Day by day Information Nuggets | At the moment’s high tales for gold and silver traders

October 2nd, 2025

Gold Extends Rally to 5 Days

Gold costs are driving a five-day profitable streak, holding close to $3,880/oz as merchants weigh political turmoil on the Federal Reserve and a looming U.S. authorities shutdown. Silver can be agency, hovering round $47.50/oz.

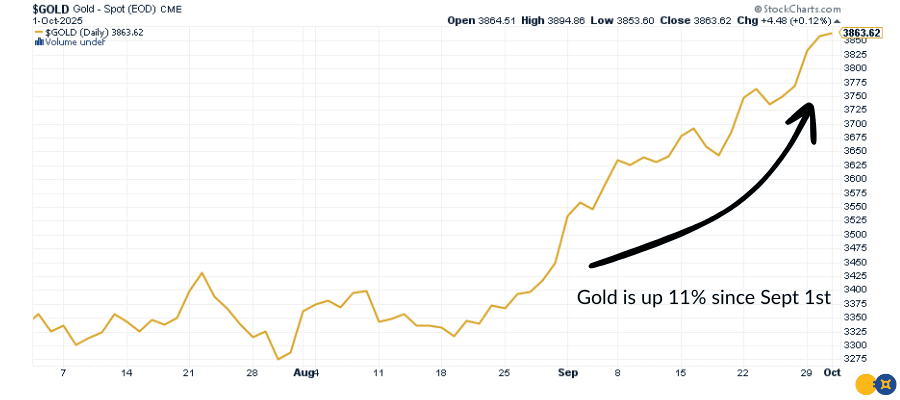

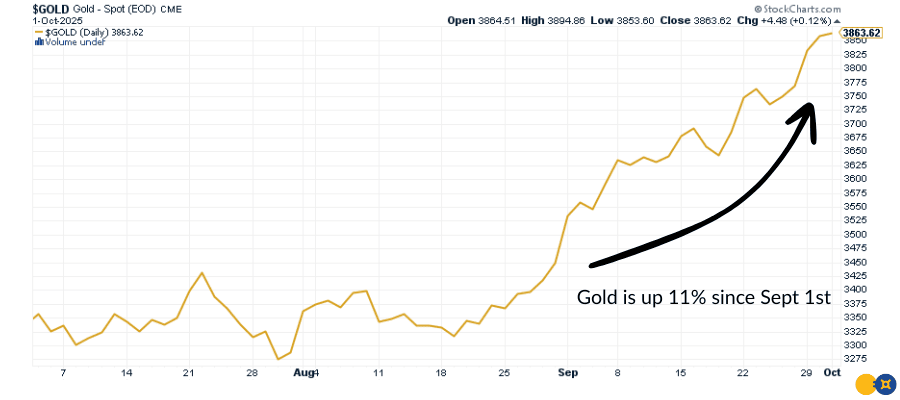

The actual headline, although, is September’s efficiency: up 11% in a single month — one in every of gold’s strongest runs in latest reminiscence. The chart tells the story: traders have poured into secure havens as political turmoil shakes confidence within the Fed and a authorities shutdown provides to uncertainty.

This type of transfer is greater than a knee-jerk response. It alerts traders are repositioning for a weaker greenback, unstable bond markets, and the chance the Fed will maintain chopping charges nicely into 2025.

Authorities Shutdown Begins Amid Healthcare Conflict

The U.S. authorities formally shut down Wednesday after Congress did not cross a finances settlement. A vote to reopen the federal government shortly collapsed, with Senate Democrats holding agency on calls for to increase healthcare subsidies underneath the Reasonably priced Care Act. With no deal, lots of of hundreds of federal employees face furloughs, and significant knowledge releases — from jobs to inflation — are actually delayed.

The standoff hinges on tax credit that assist thousands and thousands afford insurance coverage, set to run out at yr’s finish if no extension is handed. With each events digging in, traders face renewed coverage uncertainty. For markets, the fast threat is the absence of dependable knowledge, which might complicate Fed decision-making. Traditionally, gold has drawn safe-haven flows throughout shutdowns as traders hedge towards volatility and political dysfunction.

With the shutdown underway, all eyes flip to Friday’s jobs report — assuming it’s launched on schedule.

Supreme Court docket Retains Lisa Prepare dinner on the Fed

The U.S. Supreme Court docket dominated Wednesday that Lisa Prepare dinner will stay a Federal Reserve governor at the least till January, when it hears arguments on her contested dismissal. President Trump has sought to take away her, accusing the Fed of dragging its ft on fee cuts. At stake is a precedent-setting query: can a president fireplace a Fed governor with out trigger?

The implications go nicely past one seat. If the Court docket sides with Trump, it might alter how impartial the Fed actually is — a cornerstone of investor confidence for many years. For markets, that uncertainty fuels demand for belongings immune from political tampering, with gold once more standing out because the safe-haven of alternative.

Goldman Sachs: ‘Giant Upside Danger’ for Gold

Goldman Sachs analysts say the metallic’s record-setting run might solely be the start. The financial institution sees “important upside threat” for gold if the Fed retains easing and Washington stays gridlocked. Goldman says if personal capital flows aggressively into gold, the financial institution believes costs might climb towards $4,500/oz — and notes a extra reasonable path to $4,000+ by mid-2026.

The underside line: Goldman’s name echoes the broader thesis that gold is not only a disaster hedge — it’s changing into a structural portfolio allocation for each massive establishments and particular person traders.

Investor Outlook: Gold in a Stagflation World

The World Gold Council is warning that stagflation — the poisonous mixture of slowing development and cussed inflation — is again on the radar. For traders, meaning the worst of each worlds: weaker inventory market returns alongside rising prices on the grocery retailer and gasoline pump.

Traditionally, this backdrop has punished equities however supported gold, which tends to profit when confidence in development belongings falters. With tariffs, political shocks, and Fed coverage uncertainty including gas to the hearth, gold’s function as a stabilizer seems more and more important.

As This autumn begins, the regular climb in gold suggests traders are already bracing for a stagflationary squeeze.