Brandon Sauerwein, Editor

Gallup Ballot: Individuals’ Favourite Lengthy-Time period Funding Simply Shifted

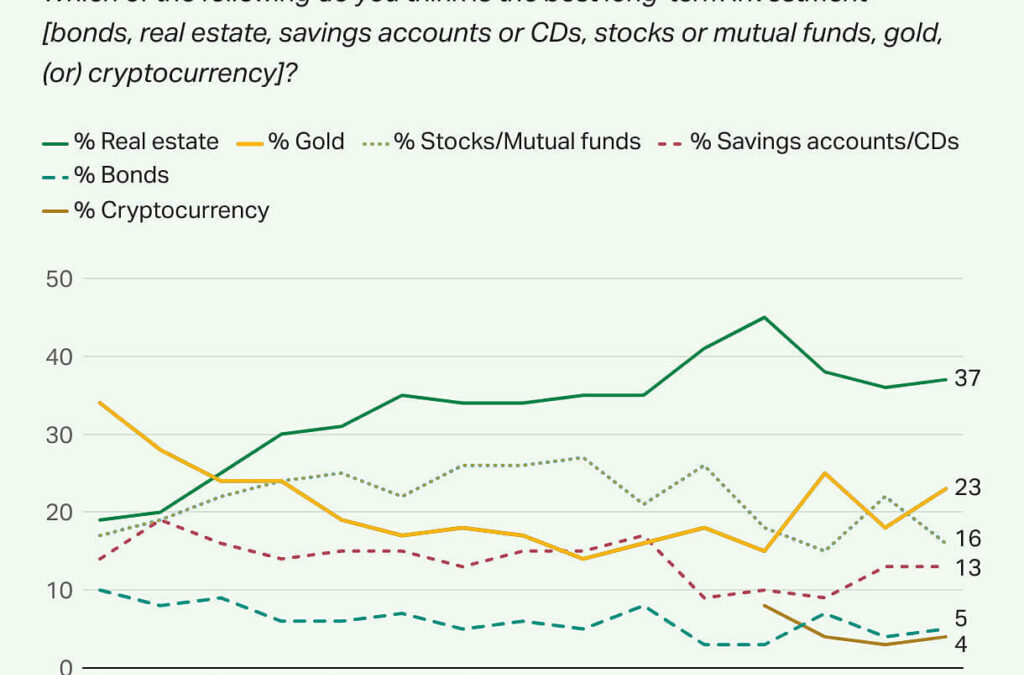

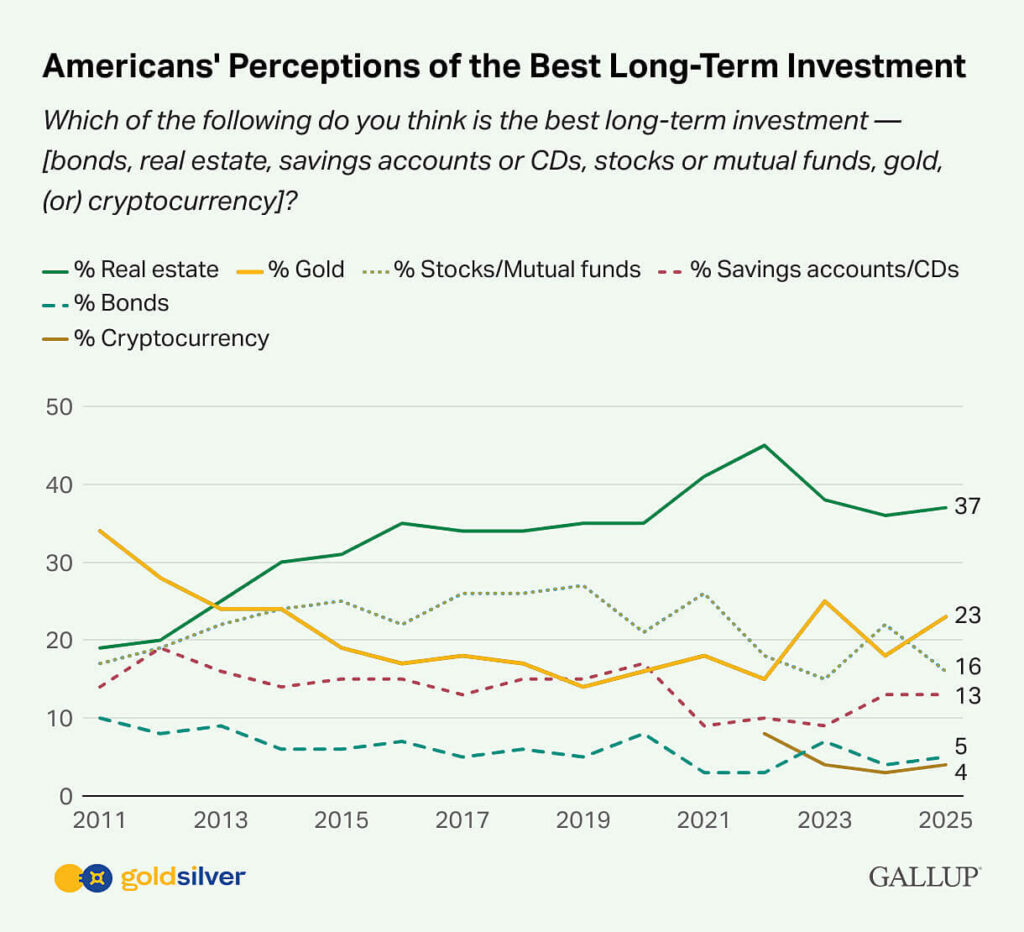

Which of the next do you suppose is the most effective long-term funding — [bonds, real estate, savings accounts or CDs, stocks or mutual funds, gold, (or) cryptocurrency]?

