Written by: The MacroButler

Savvy buyers who’ve totally studied the enterprise cycle, the impression of financial phantasm on it, and its results on asset allocation inside the Everlasting Browne portfolio ought to by now perceive that in an inflationary atmosphere, they need to personal solely properties and keep away from contracts.

Skilled buyers perceive that equities are comparatively easy to worth utilizing strategies like Discounted Money Stream (DCF), Value-to-Earnings (P/E), Value-to-E book (P/B), and Dividend Low cost Mannequin (DDM). Different key metrics, corresponding to EV/EBITDA, Value-to-Gross sales (P/S), Free Money Stream (FCF) Yield, and the PEG ratio, present further insights. Comparative valuation, business traits, and broader financial situations additional refine assessments, serving to buyers decide whether or not a inventory is undervalued, overvalued, or pretty priced.

Valuing gold is much extra complicated than valuing equities, as its value is pushed by shortage somewhat than utility or money flows. Gold capabilities as cash, a commodity, a monetary asset, and a consumption good, making its valuation inherently difficult. With costs dictated by rapid provide and demand, the dearth of a transparent ‘truthful worth’ seemingly contributes to gold’s relative unpopularity amongst institutional buyers.

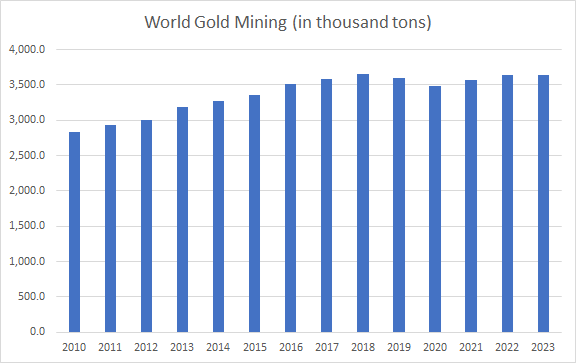

From a pure provide perspective, international gold manufacturing has basically flatlined at round 3,500 tons per yr since 2016, regardless of vital exploration and manufacturing budgets by miners. At immediately’s gold worth, this interprets to an annual provide improve of roughly $260 billion, lower than two months’ value of the U.S. finances deficit. In the meantime, the worldwide inhabitants, GDP, cash provide, and different elements tied to financial exercise proceed to develop.

Those that perceive the geopolitical dynamics of world finance will word that China and Russia, the 2 pillars of the World South and BRICS, in search of to bypass the weaponization of USD belongings, are by far the biggest gold producers, collectively accounting for about 18% of annual international gold extraction.

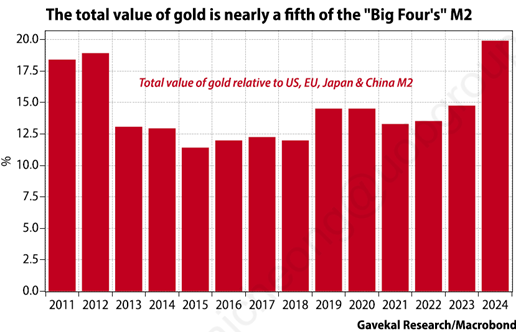

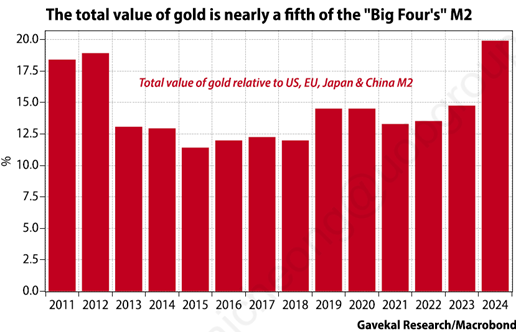

If gold is taken into account cash, as John Pierpont Morgan famously said, its worth relative to the broad cash provide within the ‘Large 4’ economies (U.S., EU, Japan, and China) ought to the reference level for its valuation. Over the previous 15 years, this ratio has ranged between 12% and 18%. With the continuing gold bull market and the contraction in U.S. M2, this ratio has now nearly reached 20%, a traditionally elevated stage. Nonetheless, since it’s clear that the worldwide elite will proceed printing cash to inflate their method out of future crises, this excessive gold-to-money provide ratio could show solely ‘transitory’. Certainly, the truth is that savvy buyers perceive the necessity to personal gold of their portfolios for its antifragile traits and its hedge in opposition to reckless authorities spending, which in the end result in sovereign defaults. It ought to due to this fact come as no shock that gold performs nicely when the U.S. debt-to-GDP ratio rises. The occupant of the White Home could change, however the pattern within the U.S. deficit won’t, significantly in an atmosphere the place commerce wars add to the burden of kinetic conflicts and due to this fact gold is much from being costly on that metric.

