When you’re exploring whether or not to purchase valuable metals in 2026, you’re not alone. A rising variety of analysts, wealth managers, and institutional buyers are rethinking how gold and silver match into a contemporary portfolio — and lots of are arriving on the identical conclusion: valuable metals deserve a bigger allocation than they’ve in many years.

This development gained contemporary momentum in September 2025, when Morgan Stanley’s Chief Funding Officer publicly endorsed a 60/20/20 portfolio technique — 60% shares, 20% bonds, 20% gold — positioning gold as a core inflation hedge moderately than a fringe diversifier.

For an trade lengthy anchored to the normal 60/40 stock-bond combine, it is a seismic shift.

Institutional curiosity in gold has been rising for years, however the previous 18–24 months have accelerated that development. A number of international analysis desks and main banks have highlighted the identical set of drivers:

- Cussed inflation and uncertainty round long-term worth stability

- Declining actual yields, which traditionally help larger gold costs

- Rising geopolitical danger, making non-correlated belongings extra precious

- Considerations about debt ranges and money-supply enlargement

Whereas every establishment frames its argument in another way, the takeaway is constant: valuable metals provide a singular mixture of liquidity, independence, and diversification advantages that conventional monetary belongings can’t replicate.

For buyers evaluating whether or not to purchase valuable metals in 2026, this institutional backing provides credibility — and indicators a broader shift in how portfolios could also be constructed within the coming decade.

What Occurs If Gold Turns into a Commonplace 20% Allocation?

Let’s run a easy thought experiment.

Situation 1: U.S. retirees allocate 20% of their portfolios to gold

It’d sound formidable, however it’s not implausible — and the implications can be transformative.

U.S. retirement accounts maintain roughly $45.8 trillion throughout IRAs, 401(okay)s, and pension funds. If these accounts shifted to an ordinary 20% allocation in gold, that will characterize roughly $9.16 trillion directed into valuable metals.

To place that into perspective, buying $9.16 trillion value of gold would require about 142,454 metric tonnes — greater than 44 instances the annual international mine provide.

Situation 2: International buyers undertake related allocations

However the U.S. is only one market. What if this turns into a world phenomenon?

If international pension funds within the high 22 markets adopted swimsuit and adopted a 20% allocation to gold, the stress would compound dramatically:

