The place We Are within the Cycle

In the event you’re questioning whether or not gold’s current all-time highs imply you’ve missed the rally, historical past presents a reassuring reply: gold bull markets are inclined to final far longer than most traders count on. And by historic requirements, this cycle should be in its early innings.

The most effective methods to grasp the place gold stands immediately is to match this rally with earlier gold bull markets — not simply in value, however in length. The patterns don’t repeat precisely, however they do rhyme. And what they counsel is that this transfer might have extra room to run.

How Right this moment’s Rally Compares to Previous Bull Markets

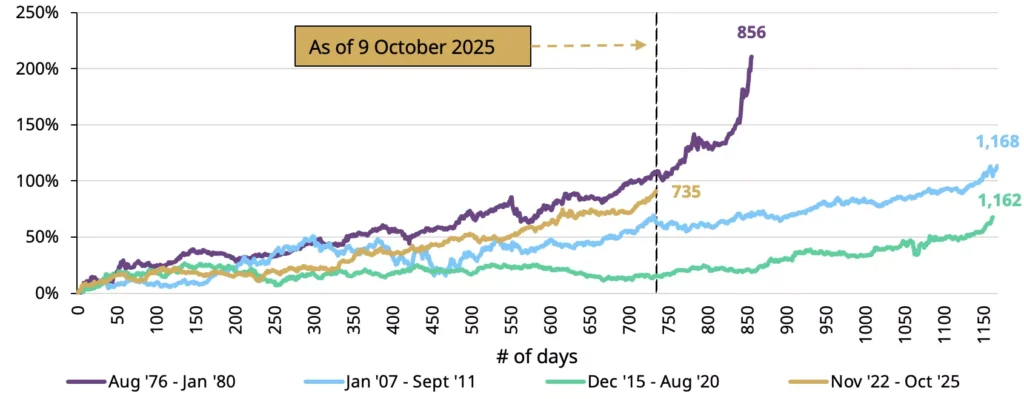

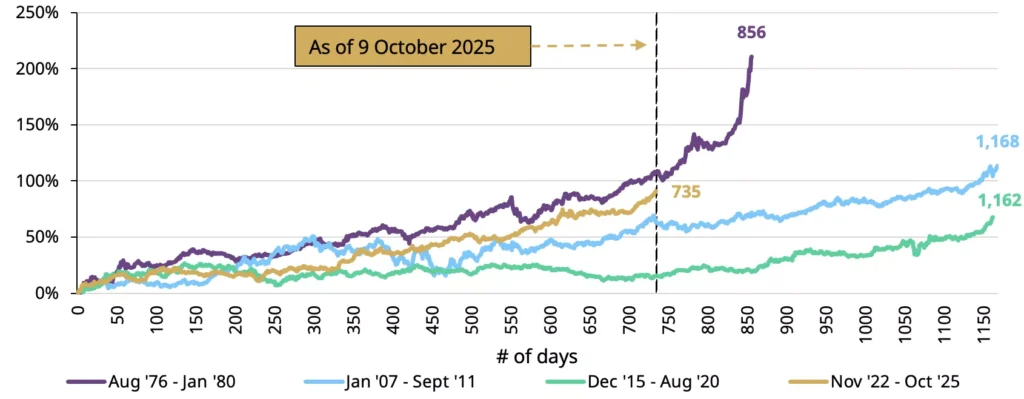

Supply: Bloomberg, World Gold Council | *Knowledge as of 10/09/2025. Primarily based on the LBMA Gold Value PM.

As of October 9, 2025, gold’s present rally is roughly 735 days outdated. That may sound substantial — till you evaluate it to historical past. Main gold bull markets have averaged about 1,062 days in length. Practically three years.

And right here’s the essential perception: in previous cycles, gold usually hit file highs early within the rally — then stored climbing for years afterward.

The chart above exhibits three main gold bull markets alongside immediately’s rally, listed to their beginning factors. What turns into instantly clear is that length issues as a lot as magnitude — and by that measure, this cycle nonetheless has runway.

The Nineteen Seventies: When Gold Rose 2,300% Over 4 Years

The Nineteen Seventies gold bull market stays probably the most dramatic instance of gold’s potential during times of financial instability.

Gold started that decade at $35 per ounce — a hard and fast value that had been maintained since 1934. When President Nixon severed the greenback’s tie to gold in 1971, the floodgates opened. By January 1980, gold had surged previous $850, a staggering 2,300% acquire in lower than a decade.