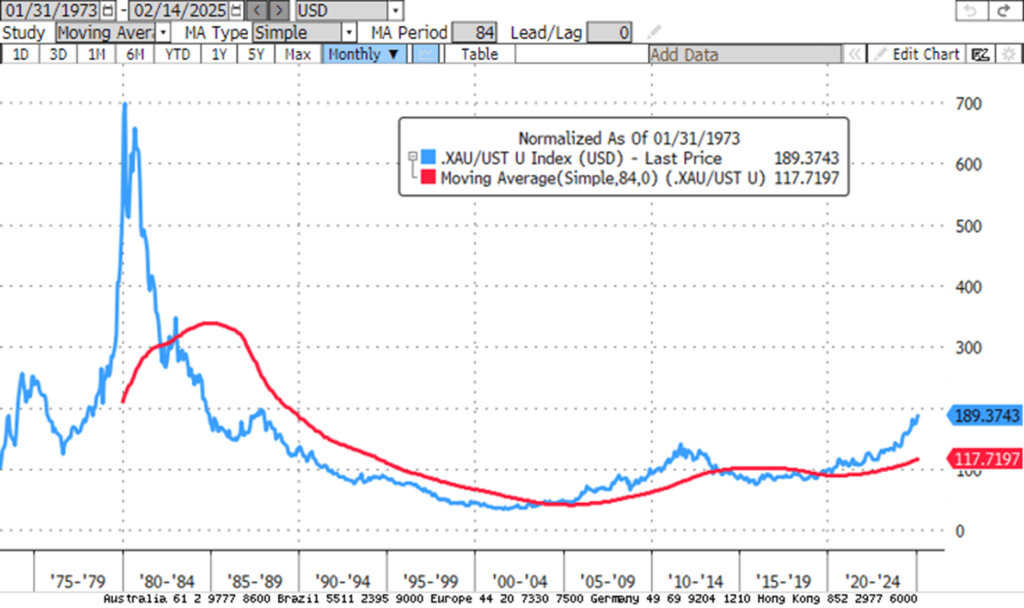

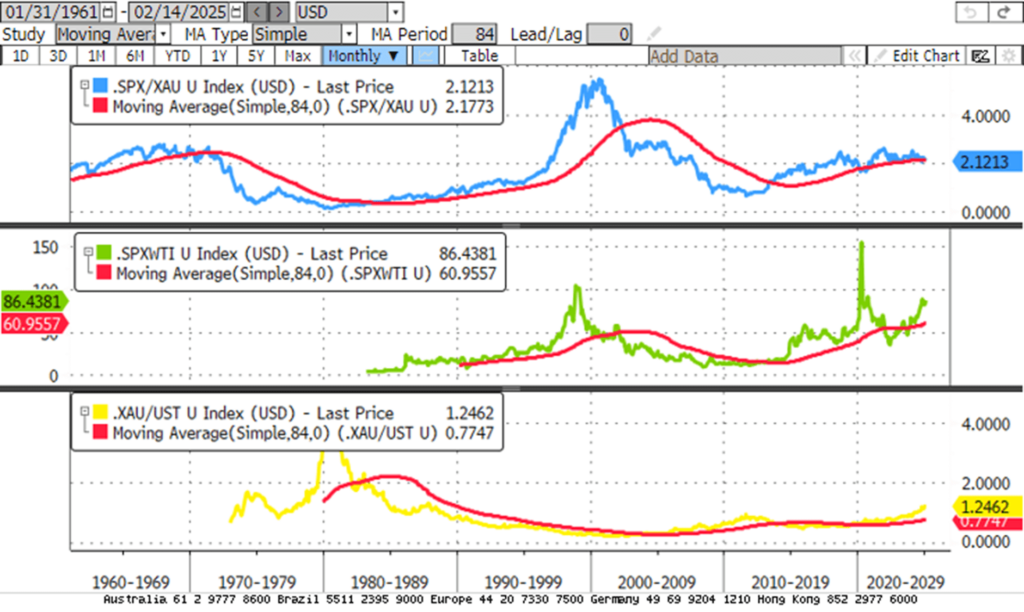

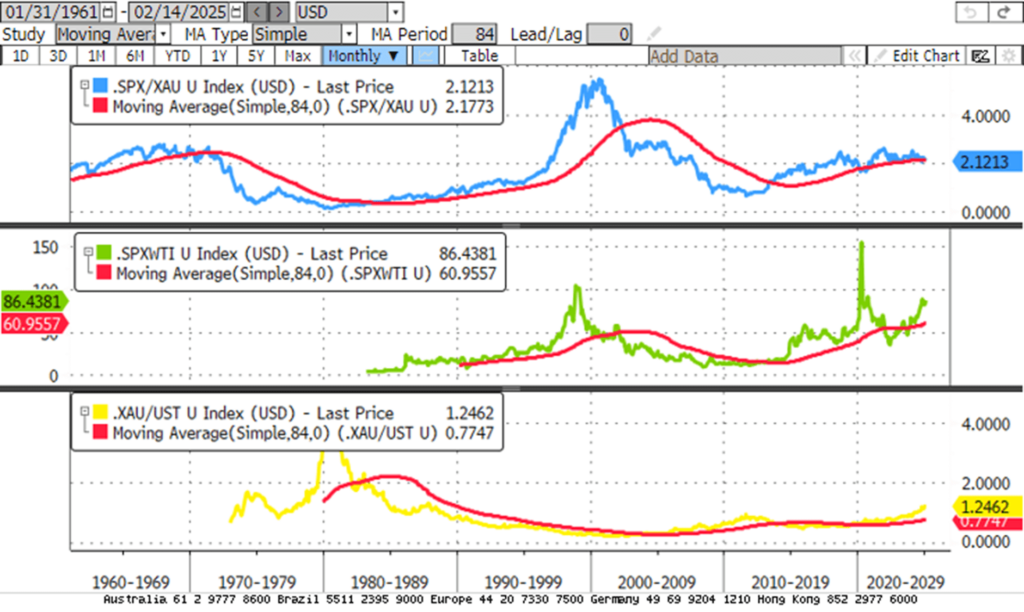

Those that have studied the enterprise cycle and how one can gauge the financial atmosphere utilizing market information and ratios know that the easiest way to find out whether or not an economic system is in an inflationary or deflationary section shouldn’t be by CPI information or different authorities statistics, however by analyzing the Gold-to-Treasury ratio and its place relative to its 7-year transferring common. Certainly, the standard of a fiat foreign money as a retailer of worth could be assessed by evaluating gold or the federal government bond market. Traders perceive that if gold costs rise sooner than bond costs and the Gold-to-Bond ratio is above its 7-year transferring common, gold is the shop of worth, signalling inflation. Conversely, if bond costs rise sooner than gold and the Gold-to-Bond ratio is beneath its 7-year common, bonds are the shop of worth, signalling deflation.

Given the explosive cash provide, the weaponization of USD belongings, and reckless authorities spending which have led to monumental fiscal deficits within the U.S., it ought to come as no shock that the Gold-to-Treasury bond ratio has risen parabolically for the reason that begin of the present decade. Nonetheless, it stays removed from the acute factors reached within the late Seventies early Nineteen Eighties, factors which may very well be reached if tariffs introduce further dangers for buyers in proudly owning U.S. authorities bonds, as soon as thought-about the ‘risk-free’ asset however now not devoid of threat. In the end, these pushed by a mercantilist spirit, which can inevitably conflict with the brand new type of ‘American narcissistic imperialism’, aiming not solely to protect its financial dominance by govt orders and pressure to annex international locations into the present 50 states of the union, will discover in bodily gold a obligatory means to keep away from the dangers of one other spherical of the weaponization of USD belongings.

Gold to US Treasury Ratio (blue line); 84-month Shifting Common of the Gold to US Treasury ratio (crimson line).

