Brandon Sauerwein, Editor

Whereas tariff uncertainty has markets in a tailspin, valuable metals are doing what they do greatest — offering a protected haven throughout instances of instability.

Gold simply shattered the $3,300/oz barrier for the primary time in historical past (+2.5% as we speak), with silver following robust at $33/oz (+2.1%). All this whereas the S&P 500 and Nasdaq proceed their painful double-digit retreat 12 months up to now.

Might escalating commerce tensions propel metals into their greatest bull market in a long time? What different key elements are fueling this historic rally? And most significantly — what strategic strikes ought to YOU be making along with your portfolio proper now?

Alan not too long ago revealed one thing stunning in an necessary interview: silver’s distinctive market place may probably make it the smarter play at this particular second — however there are crucial elements each investor wants to know first…

Silver’s Hidden Potential: Why Silver Could Outperform Gold in 2025

We’ve all felt that sinking feeling these days — checking our retirement accounts solely to see years of cautious saving eroded in a matter of weeks.

However what if this market turmoil really presents a chance most buyers are overlooking?

In his newest interview, funding knowledgeable Alan Hibbard makes a compelling case for the often-overlooked valuable metallic that would outpace gold.

Whereas recommending gold as important safety, Alan explains why silver’s distinctive market place may translate to superior good points for buyers keen to tolerate its volatility.

“Traditionally, silver outperforms gold throughout these bull runs, so it does finally rise much more in value — nevertheless, you pay the value of volatility.”

For buyers keen to climate the volatility, silver may supply a lot increased upside within the coming market cycle. All of it is dependent upon your private threat tolerance.

Safe Bulk Pricing on Each Single Gold & Silver Buy

What Else is within the Information?

🪙 Metals Market Replace

Gold continues its stellar efficiency, now buying and selling above $3,300/oz—up a powerful 26% since January. In the meantime, silver has quietly gained round 15% throughout the identical interval. This metals surge comes as main inventory indexes wrestle, with the S&P 500 down 8% and the Nasdaq tumbling 11% year-to-date.

🤺 US Challenges China’s Mineral Dominance with New Investigation

President Trump has ordered an investigation into potential tariffs on crucial mineral imports, citing nationwide safety considerations. The probe will study provide chains for important supplies together with cobalt, nickel, uncommon earths, and uranium. This motion comes because the US stays closely depending on overseas sources—notably China—for processed minerals important to the economic system. China not too long ago underscored America’s vulnerability on this sector by limiting uncommon earth exports in retaliation to earlier US tariffs.

📉 Fed’s Waller Alerts Potential Fee Cuts

Talking to the CFA Society in St. Louis, Federal Reserve Governor Chris Waller urged substantial rate of interest cuts could also be vital if President Trump’s tariffs stay in place long-term. Waller, thought-about a possible successor to Jerome Powell as Fed Chair in 2026, indicated the Fed may “look via” tariff-induced inflation as much as 5% as short-term, slightly than responding with price hikes. He acknowledged this “transitory inflation” strategy would doubtless face criticism from Wall Road, particularly given the Fed’s misjudgment in the course of the 2021-22 post-COVID inflation surge.

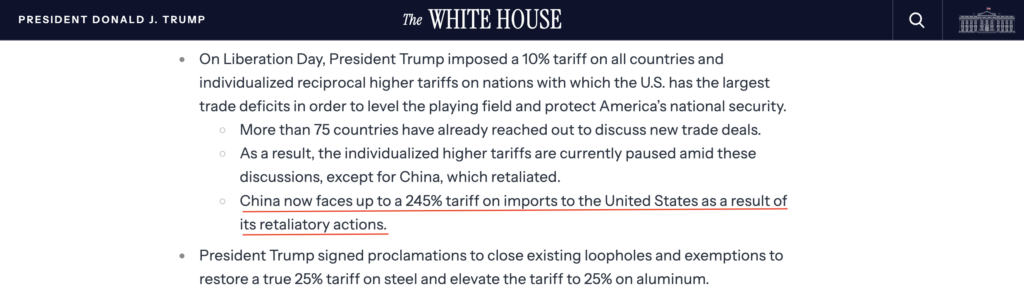

📈 Trump Administration Ramps Up China Tariffs to 254%

President Trump clarified that Chinese language-made smartphones and different electronics won’t be exempt from tariffs, earlier this week. However the fued is way from over. Based on a brand new White Home press launch, China now faces as much as a 245% tariff on United States imports on account of its retaliatory actions.

💰 Goldman Sachs: Nonetheless Room to Run in Gold Rally

Regardless of gold’s current good points, Goldman Sachs believes there’s nonetheless vital upside potential. The funding financial institution not too long ago predicted gold may attain $4,000/oz by 2026 if a recession materializes — representing roughly 25% development from present ranges.

💬 What GoldSilver Buyers are Saying

⭐ ⭐ ⭐ ⭐ ⭐ Jenelle in buyer assist – excellent girl!

“Jenelle helped me to replace my particulars at Gold and Silver in addition to explaining quite a few issues that I didn’t totally perceive together with making a Roth IRA. She very patiently took me via every little thing I wanted for over half an hour -she was so useful, very nice and if I may price her over 5 stars, I’d-she is an absolute gem and ask you to please share this with Mike directly-she is a tribute to your Firm-thank you…” — G. Elias

Expertise the GoldSilver distinction:

- Obtain knowledgeable steering from devoted valuable metals specialists

- Entry complete academic sources to grasp your funding technique

- Belief in our industry-leading customer support crew that places you first

Able to get began?