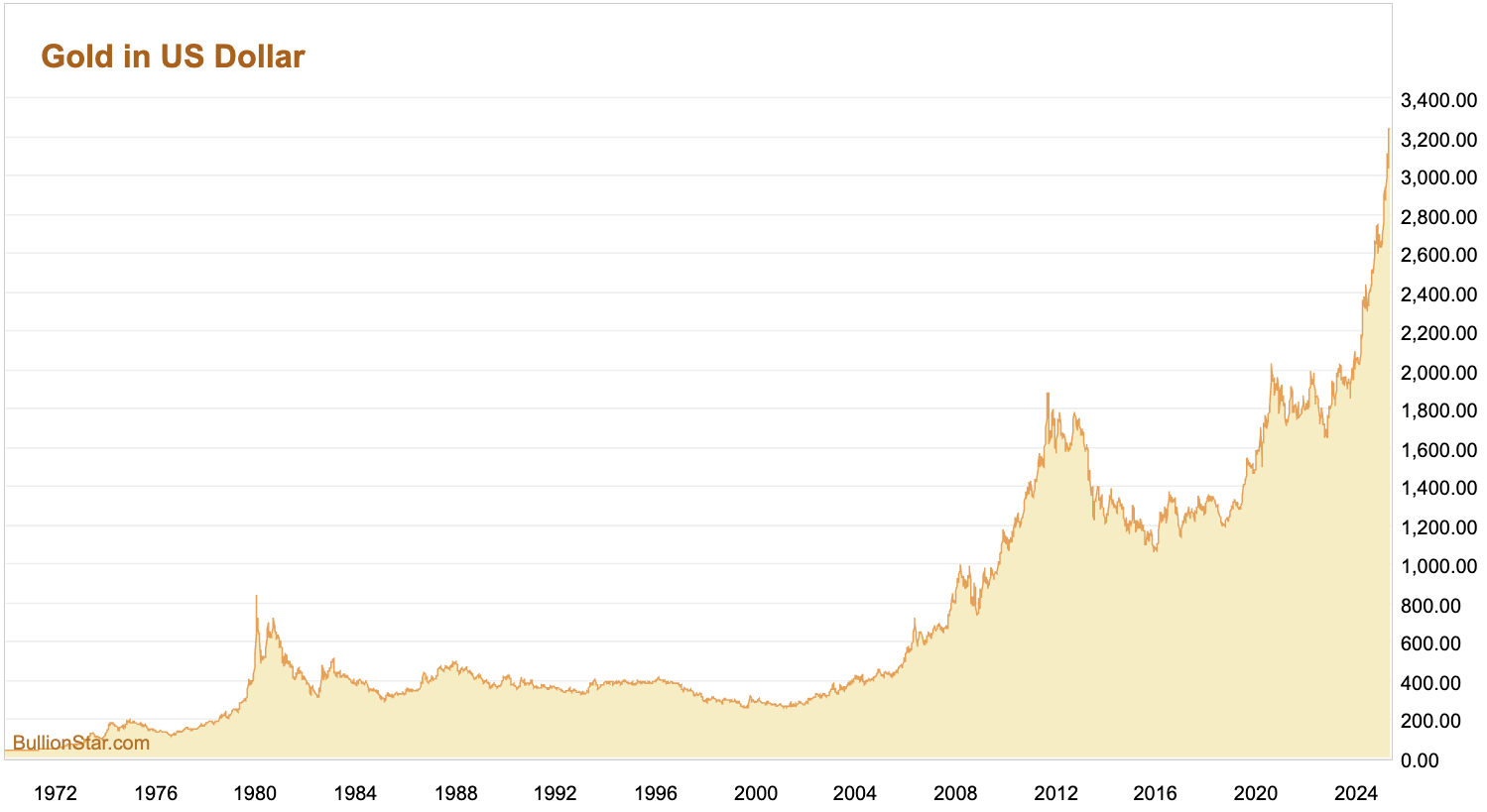

Gold costs have shattered information all through 2025, surpassing the $3,300 per ounce mark. Many buyers observing from the sidelines ask: “Have I missed the golden alternative, or is that this only the start?”

Is It Too Late to Purchase Gold in 2025? In keeping with specialists in treasured metals, we’re witnessing what may be the early phases of a historic bull market in gold. Let’s study the proof and examine gold’s present trajectory with earlier cycles.

The Professional Consensus: The Gold Rally Is Simply Starting

Regardless of gold’s spectacular efficiency, all key indicators recommend 2025 may symbolize simply the preliminary section of what analysts name “a generational wealth switch into treasured metals.”