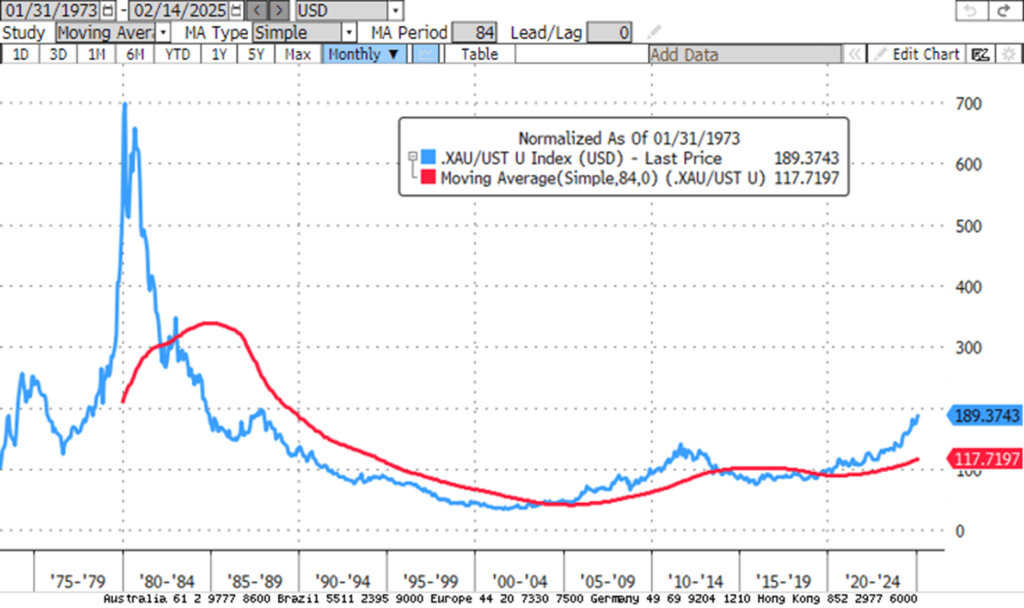

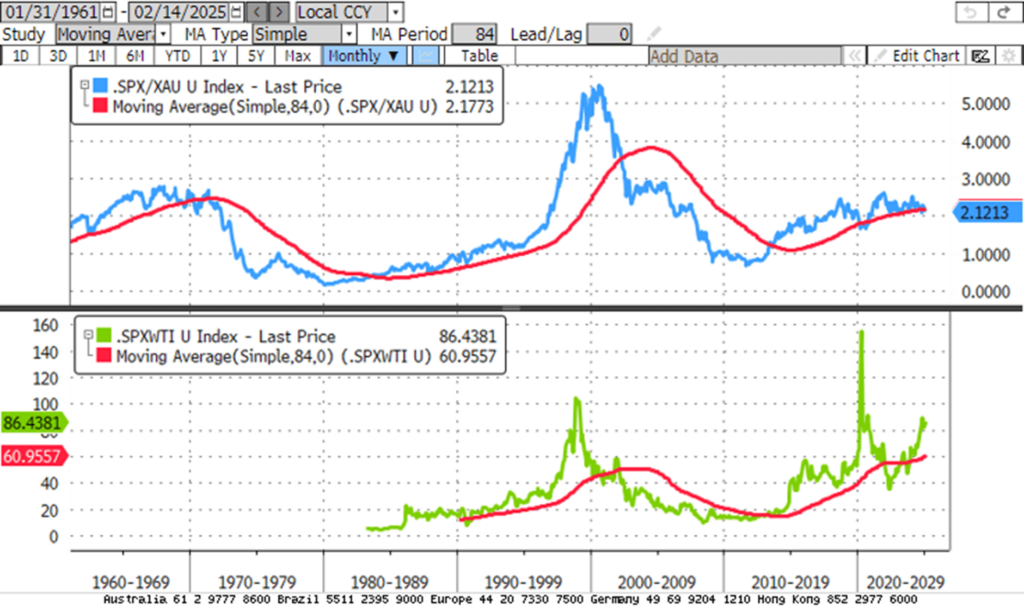

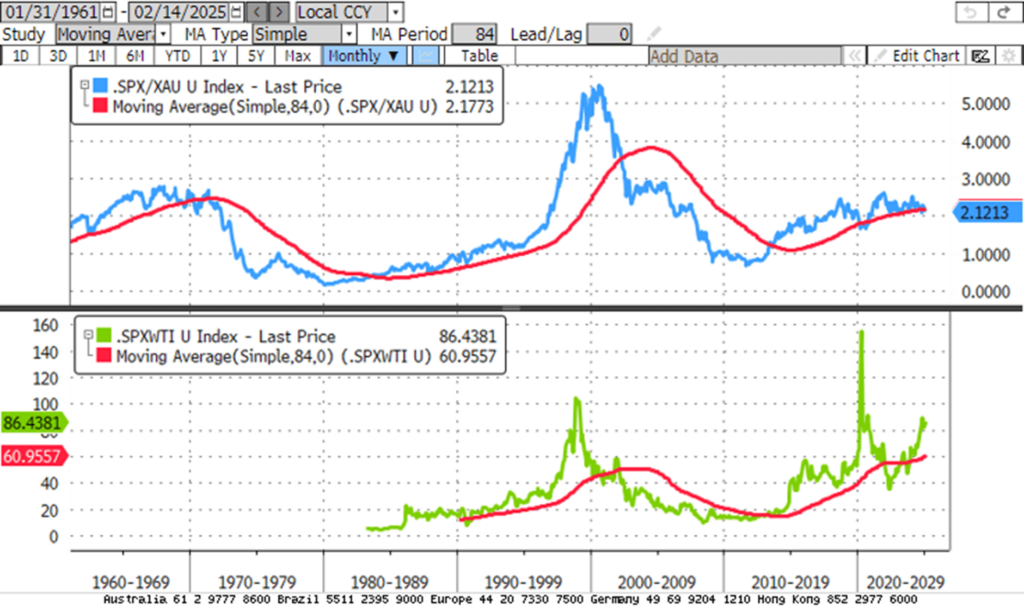

One other key ratio driving the enterprise cycle is the S&P 500-to-Gold ratio, which serves as top-of-the-line indicators for monitoring financial phantasm in monetary markets. Since folks are inclined to understand wealth in nominal phrases (USD) somewhat than actual phrases (inflation-adjusted or gold adjusted), it’s essential to measure the efficiency of monetary belongings in gold phrases somewhat in USD phrases. These finding out the enterprise cycle have discovered from historical past that when the S&P 500-to-Gold ratio trades beneath its 7-year transferring common, it has sometimes been a foul omen for the U.S. economic system. In actual fact, the break of this ratio’s 7-year transferring common has constantly been a number one indicator of the break within the S&P 500-to-Oil ratio and the onset of an financial bust within the U.S. inside the subsequent 6 to 9 months.

