Lookup the gold value on three totally different web sites and also you’ll possible see barely totally different figures. Not like shares with a single alternate value, gold trades constantly throughout world markets via a community of banks, exchanges, and information suppliers. Every web site is quoting the spot value, i.e. the present market worth of gold for instant supply, although small variations seem as a result of totally different platforms pull information from totally different sources. This text explains how gold spot value truly works, who units it, and why understanding these mechanisms helps buyers make smarter choices.

Watch this instructional video for added context on the important thing market forces that drive gold value actions.

What Does “Gold Spot Worth” Truly Imply?

The time period “spot value” sounds simple, however in gold it comes with technical complexities that don’t exist in most different markets.

The Technical Definition

The gold spot value is the present market value for one troy ounce of gold, quoted for instant settlement. On this context, “spot” refers to a purchase order meant for instant supply, versus a futures contract for supply at a later date. In apply, “instant” means settlement inside two enterprise days (T+2), which is the usual time required for cost to clear and possession to switch.

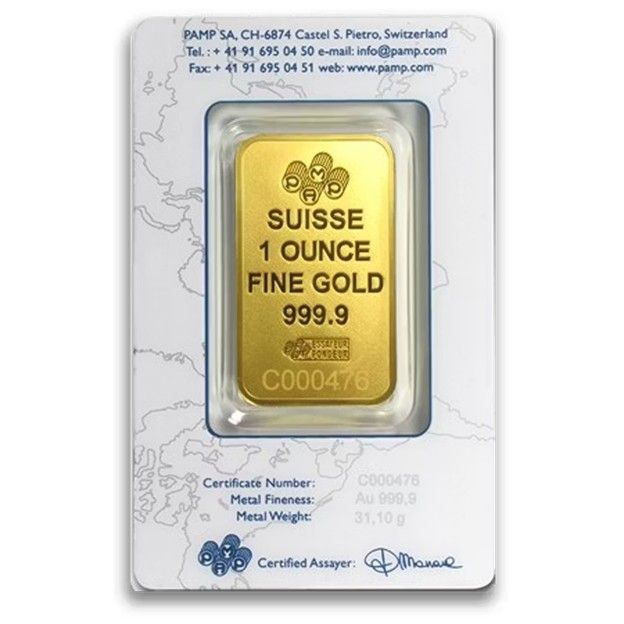

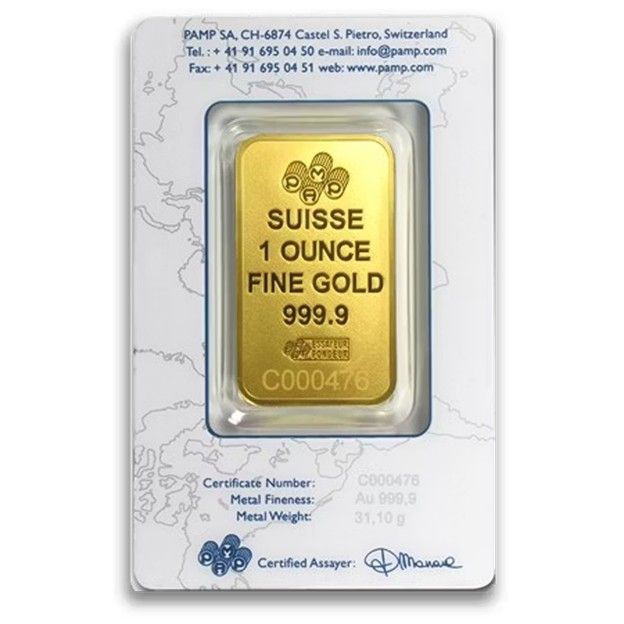

Picture: Gold spot costs are quoted per troy ounce, with bars like this 999.9 tremendous gold serving because the benchmark.

Supply: Blanchard

Idea vs. Actuality in Bodily Markets

Spot transactions by definition require instant supply, however bodily gold markets function in a different way than this theoretical framework suggests. A number of sensible components sometimes complicate true spot pricing in bodily transactions. Bodily sellers normally should supply stock, confirm authenticity, organize safe transport, and course of documentation – actions that always lengthen past the two-day settlement window. Massive institutional consumers face comparable constraints when buying bodily metallic moderately than paper contracts, ceaselessly requiring prolonged settlement durations for vault storage and chain-of-custody procedures. These logistical realities imply that almost all quoted spot costs replicate paper gold markets the place transactions occur electronically, although some sellers with adequate stock and infrastructure can accommodate real spot transactions.

