Gold’s worth could also be grabbing headlines, however there is a greater story unfolding within the mining trade.

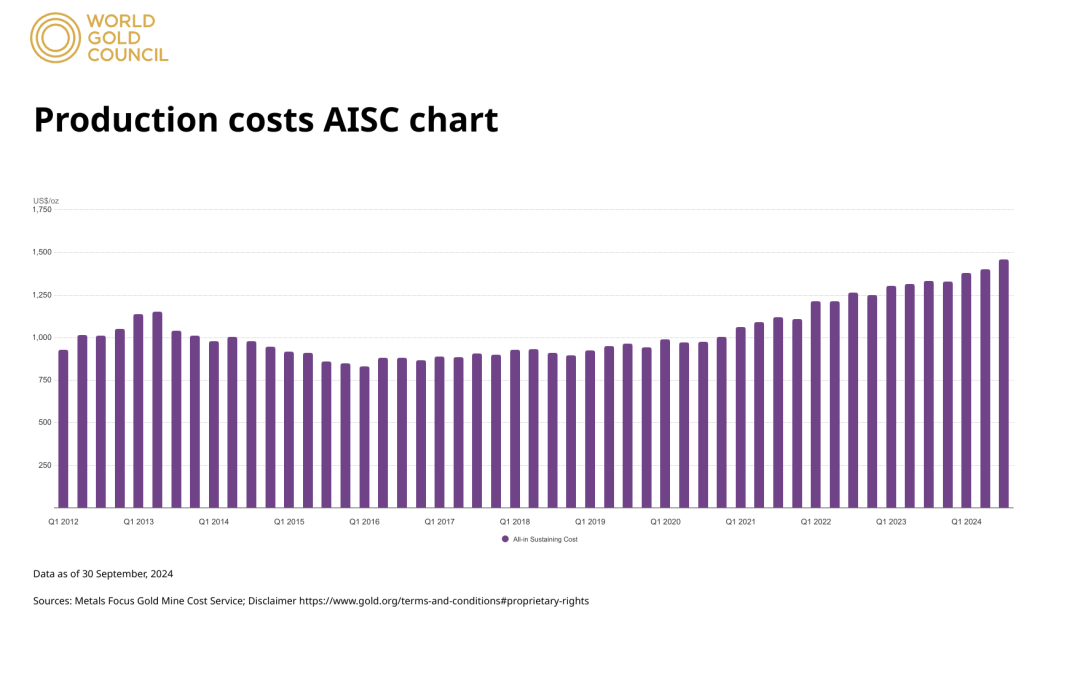

Regardless of gold reaching near-record highs earlier this 12 months, miners are dealing with a critical problem: manufacturing prices are hovering at an unprecedented price.

In response to the World Gold Council, these rising prices are pushing some mining operations to the brink, whilst gold costs stay robust…

The True Price of Gold Mining

To get a greater understanding of the rising value of mining let’s have a look at the All-in Sustaining Price (AISC). This important metric exhibits the true value of operating a gold mine – from extraction to gear upkeep and future exploration. When AISC rises, it instantly impacts miners’ capability to remain worthwhile.

Here is the place issues get fascinating. In response to the World Gold Council, gold manufacturing is anticipated to develop by simply 0.9% yearly by way of 2030. That is barely any development in any respect.

In the meantime, demand for gold continues to rise from each buyers looking for security and industries needing it for manufacturing.

Easy economics tells us what occurs subsequent: when provide struggles to maintain up with rising demand, costs are likely to rise. With mining prices climbing and manufacturing development restricted, the stage seems set for probably larger gold costs forward.

Recession Forward? The Information Says Sure

One recession indicator has predicted each recession since 1960 with no single miss. Watch Mike’s response when Alan reveals this remarkably correct predictor and what it is signaling for 2025.

See the proof for your self proper right here.

Robert Kiyosaki: “Purchase Silver Now”

Robert Kiyosaki, writer of the bestseller “Wealthy Dad, Poor Dad,” is making waves together with his newest funding recommendation. On social media platform X, he not too long ago urged followers to contemplate shopping for silver bullion, linking his advice to considerations about banking sector stability.

“Even when you have little or no cash, you should still have the ability to revenue from this crash,” Kiyosaki wrote, noting that silver stays accessible to most buyers.

Whereas his earlier daring worth predictions haven’t but materialized, he raises an fascinating level about silver’s accessibility to on a regular basis buyers.

However there’s extra to silver’s story than simply funding demand.

Silver: Extra Than Only a Treasured Metallic

Whereas gold is primarily saved as wealth, silver performs a twin position – it is each a treasured steel and an industrial workhorse. From electronics to electrical automobiles to photo voltaic panels, silver is a vital part in lots of at present’s fastest-growing industries.

Each new photo voltaic panel set up and electrical car that rolls off the manufacturing line completely makes use of up a bit extra silver. As these inexperienced applied sciences develop, so does the demand for silver.

In the meantime, not like paper belongings, you may’t merely print extra silver when demand rises.

This distinctive mixture – rising industrial consumption alongside conventional funding demand – might create fascinating dynamics for silver’s future. Whereas nobody can predict costs with certainty, the basics of provide and demand inform an compelling story.

Prepared so as to add treasured metals to your portfolio? It takes simply minutes to get began.

Log In Now to Purchase Treasured Metals

Right here that will help you construct lasting wealth,

Brandon S.

Editor

GoldSilver