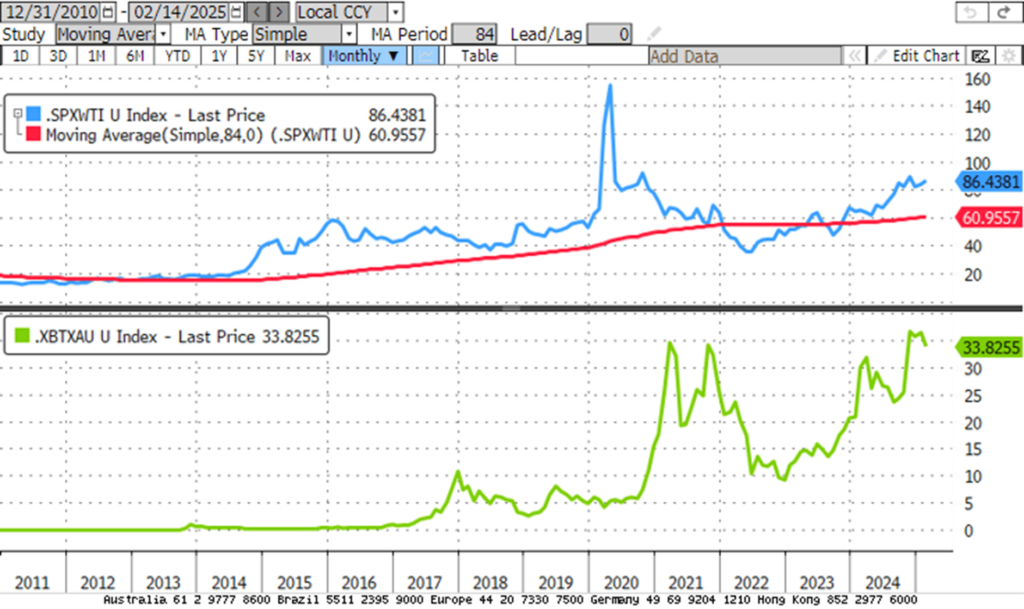

Higher Panel: S&P 500 to Gold Ratio (blue line); 84-month Shifting Common of the S&P 500 to Gold Ratio (crimson line); Decrease Panel: S&P 500 to WTI Ratio (inexperienced line); 84-month Shifting Common of the S&P 500 to WTI Ratio (crimson line)

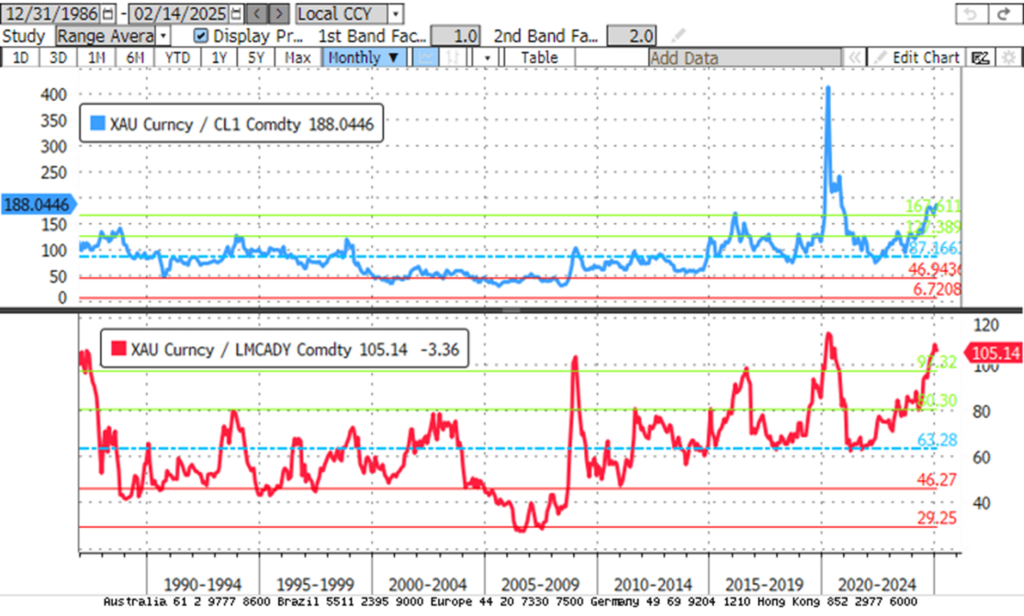

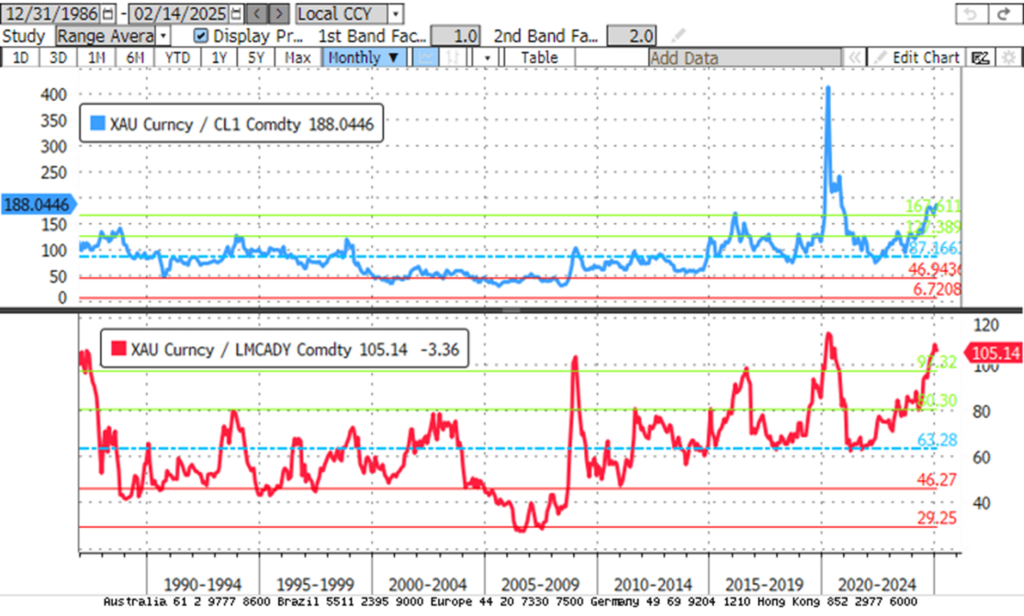

For individuals who view gold as a commodity, its valuation needs to be thought-about relative to important commodities like oil and copper, that are key to affluent financial development. On this context, gold’s present worth in opposition to oil and copper seems undeniably excessive, although it might merely be that oil and copper are undervalued in fiat foreign money phrases at first.

Gold to Oil ratio (blue line); Gold to Copper ratio (crimson line) rebased at 100 as of December 31st, 1986.

Gold has lengthy been valued not solely as a retailer of wealth but additionally as a consumption good, significantly in Asia, the place its cultural significance dates again centuries. In India, gold performs a central position in traditions, with weddings and festivals driving sturdy demand for jewelry, which serves each ornamental and monetary functions. In China, gold symbolizes prosperity and success, with demand peaking in the course of the Lunar New Yr and different celebrations. Traditionally, Southeast Asian civilizations, corresponding to these in Thailand and Vietnam, have used gold for ornaments, spiritual artifacts, and whilst a medium of trade. Throughout Asia, opposite than within the western world, gold stays integral to every day life, mixing custom with monetary safety, making certain its relevance as each an funding and a consumption good. That’s why it’s vital to think about the world’s whole gold inventory relative to the worldwide inhabitants, which is priced at round $2,150 per individual alive immediately, a barely larger stage than in current historical past. This may very well be problematic, as many of the marginal bodily demand for gold comes from rising economies like India, China, the Center East, and Southeast Asia, the place gold is comparatively costly in comparison with native wages.

