Think about this — it is 1999, and you’ve got simply retired with a hard-earned $1 million nest egg. You are trying ahead to a cushty retirement, withdrawing a modest $50,000 yearly.

After 24 years, how do you assume your portfolio would have fared? How a lot of your million-dollar portfolio is left?

The reply relies upon closely in your funding allocation — and the variance in outcomes would possibly actually shock you. A current evaluation by ValueStockGeek on X (previously Twitter) reveals a stark distinction in outcomes primarily based on portfolio allocation.

In only a second, we’ll study this thought-provoking case examine and take into account whether or not it is time to rethink your gold allocation.

The Million Greenback Portfolio Allocation Query

Let’s take a look at this state of affairs and study the charts ValueStockGeek shared:

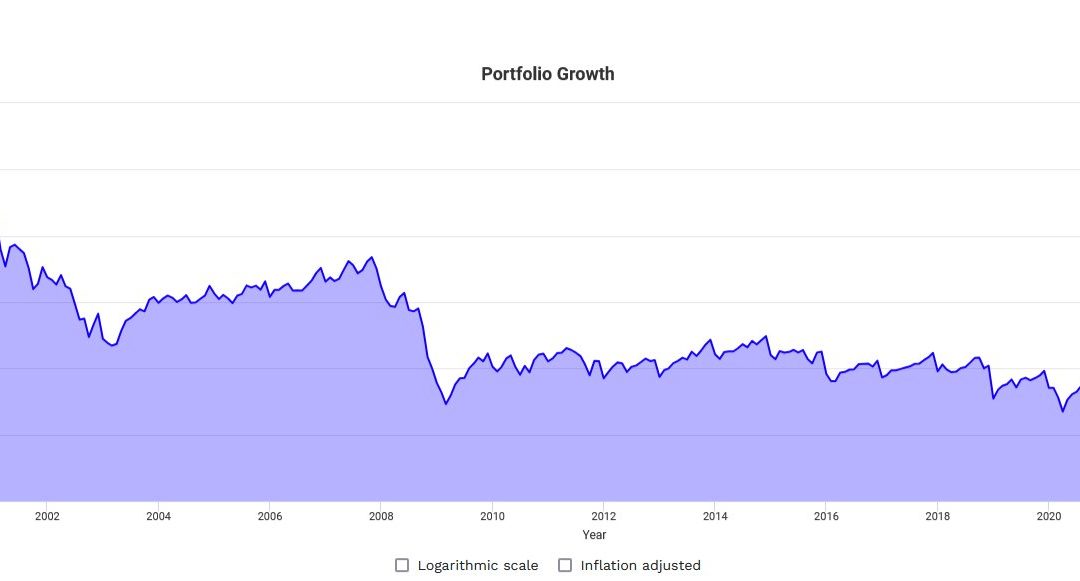

$1M Portfolio | 100% in U.S. Shares

$1M Portfolio | 25% Shares, 25% Lengthy Time period Bonds, 25% Money, 25% Gold

This comparability highlights a vital lesson: diversification, significantly together with gold, generally is a game-changer for long-term monetary stability.

Typical funding knowledge has usually advisable allocating solely round 5% of a portfolio to property like gold. Nevertheless, in right this moment’s period of financial uncertainty and market volatility, this strategy could also be overly conservative.

Keep in mind, the secret is steadiness. Whereas an all-gold portfolio is not advisable, this evaluation demonstrates the next 25% allocation to gold may very well be extra appropriate for retirees trying to protect their wealth. In spite of everything, on this instance it made a virtually $700,000 distinction in retirement outcomes.

However this raises an necessary query: What’s the optimum gold allocation for right this moment’s financial panorama?

How A lot Gold Is Sufficient?

Financial institution of America strategists just lately mentioned traders following the 60/40 (60% shares 40% bonds) methods ought to take into account swapping out bonds for commodities.

“The commodity secular bull market within the 2020s is simply getting began as debt, deficits, demographics, reverse-globalization, AI and web zero insurance policies are all inflationary,” the BofA strategists mentioned.

BofA’s technique workforce, led by Jared Woodard and Michael Hartnett, argues that commodities will fare higher in right this moment’s setting of excessive inflation. They assist their declare by declaring:

- 30-year US Treasuries have handed traders losses of virtually -40% prior to now 4 years.

- In the meantime, commodities have delivered annualized returns starting from +10% to +14% for the reason that begin of the last decade.

This advice from one of many world’s largest banks highlights a big shift in considering amongst main monetary establishments. Conventional portfolio methods are being reevaluated and property like gold are gaining main traction amongst mainstream monetary advisors.

The potential influence of this assertion from Financial institution of America may very well be enormous.

A whole lot of thousands and thousands of traders worldwide observe the 60/40 portfolio mannequin. If even a fraction heed BofA’s recommendation, we may see billions of {dollars} flooding into gold and silver markets. This inflow may dramatically increase treasured steel costs, benefiting current holders.

For a lot of traders, this can be the sign to rethink their treasured metals allocation. When you had been beforehand on the fence, seeing Financial institution of America advocate a 40% allocation to commodities may carry numerous weight and shift your decision-making. Such a robust advice would possibly simply be the nudge you want to enter the market.

For present treasured metals traders, this shift may convey the validation – and worth improve – you have been anticipating.

When you resolve you do wish to improve your allocation in treasured metals, we’re right here to assist. Discover our premium number of gold and silver bullion merchandise right this moment.

Purchase Gold or Silver In the present day

In Different Information…

Gasoline Costs Hit Six-Month Low Nationwide

U.S. gasoline costs are declining considerably, with the nationwide common reaching a six-month low of $3.32 per gallon. This drop is attributed to falling oil costs, weakening gasoline futures, and the tip of the summer season driving season. Some analysts predict costs may attain $3 per gallon by year-end, barring main disruptions.

Tender Touchdown or Slowdown? August Job Numbers Spark Debate

The US financial system added 142,000 nonfarm payroll jobs in August. Whereas that is decrease than the 165,000 anticipated, some economists view the report as in line with a “comfortable touchdown” quite than a recession.

Fed Governor Waller Requires Motion on Curiosity Charges

Federal Reserve Governor Christopher Waller has acknowledged that it is time to reduce rates of interest. On Friday, he emphasised, “The present batch of information not requires endurance; it requires motion.” The choice shall be made on September 18th, marking the primary charge reduce in 4 years if carried out.

Fee Cuts Might Be on the Approach – However How A lot?

The market thinks charge cuts are coming, the query now appears to be, “how a lot?” Curiosity-rate futures present merchants betting on a 50 basis-point reduce within the September assembly, and a full share level easing by the tip of 2024.

A charge reduce would lower the chance value of holding non-yielding property like gold and silver, probably boosting their attraction as safe-haven investments. .

That’s it for this week’s GoldSilver Nuggets. We’ll be again subsequent week with extra information and updates.

Greatest,

Brandon S.

Editor

GoldSilver