In an in-depth interview with BullionStar, economist and former Goldman Sachs and Bear Stearns managing director Dr. Nomi Prins shared her perspective on the accelerating shift in international finance—pushed by sovereign debt considerations, geopolitical tensions, and renewed curiosity in actual belongings resembling gold. Drawing on themes from her books Everlasting Distortion and Collusion, Prins outlined the structural disconnect between monetary markets and the true economic system, and defined why she believes gold is changing into a foundational asset within the rising financial order.

From Wall Avenue to a World Macroeconomic Lens

Reflecting on her transition from senior roles at Goldman Sachs and Bear Stearns to impartial analysis, Prins defined:

“What was at all times fascinating to me was taking a look at the true economic system, the one which works within the bodily and operates for folks, the one which has provide chains, versus the kind of monetary facet of that economic system which is extra kind of engineered merchandise paper markets and fiat foreign money”

Her work now focuses on uncovering long-term systemic shifts, significantly these obscured by conventional monetary narratives.

A System Untethered: Central Financial institution Coverage and ‘Everlasting Distortion’

Prins warned of a continued detachment between asset markets and underlying worth creation, a dynamic she explored in Everlasting Distortion:

“You may have these synthetic insurrections, actually, from the standpoint of central banks infusing the markets with fictitious cash, cash that didn’t come from incomes or constructing or expertise or infrastructure improvement or actually something.”