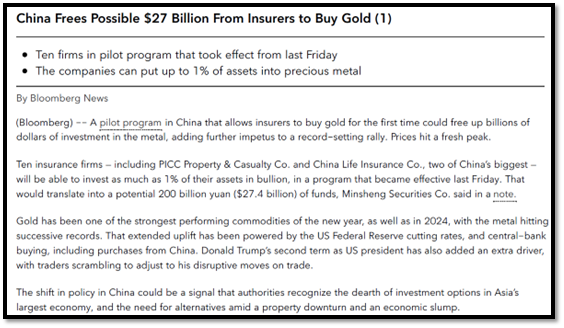

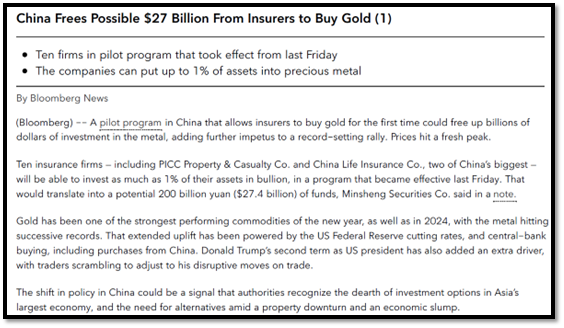

For these within the Western world who nonetheless doubt the stark distinction in how retail buyers and regulators understand gold in Asia in comparison with the U.S. and the remainder of the West, current developments in China supply a transparent distinction. Whereas Western monetary regulators proceed forcing banks and insurance coverage corporations to carry sovereign bonds, arguably the riskiest asset within the foreseeable future, the Chinese language insurance coverage regulator launched a pilot program on February seventh, permitting the nation’s 10 largest insurers to allocate as much as 1% of their belongings to gold. This transfer may unleash over $27 billion in further gold demand from Chinese language institutional buyers. Whereas 1% could look like a small allocation, it underscores that in China, gold isn’t just a shopper good or a hedge in opposition to the weaponization of USD belongings but additionally a acknowledged monetary asset inside institutional mandates.

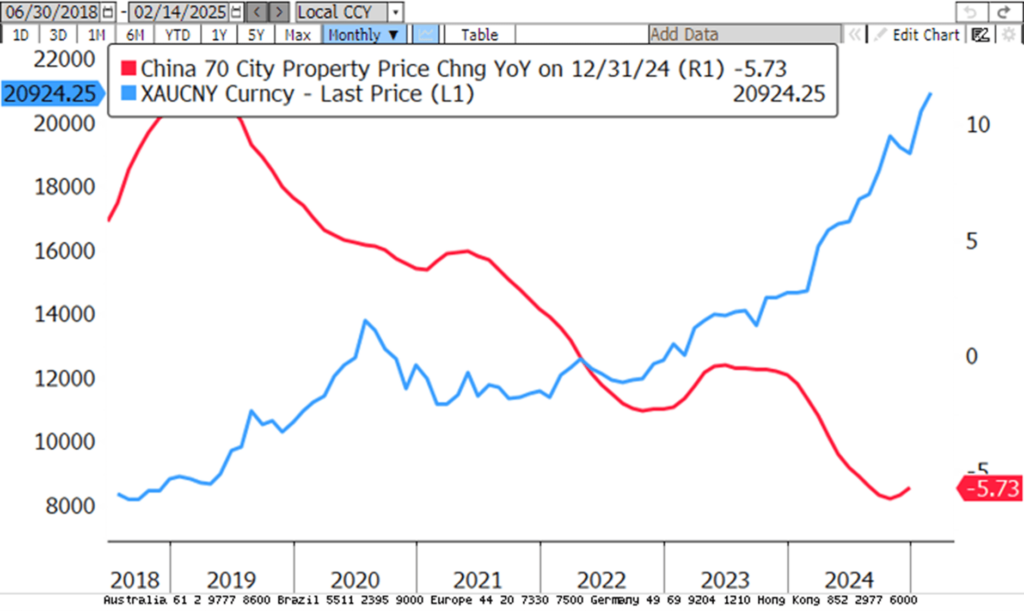

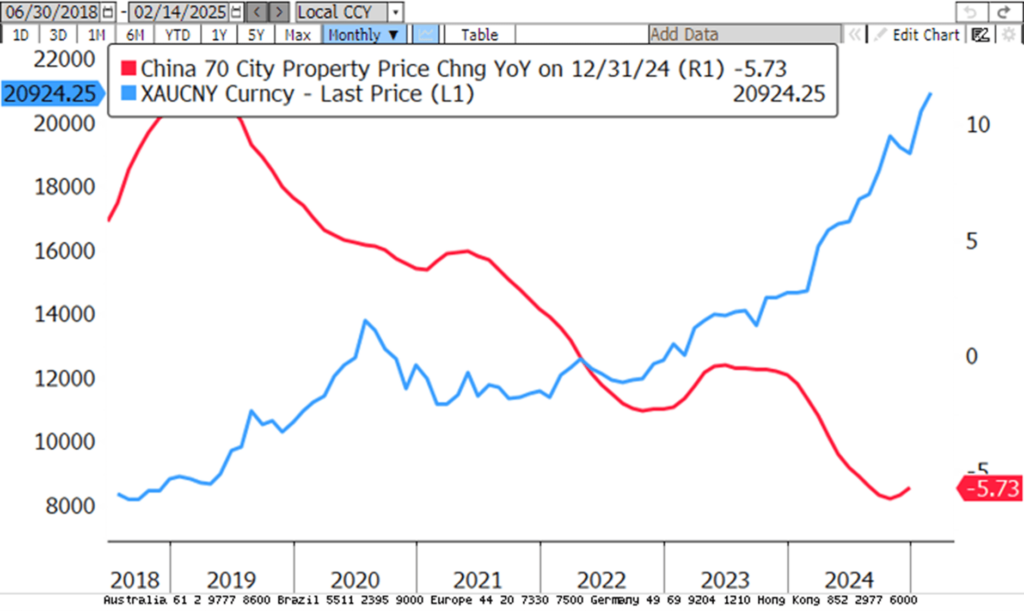

Rising gold costs have strained affordability for Chinese language shoppers however falling property values have made gold an more and more enticing wealth-preservation asset. China’s actual property market is experiencing its worst downturn since 2014, with record-high residence inventories suggesting that present stimulus efforts could also be inadequate and making gold one of many few belongings home buyers can personal because the inventory market stay topic to the uncertainties associated to the heating commerce warfare with the US and its allies.

