As a contentious election looms across the nook, many main coverage points dangle within the steadiness.

However amid the uncertainty, there’s one factor that many Wall Avenue merchants agree on: Gold is having a second – and it is not simply any second.

Breaking value data nearly weekly, gold is presently on monitor for its greatest efficiency in over 45 years. What started as a surge in demand from China and central banks has reworked into one thing greater – a worldwide gold-buying spree that exhibits no indicators of slowing…

Breaking Data and Making Historical past

On Thursday, gold costs practically breached $2,800 per ounce, pushing the yr’s features above 33%.

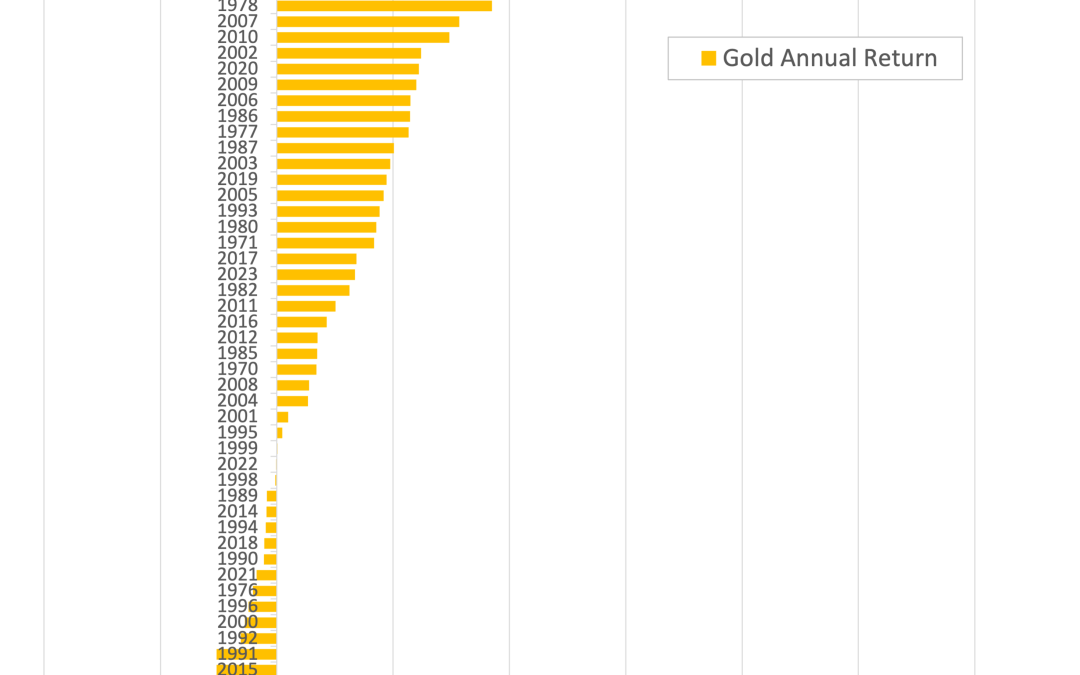

To place this extraordinary efficiency in context, our senior analyst Alan Hibbard lately shared an eye-opening perspective: 2024 is shaping as much as be among the best years for gold previously half-century.

Gold’s Annual Returns Since 1970

Let that sink in. We’re witnessing historical past within the making. Solely 4 instances since 1970 has gold delivered stronger returns:

- 1979: +126.5%

- 1973: +73%

- 1974: +66.1%

- 1972: +48.8%

However here is what makes 2024 completely different: Gold is reaching these features with out the double-digit inflation of the Seventies.

This implies there’s one thing greater behind this gold rally.

Why Gold Now?

The celebrities are aligning for gold throughout a number of fronts: The U.S. nationwide debt has surged previous $34 trillion, international geopolitical tensions have reached their highest ranges in a long time, and the U.S. greenback’s dominance in international reserves has weakened to simply 59% – a low not seen since 1995.

However it’s not simply the basics which are turning heads on Wall Avenue:

“Markets like gold in uncertainty, particularly when it has to do with geopolitical points,” says Portfolio supervisor Patrick Fruzzetti of Rose Advisors in New York in a latest Bloomberg interview. “That is a cause why you’d wish to personal gold going into the election.”

Paul Wong, market strategist at Sprott Asset Administration, factors to structural shifts: “Gold is now in a brand new bullish section, pushed by components like central financial institution shopping for, rising U.S. debt and a possible peak within the U.S. greenback.”

Much more emphatic, famend valuable metals professional Adrian Day says we’re presently within the “most bullish atmosphere for gold possible.”

The numbers again up these professional opinions: World Gold Council information exhibits central banks bought a record-breaking 483 tons of gold within the first half of 2024 alone – 5% above the earlier report set simply final yr.

This unprecedented central financial institution shopping for, mixed with surging international investor demand, suggests gold’s rally has robust elementary help that transcends subsequent week’s election final result.

Wanting Forward: The place Does Gold Go Subsequent?

Whereas nobody can predict the long run with certainty, the momentum is simple. In his newest video evaluation, Alan Hibbard maps out a compelling state of affairs for gold in 2025:

“If gold repeats subsequent yr what it did in 2024, we are going to hit $4,000 per ounce earlier than the tip of 2025.”

Need to be taught extra from Alan about gold’s potential throughout this historic bull run? Click on right here to observe Alan’s full evaluation.

Collaborating in Gold’s Historic Rally

Whereas central banks and establishments race to safe their gold positions, particular person traders have a singular alternative to take part on this historic bull market.

At GoldSilver.com, we imagine in empowering you with information first, adopted by entry to the best investment-grade bullion out there. Our storage program gives the identical safe vault choices utilized by institutional traders, whereas our direct supply ensures you preserve full management of your valuable metals.

Whether or not you are new to valuable metals or trying to broaden your place, we’re right here to assist once you’re able to act.

Discover Our Assortment of Gold and Silver Bullion

Till subsequent week,

Brandon S.

Editor

GoldSilver