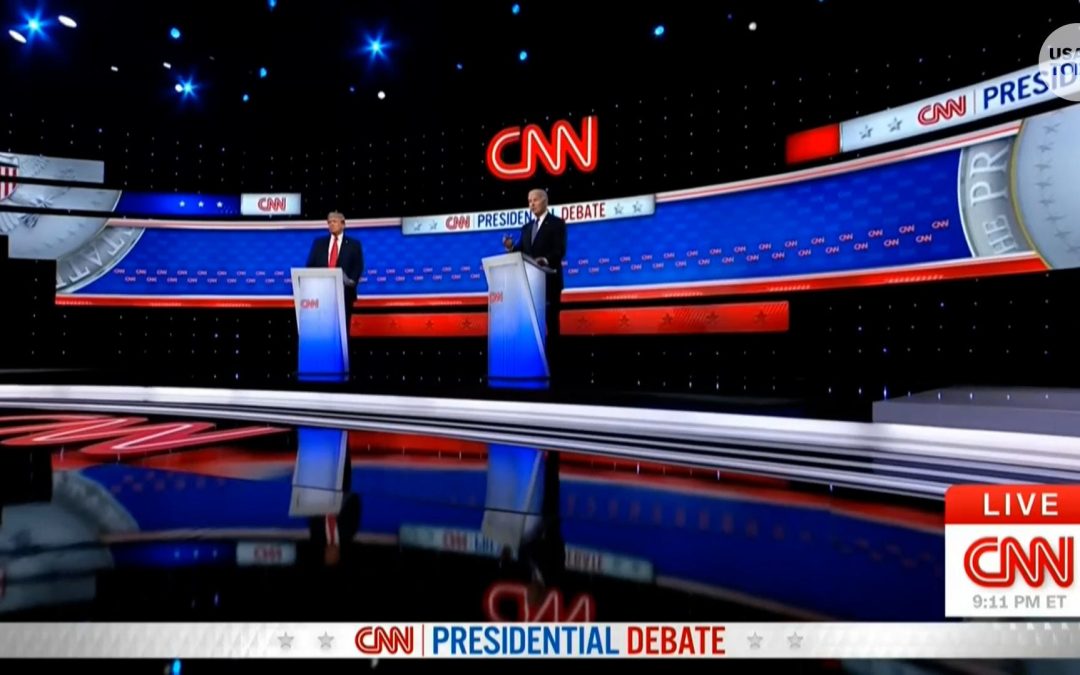

Biden/Trump debate: Slicing taxes, nationwide debt

President Biden and former President Trump confront one another over the economic system.

The economic system picked up sharply within the second quarter as an increase in shopper and enterprise spending offset a drop in housing development and a widening commerce hole.

The nation’s gross home product, the worth of all items and providers produced within the U.S., expanded at a seasonally adjusted annual price of two.8% within the April-to-June interval, the Commerce Division mentioned Thursday. That’s up from a tepid acquire of 1.4% early this yr and a pair of.5% improve for all of 2023.

Forecasters surveyed by Bloomberg had projected a 1.9% improve.

Is the economic system doing nicely proper now?

The economic system has been surprisingly resilient regardless of excessive rates of interest and inflation the previous two years on account of sturdy job and wage features which have supplied shoppers the wherewithal to maintain spending.

However cracks are starting to indicate as excessive borrowing prices take an even bigger toll on households and corporations.

Is US shopper spending rising or reducing?

Within the second quarter, shopper spending elevated a stable 2.3% annualized, above the 1.5% tempo early this yr however slightly below the greater than 3% clip within the second half of 2023. Consumption makes up about 70% of financial exercise.

To gas their purchases, Individuals are spending extra of their paychecks, saving about 3.8% of their month-to-month revenue, nicely beneath the typical 7% or so that they socked away earlier than the pandemic. Consequently, they don’t have a lot cushion. Low and middle-income households have largely depleted their COVID-19-related reserves. Bank card debt is close to a report excessive and delinquencies are traditionally elevated.

Test it out: What the typical family spends on grocery prices per thirty days

Extra broadly, the economic system is forecast to develop lower than 2% annualized the second half of the yr, based on a survey by Wolters Kluwer Blue Chip Financial Indicators.

“We should always obtain cooler GDP studies from right here on out as shoppers tighten their purse strings and companies turn into extra reticent to take a position and rent,” says Nationwide economist Oren Klachkin.

When can we anticipate the Fed to decrease rates of interest?

Many economists are urging the Federal Reserve to chop its key rate of interest − now at a 23-year excessive of about 5.3% to combat inflation − quickly. They argue the danger of appearing too late and permitting the U.S. to tip right into a recession is beginning to outweigh the hazards of transferring too quickly and reigniting inflation, which has fallen to three% from 9.1% in 2022. Most forecasters anticipate the Fed to start out reducing its benchmark price in September.

The sturdy 2.8% rise in output within the second quarter might make the central financial institution assume twice about lowering charges within the close to time period. And it is prone to “mildly disappoint” buyers who hoped the Fed would take into account making a shock price minimize at a gathering subsequent week.

However high forecasters nonetheless anticipate the central financial institution to make a transfer in a few months.

“The current loosening of labor market situations and indicators of slower worth development nonetheless imply there’s a sturdy case for at a minimize” on the Fed’s September assembly, economist Stephen Brown of Capital Economics wrote in a notice to shoppers.

How different components of the economic system carried out:

Enterprise funding accelerates

Enterprise funding grew 5.2% after rising 4.4% the prior quarter.

Outlays for computer systems, supply vans, manufacturing facility machines, and different gear surged 11.6% regardless of excessive rates of interest that boosted the price of borrowing. Many firms have bought labor-saving know-how to handle labor shortages that proceed to plague some industries.

Spending on buildings, oil rigs and different constructions fell 3.3%.

Enterprise stockpiling rebounds

Companies replenished their inventories extra briskly after drawing them down the earlier quarter, including almost a proportion level to development.

Such stockpiling has been risky and does not sometimes replicate the economic system’s underlying well being. Firms closely stocked up in 2021 in response to provide chain snarls and product shortages, resulting in large swings the previous couple of years.

Authorities spending will increase

Authorities outlays rose 3.1%, up from 1.8% the earlier quarter. State and native purchases have been juiced by a flurry of infrastructure and clear vitality initiatives spurred by sweeping federal laws.

Economists nonetheless anticipate a pullback in state and native spending amid a progressively slowing economic system that has crimped tax income and the depletion of the federal authorities’s pandemic-related help.

Commerce partly offsets GDP features

Commerce was a drag on development as imports far outpaced exports.

Imports leaped 6.9% as Individuals continued to snap up foreign-made merchandise. Exports rose simply 2% due to financial weak spot abroad and a powerful greenback that makes U.S. shipments dearer for abroad patrons.

That larger commerce hole slowed GDP development.

Housing dampens development

Housing development and renovation dipped 1.4% after three straight quarterly features.

Residence constructing was choosing up due to a extreme scarcity of current homes in the marketplace. Many owners aren’t promoting as a result of they don’t wish to be hit with a a lot greater mortgage price for his or her new house.

However lately, single-family housing begins have softened as excessive mortgage charges have discouraged development.