It’s been simply over a yr since H&M introduced a shock change in management, ousting pandemic-era CEO Helena Helmersson and appointing firm veteran Daniel Ervér in her stead.

Ervér’s problem was to rejuvenate gross sales on the world’s second-biggest publicly traded trend retailer, which had grow to be caught in a squeezed center market between low-priced Shein and extra premium Zara. His answer: make H&M cool once more.

This fall, the model launched a high-octane advertising marketing campaign that includes Brat-summer architect Charli XCX. Behind the scenes, Ervér turned his focus to refreshing the corporate’s design chops, upgrading the H&M buying expertise and guaranteeing the model was competing on worth.

“The place to begin is to be actually enticing, related and delight and shock the client,” Ervér advised analysts on a name to debate the corporate’s first quarter earnings. “We imagine that may result in gross sales development.”

The outcomes launched Thursday and overlaying the majority of the vacation buying interval, have been subsequently an vital litmus check for Ervér’s turnaround technique, providing an early style of how shoppers responded to the model’s large advertising push.

The decision: H&M has much more work to do.

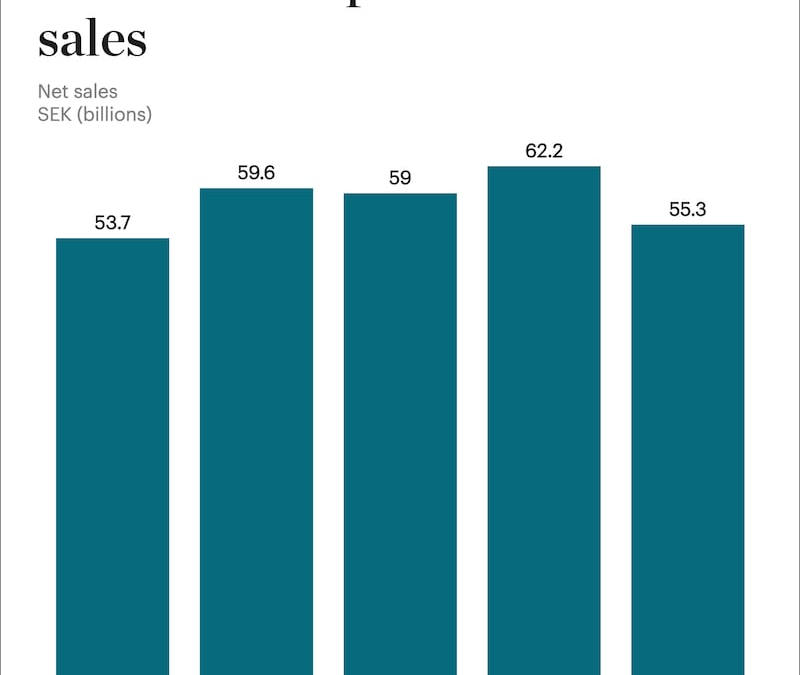

Gross sales rose 3 % year-on-year within the three months ending Feb. 28 to achieve SEK55.3 billion ($5.52 billion), underperforming analyst expectations of SEK55.8 billion. Working revenue of SEK1.2 billion ($0.1 billion) was beneath the common SEK1.9 billion forecast by analysts. The worth of stock held in inventory rose 9 %, elevating the danger the corporate should resort to heftier discounting within the coming quarters. A medium-term goal to achieve an working revenue margin of 10 % is more and more elusive.

As Deutsche Financial institution put it in a notice after the outcomes got here out, the Swedish retailer’s newest spherical of earnings managed to disappoint, regardless of already low expectations. The response from traders was muted, with shares buying and selling broadly flat Thursday. They’re down 10 % since Ervér took over final January.

H&M mentioned it expects issues to select up within the second half, because it sees extra outcomes from its spending on design and advertising and profitability drags from funding, hefty discounting and antagonistic trade charges ease off. Gross sales grew simply 1 % in March, signalling a gradual begin to the spring/summer season season.

“Even when we’ve taken vital steps we’re not glad with our ends in the primary quarter,” Ervér mentioned on an earnings name. “We stand steadfast in our concentrate on our long-term plan.”

Beneath Strain

Ervér’s job will not be a straightforward one. The model is attempting to place itself as a goldilocks label, providing garments which can be higher high quality than Shein, however cheaper than Zara. “We’re very targeted on offering excellent worth for cash,” Ervér mentioned.

It’s a crowded and intensely aggressive a part of the market with loads of choices for shoppers searching for a mixture of social-media-worthy pattern items and inexpensive fundamentals, from Primark, Mango and Uniqlo to Abercrombie and Hole.

H&M’s fashion-focused turnaround playbook doesn’t have a lot to tell apart itself from the methods of different manufacturers vying to revive light fortunes, who’ve additionally laid out methods that revolve round variations on improved product, extra advertising and slicker buying experiences. Few have managed to drag it off.

H&M’s downside is that it’s nonetheless working on a 2005 enterprise mannequin in a 2025 market, mentioned Bernstein analyst William Woods. Whereas manufacturers like Shein and Zara are leaning into quick trend’s accelerating tempo with blink-and-you-miss-it drops, H&M continues to be largely working round seasons. That’s a part of the explanation why it has a persistent downside with extra stock and hefty discounting.

“The enterprise mannequin continues to be gradual. They’re nonetheless on six month lead instances, not near-shoring a lot and not likely sustaining the product newness,” mentioned Woods. “Zara is dropping product into shops as soon as every week.”

In some methods, the corporate’s Charli XCX tie up was emblematic of this lack of agility. The launch occasion for its reenergised new look befell in mid September, two weeks after the singer put out a social media submit bidding “goodbye perpetually” to brat summer season.

An uptick in gross sales within the wake of the launch was extra all the way down to good climate and low comparable numbers a yr sooner than the model advertising marketing campaign, in accordance with the corporate. Ervér mentioned the activations aren’t supposed to have an instantaneous impact, however somewhat drive regular gross sales development all year long.

“For lots of shoppers H&M has misplaced what it stands for and why they might store there,” mentioned Deutsche Financial institution Analysis analyst Adam Cochrane. “Have they got to do much more by way of advertising to get the model shifting?”

In the meantime, there’s little to recommend that the market goes to grow to be extra forgiving. Geopolitical uncertainty and mounting commerce tensions are having a dampening impact on client spending and consuming up government headspace with tariff administration plans.

H&M’s largest manufacturing hubs are China and Bangladesh. The previous has already been hit with a 20 % tariff on imports to the US.

The corporate mentioned it’s working to shift its sourcing to markets with decrease tariff burdens.

“Work has been ongoing for fairly a while to seek out relative options to make sure that we are able to provide additionally the US buyer one of the best worth for cash regardless of a few of these strains to world commerce,” mentioned H&M CFO Adam Karlsson. Nonetheless, greater import duties will doubtless imply greater costs for shoppers. “We’ll, after all, additionally work with the worth positioning. We’ll comply with how opponents do that,” Karlsson added.