The Structural Silver Deficit and Worth Potential

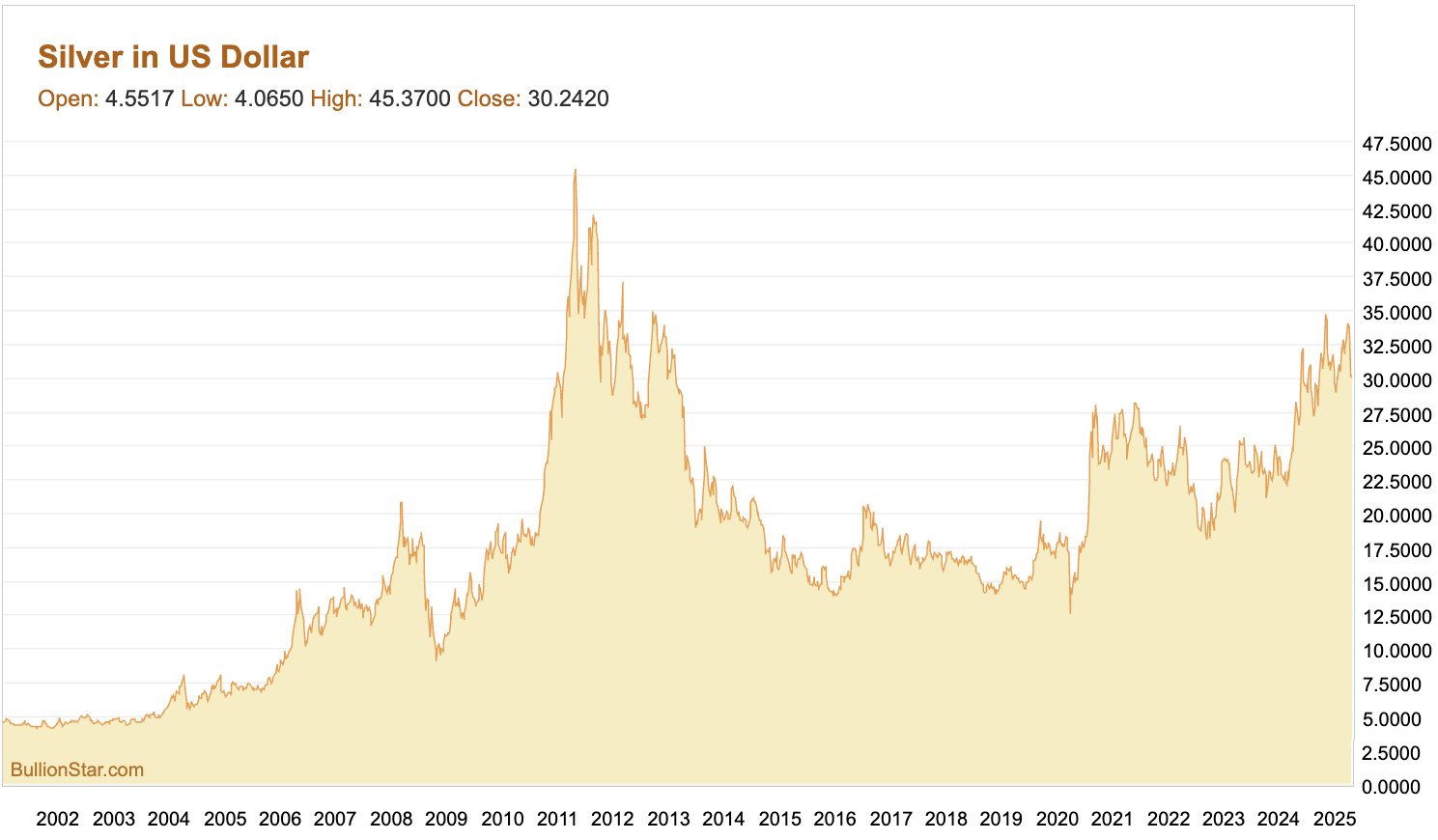

In a current interview with BullionStar, famend silver market knowledgeable Peter Krauth, creator of “The Nice Silver Bull” and editor of Silver Inventory Investor, shared compelling insights on why silver could possibly be poised for a historic breakout. Regardless of already spectacular positive factors lately, Krauth believes we’re nonetheless within the early innings of a serious bull market that might ultimately take silver to ranges few traders can think about.

Understanding the Persistent Silver Deficit

On the core of Krauth’s bullish outlook is the persistent structural deficit within the silver market. “Provide is a couple of billion ounces a yr. About 850 million ounces or 85 % comes from mining. And the opposite 15 % roughly comes from recycling,” Krauth defined. “But for the final 4 years, on common, demand has been about 1.2 billion ounces per yr. So we’re a 20 % deficit yearly for the final 4 years.”

This ongoing deficit raises an important query: How can silver costs stay comparatively subdued regardless of such a big provide shortfall?

The Secondary Provide Cushion Is Depleting

The reply, in line with Krauth, lies within the drawdown of secondary above-ground silver provides from main exchanges. Since early 2021, stock ranges on the Shanghai Futures Alternate, the London Bullion Market Affiliation (LBMA), and COMEX have declined dramatically—by 40% to 70% relying on the trade.

Krauth believes these trade inventories have briefly buffered the value affect of the structural deficit. Giant industrial shoppers, particularly from the photo voltaic sector, have been capable of faucet into these stockpiles by taking bodily supply in opposition to futures contracts. Nonetheless, this buffer is quickly depleting.

“This might go on for about perhaps 12 or 18 months on the present tempo. And after that, we actually would dry up this secondary provide of silver,” Krauth notes, referencing a supporting evaluation from TD Securities that reached related conclusions.