Gold Value in CNY (blue line); China 70 Cities Newly Constructed Business & Residential Buildings Value YoY change (crimson line).

Coming again to the US and the affordability of gold for the US layman, it now takes the typical U.S. employee about 9 and a half hours to purchase a gram of gold. This ratio is traditionally excessive, and primarily based on this metric, gold could be thought-about overvalued.

The worth of a Gram of Gold in USD divided by the US common hourly earnings of Personal Non-farm staff.

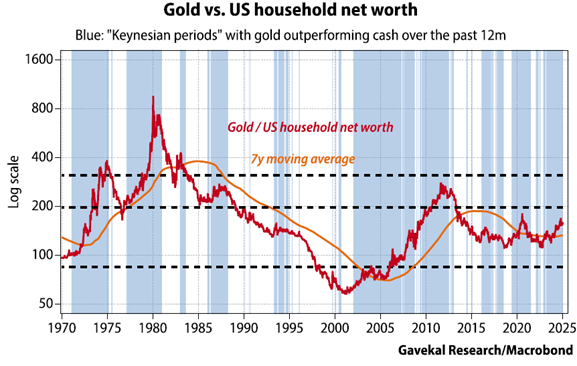

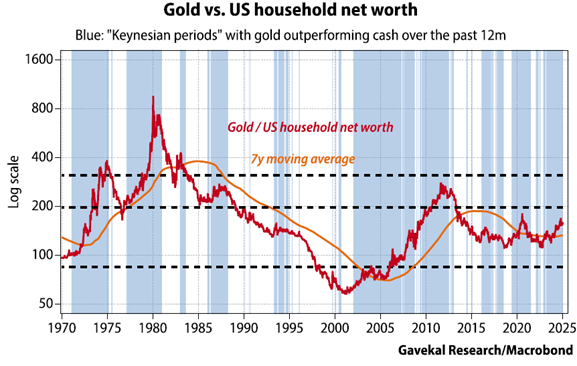

Taking a broader strategy to U.S. family internet value and the worth of gold relative to the online value of U.S. residents, it’s not particularly excessive at present ranges. That is seemingly as a result of many U.S. residents have been influenced by mass media and monetary advisors, who declare that in a supposedly digital world, gold is now not a obligatory asset, resulting in its underrepresentation in U.S. portfolios. On this context, gold’s relative place may simply double earlier than the top of this decade, particularly as YOLO buyers notice that gold is and stays the one antifragile asset with no counterparty threat, whereas Bitcoin serves as a money-laundering device promoted to complement tech billionaires and ‘techligarchs’ inside the Washington plutocracy.

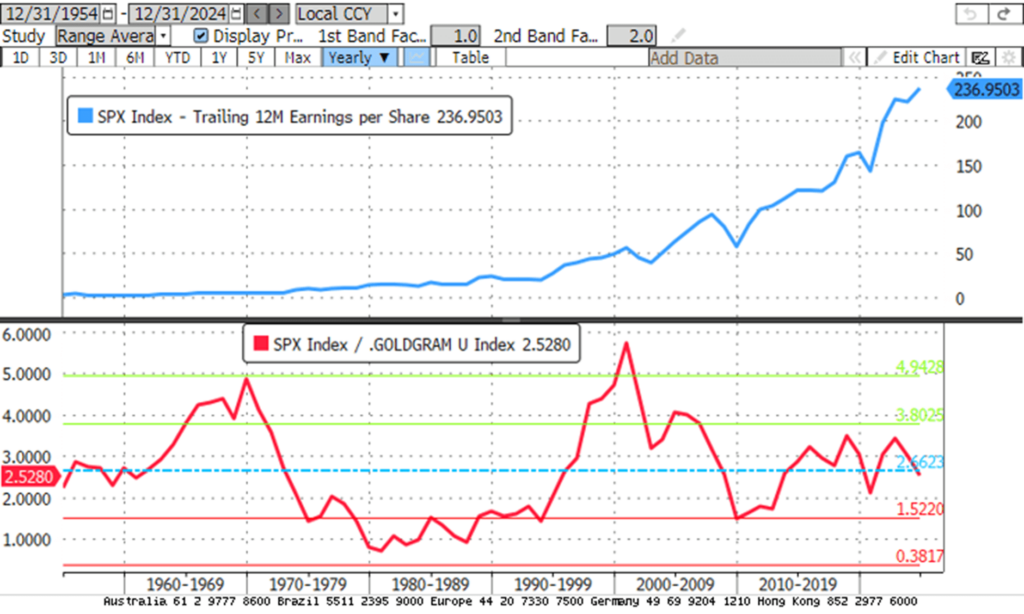

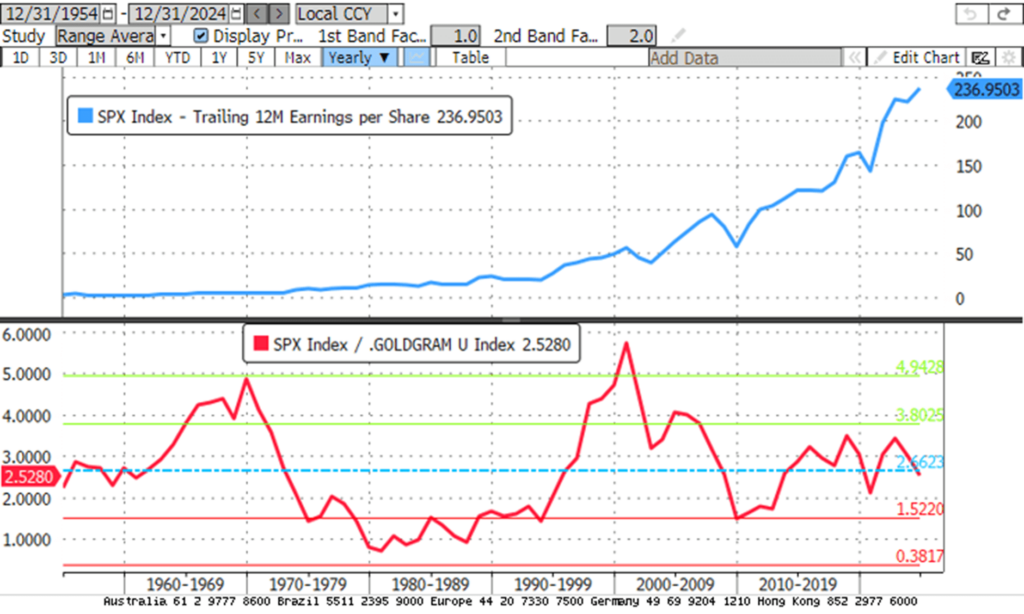

Circling again to monetary markets, a take a look at the ratio of S&P 500 company earnings to gold reveals that it’s at present close to its historic imply of round 2.66 grams of gold. If an financial bust materializes inside the subsequent 4 years, this ratio may simply fall to 1.5 grams and even decrease. It’s vital to notice that every time the ratio has dropped beneath 1.5 grams (corresponding to between 1972-1984 and in 2009), the U.S. has confronted a extreme financial disaster.

