Add ‘Disaster-Proof’ Returns to Your Portfolio It is overwhelmed shares in each main downturn—and most buyers nonetheless do not personal sufficient.

Individuals Additionally Ask

What’s the gold value forecast for 2026?

Most institutional buyers count on gold costs to rise into 2026, with some projecting ranges above $5,000 per ounce. This outlook is pushed by sturdy central financial institution demand, geopolitical uncertainty, and inflation pressures.

Why do establishments suppose gold will go up within the subsequent few years?

Practically 70% of surveyed institutional buyers imagine gold will climb as a result of demand from central banks and rising markets stays exceptionally sturdy. On the similar time, geopolitical instability and rising debt ranges assist larger long-term costs. GoldSilver presents in-depth schooling on the elements driving gold’s efficiency.

How do central banks affect the gold value?

Central banks are shopping for gold on the quickest tempo in many years, decreasing obtainable provide and making a long-term value ground. Their purchases are strategic, usually tied to foreign money diversification and geopolitical danger administration.

What geopolitical occasions may push gold larger by 2026?

Rising world tensions—resembling U.S.–China competitors, regional conflicts, and increasing BRICS alliances—drive demand for safe-haven property. As uncertainty rises, gold traditionally outperforms, making it a core hedge for each establishments and particular person buyers. You’ll be able to monitor these developments by GoldSilver’s information and analysis updates.

How does inflation have an effect on the gold value forecast for 2026?

Persistent inflation erodes buying energy, rising demand for laborious property like gold. Even when headline inflation cools, structural inflation in wages and companies continues to push buyers towards valuable metals.