Throughout financial uncertainty, buyers typically flock to treasured metals. These property have a tendency to carry their worth when others fall and will help guard in opposition to inflation. In contrast to paper currencies, they provide tangible price that may’t be eroded by authorities insurance policies. Amongst them, silver stands out due to its twin nature. It features as an industrial steel important in electronics, photo voltaic panels, and medical purposes whereas serving as an funding asset. This text analyzes silver’s historic efficiency throughout main downturns, inspecting silver value throughout recession intervals in comparison with different investments and whether or not it deserves consideration as a portfolio stabilizer throughout turbulent financial instances.

On the lookout for extra insights on how silver behaves throughout financial downturns? This informative evaluation breaks down silver’s historic efficiency throughout varied recession intervals: https://www.youtube.com/watch?v=z5wDHuSgooU

Silver’s Historic Efficiency Throughout Main Recessions

Over the previous 50 years, silver’s efficiency throughout recessions has adopted clear patterns. Though every downturn is totally different, silver has proven each weak point and resilience relying on the character of the recession, financial coverage responses, and general market sentiment. This part seems to be at 4 main recessions to make clear the query “How does silver carry out in a recession?”.

The Nineteen Seventies Recession and Silver’s Worth Motion

The stagflation of the Nineteen Seventies, characterised by excessive inflation and stagnant financial development, created perfect situations for the silver market recession response. Silver costs surged from below $2 per ounce in early 1970 to just about $50 by January 1980, delivering probably the most dramatic bull runs in its historical past. Throughout this decade, silver vastly outperformed conventional property. Whereas the S&P 500 struggled with inflation-adjusted losses and bond yields have been eroded by rising costs, silver delivered exponential positive aspects. Although gold drew extra headlines, silver outpaced it in share phrases, highlighting its position as a high-performing inflation hedge.

Chart: S&P500 vs. Dow Jones vs. Gold vs. Silver (1973-1975). Supply: Knowledge from LongTermTrends.web.