The Benchmark Requirements

Spot gold value quotes require exact specs to make sure consistency throughout world markets. Two major benchmarks outline gold pricing: on COMEX, futures contracts are based mostly on 100-ounce bars of .995 tremendous gold, whereas the London Bullion Market Affiliation (LBMA) makes use of Good Supply bars weighing 350-430 ounces at a minimal of .995 purity. These shared requirements permit merchants and establishments worldwide to reference the identical underlying product when discussing the gold spot value, whether or not the commerce settles bodily or via paper contracts.

Greenback-Denominated Pricing

World gold spot pricing is universally quoted in U.S. {dollars}, making the greenback the reference level for gold’s worth worldwide. In monetary markets, this seems because the XAU/USD pair, the place XAU represents one troy ounce of gold (from the Latin aurum) and USD represents U.S. {dollars}. Whereas gold may be bought in native currencies throughout the globe, all elementary pricing originates in {dollars}. In consequence, shifts in greenback energy have instant results on gold costs all over the place, even when consumers and sellers by no means deal with U.S. foreign money straight. This dollar-centric system ensures that whether or not you’re shopping for gold in London, Shanghai, or New York, the core worth calculation all the time traces again to the identical USD-denominated spot value of gold.

Who Units the Gold Spot Worth?

Not like markets with a single alternate value, the spot value of gold is formed collectively by many establishments buying and selling around the globe.

Main Gold Pricing Hubs

The London Bullion Market Affiliation (LBMA) operates the world’s largest over-the-counter gold market. Twice each day at 10:30 AM and three:00 PM London time, the LBMA conducts digital auctions amongst main bullion banks to determine the official “LBMA Gold Worth.” This value serves as a world benchmark that changed the century-old “London Repair”, i.e. a telephone-based course of the place 5 main banks negotiated a single gold value, in 2015.

Picture: The LBMA headquarters, the place twice-daily digital auctions set world gold value benchmarks.

Supply: LBMA

COMEX, a part of the Chicago Mercantile Alternate Group, runs the world’s most lively gold futures market in New York. These contracts signify agreements to purchase or promote 100-ounce gold bars at future dates, however the large buying and selling volumes – typically exceeding 200,000 contracts each day – create vital affect on the present spot gold value. Most COMEX contracts settle in money moderately than via bodily supply, making it primarily a paper gold market that shapes pricing worldwide.

Secondary Market Influences

Past the 2 major hubs, different gamers straight form XAU USD spot gold value. The Shanghai Gold Alternate drives vital actions throughout Asian buying and selling classes, notably when Chinese language demand surges or new contracts shift world provide calculations. Collectively, these classes create a 24-hour pricing cycle by which buying and selling passes from Asia to London to New York, with every area’s open sparking contemporary exercise that may transfer spot costs instantly.

Picture: Gold buying and selling follows the solar throughout world time zones, creating steady value discovery.

Supply: Investing Reside

Liquidity and Knowledge Suppliers

Day-to-day gold buying and selling will depend on bullion banks and market makers, who present steady purchase and promote quotes that preserve the market liquid. Their quotes feed into the spot market and assist decide the XAUUSD spot gold value buyers truly see. Knowledge suppliers comparable to Reuters, Bloomberg, and different monetary platforms then combination these inputs from throughout the globe, publishing real-time costs that turn into the reference level for sellers and buyers.

Why Spot Gold Worth Differs Throughout Platforms

Provided that a number of information sources feed into spot pricing, variations between platforms are inevitable and spotlight key variations in how firms deal with pricing information.

Knowledge Aggregation Strategies

Completely different platforms prioritize totally different market sources when calculating their displayed value, creating the primary layer of variation. Some platforms emphasize COMEX futures information from New York buying and selling, whereas others weigh LBMA public sale outcomes from London extra closely. These supply preferences can produce official variations of a number of {dollars} per ounce.

Moreover, platform refresh charges differ considerably. Some replace costs each few seconds to seize real-time actions, whereas others lag by minutes, creating non permanent discrepancies that turn into pronounced throughout risky buying and selling durations when gold costs shift quickly.

Foreign money conversion timing introduces one more variable, since platforms might replace XAU USD spot gold value charges at totally different factors all through the buying and selling day.

That is why checking a number of sources typically exhibits barely totally different spot costs, even on the identical second.

