Each day Information Nuggets | In the present day’s prime tales for gold and silver traders

October 7th, 2025

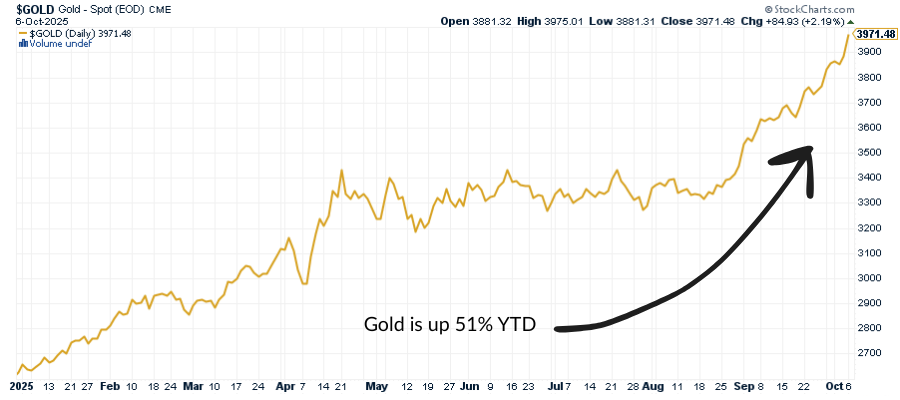

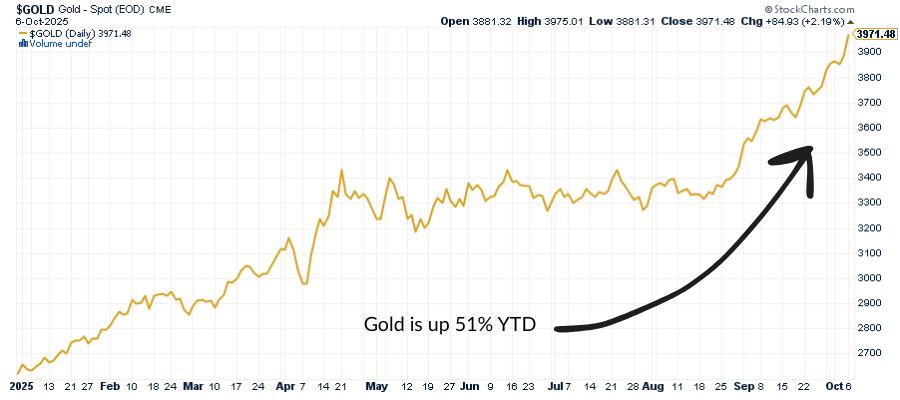

Gold Rush Nears $4,000, Silver Approaching $50

Gold surged towards the $4,000 mark Tuesday, whereas silver climbed inside hanging distance of $50 as traders poured into treasured metals amid mounting international uncertainty. Analysts cite an ideal mixture of drivers — political volatility, weak U.S. information, and report central financial institution demand — fueling the transfer.

Gold is now up greater than 50% year-to-date, on tempo for its finest 12 months for the reason that Seventies. Silver has surged 67%, propelled by sturdy industrial demand and speculative inflows. With financial coverage anticipated to ease and inflation nonetheless cussed, traders look like rotating from paper property into tangible shops of worth.

And as bullion breaks new floor, Wall Road’s greatest gamers are lastly beginning to chase the rally they as soon as dismissed.

Goldman Hikes December 2026 gold worth forecast to $4,900

Goldman Sachs has lifted its 2026 gold goal to $4,900 per ounce, citing persistent central financial institution shopping for, a weaker greenback, and slowing progress. The agency sees structural help for gold as traders diversify away from overvalued equities and long-duration bonds.

The improve joins a refrain of bullish calls, echoing Constancy’s current $4,000 projection. Each relaxation on the identical premise: actual rates of interest are staying low whereas religion in fiat cash continues to erode.

For months, markets have handled gold’s rise as a curiosity fairly than a warning. However the scale of this transfer — and the institutional shift behind it — suggests traders are quietly making ready for an extended period of instability. And if the economic system is as fragile as new non-public information implies, these fears could also be effectively positioned.

Personal Sector Steps In: Carlyle Tracks Weak U.S. Jobs Development

After President Trump fired the top of the Bureau of Labor Statistics earlier this summer season, skepticism concerning the accuracy of U.S. jobs information has solely deepened. With the federal government nonetheless shut down and no official report obtainable, non-public companies are stepping in to fill the void.

The Carlyle Group’s new proprietary mannequin estimates simply 17,000 jobs had been created in September — far weaker than prior authorities developments urged. ADP’s report reveals a 32,000-job loss, whereas Revelio Labs estimates a modest acquire, revealing how unclear the true image has develop into.

These unbiased readings add weight to fears that the labor market is weaker than Washington admits. A softening jobs backdrop might power the Fed into deeper fee cuts — a setup that traditionally boosts gold as traders search security from coverage missteps.

As confidence in official information falters, policymakers are turning their consideration towards one thing much more tangible — management over actual property.

Trump Greenlights Alaska Mining Push

President Trump has permitted a long-disputed entry street to Alaska’s Ambler mining district — a transfer to unlock home provides of copper and different essential minerals. The manager order contains $35.6 million in U.S. funding for Canada’s Trilogy Metals, giving Washington a ten% stake and warrants for an extra 7.5%.

The Ambler venture might develop into a cornerstone in America’s effort to safe its mineral provide chain and cut back dependence on China. Environmental teams warn of threats to fragile Arctic ecosystems, however for the administration, the calculus is strategic: entry to assets equals leverage in a unstable world.

Whereas new provide might strain some industrial metals within the brief run, the larger image is evident — nations are racing to safe bodily commodities as belief in monetary property weakens. And whereas Washington shores up its personal mineral provide, Beijing is quietly stockpiling the world’s oldest reserve asset.

China’s Central Financial institution Extends Gold Shopping for Spree

China’s central financial institution elevated its gold reserves for an eleventh straight month in September, extending the longest accumulation streak in over a decade. The Folks’s Financial institution of China now holds greater than 2,250 tons, solidifying its function because the world’s most constant sovereign purchaser.

This shopping for spree underscores a world shift in financial technique. Central banks — particularly throughout Asia and the International South — are hedging towards greenback dependence and sanctions threat, transferring steadily towards arduous property.

The course of movement has reversed: what was as soon as a westward “gold drain” within the twentieth century is now a gentle motion east. It’s not only a tactical commerce — it’s a structural realignment of financial energy that would outline the following monetary period.

If 2025 has proven something, it’s that gold is not the choice — it’s turning into the anchor.