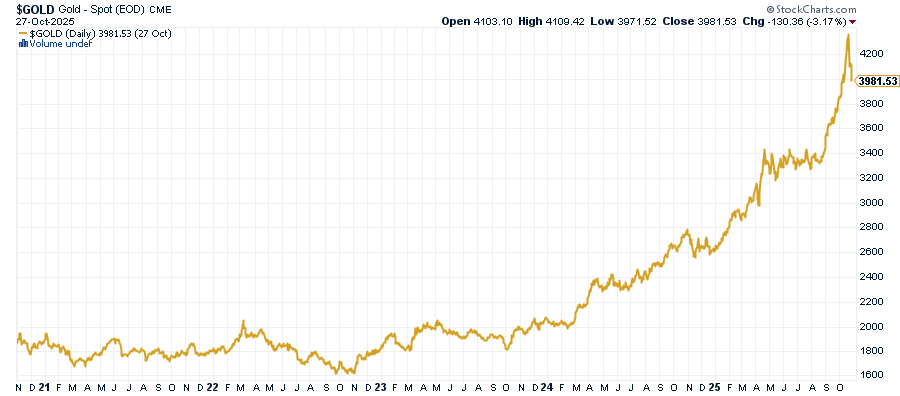

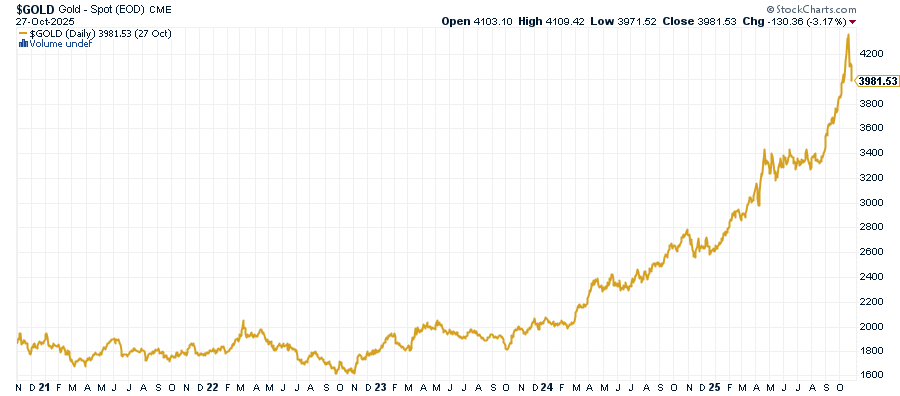

Almost each main financial institution’s gold worth prediction for 2025 pointed increased — however few anticipated simply how explosive the rally could be. Gold surged above $4,000 per ounce in October 2025, setting historic new highs and reaffirming its function as the final word protected haven in an period of financial and geopolitical uncertainty.

The numbers inform a compelling story. Over the previous 5 years, gold has quietly delivered one of many strongest risk-adjusted performances of any main asset class:

(Supply: StatMuse, CME, World Gold Council)

Gold Worth 5 12 months Chart

With costs now consolidating just under document highs, buyers are asking the precise query: how a lot increased can gold go — and the way lengthy can this bull market final?

What the Large Banks Are Saying: 2026–2030 Outlook

The consensus amongst main monetary establishments has shifted dramatically. What was as soon as thought-about bullish is now baseline, with a number of banks publishing $5,000 gold worth predictions extending into 2026 and past.

Right here’s what the road is looking for:

HSBC sees a “bull wave” taking gold to $5,000/oz by the primary half of 2026, lifting their annual common forecast to $4,600.

Financial institution of America raised its 2026 goal to $5,000 (with a ~$4,600 common), citing coverage uncertainty and surging funding demand.

J.P. Morgan (up to date October 2025) now tasks gold averaging ~$5,055 in This fall 2026, with a longer-term goal of ~$6,000 by 2028.

The underside line? The “forecast vary” has shifted upward. Baseline forecasts now cluster across the excessive $3,000s for late 2025 and ~$4,000+ in early-to-mid 2026, whereas a number of credible banks publish $5,000 eventualities for 2026 — and at the least one marquee desk lays out an prolonged path towards $6,000 by 2028.

What’s Driving Gold Increased?

Three main forces are supporting this bullish outlook:

1. Central Financial institution Demand Stays Voracious

Central banks proceed to load up on gold, averaging round 710 tonnes per quarter in 2025. Based on J.P. Morgan’s evaluation, central banks aren’t carried out but — added political uncertainty is more likely to gas a revival into 2025 and past.

When the world’s largest monetary establishments are shopping for aggressively, it’s price paying consideration.

2. Inflation and Financial Coverage

The CPI mixed with M2 cash provide development continues to point out secure growth — a recipe for continued gold appreciation. Historic knowledge confirms gold’s robust relationship with inflationary intervals, making it a gorgeous hedge in opposition to forex devaluation.

Translation? So long as cash printing continues and inflation stays elevated, gold ought to maintain its worth relative to weakening fiat currencies.

3. Geopolitical Uncertainty Exhibits No Indicators of Easing

Present world tensions proceed to help gold’s safe-haven attraction. Ought to financial and monetary situations deteriorate additional — exacerbating stagflationary pressures and geoeconomic tensions — protected haven demand might push gold 10%-15% increased from present ranges.