Industrial Manipulation and Transparency

Extra regarding than technical variations are deliberate industrial changes, the place some sellers inflate a displayed XAUUSD spot gold value to extend revenue margins on bodily gross sales. These manipulated feeds can present costs considerably above true market charges, deceptive prospects about precise gold values.

Dependable pricing requires direct entry to unfiltered market information from major sources moderately than third-party aggregators who might introduce delays or modifications. Platforms utilizing verified feeds from bullion banks and main exchanges present extra correct pricing than these counting on secondary information sources or making use of industrial markups.

Blanchard’s pricing displays direct market feeds with out industrial manipulation, making certain prospects see genuine spot costs moderately than artificially inflated charges designed to spice up supplier margins. This transparency turns into particularly vital in periods of market volatility when world financial shifts can dramatically affect gold’s position as a safe-haven asset, making correct pricing information essential for knowledgeable funding choices.

What Elements Affect Day by day Actions

Gold spot costs fluctuate consistently as markets weigh a number of competing forces that have an effect on provide, demand, and investor sentiment.

Bodily Provide and Demand

Gold provide is comparatively secure, which implies even small modifications can transfer spot costs. When mining output falls, provide tightens and costs typically rise. Recycling flows push the opposite means: increased costs encourage individuals to promote previous jewellery and electronics, boosting provide and generally capping additional positive aspects.

On the demand aspect, jewellery accounts for about half of worldwide consumption, with seasonal patterns like India’s marriage ceremony season including predictable stress. Funding demand is extra reactive: in periods of monetary uncertainty, buyers seeking to purchase gold at spot value via ETFs and bodily bullion typically surge, pushing costs increased inside hours. Central banks additionally sit on this aspect of the equation after they purchase or promote reserves straight: their large-scale purchases or gross sales can shift demand dramatically, generally creating the largest spot value strikes of all.

Financial Indicators

Past bodily fundamentals, the spot value of gold additionally responds to macroeconomic circumstances. Rates of interest create the clearest relationship: when central banks increase charges, bonds and financial savings accounts look extra enticing, weighing on gold; when charges fall, gold positive aspects enchantment as a retailer of worth.

The greenback’s energy is one other key driver. As a result of gold is priced in USD worldwide, a stronger greenback makes gold costlier for abroad consumers, decreasing demand, whereas a weaker greenback makes it cheaper and sometimes spurs shopping for.

Inflation expectations spherical out the image. When inflation runs hotter than anticipated, or when central banks appear sluggish to behave, buyers flip to gold to protect buying energy, typically fueling a number of the quickest value spikes. This inflation-hedging attribute helps clarify why gold typically strikes independently from conventional inventory investments, making it a priceless portfolio diversification instrument.

Geopolitical and Market Forces

Political instability, commerce disputes, and army conflicts persistently spark safe-haven shopping for as buyers search safety outdoors conventional monetary belongings. Even rumors of instability, comparable to elections, sanctions, or sudden coverage shifts, can set off sharp gold strikes earlier than fundamentals catch up. These geopolitical dangers and their affect on gold markets have created a number of the most dramatic spot gold value actions all through historical past.

Market sentiment then amplifies these reactions. When momentum builds, technical merchants and algorithms typically pile in, pushing costs increased or decrease than underlying provide and demand alone would justify. This mixture of geopolitics and psychology explains why gold can generally spike or fall dramatically in a matter of hours, even with out main modifications in bodily provide or macroeconomic indicators.

Technical Buying and selling

Algorithmic buying and selling techniques now execute 1000’s of gold transactions in milliseconds, reacting to cost patterns and momentum indicators. These automated methods can speed up value strikes in both course, particularly when massive orders hit throughout skinny liquidity. As soon as gold breaks key technical ranges, algorithms and momentum merchants typically amplify the transfer, producing sharp intraday swings within the present spot gold value per ounce which will seem disconnected from fundamentals.

Spot Gold Worth in Observe

When buyers analysis gold purchases, the spot value of gold offers a beginning reference level, however two sensible points instantly come up: bodily merchandise all the time price greater than the revealed spot fee, and totally different web sites might show considerably totally different spot costs.

