Over the previous three years, luxurious quantity progress has softened, with manufacturers more and more counting on value will increase to take care of top-line efficiency. Between 2023 and 2025, round 80 % of luxurious market progress is estimated to have stemmed from value will increase slightly than quantity positive factors — a lever that can’t be relied on indefinitely.

On the similar time, competitors for share of pockets has intensified as clients redistribute discretionary spending throughout a wider vary of classes, together with journey and wellness. Aspirational consumers — these spending between €3,000 (roughly $3,494) and €10,000 ($11,647) yearly on luxurious items — have lower spending on luxurious items amid value will increase and a tougher financial backdrop, with an estimated 35 % of aspirational luxurious clients pulling again on or delaying luxurious spend.

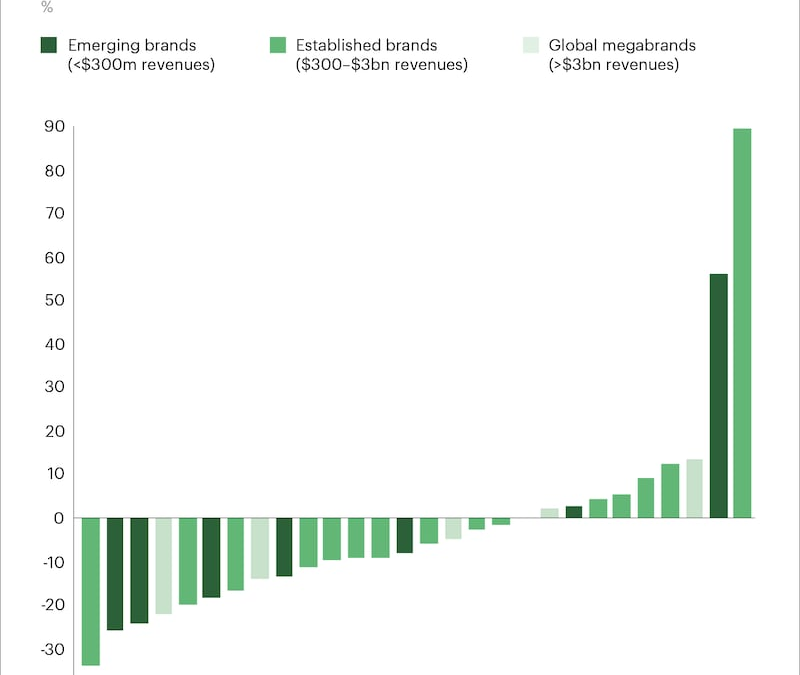

Model efficiency has turn into extra polarised amid this shift: The vary of EBITA margins among the many center 50 % of performers (analysed to exclude outliers) has elevated greater than 2.5 share factors since 2021. Manufacturers that outperformed did so by focussing on extra resilient components of the market, reminiscent of onerous luxurious classes like jewelry and ultra-high-net-worth clients.

Manufacturers are turning to inventive reboots to reignite buyer demand

Luxurious’s inventive refresh

Over the previous decade of speedy progress, many luxurious manufacturers have widened their buyer bases — at occasions, buying and selling exclusivity for broader attain. This has accelerated buyer need for higher creativity and differentiation, which is most pronounced amongst youthful clients: 81 % of consumers below the age of 35 cite design and creativity as their main buy driver. In response to this and slowing gross sales, luxurious homes changed their inventive administrators at an unprecedented price over the past 12 months.

9 of 15 of the biggest luxurious manufacturers appointed new inventive administrators within the 12 months till September 2025, with 4 additionally appointing a brand new chief govt.

The extremely anticipated Spring/Summer season 2026 season

The Spring/Summer season 2026 trend present season was an early check of manufacturers’ new inventive instructions, with designers at homes from Chanel and Dior to Balenciaga and Loewe exhibiting their debut womenswear collections.

Jonathan Anderson’s Dior was the top-performing present throughout Paris Vogue Week Spring/Summer season 2026 by share of voice in user-generated content material on social media.

On-line audiences praised Jonathan Anderson’s Dior for its trendy reinterpretation of heritage motifs and sculptural silhouettes and described Matthieu Blazy’s solar-system adorned Chanel runway as symbolic of the model’s new period, in keeping with social listening evaluation. In the meantime, audiences considered former Proenza Schouler designers Jack McCollough and Lazaro Hernandez’s debut at Loewe as an lively and playful reinterpretation of the model’s craft heritage by means of the gathering’s daring colors, frayed parts and clear footwear.

Manufacturers have began to capitalise on this preliminary buzz by accelerating their go-to-market calendars, making their collections obtainable the identical week the lookbook is launched. The following problem to completely translate this into business impression is to make sure aligned advertising, merchandising and retailer ideas.

Rebuilding buyer belief is a necessary a part of the sector’s recalibration

Luxurious’s worth equation has come below stress from repeated value will increase and up to date labour investigations, leaving clients questioning if luxurious items are definitely worth the excessive value tags.

Rebuilding worth notion has turn into a strategic crucial as manufacturers reset for progress, partly achieved by taking extra management over practices throughout the complete worth chain to make sure their integrity. Some manufacturers are trying to achieve oversight of their total worth chains and shield craftmanship. For instance, Dior created a brand new industrial division in late 2024 to centralise oversight of suppliers and workshops to strengthen high quality management and protect artisanal know-how.