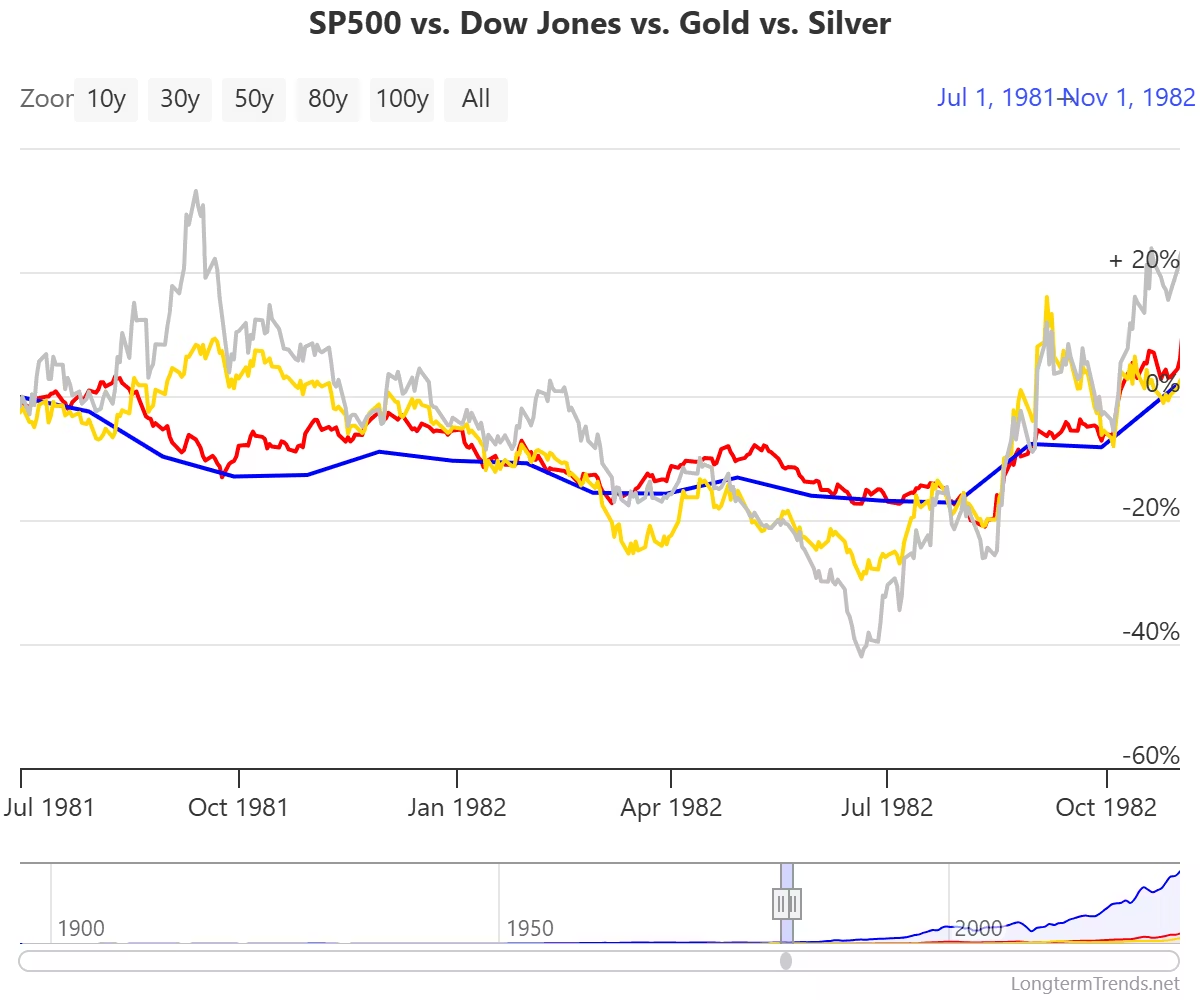

Silver Throughout the 1981 Recession

The 1981-1982 recession tells a unique story for silver markets. In keeping with knowledge from Visible Capitalist, silver underperformed in comparison with each gold and equities throughout this contraction. Silver costs fell from roughly $16 to $8 per ounce by way of this era. This was influenced by two key elements. Firstly, the Federal Reserve’s aggressive rate of interest hikes to fight inflation performed a big position, driving up the worth of the U.S. greenback and making treasured metals much less engaging. Secondly, silver confronted stress from weak industrial demand as financial exercise slowed, alongside lowered investor curiosity in commodities.

Chart: S&P500 vs. Dow Jones vs. Gold vs. Silver (1981-1982). Supply: Knowledge from LongTermTrends.web.