- $11.7 trillion in potential demand

- Equal to roughly 181,956 metric tonnes of gold

- Almost 57 instances the annual new mine provide

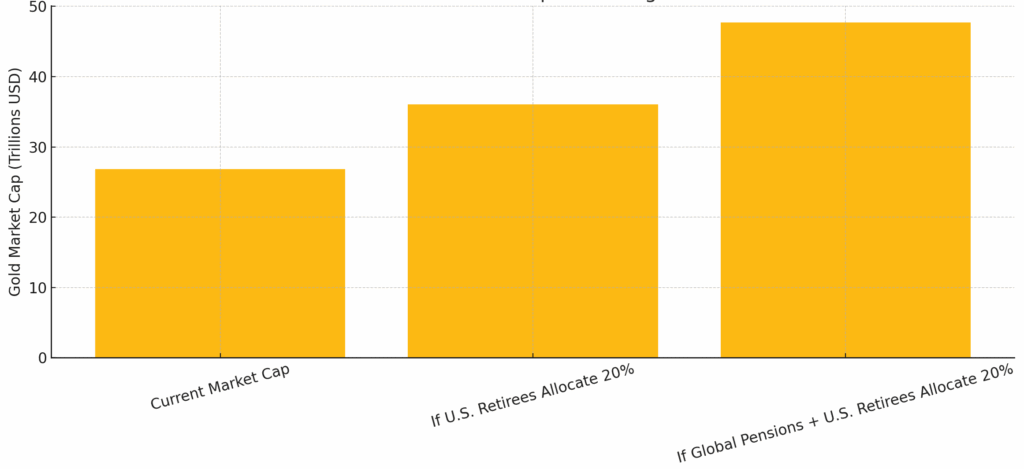

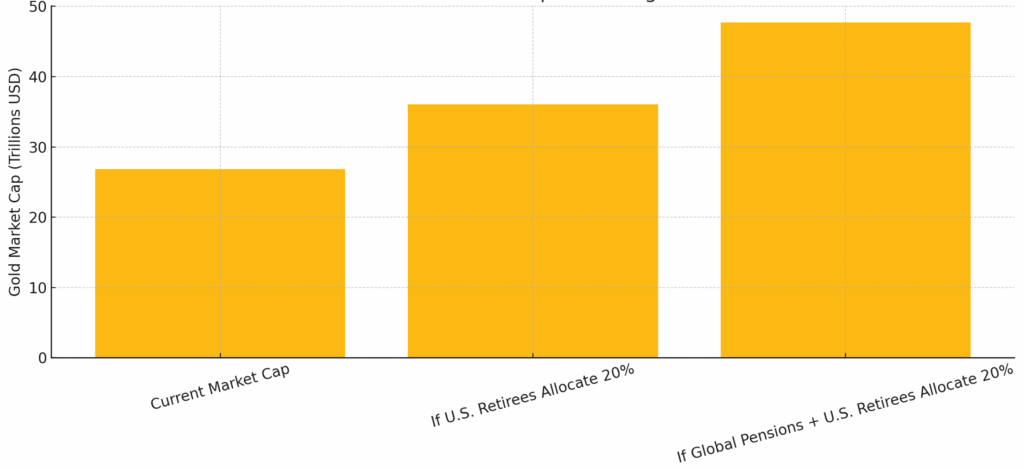

Precise vs. Theoretical Gold Market Cap Below Greater Allocation Chart

- Present market cap (at $4,000 gold): $26.86T

- If U.S. retirees allocate 20%: +$9.16T → $36.02T

- If international pension funds additionally allocate 20%: +$11.7T → $47.72T

Demand like this is able to rapidly eclipse out there new provide and will basically reshape the construction, pricing, and liquidity dynamics of the gold market.

That is why even discussing larger allocations issues. The market doesn’t want common adoption — it solely wants a fraction of buyers shifting on this path for demand to rise structurally.

Even a modest 5% shift into gold throughout retirement accounts would dramatically exceed as we speak’s annual manufacturing. A 20% allocation changing into “regular” would place huge upward demand stress on gold, far past what the present bodily market is constructed to soak up.

The Tutorial Case for Greater Treasured Metals Allocation

Lengthy earlier than wealth managers started revisiting gold’s position, educational researchers had already documented its affect on portfolio efficiency.

The findings are remarkably constant throughout research: portfolios with a 5–15% allocation to gold and silver are likely to ship higher risk-adjusted returns over time. They expertise smaller drawdowns throughout market stress and keep extra steady efficiency via financial uncertainty.

Why? Gold tends to carry out properly when equities battle, inflation rises, or volatility spikes. Silver provides industrial leverage and additional diversification inside the metals allocation.

This knowledge is measurable throughout many years of market cycles — and it’s why extra buyers are treating valuable metals as a strategic place moderately than a tactical commerce.

Why 2026 Might Be a Strategic Entry Level

A couple of macro forces are converging:

- Central banks proceed accumulating gold at multi-decade highs.

- Actual yields are fluctuating however trending decrease over the long run.

- Inflation stays above pre-2020 norms in lots of areas.

- Market cycles seem late-stage, whereas geopolitical dangers stay elevated.

- Structural demand from know-how, photo voltaic, and vitality infrastructure is rising — particularly for silver.

None of those alone dictate the value path of gold or silver. However collectively, they paint an image of long-term resilience for valuable metals — and a powerful case for strategic accumulation.

The Backside Line

Whether or not you’re a retiree defending financial savings, a long-term investor in search of steadiness, or just exploring the way to purchase valuable metals in 2026, it’s clear the panorama is shifting.

Establishments are nudging allocations larger. Tutorial analysis continues to point out that gold and silver can strengthen portfolios. And international uncertainties are reinforcing why metals stay probably the most dependable shops of worth all through historical past.

This isn’t a worry commerce — it’s a strategic shift. And for those who’re evaluating your subsequent transfer, it pays to know these tendencies earlier than the broader market catches on.

GoldSilver has spent years serving to buyers navigate precisely these sorts of transitions. In order for you deeper training, knowledge, and steerage, our assets are right here that can assist you make knowledgeable, assured selections by yourself phrases.

Individuals Additionally Ask

Is 2026 a very good time to purchase valuable metals like gold and silver?

2026 could also be a strategic 12 months for purchasing valuable metals as a result of inflation, actual yields, and international debt ranges proceed to help long-term demand. Analysts and establishments are additionally revisiting larger gold allocations as a hedge. You possibly can discover market tendencies and education-driven insights at GoldSilver to make an knowledgeable determination.

Why are extra buyers rising their allocation to gold?

Traders are boosting gold allocations because of persistent inflation, geopolitical uncertainty, and the weak efficiency of bonds in actual phrases. Gold has traditionally carried out properly in periods of elevated danger and declining actual yields. GoldSilver offers analysis and instruments to assist buyers perceive these drivers.

How large is the present gold market cap at $4,000 per ounce?

At $4,000 gold, the worldwide above-ground provide is valued at round $26–27 trillion. This offers a baseline to check how main institutional allocations might increase the market. GoldSilver’s charts and evaluation make these dynamics simple to visualise.

What share of a portfolio do specialists advocate for gold?

Tutorial and quantitative research usually recommend 5–15% in gold or silver to enhance diversification and cut back drawdowns. Some trendy fashions — just like the Morgan Stanley CIO’s — discover even larger allocations relying on danger profile. GoldSilver’s guides can assist you consider the proper allocation on your objectives.

What would occur if U.S. retirees allotted 20% of their portfolios to gold?

A 20% allocation amongst U.S. retirement accounts would create roughly $9.16 trillion in new gold demand — greater than 44 instances the annual international mine provide. This sort of shift would dramatically reshape the gold market. The article breaks down the maths and charts the potential affect.