The #1 attribute that epitomises luxurious is ”experience and high quality,” in keeping with ultra-high-net-worth clients.

Main homes are additionally aiming to enhance worth notion by investing of their producers, growing expertise in-house or vertically integrating manufacturing to protect uncommon artisanal expertise. Most not too long ago in June 2025, Prada acquired a ten % stake in Italian leather-based group Rino Mastrotto, strengthening its management over leather-based manufacturing. In the meantime, manufacturers like Van Cleef & Arpels and Bulgari are opening their jewelry faculties to the general public to showcase in-house craftmanship expertise and encourage a brand new era of consumers — a rising engagement tactic throughout the business.

67% of customers say belief in a model interprets into long-term loyalty and advocacy.

Regional variations in buy drivers reveal distinctive formulation to seize excessive spenders

In China, high-net-worth clients proceed to prize exclusivity and innovation, gravitating in the direction of manufacturers that stability recognisable heritage design codes with creativity. Luxurious is seen as an expression of style and individuality, the place exclusivity might be signalled by showcasing entry to distinctive design and model iconography.

When requested about associations with luxurious, respondents within the US and UK emphasised attributes reminiscent of high quality, sturdiness, class and affluence. Against this, Chinese language customers cited particular model names twice as usually.

Within the US and UK markets, strengthening clienteling and retailer experiences by means of AI or digital instruments generally is a key supply of aggressive benefit. For instance, such instruments can be utilized to personalise internet interfaces to clients’ buying and shopping historical past to maximise engagement, or can information gross sales advisors to extra successfully put together for in-store visits. Whereas use in luxurious is nascent, manufacturers like Saks Fifth Avenue have began to make use of AI to personalise editorial content material and product suggestions on their web sites.

Youthful cohorts place higher emphasis on luxurious as a marker of identification and standing

Premium high quality and craftmanship are key for all clients, however there are slight variations between generations on different associations with luxurious.

Redefining wealth and luxurious

Gen Z and Millennials are reshaping expectations of luxurious manufacturers. Youthful clients use luxurious purchases to sign standing, picture and self-definition greater than older cohorts and are much less prone to hyperlink luxurious to wealth, redefining luxurious past affluence. That is linked to luxurious’s widening scope to incorporate experiences, and is bolstered by resale’s rise, which weakens luxurious’s hyperlink to wealth.

The evolving that means of exclusivity

Gen Z and Millennial clients cite exclusivity as a driver for elevated luxurious spend, 11 share factors above the common. But as luxurious continues to develop its buyer base and the notion of exclusivity evolves, manufacturers should foster desirability by means of storytelling, personalisation and product distinction slightly than restricted entry alone.

Youthful cohorts are gaining spending energy

Gen Z spending is rising twice as quick as that of earlier generations. It’s anticipated to surpass Child Boomer spending by 2029, fuelled by $15 trillion to $20 trillion in wealth transferred from Child Boomers to Millennials and Gen Z.

How ought to executives reply to those shifts?

Translate inventive power into sustained business impression

Help inventive intuition with buyer perception and analytics. Use consumer insights to focus creative instincts, not exchange them. Steadiness the artwork of risk-taking with a deep understanding of brand name heritage and viewers reception to create work that feels daring and recent however lands with clients.

View advertising and shops as additional alternatives to distinguish creatively from opponents. Essentially the most compelling inventive reboots will drive early buzz, maintain momentum by means of constant advertising narratives and convert it into measurable enhancements to retailer and internet site visitors, engagement and gross sales.

Prioritise rebuilding consumer belief

As transparency turns into a baseline expectation and regulatory stress will increase, duty in sourcing and labour is central to rebuilding belief.

Whether or not vertically built-in or not, manufacturers should personal duty for your entire worth chain — from uncooked supplies and sourcing by means of to the completed product. Prioritising traceability and truthful labour practices indicators real integrity to clients and permits tighter management over manufacturing high quality and dealing situations, and permits manufacturers to safe (and the place required, rebuild) their reputations.

Clients need proof of remarkable supplies and human talent seen within the product. Manufacturers ought to anchor model tales in craft and product high quality. They could additionally invite clients behind the scenes in manufacturing with atelier visits, open workshops or storytelling to assist restore worth notion and strengthen emotional connection.

Enhance the consumer retail expertise throughout channels

Empower advisors to ship extra private, high-touch service each on-line and in retailer, pairing funding in clienteling instruments with ongoing coaching and incentivising digital fluency.

Information should additionally movement seamlessly throughout shops, e-commerce and social channels, making a single, unified view of every consumer to allow:

- Tailor-made outreach, reminiscent of notifying a leather-based items consumer {that a} new purse has dropped forward of their birthday or anniversary.

- E-commerce personalisation, reminiscent of adapting product itemizing pages to distinctive preferences to maximise engagement and conversion.

- Distinctive in-store expertise, reminiscent of consumer advisors utilizing AI instruments to extra successfully put together for appointments.

This text first appeared in The State of Vogue 2026, an in-depth report on the worldwide trend business, co-published by BoF and McKinsey & Firm.