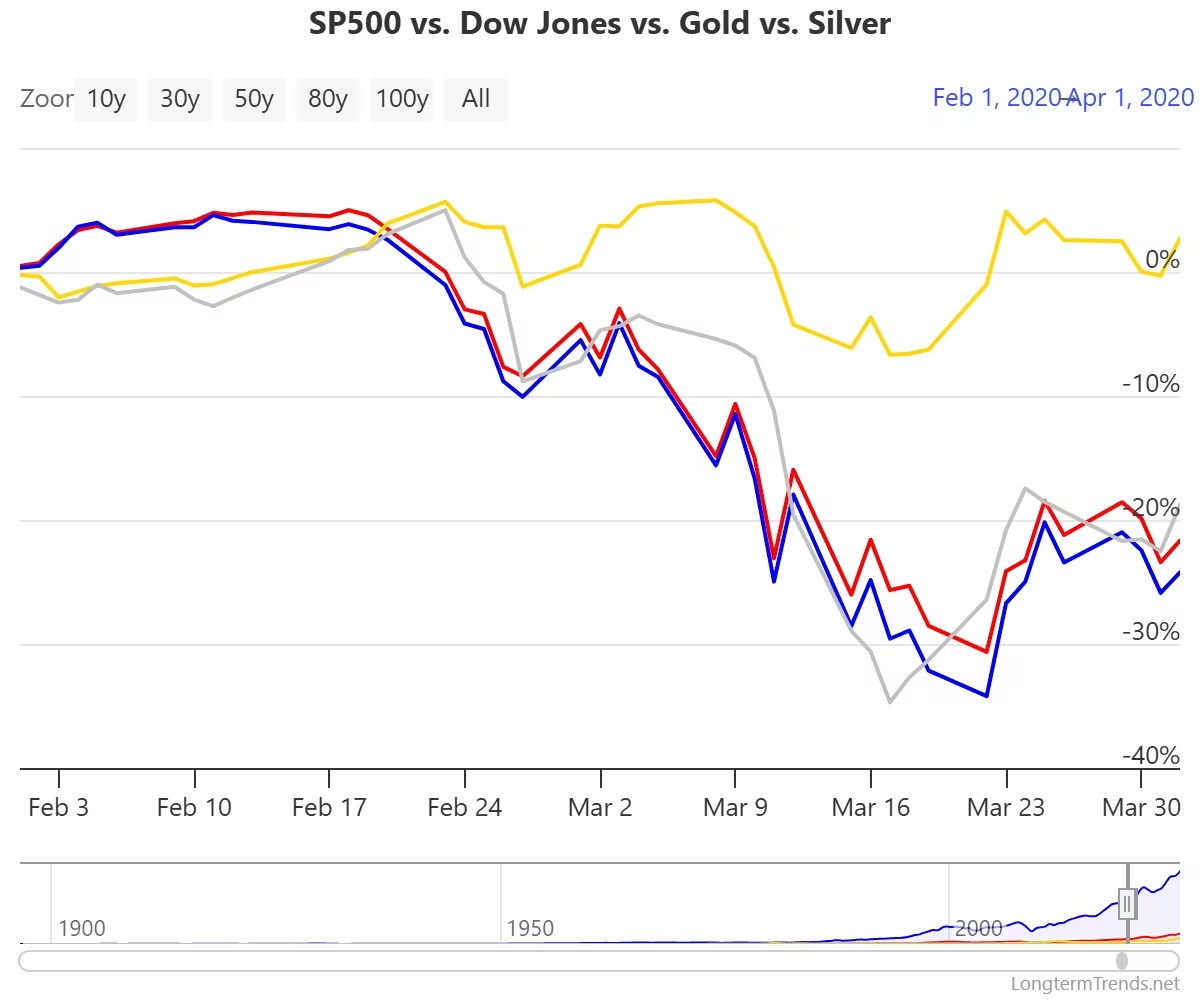

COVID-19 Financial Contraction and Silver Costs

The COVID-19 pandemic created excessive volatility in silver markets. This latest case examine illustrates what occurs to silver costs throughout a recession characterised by world pandemic situations and unprecedented financial intervention. Initially, silver plummeted alongside equities, falling practically 40% in March 2020 to under $12 per ounce as market liquidity evaporated. This preliminary response highlighted how silver can typically behave like danger property throughout panic phases. Nevertheless, silver’s restoration was exceptional, greater than doubling from its lows inside 5 months to over $28 per ounce by August 2020. This efficiency was pushed by a mix of financial stimulus, provide disruptions from mine closures, industrial demand restoration, and investor curiosity in laborious property. The COVID recession bolstered the sample that whereas silver might not present speedy recession safety, it typically delivers sturdy efficiency throughout the restoration part.

Chart: S&P500 vs. Dow Jones vs. Gold vs. Silver (Feb-Apr 2020). Supply: Knowledge from LongTermTrends.web.

Evaluating Silver vs. Shares Throughout Recessions

Understanding how silver performs relative to equities throughout financial downturns will help buyers optimize their portfolio allocations when recession alerts seem. Blanchard’s Silver vs. Shares: Evaluating Efficiency Throughout Recessions offers additional beneficial insights into this relationship by way of historic evaluation.

