Day by day Information Nuggets | Right this moment’s high tales for gold and silver traders

October 22nd, 2025

Authorities Shutdown Hits Employees — Presidential Wishlist Marches On

It’s Day 22 of the federal authorities shutdown. Meals applications for girls and youngsters are working out of funding, federal employees are submitting for unemployment, and important companies are grinding to a halt. But someway, demolition work began this week on a $250 million ballroom addition to the White Home — a 90,000-square-foot glass-walled area Trump says will accommodate 999 individuals.

Oh, and Trump can also be demanding that the Justice Division pay him $230 million for investigations he confronted whereas out of workplace. The White Home claims the ballroom is privately funded, however the broader image is tough to disregard: authorities can’t hold the lights on for important applications, but vainness initiatives and self-dealing someway discover a method ahead.

That type of institutional chaos doesn’t simply erode confidence — it raises main questions concerning the reliability of the information popping out of Washington.

Friday’s Inflation Report Comes With an Asterisk

September’s CPI information drops Friday, however Wall Road is approaching the numbers with extra skepticism than ordinary. The Bureau of Labor Statistics is already below fireplace after large downward revisions to jobs information led to the commissioner’s ouster in August. Now, with the federal government shutdown limiting staffing throughout information assortment, traders are overtly questioning whether or not the inflation studying can be dependable.

“Skeptics like me are going to be targeted on how clear is that this information,” says Vishal Khanduja of Morgan Stanley Funding Administration. If traders lose confidence in official inflation metrics — or if the information reveals surprises both method — it might gas volatility throughout markets. For gold, which thrives on inflation fears and coverage uncertainty, doubts concerning the trustworthiness of presidency information solely add to the metallic’s enchantment as an goal retailer of worth.

With belief in official metrics wobbling, traders are taking a contemporary have a look at belongings that don’t rely upon authorities statisticians for his or her worth.

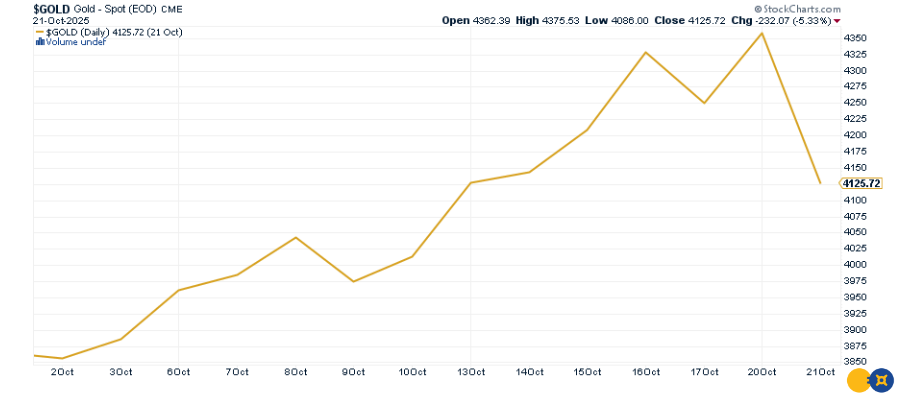

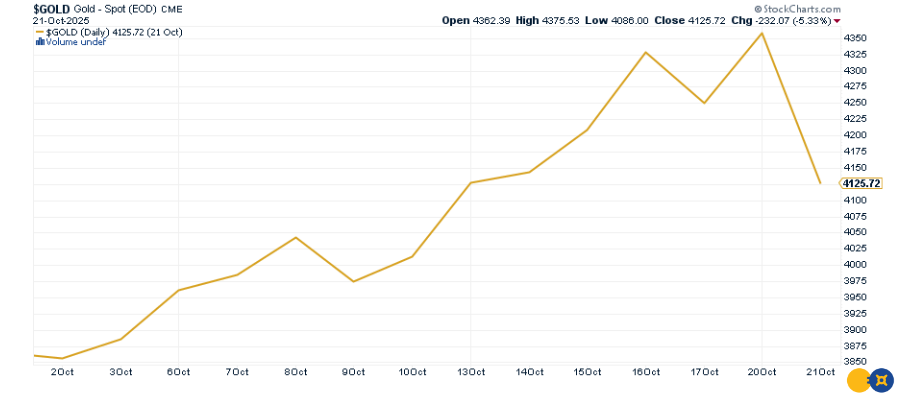

Gold Slides as Traders Ebook Income

Spot gold dipped under $4,080 an oz this week, snapping a exceptional run that’s pushed costs up 55% this yr. The pullback seems to be like traditional profit-taking after one among gold’s strongest stretches in latest reminiscence — the metallic has been on a tear since mid-August.

The drivers behind gold’s surge are nonetheless very a lot in play. Considerations about unsustainable authorities debt are pushing traders towards laborious belongings and away from conventional bonds and currencies. In the meantime, expectations for aggressive Fed price cuts are retaining downward strain on actual yields.

These fundamentals haven’t modified. In case you’ve been ready for an entry level or wanting so as to add to your place, a brief dip after a historic rally might be precisely that. And in order for you real-world proof that the bull case is unbroken, have a look at what’s occurring in Sydney this week.

Queues Across the Block for Bullion in Sydney

A contemporary‑day gold rush is unfolding in Sydney’s monetary district. As many as 1,000 individuals a day are lining up — typically for 4 hours — outdoors ABC Bullion to purchase bodily gold and silver. Administration stories September storage demand practically tripled yr‑over‑yr. With gold close to file highs round A$6,700/oz and silver breaking a forty five‑yr file, patrons cite insurance coverage towards U.S. political dysfunction, geopolitical flare‑ups, and expectations for additional Fed easing.

The takeaway: When uncertainty spikes, traders typically need one thing they will maintain. The sight of lengthy queues are a visceral reminder of the broader shift towards tangible hedges — supportive for bullion costs whilst futures merchants take earnings.

That rush for bodily metallic isn’t an remoted phenomenon—regulators on the planet’s second-largest gold market are reinforcing gold’s central position of their monetary system.

India Tightens Gold Mortgage Guidelines — And Alerts Deeper Belief in Bodily Metallic

India’s central financial institution issued complete new guidelines in June for lending towards gold and silver collateral, consolidating many years of scattered laws right into a unified framework efficient by April 2026. The modifications embrace tiered loan-to-value ratios—as much as 85% for small loans, dropping to 75% for bigger quantities—and strict bans on lending towards bullion, bars, or gold ETFs. Lenders should return collateral inside seven days or pay ₹5,000 per day in penalties.

The larger image: India accounts for roughly 25% of world gold demand, and gold loans there exceed $50 billion yearly. Regulators aren’t limiting gold-backed lending—they’re tightening it, which alerts that bodily gold stays completely central to monetary safety on the planet’s most populous nation. For Western traders, India’s regulatory give attention to bodily metallic over paper proxies sends a transparent message about the place lasting worth resides.