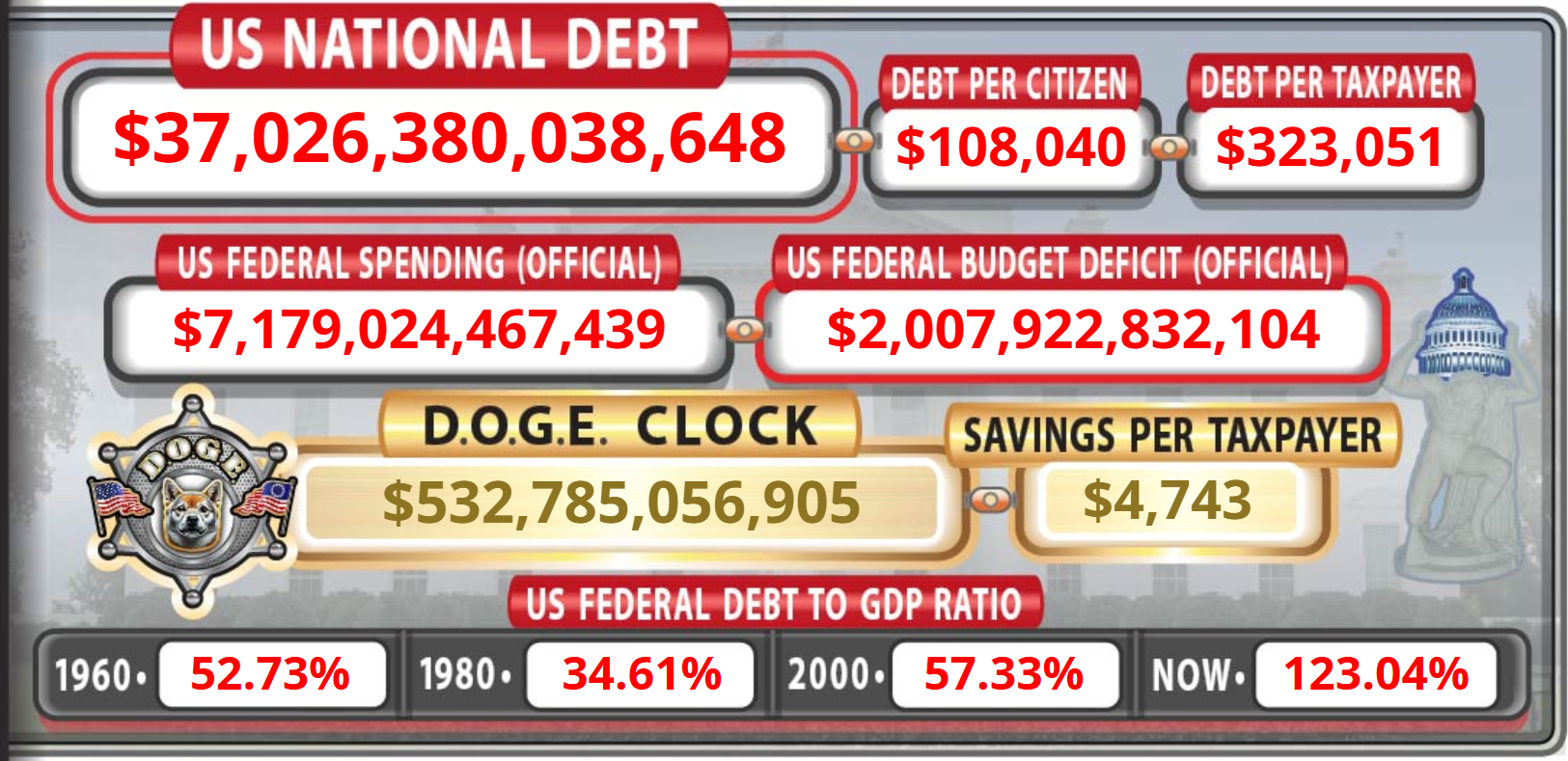

She highlighted that U.S. sovereign debt is approaching $37 trillion, with curiosity funds nearing $1 trillion yearly—a construction she views as more and more unsustainable.

The Erosion of Greenback Dominance and the Function of Gold

Whereas Prins doesn’t foresee the U.S. greenback dropping its reserve foreign money standing imminently, she famous an accelerating pattern of nations lowering publicity to dollar-based commerce:

“Is it going to cease being the reserve foreign money in our lifetimes? No. However… there’s a motion and an accelerating motion to go away from utilizing the greenback as the bottom commerce foreign money amongst nations.”

Among the many most notable shifts: China lowering its U.S. Treasury holdings whereas growing its gold reserves.

“It’s successfully elevated its proportion of gold allocation and diminished its proportion of US Treasuries.”

China’s Systematic Re-monetization of Gold

China’s central financial institution gold purchases are a part of a broader, multi-tiered technique. In line with Prins:

“It’s been very systematic when it comes to spreading gold from the central financial institution, you realize, all the way in which all the way down to the person in fairly a deliberate approach.”

She described this as a structural realignment:

“It’s changing into a part of the kind of structure of the realignment of the monetary methods away from the greenback based mostly, the kind of Western based mostly system into the Jap based mostly system.”

Towards a New Framework for Gold in World Commerce

Prins believes gold could more and more be used not solely as a reserve asset, but additionally as a structural requirement in worldwide commerce and fee methods:

“There may very well be guidelines that relate to gold, type of a brand new type of a gold normal the place there’s a certain quantity that’s required, or a certain quantity in reserve that’s required, or a certain quantity that the State banks have, or the non-public banks inside a rustic have.“

She emphasised this isn’t merely theoretical—taking part nations are actively increasing their gold reserves.

Gold’s Renewed Function for Buyers and Central Banks Alike

Gold’s enchantment, Prins argues, is now not restricted to hedging inflation or volatility. As a substitute, it’s being positioned as a strategic anchor in a fragmented international system:

Gold doesn’t care which governments purchase it. The extra it owns, the extra it has management of the nationwide market.”

She noticed that gold has held agency by financial turbulence:

It’s proven outstanding stability by greater inflation, financial uncertainty, extra debt… and it’s persevering with to remain in there as a result of it has a bid from each facet of China… and each type of investor.

CBDCs and the Case for Privateness-Preserving Belongings

![]()

Prins expressed severe reservations in regards to the rising adoption of central financial institution digital currencies (CBDCs), significantly when it comes to knowledge privateness:

“People could have their monetary transactions in the end in a ledger that in the end a central financial institution and a authorities can see.

She contrasted this with the autonomy that bodily belongings provide:

“You’ll be able to’t actually put a blockchain inside a bullion bar.”

A Bullish Outlook on Gold’s Value Trajectory

Trying forward, Prins anticipates a continued imbalance between provide and demand, pushed by each retail and institutional accumulation:

There’s a shortage. If there’s a shortage, it’s going to push the worth up. You’ll be able to’t identical to begin a gold mine and dig for gold, I imply, sure, there are lots of working mines on the planet, and they’re producing gold. However then there’s additionally lots of junior miners which can be starting, or initially or center levels of growing mines which have but to supply gold.

Her forecast is evident:

I see costs of gold going up round 4,000 by the tip of this 12 months, starting of subsequent 12 months, per ounce in {dollars} and 5,000 by the tip of the subsequent 12 months.