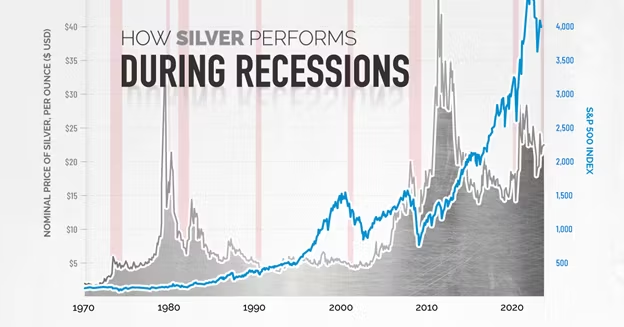

Statistical Evaluation: Silver vs. S&P 500

In keeping with knowledge highlighted by Visible Capitalist, silver vs shares throughout recession evaluation reveals silver outperformed the S&P 500 in three of the final eight U.S. recessions. These intervals have been marked by financial instability, inflationary stress, or monetary crises, which are inclined to favor laborious property over equities. Throughout the 1973-75 recession, silver surged as a consequence of inflation and geopolitical tensions, whereas the inventory market skilled vital declines. Equally, within the 1981 recession and the 2007-09 monetary disaster, silver preserved or gained worth as equities struggled. This sample means that silver tends to excel in downturns pushed by inflation, coverage shifts, or market uncertainty.

Chart: How Silver Performs Throughout Recessions by Parts, Visible Capitalist (2022). Knowledge sourced from Macrotrends and MarketsWiki.

When Silver Outperforms Equities

Silver sometimes outperforms shares below three situations: throughout excessive inflation and forex devaluation, throughout monetary system stress, and following aggressive financial stimulus. In 1973-75, silver rose sharply as inflation surged and confidence in conventional markets weakened. In 1981, though the Fed’s charge hikes later suppressed silver, it initially held sturdy as a consequence of inflation fears. Throughout the 2007-09 disaster, silver acted as a safe-haven asset amid collapsing monetary establishments and aggressive financial stimulus. These case research present that silver thrives when fiat forex worth is in query or when buyers search a hedge in opposition to systemic danger – situations below which equities sometimes underperform.

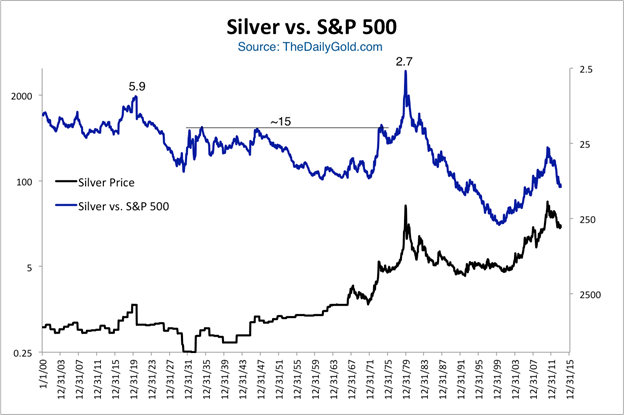

Chart: Silver vs. S&P 500

When Shares Outperform Silver

Shares are inclined to outperform silver throughout recession restoration phases marked by financial stabilization, rising shopper confidence, and robust company earnings. In such intervals, buyers shift from safe-haven property like silver to danger property like equities, anticipating development and profitability. Silver underperforms when inflation is low or falling, rates of interest are steady or rising, and industrial demand is weak. For instance, throughout the mid-Nineteen Nineties restoration and the post-2001 recession interval, silver lagged behind the S&P 500 as tech and monetary sectors led the market rebound. These environments favor fairness positive aspects over treasured metals, which lose enchantment as worry and uncertainty fade.

What Occurs to Silver Costs Throughout a Recession?

