A brand new spherical of tariff bulletins from the Trump administration despatched markets reeling, with chilly coming down from its all-time excessive over $4,050, solely to settle above $4,000, signaling collective doubt within the system itself as traders rush to guard themselves with exhausting property.

Collectively, markets are reaffirming gold’s function on the heart of sovereignty, financial stability, and international reserve technique, even because it has develop into a favourite goal of Keyneseian ridicule as every little thing from a “barbarous relic” to a waste of bodily and monetary area in funding portfolios and stability sheets.

But, confidence in US debt continues to say no, with the “protected” standing of Treasuries more and more being questioned. That’s why now, for the primary time in a long time, collective central financial institution gold holdings have surpassed the worth of their Treasuries. Central banks now maintain 20% of all gold ever mined, defending themselves from the consequences of forex debasement whilst they, satirically, trigger it. As an alternative of incomes yield by holding Treasuries, they proceed stocking up on gold, which is a strong assertion in opposition to the outcomes of their very own financial experiments.

As a result of gold may be very tough to govern in comparison with different asset lessons, and isn’t topic to the whims of central bankers or the power of an overindebted, over-spending nation to pay again what it owes, central banks are dashing to inventory extra of it. Whereas uncontrolled debt issuance, greenback weak spot, and an enormous sovereign stability sheet, central banks purchase gold to guard themselves from precisely the identical issues that have been attributable to centralized management.

In the meantime, traders, commentators, and asset managers, like to sing about inventory market highs whereas ignoring the issue: these shares are being measured in a forex that’s always being debased. Once you worth them in gold, you’re utilizing a real measuring stick that hasn’t been reconfigured by central financial institution wizards. All of the sudden, denominated in actual cash, most different “booming” property don’t look practically pretty much as good.

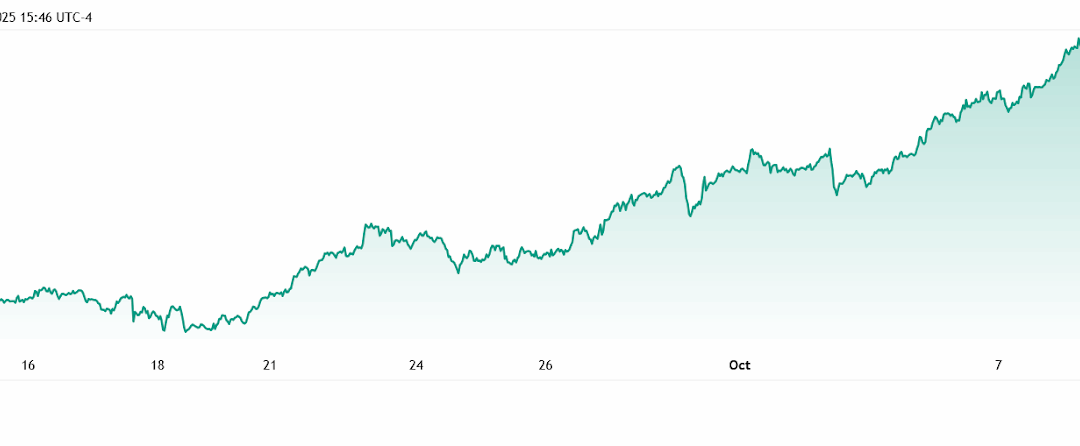

USD vs. Gold, 1-Month

Fairness indexes just like the S&P 500 are nicely off their nominal highs whenever you measure them in gold as an alternative of {dollars}. At the same time as equities rise in greenback phrases, zoom out, and people positive factors typically fail to beat gold’s rise. That’s as a result of asset booms are being pushed by manipulations within the type of cash printing, low rates of interest, and liquidity as an alternative of actual fundamentals.

‘Dow Jones to Gold Ratio is about to cross a stage solely seen 3 occasions in historical past. 2008, 1973 and 1929’ through @FinanceLancelot 📉 pic.twitter.com/MhyCyhCHM1

— Davide Iacovozzi (@davideiacovozzi) October 10, 2025

Bitcoin isn’t any completely different. Bitcoiners, who love dunking on gold, are celebrating latest newest all-time highs, however like to ignore the truth that actual gold is massively outperforming “digital gold.” A spectacular Bitcoin crash after Trump’s latest tariff bulletins introduced Bitcoin down from its highs of over $125k right down to $107k, all whereas gold held its floor.

Bitcoin is crashing. It simply dropped under $112,000. When it comes to gold, Bitcoin is now down over 25% from its report excessive set in August. It nonetheless has a good distance right down to fall.

— Peter Schiff (@PeterSchiff) October 10, 2025

As Peter Schiff mentioned on X, previously Twitter, final week:

“At the moment is one other instance of why Bitcoin isn’t digital gold and even digital silver. Gold closed the week up 3%, above $4,000, and silver rose 4.4%, closing above $50. Each symbolize record-high weekly closes. In distinction, Bitcoin dropped over 5%, double the decline of the Nasdaq.”

Regardless of being the topic of established order ridicule, gold continues to be the king of monetary property. Wall Avenue’s reflexive scorn of gold is because of the truth that gold exposes Keynesians as frauds and generally thieves, and threatens the premise of the existence of a complete class of lecturers and professionals, from Ivy League lecturers to mom-and-pop retail funding advisors. If a 5,000-year previous rock performs simply in addition to a standard 60/40 stock-bond portfolio, lots of people are losing their money and time.

Once you measure a lot of the monetary world in gold, lots of the supposed winners lose their luster. All you wanted was a sincere yardstick.

Name 1-888-GOLD-160 and converse with a Treasured Metals Specialist at present!