Trailing 12-months Earnings per share of S&P 500 index in USD (blue line); Trailing 12-months Earnings per share of the S&P 500 index expressed in grams of gold (crimson line).

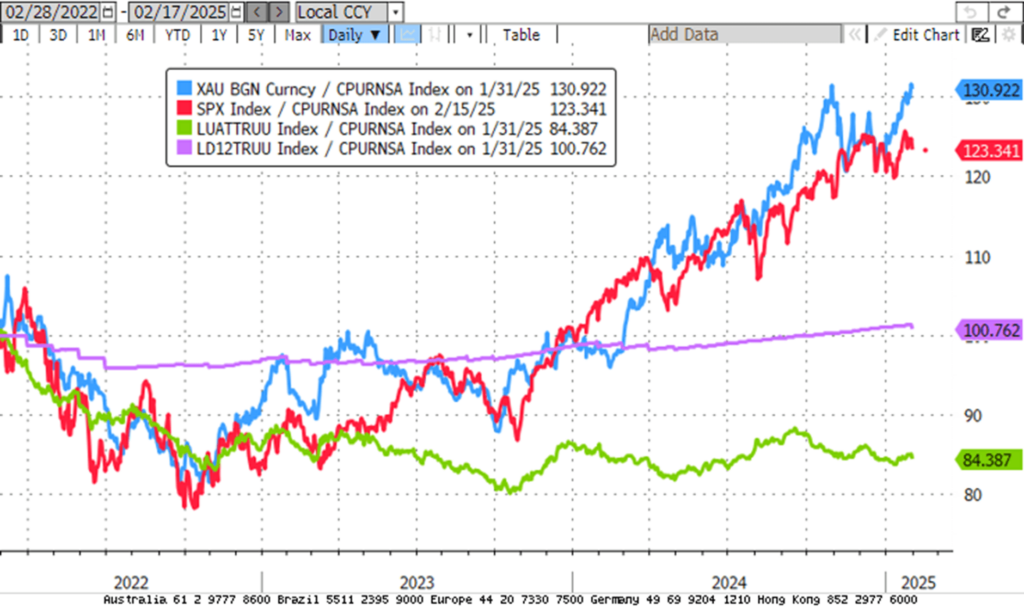

In the end, gold thrives in wartime, preserving wealth as conflicts drive shortages in power, metals, and meals. Historical past confirms this, from the Vietnam Struggle and the Gulf Struggle to immediately’s Ukraine battle, the place gold has outshone oil, shares, and bonds. With ‘Trumperialism’ changing into a actuality, gold stays the final word warfare asset, immune to cost sensitivity because the imperialistic American diplomacy is used for hanging plutocratic actual property offers.

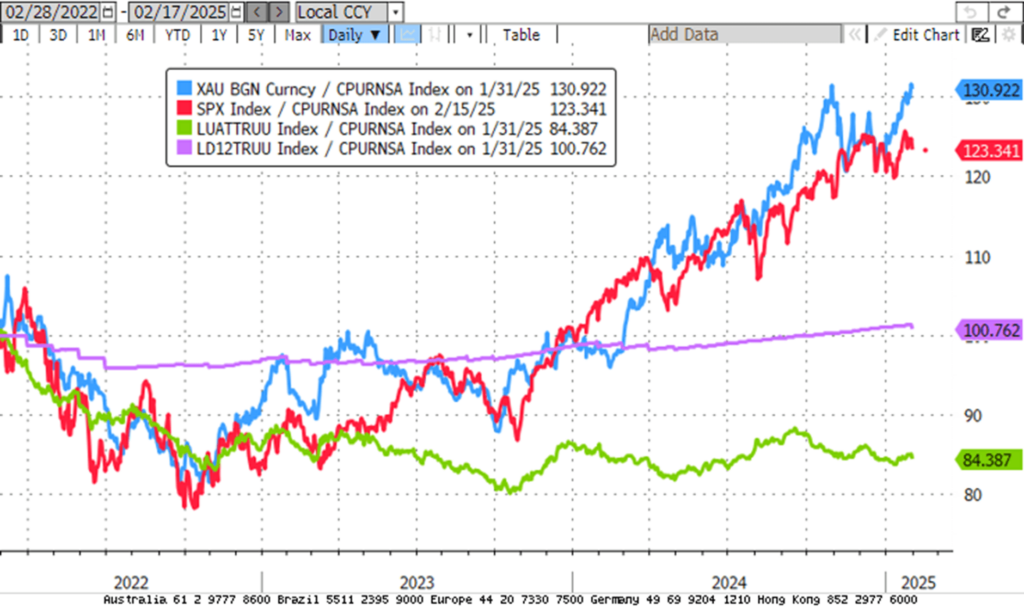

Evolution of $100 invested Gold (blue line); S&P 500 (crimson line); Bloomberg US Agg Complete Return Index (inexperienced line); Bloomberg T-bills 1-3 months Index (purple line) adjusted to inflation since twenty fourth February 2022.

In abstract, if gold is considered as ‘cash’, accurately in a structurally inflationary atmosphere, particularly within the Western world, it’s removed from overvalued or nearing the acute worth ranges seen throughout earlier bull runs.

As a ‘commodity’, gold could appear costly, however that is seemingly as a result of different commodities are too low-cost.

As a ‘monetary asset’, gold can proceed to rise relative to U.S. equities and treasuries.

As a ‘consumption good’, it might seem expensive when in comparison with the typical employee’s earnings or the value relative to the worldwide inhabitants, but it surely stays reasonably priced when contemplating the energy of U.S. shopper stability sheets and company funds.

The underside line is that gold remains to be removed from reaching the acute valuations seen on the peak of earlier bull markets. Whereas some indicators are elevating warning, they’re unlikely to be critical sufficient to finish the present bull market, particularly in an atmosphere of rising international polarization and the growing weaponization of USD belongings, significantly for many who select to not be the servant of the brand new American ‘Tumperialism‘.