Whereas no two recessions impression silver identically, its costs observe distinctive patterns throughout financial downturns that mirror competing forces of provide, demand, and investor sentiment.

Preliminary Market Response and Worth Volatility

Within the early phases of a recession, silver costs typically expertise heightened volatility as a consequence of shifting investor sentiment and liquidity pressures. Initially, silver might drop as buyers dump property to boost money and canopy losses elsewhere. This sample was evident in 2008 when silver dropped from $21 to $16 per ounce and in March 2020 when costs plummeted practically 40%. This liquidity-driven dip is widespread throughout sudden market stress, creating short-term stress no matter elementary outlook.

Industrial Demand Impression

Silver is a key industrial materials, with over 50% of its demand tied to manufacturing sectors similar to electronics, photo voltaic power, and medical units. Throughout recessions, when industrial manufacturing slows, this demand typically contracts, placing downward stress on silver costs. The electronics sector, which accounts for practically 25% of commercial silver utilization, typically sees lowered output throughout recessions. Equally, automotive business slowdowns have an effect on silver demand for electrical parts.

Funding Demand as Protected-Haven Asset

Counterbalancing industrial weak point, funding demand for silver typically will increase throughout extended intervals of market stress and financial uncertainty, influencing silver vs shares throughout recession efficiency patterns. Traders sometimes flip to bodily silver as a retailer of worth, particularly when inflation rises or confidence in monetary markets declines. That is mirrored in elevated purchases from each retail and institutional patrons. Moreover, silver-backed ETFs typically expertise notable inflows throughout recessions, signaling heightened investor curiosity. For instance, throughout the 2008 monetary disaster and the COVID-19 recession, silver ETFs noticed vital development, with the iShares Silver Belief seeing inflows of over $500 million in April 2020 alone.

Is Silver Simply as Good as Gold in a Recession?

Whereas each metals function portfolio hedges throughout financial uncertainty, silver and gold behave fairly otherwise in recessions, every providing distinct benefits and downsides for buyers looking for safety.

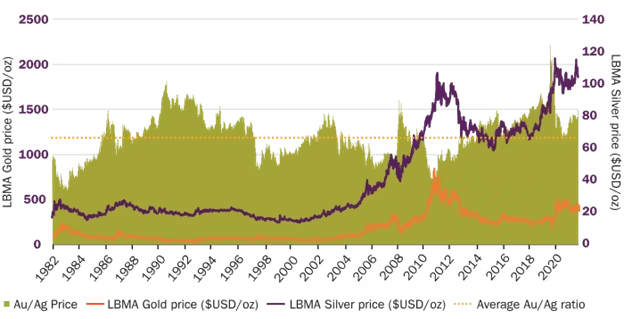

Evaluating Silver and Gold Efficiency

Historic knowledge reveals gold sometimes outperforms silver throughout recession preliminary phases. Within the 2008 disaster, gold declined simply 12% from peak to trough, whereas silver plummeted over 50%, making gold choices like Blanchard Gold Merchandise notably engaging throughout early recession phases. Nevertheless, silver typically delivers stronger returns throughout restoration phases. After 2008, silver surged 400% from its lows versus gold’s 170%. The gold-to-silver ratio sometimes spikes throughout recessions, reaching 114:1 in March 2020 in comparison with its historic common of 60:1, typically contracting throughout recoveries and creating potential alternatives. Blanchard’s Measuring the Impression of Silver versus Gold in Your Portfolio explores how these dynamics can affect optimum allocation between each metals.

Chart: Historic Gold and Silver Costs (1992-2020). Knowledge from London Bullion Market Affiliation (LBMA).

Silver’s Increased Volatility

Silver constantly demonstrates larger volatility than gold, with sharper value swings throughout each downturns and recoveries. Throughout the 2020 COVID-19 disruption, silver dropped 40% in comparison with gold’s 15% decline however subsequently gained 140% versus gold’s 40% rise. This volatility stems from silver’s smaller market dimension (roughly one-tenth of gold’s), making it extra prone to liquidity pressures. Whereas gold sometimes gives a steadier, lower-risk profile, silver presents the next risk-reward proposition. As such, silver tends to be extra interesting to buyers who can face up to short-term turbulence in pursuit of long-term upside.

