Brandon Sauerwein, Editor

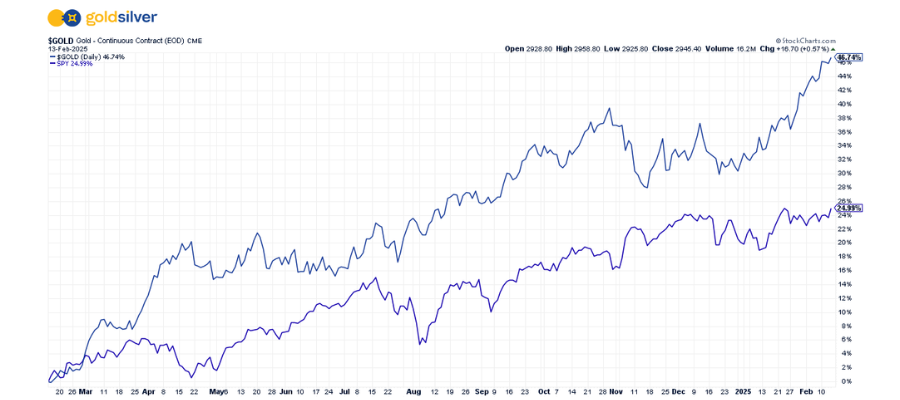

Gold Has Practically Doubled the S&P 500 Over Previous 12 Months

Gold’s exceptional efficiency has vindicated long-term believers. The yellow metallic has delivered spectacular returns, climbing over 46% since February 2024 – almost double the S&P 500’s features.

Whether or not you selected gold as a hedge towards forex dangers, market volatility, or each, this highly effective rally helps verify what our neighborhood has lengthy acknowledged about valuable metals…

20 Years of Gold Information That Will Shock You

How a lot has the gold market modified up to now 20 years?

To rejoice GoldSilver’s twentieth anniversary, Alan presents 5 surprising charts that seize dramatic financial shifts since 2005.

Watch as Mike and Alan analyze gold’s efficiency towards the S&P 500, explosive cash provide development, and an interesting have a look at housing prices measured in gold. The info would possibly shock you.

You and a good friend might each win a free 1oz American Silver Eagle Coin! It’s easy to enter:

1️⃣ Comply with the GoldSilver account on Instagram

2️⃣ Like this put up

3️⃣ Tag a good friend who loves studying about investing!

Every remark = 1 entry, so tag as much as 5 mates… ⏰ Hurry! Contest ends TODAY (2/14) at 1pm EST

What Else is within the Information?

📈 GOLD NEARS $3,000 MARK IN HISTORIC SEVEN-WEEK RALLY

Gold notched its seventh consecutive weekly achieve, pushing towards the $3,000 mark amid escalating commerce tensions. The dear metallic rose to $2,936.99 per ounce, extending its spectacular 2024 rally as buyers search safe-haven property.

🔥 INFLATION SURGES TO 18-MONTH HIGH

U.S. shopper costs jumped 0.5% in January, marking the sharpest month-to-month enhance since August 2023. This surprising inflation spike, pushed by rising shelter and meals prices, has dampened hopes for early Fed charge cuts – a growth that would affect valuable metals markets.

🔄 GLOBAL TRADE SHAKE-UP LOOMS FOR METALS

The Trump administration’s imminent reciprocal tariff coverage might considerably affect world metals costs and provide chains. This main commerce coverage shift, spearheaded by Peter Navarro, goals to match overseas duties on U.S. exports – a transfer that would reshape worldwide metals buying and selling dynamics.

✈️ UNPRECEDENTED GOLD MIGRATION REVEALS MARKET STRESS

Main banks are flying billions in bodily gold from London to New York, with JPMorgan alone shifting $4 billion value this month. This uncommon state of affairs, pushed by market worth gaps and commerce tensions, has created chaos at financial institution vaults and pushed gold futures close to $3,000. With refineries scrambling to recast bars and fill demand, these mounting pressures might drive gold costs even larger.

💬 What GoldSilver Buyers are Saying

⭐ ⭐ ⭐ ⭐ ⭐ Greatest Firm & Buyer Service within the Trade

“GoldSilver.com has been my go-to bullion firm for over a decade. Each buy or sale with them is all the time easy, quick, {and professional}. Final week, I had an pressing order, and Travis from the customer support staff went above and past to expedite my transaction and meet my impossibly tight deadline. I couldn’t be happier with this firm, and all of the free academic assets they supply are life-changing. I’m trying ahead to many extra years with GoldSilver.com as my most well-liked metals seller.”

— A. Mackness

Able to expertise the GoldSilver distinction?

- Knowledgeable steering from actual people who perceive valuable metals

- Complete academic assets to tell your funding choices

- Trade-leading customer support that places you first

Able to get began?