As tariffs are more and more used as instruments of negotiation and even to spark perpetual kinetic bankers’ wars, it’s clear that the world is heading towards a melancholy for some nations, pushed by an impending sovereign debt disaster that can materialize first within the “Trump-Re-Flation.” In the end, the worldwide enterprise cycle can’t be altered, no matter who sits within the Oval Workplace. To climate the upcoming “Trump-Reflation’ morphing into the ‘Trump Stagflation,” holding bodily gold, the one antifragile asset with no counterparty threat, alongside a portfolio of short-dated investment-grade (IG) USD bonds with maturities of lower than 12 months and Treasury payments (T-bills) with maturities not exceeding 3 months will present stability as Trump’s financial selections result in “Trump stagflation.”

By doing this, buyers will proceed to prioritize the RETURN OF CAPITAL over the RETURN ON CAPITAL, having fun with each peace of thoughts and preserved wealth.

KEY TAKEWAYS.

As People celebrates their presidents, the important thing takeaways are:

- Valuing gold is extra complicated than valuing equities, as gold serves as cash, a commodity, a monetary asset, and a consumption good.

- Gold’s elevated worth relative to the cash provide is probably going transitory, because it stays the solely hedge in opposition to authorities spending and rising sovereign dangers.

- As a ‘commodity’, gold could appear costly, however that is seemingly as a result of different commodities are too low-cost.

- As a ‘monetary asset’, gold can proceed to rise relative to U.S. equities and treasuries.

- As a consumption good, gold could appear costly relative to common incomes or international inhabitants however stays low-cost when factoring within the energy of U.S. shopper and company stability sheets.

- Gold stays removed from excessive valuations, and regardless of cautionary indicators, the present bull market is more likely to be removed from over amid rising international polarization and the weaponization of USD belongings.

- As volatility is predicted to rise, buyers ought to favour antifragile belongings like gold over bonds, as gold gives low fairness correlation, stability, and resilience in opposition to foreign money debasement.

- In such atmosphere, buyers will as soon as once more have to give attention to the Return OF Capital somewhat than the Return ON Capital, as stagflation spreads.

- Bodily gold stays THE ONLY dependable hedge in opposition to reckless and untrustworthy governments and bankers.

- Gold stays an insurance coverage to hedge in opposition to ‘collective stupidity’ and authorities’ hegemony which arein nice abundance in all places on the planet.

- With continued decline in belief in public establishments, significantly within the Western world, buyers are anticipated to maneuver much more into belongings with no counterparty threat that are non-confiscable, like bodily Gold and Silver.

- Lengthy dated US Treasuries and Bonds are an ‘un-investable return-less’ asset class which have additionally misplaced their rationale for being a part of a diversified portfolio.

- Unequivocally, the dangerous a part of the portfolio has moved to mounted earnings and due to this fact somewhat than chasing long-dated authorities bonds, mounted earnings buyers ought to give attention to USD investment-grade US company bonds with a period not longer than 12 months to handle their money.

- On this context, buyers also needs to be ready for a lot larger volatility in addition to boring inflation-adjusted returns within the foreseeable future.

HOW TO TRADE IT?

As of February 14th , 2025, the US stays in an inflationary increase, however with the S&P 500 to Gold ratio now beneath its yr beneath its 7-year transferring common for the reason that 47th US president was inaugurated, an inflationary bust will materialize a lot ahead of Wall Avenue pundits and their parrots are keen to inform their purchasers. On this context, buyers ought to keep calm, disciplined, and use market information instruments to anticipate adjustments within the enterprise cycle, somewhat than fall into the ahead confusion and phantasm unfold by Wall Avenue.

Because the U.S. economic system shifts from inflationary increase to bust, buyers will prioritize return of capital over return on capital, with gold, somewhat than authorities bonds or Bitcoin, serving as the final word ANTIFRAGILE ASSET.

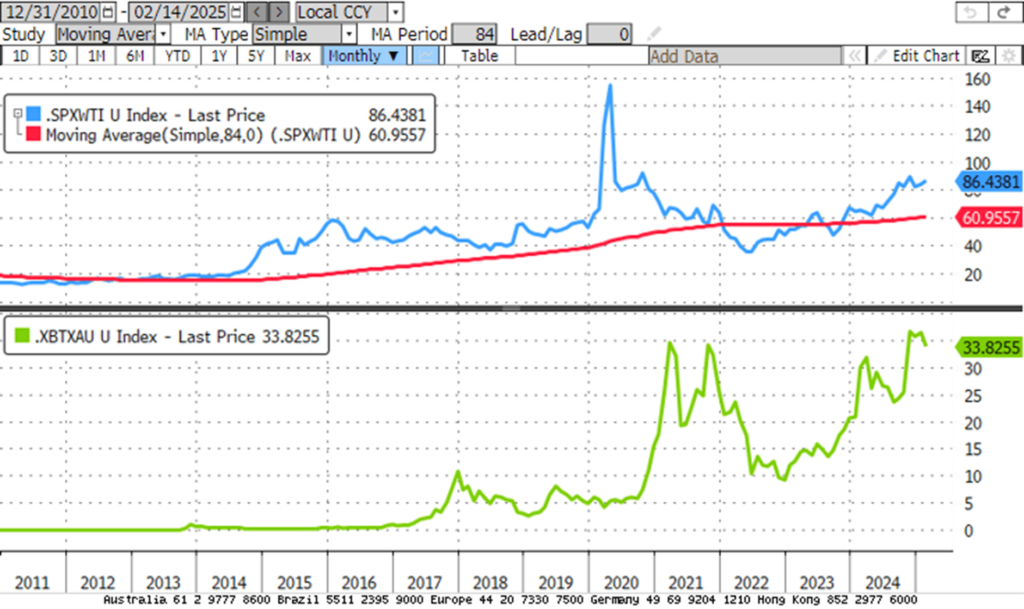

Bodily Gold and silver saved outdoors the banking system, in contrast to politically pushed cryptocurrencies, supply stability throughout crises, offering entry to requirements even in instances of chaos, and stay apolitical, securing freedom from any type of management, even from businessmen-turned-politicians who should not shy about utilizing monetary belongings notoriously generally known as cash laundering instruments to complement themselves and their ‘tech bros.’ This aligns with the enterprise cycle, which could be altered by anybody, even the all-powerful forty seventh U.S. president, as shifts within the S&P 500-to-Oil ratio correlate with peaks within the Bitcoin-to-Gold ratio.

Higher Panel: S&P 500 to Oil ratio (blue line); 84-months Shifting Common of the S&P 500 to Oil ratio (crimson line); Decrease Panel: Bitcoin to Gold ratio (Inexperienced line).

As the worldwide economic system, together with the U.S., enters an inflationary bust, gold will preserve outperforming equities; authorities bonds, money, and even Bitcoin. Within the years forward, wealth preservation will depend on bodily gold and disciplined fairness choice, not fleeting Wall Avenue recommendation, providing safety in opposition to wars, reckless authorities insurance policies, and the ‘Trump Stagflation’ main into World Struggle 3.