Industrial vs. Financial Demand

A key distinction between silver and gold lies of their demand sources. Silver derives a good portion of its worth from industrial use, making it extra delicate to financial slowdowns. In distinction, gold’s major position as a financial asset creates extra constant recession demand, with roughly 85% of annual demand from funding and central banks. Gold responds extra on to rates of interest and forex considerations, whereas silver provides publicity to industrial restoration. This makes silver much less dependable throughout recession depths however probably extra rewarding throughout restoration transitions.

Is Silver a Good Funding Throughout a Recession?

Whereas not an ideal protected haven, silver gives distinctive traits that will profit portfolios positioned for each safety and restoration potential. This part examines the important thing issues that may assist buyers determine if silver belongs of their recession technique.

Silver’s Execs Throughout Financial Downturns

When contemplating silver’s benefits throughout financial contractions, a number of elements stand out. First, silver offers efficient inflation safety when central banks implement stimulus measures. Since silver can’t be created by way of financial coverage like currencies, it typically preserves buying energy when cash provide expands. Second, silver serves as a portfolio diversifier, sometimes exhibiting low correlation with conventional property throughout market stress intervals. Third, silver gives distinctive restoration potential. Following the 2008 disaster, costs rose over 400% from their lows as financial situations improved whereas stimulus remained in place.

Potential Drawbacks to Contemplate

Regardless of its advantages, silver comes with some limitations throughout recessions, too. First, silver’s industrial demand part creates vulnerability when manufacturing exercise declines, as roughly half of silver consumption comes from industrial purposes. Second, silver reveals considerably greater volatility than gold, with value swings typically 2-3 instances extra extreme in each instructions, requiring larger investor conviction. Third, sensible challenges exist. Bodily silver requires appreciable space for storing as a consequence of its decrease worth density in comparison with gold.

Methods to Put money into Silver for Recession Safety

There are a number of methods for buyers to entry silver’s recession safety, every suited to totally different funding methods and danger preferences.

Bodily Silver Choices

Traders in search of direct publicity to silver throughout a recession typically flip to bodily silver, similar to cash and bars from respected sellers like Blanchard Silver Merchandise. These tangible property supply a safe retailer of worth, excessive liquidity, and recognition. Nevertheless, premiums on bodily silver can enhance throughout market stress as a consequence of greater demand and provide chain disruptions. The price of buying silver in its bodily type throughout a recession interval typically exceeds the spot value, with premiums various based mostly on the kind of silver, mint, and market situations. Notably, throughout the March 2020 silver market recession, Silver Eagle premiums briefly exceeded 100% over spot costs as retail demand surged whereas provide chains confronted disruption.

Paper Silver Investments

Paper silver investments, similar to silver-backed ETFs and mining shares, supply a extra liquid and accessible strategy to achieve publicity to silver. ETFs observe silver’s value with out requiring bodily storage, making them a handy choice. Mining shares present oblique publicity, benefiting from rising silver costs whereas providing extra development potential by way of firm efficiency. Nevertheless, paper silver doesn’t present direct steel possession and comes with its personal set of dangers, together with monitoring errors in ETFs and the volatility of mining shares. In contrast to bodily silver, paper investments are topic to market fluctuations and might be impacted by elements past the value of silver itself, similar to firm administration and geopolitical dangers.

Timing and Allocation Methods

When investing in silver, it’s vital to fastidiously contemplate the suitable portfolio allocation, notably during times of financial uncertainty. Usually, monetary advisors counsel allocating 5-10% of a diversified portfolio to treasured metals like silver, although this could fluctuate relying on an investor’s danger tolerance and market outlook. Some buyers additionally contemplate numismatic choices, as outlined within the Blanchard Uncommon Cash Information, for added portfolio diversification. For timing, a dollar-cost averaging (DCA) method is commonly really helpful. This technique includes spreading purchases over time to scale back the impression of short-term value fluctuations, permitting buyers to keep away from making giant commitments throughout market peaks.