However right here’s what many traders neglect: gold broke above its earlier all-time excessive comparatively early in that cycle. It then spent years consolidating and climbing greater earlier than its ultimate parabolic surge.

The drivers have been clear: double-digit inflation, increasing funds deficits, geopolitical shocks (oil embargoes, Chilly Battle tensions), and a disaster of confidence in fiat currencies. Sound acquainted? Right this moment’s macro surroundings shares extra parallels with the Nineteen Seventies than most traders notice.

The 2001-2011 Rally: A Decade-Lengthy Climb

The following main gold bull market started in 2001, following twenty years of bear market circumstances. This rally was totally different in character — steadier, longer, and pushed by a brand new set of issues.

Gold bottomed close to $250 in 1999 and commenced climbing because the dot-com bubble burst. By 2006, it had reached new nominal highs round $725. Many traders at that time assumed the rally was overextended.

They have been unsuitable. Over the subsequent 5 years, gold tripled from these “all-time highs,” ultimately peaking close to $1,900 in September 2011.

What drove that decade-long climb? The monetary disaster of 2008, unprecedented financial growth by means of quantitative easing, sovereign debt issues in Europe, and chronic concern that central banks have been debasing their currencies. As soon as once more, the rally didn’t finish as a result of costs felt excessive — it ended when these elementary drivers started to ease after 2011.

What Truly Ends a Gold Bull Market

Gold rallies don’t finish simply because costs really feel excessive. They finish when the underlying drivers reverse — and proper now, these forces are accelerating, not easing.

The fundamentals supporting gold immediately embrace:

- Mounting sovereign debt throughout developed economies

- Persistent inflation pressuring buying energy

- Foreign money debasement by means of expansionary financial coverage

- Rising geopolitical instability driving safe-haven demand

Till these tendencies shift, the macro backdrop stays bullish for gold. And none of them present indicators of reversing quickly.

Why This Cycle Might Nonetheless Be Early-Stage

By length alone, immediately’s rally appears to be like youthful than earlier gold bull markets. If this cycle follows historic patterns, the danger of being under-allocated to gold might outweigh the danger of holding a core place.

The takeaway isn’t to chase value or time each dip. It’s to acknowledge that gold bull markets have traditionally rewarded persistence over market timing. The pattern size has favored staying invested quite than buying and selling round headlines or short-term volatility.

Historical past suggests we could also be watching the center chapters of this story — not the ultimate act.

Folks Additionally Ask

How lengthy do gold bull markets usually final?

Main gold bull markets have traditionally averaged round 1,062 days — almost three years in length. The Nineteen Seventies rally lasted over 4 years, whereas the 2001-2011 bull market ran for a full decade. By comparability, the present cycle (as of October 2025) is roughly 735 days outdated, suggesting it could nonetheless have room to run.

Can gold proceed rising after hitting all-time highs?

Completely. In previous gold bull markets, reaching all-time highs was usually an early-stage sign, not a peak. Throughout the Nineteen Seventies rally, gold greater than doubled after breaking information, and within the 2001-2011 cycle, it tripled following its first new highs in 2006. Historic patterns present that length issues greater than value ranges alone.

What causes a gold bull market to finish?

Gold bull markets usually finish when their underlying drivers reverse — not just because costs really feel elevated. The important thing components embrace fiscal stress, foreign money debasement, inflation, and geopolitical instability. When authorities debt stabilizes, inflation subsides, and geopolitical tensions ease, gold rallies are inclined to plateau. These circumstances aren’t current immediately.

Is it too late to purchase gold in 2025?

Historical past suggests it is probably not. If this cycle follows earlier patterns, the rally might nonetheless be in its center phases quite than approaching a peak. The chance of being under-allocated to gold might outweigh the danger of ready for a pullback that by no means comes. GoldSilver presents academic sources to assist traders construct a strategic place quite than making an attempt to time the market.

How does the present gold rally evaluate to the Nineteen Seventies bull market?

The Nineteen Seventies gold bull market lasted over 4 years and noticed costs surge greater than 2,000% from begin to end. Importantly, gold continued climbing for years after breaking all-time highs. Right this moment’s rally shares related elementary drivers — fiscal deficits, foreign money issues, and geopolitical danger — however is shorter in length up to now, suggesting it could nonetheless have vital upside potential.