Actual property nonetheless tops the record of long-term investments for Individuals, based on a brand-new Gallup ballot.

However right here’s the true headline: for the primary time in over a decade, gold has overtaken shares.

In an period of political chaos and market volatility, increasingly more Individuals are turning to one thing actual — bodily gold — as their long-term protected haven. And what we’re seeing could also be simply the early innings of a a lot greater development.

Behind the headlines, a serious reallocation of capital is underway. JP Morgan analysts now forecast gold may attain $6,000 per ounce by 2029 — if even simply 0.5% of U.S. property held by overseas buyers shift into the steel.

However the impression could possibly be much more dramatic at dwelling.

As of the tip of 2024, complete U.S. retirement property stood at $44.1 trillion. A modest shift — simply 0.5% — into treasured metals would signify over $220 billion in new demand.

That’s why many see this gold rally as the start, not the height.

However right here’s the twist: whereas gold captures headlines, silver could maintain the larger upside. With the gold-to-silver ratio signaling historic alternative, sensible cash is watching intently — and transferring quick.

Mike Maloney: Why Silver Might 10x in Worth

It’d sound far-fetched — till you see the information.

Mike Maloney and Alan Hibbard break down the information behind the $300 silver state of affairs. Is $300 silver actually potential? Mike and Alan say the maths checks out.

You’ll uncover:

- Why Wall Road nonetheless misunderstands gold and silver

- What the gold-to-silver ratio is signaling proper now

- How previous authorities strikes may repeat themselves

- The smarter strategy to construct long-term safety in a shifting world

Should you personal any silver — or are desirous about it — it is a must-watch.

Is Now the Time to Swap Gold for Silver?

Gold is climbing. Silver is lagging. Mike Maloney says that’s no accident—and it could be your likelihood to behave.

On this eye-opening episode, Mike and Alan Hibbard present how one can purchase gold for as little as $35 and why changing between metals on the proper time could possibly be a game-changer in your portfolio.

They reply actual viewer questions, break down financial developments, and clarify why common buyers can nonetheless make extraordinary strikes — in the event that they know the place to look.

What Else is within the Information?

🇺🇸🇨🇳 U.S.–China Comply with 90-Day Tariff Truce

The U.S. and China have struck a brief commerce deal, slashing tariffs for 90 days whereas negotiations proceed. U.S. tariffs on Chinese language items will drop from 145% to 30%, whereas China’s tariffs on U.S. merchandise fall to 10%. Treasury Secretary Scott Bessent known as the settlement — finalized throughout talks in Switzerland — a “main step ahead.” The deal additionally contains joint efforts to sort out the fentanyl disaster.

🥇 Gold Pulls Again from Document Highs on Commerce Optimism

Gold costs dipped barely following the commerce breakthrough between the U.S. and China, together with softer U.S. inflation knowledge. Whereas gold retreated from its latest file above $3,500 per ounce, it stays up roughly 20% year-to-date. Improved geopolitical sentiment has pushed some buyers again towards riskier property, at the very least for now.

📉 Inflation Eases to 2.3%, Lowest Since 2021

U.S. inflation cooled in April, with each headline and core CPI rising simply 0.2% — beneath expectations. The annual inflation charge dropped to 2.3%, its lowest degree in additional than three years. Grocery costs declined, and egg costs noticed their largest month-to-month drop since 1984. Whereas housing stays the most important driver of inflation, markets welcomed the information: shares climbed and Treasury yields slipped.

🏛️ Fed’s Jefferson Warns: Tariffs Might Disrupt Inflation Progress

Federal Reserve Vice Chair Philip Jefferson acknowledged latest progress on inflation however cautioned that new tariffs may reverse that development. Whereas April’s CPI knowledge got here in softer than anticipated, Jefferson famous that sustained import taxes could briefly push inflation greater — and probably gradual the financial system. He emphasised the necessity for a gradual hand on rates of interest, calling present ranges “nicely positioned” to answer rising dangers.

💬 What GoldSilver Traders are Saying

⭐ ⭐ ⭐ ⭐ ⭐ Finest Firm & Buyer Service within the Trade

“GoldSilver.com has been my go-to bullion firm for over a decade. Each buy or sale with them is all the time easy, quick, {and professional}. Final week, I had an pressing order, and Travis from the customer support workforce went above and past to expedite my transaction and meet my impossibly tight deadline. I couldn’t be happier with this firm, and all of the free instructional sources they supply are life-changing. I’m wanting ahead to many extra years with GoldSilver.com as my most well-liked metals seller.”

— A. Mackness

Expertise the GoldSilver distinction:

- Obtain knowledgeable steering from devoted treasured metals specialists

- Entry complete instructional sources to grasp your funding technique

- Belief in our industry-leading customer support workforce that places you first

Able to get began?