Bodily Merchandise vs. Spot Worth

Bodily gold virtually all the time trades above spot on account of unavoidable prices. Fabrication, delivery, insurance coverage, and supplier margins sometimes add a noticeable premium to the present gold spot value USD per ounce. Blanchard’s gold stock showcases the vary of accessible choices, from cash that normally carry increased markups than bars due to design prices and, in some instances, collectible or numismatic worth, to bars with premiums that change by manufacturing methodology. Alternate-traded funds (ETFs) monitor spot costs extra carefully since they signify paper possession of gold, although administration charges nonetheless create a slight divergence over time.

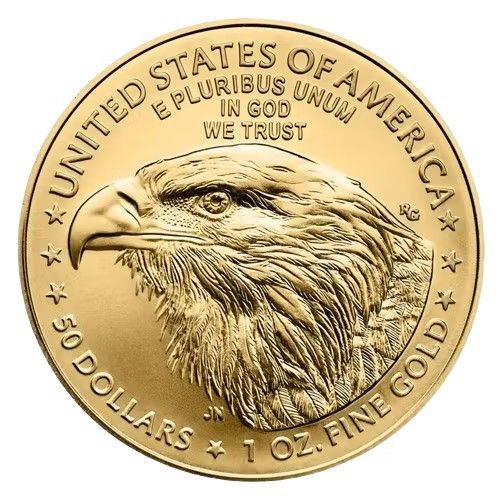

Picture: Gold cash just like the American Eagle carry premiums above spot value on account of design prices and collectible worth.

Supply: Blanchard

Verifying Genuine Spot Pricing

Figuring out that gold merchandise commerce above spot is just a part of the image. It’s equally vital to substantiate that the spot value itself is correct. Some platforms publish delayed information or artificially inflate their displayed spot to justify increased markups on bodily merchandise. These practices can mislead buyers about each the true worth of gold and the equity of quoted premiums.

Dependable spot pricing comes from direct feeds supplied by major exchanges and bullion banks, up to date constantly throughout buying and selling hours. Cross-checking the present gold spot value USD per ounce throughout a number of authoritative sources helps buyers determine discrepancies and keep away from manipulated benchmarks. Blanchard eliminates this uncertainty by publishing unfiltered market information from verified sources, making certain purchasers see real spot costs earlier than any product premiums are utilized.

Conclusion

Gold spot value emerges from a world system that spans exchanges, central banks, bullion banks, and information suppliers working throughout time zones. The LBMA’s twice-daily auctions and COMEX futures contracts anchor world benchmarks, whereas secondary forces, from Shanghai buying and selling classes and central financial institution exercise to algorithmic methods, modify pricing constantly all through every 24-hour cycle.

Understanding these mechanisms helps clarify why totally different web sites show barely totally different spot costs. Variations typically replicate timing delays, variations in information weighting, or, in some instances, deliberate industrial inflation. Figuring out the excellence permits buyers to separate official market variation from manipulated pricing.

This consciousness turns into particularly vital when buying bodily gold, the place premiums above spot are customary. By recognizing genuine spot pricing, buyers can decide whether or not premiums replicate actual prices of fabrication and distribution or inflated baselines designed to extend supplier margins.

Finally, transparency is essential. Working with sellers who present direct, unmanipulated market information helps buyers make extra assured choices. Blanchard follows this customary, providing purchasers genuine spot costs and clear visibility into product premiums, making certain valuable metals purchases are grounded in actual market circumstances.

FAQs

1. What does spot value imply in gold markets?

Gold’s spot value is the present market worth for one troy ounce of gold accessible for instant supply, sometimes inside two enterprise days. It serves because the baseline reference for all gold merchandise, from cash to bars to ETFs.

2. How is the gold spot value decided?

The gold spot value emerges from steady buying and selling throughout world markets, with major affect from LBMA’s twice-daily auctions in London and COMEX futures buying and selling in New York, plus secondary influences from Asian markets, central banks, and bullion sellers worldwide.

3. What’s the spot value of 1 oz of gold at this time?

Gold spot costs change constantly throughout buying and selling hours as markets reply to provide, demand, and financial components. You’ll be able to view present gold pricing on Blanchard’s reside spot value web page, although totally different platforms might present slight variations based mostly on their information sources and refresh charges.

4. The place can I purchase gold at spot value?

You sometimes can not purchase bodily gold precisely at spot value on account of fabrication, delivery, and supplier prices that create crucial premiums. Gold ETFs come closest to monitoring spot costs, whereas respected sellers like Blanchard provide essentially the most clear method by displaying genuine spot charges and clearly itemizing any extra prices moderately than inflating the baseline value.