Brandon Sauerwein, Editor

Whereas Markets Tumble, Gold Shines

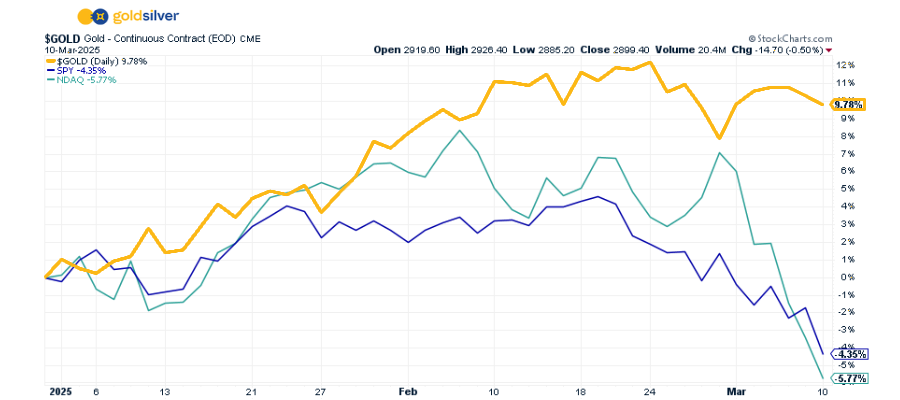

The financial panorama has shifted dramatically in current weeks. The tech-heavy Nasdaq 100 has plunged 12% from its February peak, reaching its most oversold stage since 2022. The S&P 500 has shed 8.6% from its report excessive — erasing over $4 trillion in market worth — and is now teetering on the sting of correction territory (outlined as a ten% decline).

As recession fears intensify, traders are fleeing U.S. shares for safer international property. In the meantime, gold is performing precisely as promised — a haven throughout financial uncertainty.

Gold isn’t merely preserving investor’s portfolios throughout this financial turmoil; it’s actively rising it — up 10% year-to-date and poised to climb additional as market volatility continues.

Regardless of — or reasonably, due to — the present financial uncertainty, there’s by no means been a greater time to be a gold investor…

“Shares HAMMERED… Is This Trump’s Plan?”

What About Gold?

The inventory market is in freefall with no backside in sight. All three main indices are breaking information to the draw back because the post-election euphoria fully evaporates.

Right this moment, Alan reveals how this market crash would possibly truly be a part of Trump’s financial technique. On this pressing replace, you’ll uncover:

- How the S&P 500 simply snapped its historic 336-day assist streak

- Why the Magazine 7 misplaced over $800 billion in market cap in a single day

- Important charts displaying why shares would possibly ship ZERO returns for the following decade

- How gold is silently outperforming practically EVERYTHING on this chaos

What Else is within the Information?

🔍 “NO LONGER UNTHINKABLE”: US RECESSION CONCERNS GROW

Credit score threat indicators reached their highest ranges of 2025 on Monday as market sentiment deteriorates throughout all indexes. A number of firms have postponed bond issuance amid mounting financial uncertainty tied to tariffs and federal workforce reductions. Barclays strategists have notably shifted their outlook, now contemplating a U.S. recession a real risk reasonably than a distant threat.

📉 BITCOIN FALLS BELOW $80K AND INSTITUTIONAL MONEY FLEES

Bitcoin tumbled beneath $80,000 on Monday, briefly touching $77,459 — a 14% decline over the previous week. This sell-off coincides with broader market weak point and follows 4 consecutive weeks of institutional traders lowering crypto publicity. Market sentiment has turned decidedly bearish, with the Crypto Concern & Greed Index collapsing to 17, whereas President Trump’s tariff insurance policies and feedback a couple of coming “interval of transition” for the economic system have amplified uncertainty.

📈 ROYAL MINT: GOLD BULLION SALES UP 153%

The Royal Mint has recorded a staggering 153% enhance in bullion gross sales as UK traders search safe-haven property amid market turbulence. Gold cash have skilled probably the most dramatic demand, with gross sales skyrocketing 206% year-over-year. The push has created important provide constraints, with some refineries now reporting backlogs stretching as much as 12 weeks.

🥇 GLOBAL GOLD ETF ASSETS HIT ALL-TIME HIGH

World gold ETFs attracted an enormous $9.4 billion in February — their strongest month since March 2022. North American funds led the cost with $6.8 billion in new investments, marking their finest February on report and largest month-to-month influx since July 2020. This unprecedented demand has pushed complete ETF property to an all-time excessive of $306 billion as gold costs established 9 new information in February alone.

✨ GOLD UP 57% OVER PAST 24 MONTHS

In March 2023, gold traded round $1,850/oz. These costs now look like a distant reminiscence as the dear steel continues its historic climb, nearing $3,000/oz.

💬 What GoldSilver Traders are Saying

⭐ ⭐ ⭐ ⭐ ⭐ Buyer Service may be very useful!

“Travis was superb! I used to be having problem with a wire switch of my life’s financial savings, and I used to be very frightened that I won’t be capable to obtain all of it. My husband simply handed away and I’ve been frightened about these funds together with grieving for 8 months. As quickly as I bought linked with Travis, my issues have been instantly addressed and he put me comfortable. The problem was resolved inside days. He even referred to as me again with updates to maintain me within the loop about what was happening with the funds. I’m so grateful for a buyer consultant like Travis. He actually cares for his shoppers.” — A. Howard

Expertise the GoldSilver distinction:

- Obtain knowledgeable steering from devoted valuable metals specialists

- Entry complete academic assets to grasp your funding technique

- Belief in our industry-leading customer support workforce that places you first

Able to get began?