How A lot Gold Ought to You Personal? Portfolio Allocation for the Subsequent 5 Years

The fitting allocation is dependent upon your danger tolerance and funding objectives:

Conservative Strategy (8-12% allocation): Concentrate on gold’s stability for wealth preservation. This increased allocation is especially appropriate given present financial uncertainties and the steel’s confirmed observe document throughout market volatility.

Average Technique (5-10% allocation): Stability gold’s defensive traits with different development property, benefiting from the projected regular appreciation over the subsequent 5 years.

Aggressive Positioning (3-8% allocation): Complement gold with silver publicity. Each metals sometimes profit from comparable macroeconomic situations, whereas silver presents increased volatility and doubtlessly larger returns.

In September 2025, Morgan Stanley CIO Michael Wilson made a groundbreaking name: allocate 20% to gold — changing half the bond allocation within the conventional 60/40 portfolio. His new “60/20/20” mannequin displays a stark actuality: bonds have misplaced their safe-haven standing amid persistent inflation and unsustainable debt.

When considered one of Wall Avenue’s most influential voices says gold deserves twice the allocation of bonds, it alerts that even mainstream finance is rethinking treasured metals’ function in fashionable portfolios.

Bodily Gold, ETFs, or Mining Shares? Selecting Your Funding Car

For a 5-year funding horizon, you’ve gotten a number of choices:

- Gold IRAs supply important tax benefits for retirement planning whereas sustaining publicity to bodily steel.

- Gold ETFs present liquidity and ease of buying and selling, although they introduce counterparty danger.

- Mining shares supply leveraged publicity to gold costs however include company-specific dangers.

The fitting alternative is dependent upon your storage capabilities, tax state of affairs, and liquidity wants over the five-year interval.

Threat Elements Each Gold Investor Ought to Monitor

Regardless of bullish forecasts, a number of headwinds might impression gold’s trajectory:

- US greenback power: A sustained rally within the greenback sometimes pressures gold costs downward.

- Geopolitical battle decision: Widespread and sustained peace — one thing that seems unlikely within the present atmosphere — might see gold give again 12%-17% of latest positive factors.

- Federal Reserve coverage shifts: Aggressive tightening cycles might briefly dampen gold’s attraction.

- Provide-side pressures: Elevated gold costs are more likely to proceed curbing shopper demand and doubtlessly encouraging recycling, which might create provide headwinds.

What to Count on from Gold Over the Subsequent 5 Years

The consensus amongst main monetary establishments factors to continued gold appreciation by way of 2030, with worth targets starting from $4,000 to over $5,000 per ounce. Present market positioning suggests gold stays well-positioned as each a defensive asset and development alternative over the subsequent 5 years.

As Gregory Shearer, head of Base and Treasured Metals Technique at J.P. Morgan, places it:

“We nonetheless assume dangers are skewed towards an earlier overshoot of our forecasts if demand continues to shock our expectations. For buyers, we predict gold stays probably the most optimum hedges for the distinctive mixture of stagflation, recession, debasement and U.S. coverage dangers going through markets in 2025 and 2026.”

For buyers contemplating gold as a 5-year funding, the mixture of robust institutional demand, financial coverage help, and geopolitical uncertainty creates a compelling funding thesis. Nevertheless, like all investments, gold must be considered as a part of a diversified portfolio technique slightly than a standalone answer.

For the newest market evaluation and funding steerage, go to our gold and silver investing information part and assessment present treasured steel worth charts to remain knowledgeable about market developments.

Individuals Additionally Ask

What is going to gold costs be in 2025 and 2026?

Main monetary establishments undertaking gold will common within the excessive $3,000s by way of late 2025, with a number of banks forecasting $5,000 per ounce by 2026. J.P. Morgan’s newest evaluation sees gold averaging round $5,055 in This fall 2026, with a long-term goal of $6,000 by 2028 if macroeconomic situations proceed supporting the rally.

How a lot of my portfolio must be in gold?

Most monetary advisors advocate 5-12% portfolio allocation to gold relying in your danger tolerance, with conservative buyers favoring 8-12% for wealth preservation. In a notable shift, Morgan Stanley CIO Michael Wilson just lately beneficial 20% allocation to gold, changing half the normal bond allocation in basic portfolio fashions.

Is it too late to purchase gold at $4,000?

Regardless of gold’s rally above $4,000, analysts imagine there’s nonetheless important upside potential pushed by central financial institution demand, inflation issues, and geopolitical uncertainty. Gregory Shearer of J.P. Morgan notes that “dangers are skewed towards an earlier overshoot” of forecasts, suggesting the bull market has room to run by way of 2026 and past.

What’s driving gold costs increased in 2025?

Three major elements are propelling gold: aggressive central financial institution shopping for averaging 710 tonnes per quarter, persistent inflation eroding fiat forex worth, and heightened geopolitical tensions driving safe-haven demand. Central banks’ shift away from U.S. Treasuries and towards gold has created a structural worth ground that helps continued appreciation.

Ought to I purchase bodily gold or gold ETFs?

Bodily gold eliminates counterparty danger and gives full management over your property, making it perfect for long-term wealth preservation and disaster safety. Gold ETFs supply larger liquidity and ease of buying and selling however introduce counterparty danger throughout monetary system stress. For severe buyers, GoldSilver presents each bodily treasured metals and Gold IRA choices to match your storage capabilities and funding timeline.

This evaluation is for informational functions solely and shouldn’t be thought-about funding recommendation. Previous efficiency doesn’t assure future outcomes. All the time seek the advice of with certified monetary professionals earlier than making funding selections.