It’s no secret that world central banks have been stockpiling gold. However we simply didn’t understand how vital the central financial institution gold shopping for has been. Demand for gold bullion is so sturdy that the valuable steel has surpassed the euro to grow to be the second-largest asset held by central banks world wide.

For the final three years, world central banks have purchased greater than 1,000 tons of gold annually. Due to all that gold shopping for, immediately, gold is the world’s second-largest world central financial institution reserve asset, behind the U.S. greenback.

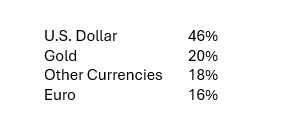

Gold pushed previous the euro in 2024, taking second place, in accordance with new information from the European Central Financial institution. Right here’s the breakdown.

International Central Financial institution Reserves

Supply: European Central Financial institution, Worldwide Financial Fund, Bloomberg

On the finish of 2024, world central financial institution holdings of gold had climbed to round 36,000 tons, close to the all-time excessive of 38,000 tons set in 1965.

Why are central banks shopping for gold? It’s easy. It seems that central banks are shopping for gold for lots of the identical causes that particular person traders are piling into the valuable steel.

Central banks are shopping for gold for diversification functions and in addition to hedge in opposition to geopolitical threat, the European Central Financial institution report mentioned. Reserve managers additionally worth gold as a portfolio diversifier to hedge in opposition to inflation, cyclical downturns, and defaults.

Why does this matter to you? Central banks are long-term traders. They see worth in gold at present ranges and proceed to purchase and stockpile the valuable metals of their world central financial institution vaults. If they’re rising their publicity to gold, possibly it’s best to contemplate it too.

It’s been an epic rally in gold, and valuable metals are nonetheless climbing.

The value of gold has climbed practically 62% for the reason that starting of 2024. Silver is hovering too. Silver simply jumped previous $36.00 an oz, and analysts at the moment are pointing to $40 as the following massive goal. Platinum can be rocketing increased, climbing 35% for the reason that begin of the 12 months. The truth is, platinum, gold, and silver are the highest three best-performing belongings of 2025. Valuable metals are in a powerful uptrend, with enormous momentum and are nonetheless climbing. A variety of Wall Road forecasts level to gold at $4,000 an oz and past.

For hundreds of years, folks have turned to valuable metals as a retailer of worth and as an asset to guard and develop their wealth. Should you’ve been occupied with rising your allocation to valuable metals, don’t wait; the markets are shifting, and gold at $4,000 might be right here earlier than it.