Authored by GoldFix, ZH Edit

The LBMA Has a Inventory-Out

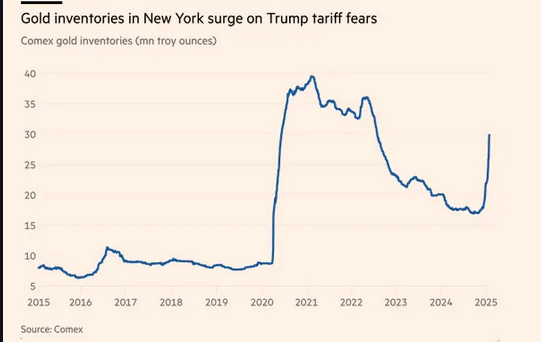

London’s bullion market is below pressure. A surge in gold shipments to the U.S. has left merchants scrambling to borrow from central banks, with wait instances on the Financial institution of England stretching from days to weeks. The gold provide chain, lengthy thought of dependable, is now uncovered to cracks that weren’t obvious earlier than.

The free float—gold out there for quick OTC buying and selling—has declined after the wave of shipments to New York. Regardless of the logistics claims, many have mentioned that that is only a good quaint stock-out

The Simply-in-Time Mannequin Breaks Down

For many years, bullion banks operated on the idea that gold was at all times out there. The system labored as a result of gold isn’t consumed—it’s recycled, leased, and traded. When provide disruptions occurred, banks may borrow steel, cowl their wants, and change it later. That mannequin is now failing.

A brand new sort of purchaser has entered the market: one which doesn’t see gold as a monetary instrument however as cash itself. International locations like China and Russia have spent years accumulating gold, prioritizing it over U.S. bonds. Their technique has chipped away on the out there leasing pool, leaving Western banks uncovered.

The Musical Chairs of Gold Provide

Bullion banks relied on a recreation of musical chairs, borrowing gold to satisfy short-term wants. However when sufficient chairs are eliminated—when consumers refuse to lease their holdings—banks are pressured to compete for an ever-dwindling provide. That’s what’s occurring now.

Central banks have been web consumers of gold, not simply in rising markets however within the West as effectively. Jap European nations like Poland and Lithuania have ramped up purchases, additional tightening provide. The once-abundant leasing market is drying up.

London’s Golden Milkshake Will get Drained:

There is a billion ounces out there.London’s Warehouses for argument sake. There is a billion ounces there, however there’s solely 300 million ounces out there. The opposite 700 million ounces are owned by individuals who have little interest in leasing it. as a result of they see what’s occurring. You have already got China, proper? You could have a giant straw sucking the gold and silver out of Europe. It comes out of London, it goes into Switzerland, it will get earmarked and it goes to China. Now you might have a brand new straw coming to the US for no matter motive you need it to be. For tariffs, however I imagine it is only a straight up repatriation of gold for Tier 1 functions and the tariffs are a catallyst motive, if not a great cowl for all of it. We now have two straws draining the LBMA, the golden milkshake in London is simply being drained by China and the US. Supply:

Gold Shipments to the U.S. Speed up the Disaster

With London’s provide already strained, massive shipments of gold to the U.S. are including stress. Whether or not the motion is pushed by tariff considerations or broader repatriation efforts, the impact is similar: gold that was as soon as a part of London’s out there float is being pulled out of circulation.

China has lengthy siphoned gold from European markets, refining it in Switzerland earlier than transport it east. Now, the U.S. is drawing from the identical supply, making a twin drain on London’s reserves. As extra gold strikes throughout the Atlantic, London’s position as the middle of the worldwide gold commerce is being examined.

What Occurs Subsequent?

If bullion banks can’t safe sufficient gold by leasing, the following step is central financial institution intervention. The G7 central banks could also be pressured to lease their gold to maintain the system functioning. Mines could divert gold earlier than it even reaches public markets. Extra nations could observe China’s lead, shopping for gold straight relatively than permitting it to move by exchanges.

“Individuals can’t get their arms on gold as a result of a lot has been shipped to New York, and the remaining is caught within the queue,” mentioned one trade govt. “Liquidity within the London market has been diminished.”

It is a coverage shift reflecting Mercantile tendencies, the place nations prioritize securing bodily gold over taking part in a globalized buying and selling system. The bullion banks, lengthy dominant in gold markets, are shedding their grip as governments take direct management of provide and the pool of lease-able gold shrinks whereas World belief is damaged making Gold’s newly reinstated Tier 1 standing extra essential for commerce than ever

Extra Detailed Video Model:

THE LBMA IS BROKEN

(We did not want them anyway)Key Moments

0:00- Intro/ Mkts

4:45- London Gold Deficit

6:10- RTRS/ FT Protection

7:23- LBMA Provide Chain

16:18- BNP Will get Bullish Gold

21:12- Trump Clothes Down Powell Once more

24:15- Gold, Silver Charts pic.twitter.com/pg6VBhO8ZE— VBL’s Ghost (@Sorenthek) January 30, 2025

Associated Tales out As we speak

Free Posts To Your Mailbox

Contributor posts revealed on Zero Hedge don’t essentially characterize the views and opinions of Zero Hedge, and are usually not chosen, edited or screened by Zero Hedge editors.

Loading…