Conclusion

Silver gives buyers a compelling choice throughout financial downturns, with historic efficiency exhibiting a particular sample throughout a number of recessions. When analyzing the query “How does silver carry out in a recession?”, we see that whereas it sometimes faces preliminary stress, it typically delivers substantial returns throughout restoration phases. This habits stems from silver’s distinctive twin position within the world financial system, functioning concurrently as an industrial commodity and a treasured steel funding.

As a portfolio part throughout unsure instances, silver offers diversification advantages that differ from each conventional property and gold. Its means to hedge in opposition to inflation whereas sustaining low correlation to equities creates defensive traits, whereas its important position in manufacturing and expertise offers buyers publicity to eventual financial restoration that purely financial metals can’t supply. Nevertheless, buyers ought to method silver with acceptable allocation methods. Its greater volatility requires larger conviction than gold, and its industrial demand part creates some vulnerability throughout manufacturing slowdowns.

For these with appropriate danger tolerance, silver represents not only a recession hedge however a probably high-performing asset that may fulfill each protecting and growth-oriented roles when strategically positioned inside a diversified portfolio.

FAQ Part

1. How does silver carry out in a recession?

Silver sometimes follows a definite sample throughout recessions: preliminary decline throughout market panic, adopted by sturdy restoration when stimulus measures are carried out. It has outperformed the S&P 500 in three main recessions (1973, 1981, 2007), with efficiency pushed by inflation charges, financial coverage responses, industrial demand fluctuations, and investor sentiment towards safe-haven property throughout monetary uncertainty.

2. Is silver simply pretty much as good as gold in a recession?

Silver gives totally different recession advantages than gold, not essentially higher or worse. Whereas gold sometimes offers extra stability throughout market turmoil (falling much less throughout the 2008 disaster), silver tends to ship stronger restoration efficiency (surging 400% after 2008 versus gold’s 170%). Silver’s greater volatility stems from its smaller market dimension and twin industrial-investment nature, creating larger draw back danger throughout recession onset however probably bigger upside throughout financial recoveries when industrial demand returns.

3. What occurs to silver costs throughout a recession?

Throughout a recession, silver costs sometimes observe a two-phase sample. Within the preliminary recession stage, silver typically experiences vital promoting stress as buyers liquidate positions to boost money, inflicting costs to say no alongside danger property. Because the recession progresses and central banks implement accommodative financial insurance policies, silver costs are inclined to get well and probably recognize considerably, notably when inflation considerations emerge or industrial demand begins to rebound whereas stimulus measures stay in place.

4. Is silver a very good funding throughout a recession?

Silver gives each benefits and dangers throughout recessions. On the constructive aspect, it acts as a hedge in opposition to inflation and forex devaluation that always observe stimulus measures whereas offering portfolio diversification with restoration potential (rising over 400% after the 2008 disaster). Nevertheless, silver additionally faces challenges throughout financial contractions since roughly half its demand comes from industrial purposes, making it susceptible to manufacturing slowdowns.

5. How does silver evaluate to shares throughout recessions?

Silver has outperformed the S&P 500 in three of the final eight recessions because the Nineteen Seventies. Silver tends to excel over shares when particular financial situations emerge: excessive or rising inflation that erodes fairness valuations, vital forex devaluation considerations following aggressive financial stimulus, and intervals of monetary system stress the place confidence in conventional markets falters. Nevertheless, shares sometimes outperform silver throughout disinflationary recessions and in restoration phases characterised by sturdy development with out vital inflation pressures.

Images:

Picture: Photo voltaic panel array.

Picture credit score: The Silver Institute

Silver Britannia coin. Picture: Osama Madlom/Unsplash