Gold isn’t just a commodity or a speculative funding; it represents preserved wealth by way of centuries of financial turmoil. In right now’s actuality of unprecedented nationwide debt, persistent inflation, and escalating international tensions, gold’s position as monetary insurance coverage has by no means been extra vital.

“In instances of financial uncertainty, gold stays the anchor of monetary stability.” – World Gold Council, 2024

Why Many Individuals Suppose They’ve Missed Out (And Why They’re Mistaken)

Sure, gold reached historic highs this yr. This naturally triggers the concern of shopping for on the peak.

However right here’s what separates gold from different belongings:

Gold doesn’t expertise the boom-and-bust cycles typical of tech shares or cryptocurrencies. It doesn’t vanish in a single day when public sentiment shifts.

As an alternative, gold strikes in long-term secular tendencies. All proof suggests we’re not on the fruits of this bull market—we’re in its center chapters.

Gold reacts to basic financial realities: inflation, foreign money devaluation, banking instability, and geopolitical danger. Think about this: Are these considerations reducing or escalating?

The reply is evident.

7 Compelling Alerts Suggesting Gold’s Upward Trajectory Will Proceed

1. Central Banks Are Accumulating at Historic Charges

We beforehand shared the unimaginable demand for gold pushed by central banks,, together with China’s announcement that it’s going to enable insurance coverage firms to put money into gold as a part of a pilot program

Why this unprecedented shopping for?

Central banks perceive that fiat currencies are systematically devalued by way of extreme cash creation.

Shouldn’t particular person Individuals think about the identical technique if the world’s financial authorities aggressively purchase gold?

