Every day Information Nuggets | Right this moment’s prime tales for gold and silver buyers

September sixteenth, 2025

All Eyes on the Fed: Close to Sure Charge Cuts

The wait is almost over. The Fed begins its two-day assembly right this moment, with merchants betting on the primary price minimize since 2020. 1 / 4-point trim seems all however sure — however there’s nonetheless a 1-in-5 probability of a bolder half-point transfer, based on CME’s FedWatch instrument.

The actual suspense? Whether or not Powell hints at a single “insurance coverage minimize” or the beginning of a broader easing cycle. The Fed’s shift from preventing inflation to fearing recession has already modified the playbook. That pivot normally unleashes a potent combine for gold and silver: decrease charges, a weaker greenback, and stronger safe-haven flows.

And buyers aren’t ready for the press convention — the greenback is already sliding.

Macro Winds Favor Metals: Greenback Weakens Forward of Fed

The U.S. greenback index slipped to 97.08 this morning, down almost 4% from a yr in the past. On the similar time, 10-year Treasury yields retreated to 4.04%, about 30 foundation factors decrease over the previous month.

Falling yields and a softer greenback have traditionally offered a tailwind for valuable metals, as they make non-yielding property like gold and silver extra engaging. With the Fed anticipated to chop charges tomorrow, this “good storm” of greenback weak point and simpler monetary situations is already feeding into larger metals costs.

And proper now, each gold and silver are testing main psychological ranges…

Gold Nears $3,700, Silver Breaks Greater

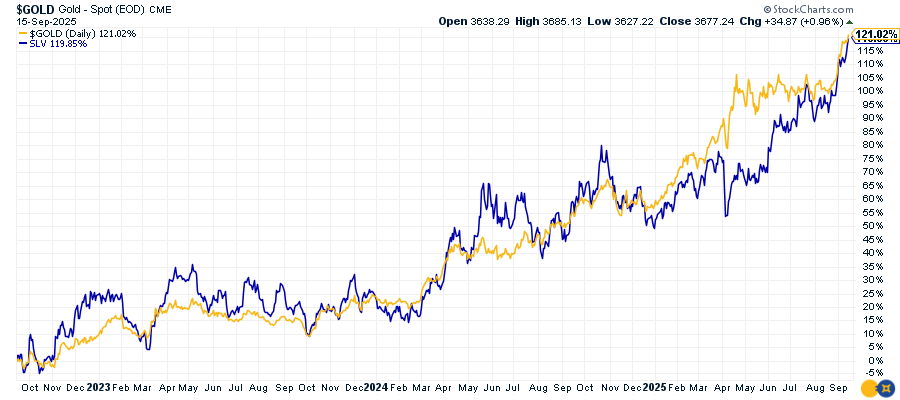

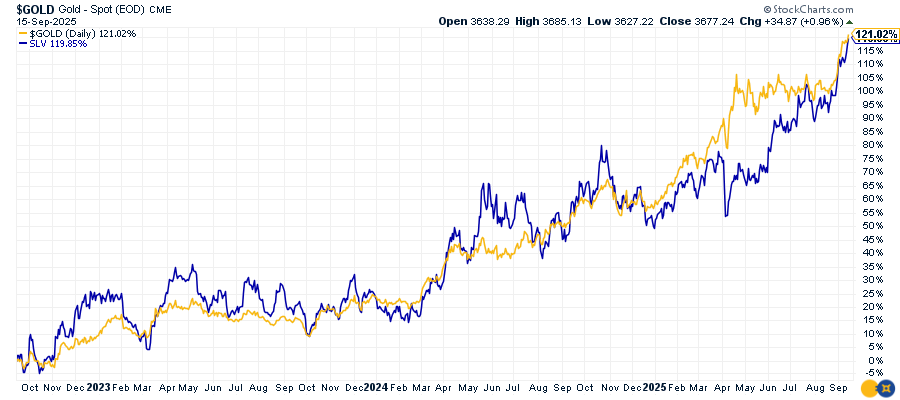

Gold is urgent towards uncharted territory, climbing to $3,690 and testing the $3,700 stage for the primary time ever. Silver can also be gaining floor, approaching $43 an oz., its highest stage in over a decade. The three-year chart under reveals simply how highly effective this transfer has been:

Gold up 121%, silver up 119%. Each metals have left shares and bonds within the mud, reinforcing their position as portfolio insurance coverage when uncertainty runs excessive. With the Fed determination looming right this moment and tomorrow, momentum stays firmly with the bulls.

Silver’s 2025 Rally Is the Strongest in Years

Silver’s 46% year-to-date surge makes 2025 one in all its sharpest rallies because the disco period. The catalyst? An ideal confluence of business demand from semiconductors and clear power, greenback weak point, and geopolitical jitters.

Whereas spectacular, this yr’s positive aspects pale in comparison with historical past’s legendary silver rallies – 2011’s 83% moonshot and 1979’s epic 267% explosion. However don’t depend silver out but.

Mike Maloney believes the true fireworks start when silver breaks via $50 – each a psychological barrier and its all-time excessive. As soon as that ceiling shatters, he expects silver to rocket into triple-digit territory. The gold-to-silver ratio helps this bullish case, suggesting the white metallic nonetheless stays undervalued in comparison with gold traditionally.

40% Gold: Central Banks Go All-In

Central banks have crossed a surprising threshold: 40% of their reserves now sit in gold vaults, based on Citi’s newest evaluation. Most monetary advisors would name that focus reckless – think about parking 40% of your portfolio in a single asset.

However these aren’t rookie buyers. These are the world’s financial guardians, and so they’re hoarding gold at unprecedented ranges. Why? Years of weaponized sanctions, foreign money wars, and exploding sovereign debt have shattered religion in paper guarantees.

This relentless accumulation isn’t simply one other information level – it’s the bedrock supporting gold’s long-term bull market. When the establishments chargeable for nationwide monetary safety are betting this closely on gold, particular person buyers may wish to ask themselves: what do central bankers know that we don’t?