The Good Storm for Increased Silver Costs

Industrial Demand vs. Funding Demand

The altering composition of silver demand creates what Krauth describes as an ideal storm for greater costs. A decade in the past, industrial purposes and funding demand every accounted for roughly 50% of whole silver consumption. Right now, industrial demand has grown to roughly 60% of the market, with funding demand shrinking to 40%.

This shift is critically essential as a result of:

-

- Photo voltaic sector development: Photo voltaic panel manufacturing now consumes virtually 25% of annual mine provide, with demand persevering with to speed up

- Technological developments: Newer photo voltaic applied sciences (Topcon and HJT) require 50-150% extra silver per panel than earlier generations

- Restricted funding pool: When funding demand inevitably returns in pressure, it is going to be competing for a smaller portion of obtainable provide

“When that demand comes again in a giant manner for individuals who say, I have to get my fingers on some bodily silver, there’ll now be much less obtainable every year. And that’ll assist drive the value up greater and sooner,” explains Krauth.

Bodily Tightness Already Evident

Indicators of tightness within the bodily silver market are already showing. Krauth shared an anecdote a couple of silver mining government who revealed that industrial shoppers had been providing as much as $4 over spot value and making advance funds to safe provide.

“We’ve seen lease charges keep excessive on silver… We’ve seen trade for bodily (EFP) premiums have stayed excessive. And each of this stuff converse to severe tightness nonetheless within the silver market,” Krauth notes.

Financial Elements and Inflation

Whereas a lot of silver’s current value motion has been pushed by industrial components, Krauth believes financial and inflation-related catalysts will more and more come into play.

Inflation and Central Financial institution Credibility

“I believe retail traders {and professional} traders have actually come to phrases with the truth that we’re in a brand new paradigm, a brand new setting on the subject of inflation and that inflation will keep elevated for in all probability the higher a part of a decade going ahead,” says Krauth.

He sees parallels to the Seventies, when stagflation (weak economic system mixed with excessive inflation) created a great setting for valuable metals. Krauth anticipates central banks will ultimately be pressured to chop charges even within the face of persistent inflation, severely damaging their credibility.

“Reducing charges within the face of rising inflation goes to inform the market they’ve misplaced management, they actually don’t have any extra selection. And once more, that is rocket gas for each gold and silver.”

Silver’s Efficiency Throughout Charge-Reducing Cycles

Krauth highlighted a very compelling sample: silver’s explosive efficiency throughout Federal Reserve rate-cutting cycles. Whereas gold tends to carry out properly as quickly as charge cuts start, silver sometimes takes off when the Fed is about midway by means of its reducing cycle.

“Within the final three charge reducing cycles, silver was up over 300% on common over the subsequent 12 to 18 months or so. So silver completely explodes after we’re in that type of setting.”

The Gold-Silver Ratio and Worth Targets

Presently, the gold-silver ratio stands at almost 100:1, that means it takes roughly 100 ounces of silver to purchase one ounce of gold. Traditionally, this ratio has averaged nearer to 55-60:1, suggesting silver is considerably undervalued relative to gold.

When requested about his long-term value goal, Krauth stood by the projection in his e-book: $300 silver throughout a possible mania section. Whereas this determine may appear excessive, Krauth derives it from a number of indicators and historic patterns from earlier bull markets, together with a gold value goal of $5,000-$10,000.

“I believe that it’s very sensible however I believe that we might get into an funding setting, an financial setting the place gold and silver reached these super highs however there was a lot inflation of fiat currencies at that time that these highs is not going to be as spectacular or as significant as they may sound as we speak.”

De-Dollarization and Treasured Metals

The interview additionally addressed the subject of de-dollarization and the potential position of gold and silver in a multi-currency world. Whereas Krauth doesn’t anticipate a sudden collapse of the greenback, he does anticipate a “gradual grind decrease” as international locations more and more discover options for worldwide commerce settlement.

Apparently, Krauth famous that gold has now surpassed the euro as a reserve asset for central banks worldwide, whereas the U.S. greenback’s share of worldwide reserves has declined from the mid-to-high 60 % vary to the low 50 % vary over the previous 15-20 years.

Funding Implications

For traders excited about gaining publicity to the silver market, Krauth’s e-newsletter, Silver Inventory Investor, covers your complete spectrum from bodily silver and silver ETFs to mining shares starting from massive producers to junior explorers.

When contemplating the bodily versus paper debate, Krauth’s perspective is evident: “Having the silver in hand proper now has a premium to it… Future supply has a giant query mark on it. Provide may be very uncertain. We’re ready to pay extra to have that in our fingers proper now.”

Conclusion: Early Days in a Historic Bull Market

Regardless of silver’s spectacular journey from $4 in 2001 to $50 in 2011 and up to date highs round $35, Krauth emphasizes that we stay within the early phases of what could possibly be a historic bull market. Adjusted for inflation, silver’s earlier peak of $50 in 2011 would equate to $65 as we speak, whereas the 1980 excessive of $50 would translate to over $145 in present {dollars}.

As industrial demand continues to develop, notably from the photo voltaic and knowledge heart sectors, and as financial insurance policies doubtlessly erode fiat forex values additional, the case for considerably greater silver costs turns into more and more compelling.

“I believe we could possibly be in a totally new international financial setting the place valuable metals, in the event that they don’t have an official position within the monetary system, even having some type of a de facto position as cash, I believe that that may help these actually excessive costs doubtlessly for many years.”

For traders looking for each inflation safety and potential capital appreciation, Krauth’s evaluation suggests silver deserves severe consideration as a core portfolio holding within the years forward.

This weblog publish relies on an interview with Peter Krauth carried out by BullionStar in April 2025. The views expressed are these of Peter Krauth and don’t essentially replicate the place of BullionStar. This content material is for informational functions solely and shouldn’t be thought of funding recommendation.