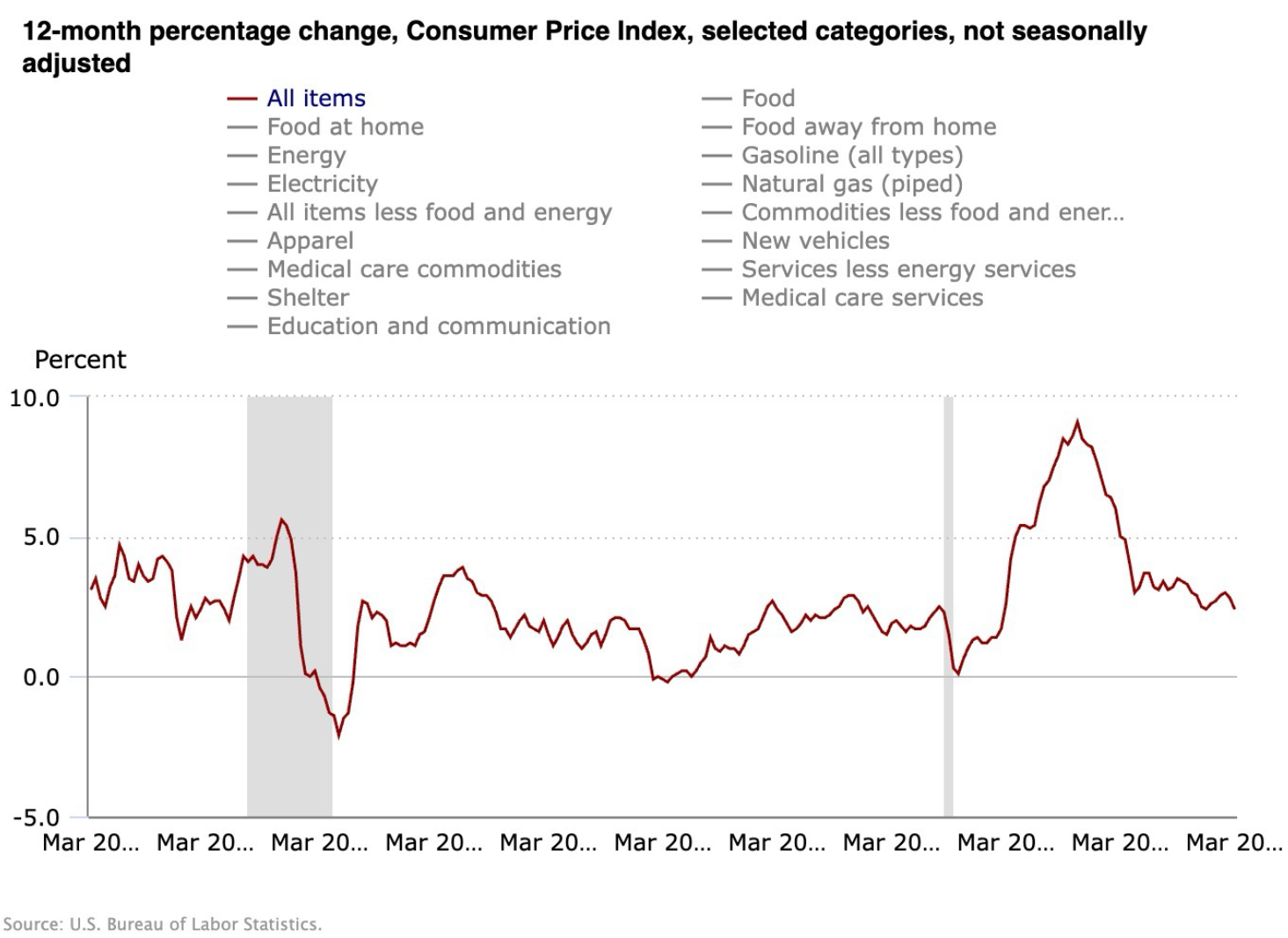

2. Gold Can Outperform Throughout Inflationary Interval

Gold isn’t simply inflation safety—it’s financial preservation in tangible kind.

Regardless of official claims of “managed inflation,” American customers face considerably larger housing, meals, healthcare, and training prices. With no finish to the commerce conflict, prices may preserve rising for on a regular basis Individuals.

3. The Banking System Stays Basically Susceptible

The 2023 regional banking disaster that started with Silicon Valley Financial institution uncovered unresolved structural weaknesses in our monetary system.

Gold thrives exactly when confidence in monetary establishments falters.

“Bodily gold possession represents one of many few belongings with out counterparty danger in an more and more interconnected monetary system.” – Investopedia.

4. America’s Debt Trajectory Has Handed the Level of No Return

The US nationwide debt surpassed $34 trillion in 2024 and continues accelerating. This mathematical actuality results in one inevitable consequence: continued foreign money debasement.

Foreign money devaluation = diminished buying energy = larger gold costs

It’s not hypothesis—it’s financial regulation.

5. Gold Stays Undervalued in Historic Context

Even at $3,300+ per ounce, gold stays in a progress trajectory fueled by commerce wars and international geopolitical tensions.

This implies vital potential for ongoing appreciation as an alternative of a market peak. As CBS Information lately highlighted, “gold’s value actions are carefully linked to actual rates of interest,” with the Federal Reserve’s troublesome place concerning inflation and financial progress, gold is poised to profit significantly.

6. World De-Dollarization Developments Help Greater Gold Costs

A major shift is going on within the international financial panorama as nations actively diversify their reserves away from the US greenback. This “de-dollarization” development has accelerated lately, with nations akin to China, Russia, India, and several other Center Japanese nations growing their gold reserves whereas reducing their greenback publicity.

In keeping with the World Gold Council, this structural change within the worldwide financial system creates sustained demand for gold from sovereign entities. One monetary analyst famous in a latest Reuters report, “We’re witnessing a once-in-a-generation restructuring of the worldwide financial order, with gold being the first beneficiary.”

This development appears to be in its early phases, indicating a long-term help for gold costs as central banks persist of their systematic accumulation of bodily gold.

7. Good Cash Is Reallocating to Bodily Gold

Institutional buyers quietly enhance their bodily gold allocations, shifting past paper gold publicity by way of ETFs. As State Road World Advisors lately highlighted.

This shift from paper to bodily gold possession represents a basic change in how subtle buyers method treasured metals—specializing in direct possession fairly than spinoff publicity.

Professional Q&A: Addressing Two Widespread Questions About Gold Funding

Q: Ought to I await gold to drop earlier than shopping for?

A: Timing the gold market has historically been troublesome, even for skilled merchants. Analysis signifies that buyers who dollar-cost common into gold typically outperform those that try to time their entry factors.

Q: Is bodily gold higher than gold ETFs or mining shares?

A: Every has distinct traits. Bodily gold gives direct possession with out counterparty danger however requires safe storage. ETFs supply comfort however introduce third-party publicity. Mining shares present leverage to gold costs however carry company-specific dangers. Most wealth preservation specialists advocate contemplating what aligns along with your scenario and objectives.

→ Discover our choice of investment-grade gold bullion merchandise with clear, aggressive pricing.

→ Resolve whether or not you favor to maintain your treasured metals protected in our U.S. vault or get pleasure from international diversification with our safe vault in Singapore. Or, get pleasure from free delivery throughout the U.S. for orders above USD 98.

→ Implement a scientific shopping for program to construct your place methodically over time.

Need assistance? Contacting BullionStar is straightforward!

Bodily gold has served as the last word monetary insurance coverage coverage all through financial historical past. This safety has by no means been extra important in right now’s unprecedented financial atmosphere.

Disclaimer: This text is for informational functions solely and shouldn’t be construed as monetary recommendation. Seek the advice of with certified professionals concerning your particular scenario earlier than making funding selections.