Unprecedented Spreads Between Spot and Futures Costs in Gold and Silver

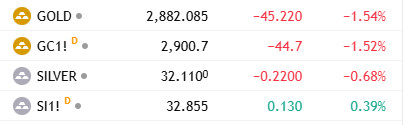

Over the previous few weeks, monetary markets have skilled an unprecedented widening of spreads between spot and futures costs for each gold and silver.

Historically slim, these spreads have expanded to as a lot as USD $60 for gold and over USD $1 for silver. This vital discrepancy has created distinctive arbitrage alternatives, prompting substantial flows of bodily metals from London to New York, as merchants capitalize on decrease spot costs in London and better futures costs in New York.

As of the time of writing, the unfold has narrowed barely, with a USD 18.615 distinction (0.65%) between spot gold (“GOLD”) and gold futures (“GC1!”). For silver, the unfold stands at USD 0.745, equal to 2.27%.

Regardless of clear arbitrage potential, these spreads haven’t normalized as shortly as could be anticipated by an environment friendly market, suggesting underlying market failures past easy arbitrage alternatives.

LBMA Bullion Financial institution Cartel

The LBMA cartel of bullion banks has traditionally managed the London OTC spot worth for gold, working inside a system that prioritizes the pursuits of bullion banks over the precise bodily gold and silver market. Opacity is the secret right here.

The LBMA lacks transparency, offering no public entry to order guide volumes or buying and selling knowledge. Because of this, buying and selling practices stay hidden from scrutiny. In essence, so-called spot gold is handled extra like a forex, with little to no bodily metallic backing. Notably, the LBMA itself holds no gold reserves, as a substitute counting on its member banks to take care of stockpiles.

BullionStar has been a very long time critic of the LBMA the place we repeatedly have been highlighting the shortage of transparency, deceptive knowledge, and prioritization of paper buying and selling over bodily bullion. The LBMA has for a very long time misrepresented vault inventory ranges making a false sense of safety about obtainable metals.

Moreover, LBMA permits the proliferation of unallocated artificial paper gold, permitting bullion banks to commerce so-called gold and silver with out precise bodily backing, which distorts true worth discovery.

Managed by bullion banks, the LBMA prioritizes their pursuits over particular person savers and bodily metallic traders, favoring monetary establishments whereas undermining the integrity of the bullion market.

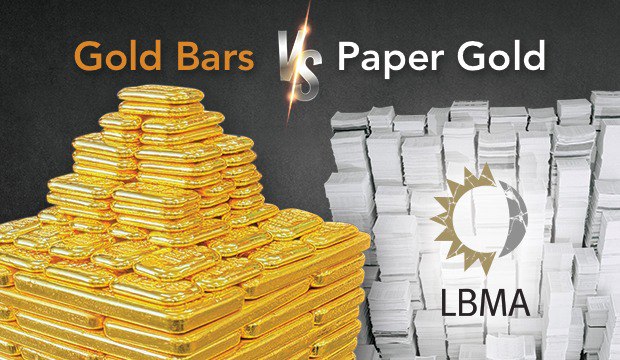

See this BullionStar infographic on The London Gold Market

Paper Metallic vs. Bodily Metallic

As many are conscious, there’s a vital disconnect between paper and bodily gold and silver markets. Estimates recommend that for each ounce of bodily metallic, between 100 and 600 instances extra paper gold and silver are traded. Our infographic from 2021 estimate paper silver to bodily silver at 243:1. A latest evaluation even locations this ratio at 408:1, highlighting the sheer scale of this imbalance.

For years, the LBMA and COMEX have maintained the phantasm that paper metallic may very well be redeemed for bodily metallic. However with the U.S. more and more pulling bodily provide off the market, the paper-based system is going through mounting stress. If only a small quantity of paper metallic holders begin demanding bodily supply, all the construction of the paper markets will collapse.

LBMA Collusion Coming to an Finish

The LBMA has traditionally relied on U.S. monetary establishments to assist handle any points. For gold liquidity, swaps and leasing preparations have been used to forestall vault runs. Nevertheless, with the U.S. establishments now prioritizing gold repatriation and hoarding over supporting worldwide markets, the LBMA has misplaced a key backstop.

This shift leaves LBMA bullion banks extra weak to bodily shortages, rising counterparty threat and undermining confidence in unallocated gold. With out U.S. help, bullion banks might resort to delaying settlements, widening spreads, or proscribing redemptions—additional exposing the paper gold system.

LBMA is Merely Out of Gold

London’s gold clearing banks—JP Morgan, HSBC, UBS, and ICBC Customary—have depleted their obtainable bodily gold for supply and at the moment are closely counting on gold lending on the Financial institution of England. Nevertheless, these borrowing avenues additionally seem exhausted.

Because of this, these banks face a liquidity crunch of their loco London gold holdings, rising counterparty threat amongst LBMA bullion banks that commerce unallocated “gold credit score.” The shortcoming to entry adequate bodily gold has led to paper gold claims buying and selling at a reduction, reflecting the rising problem in changing them into precise metallic.

See this BullionStar infographic for data on Bullion Banking Mechanics.

“Gold is Heavy” & Scarcity of “Guys with Vans” & “Ocean of Silver”

The LBMA has, as they all the time do, downplayed these developments, attributing the excessive unfold and supply delays to potential new tariffs relatively than to any structural points or shortages. They’ve acknowledged that the 4-8 weeks lag instances for gold deliveries fron London vaults are attributable to logistical challenges.

LBMA appears to lately have found that gold is heavy and that it wants “guys with vans” i.e. manpower and transportation sources to maneuver gold. Maybe they by no means realised earlier than that gold was heavy because the vaults had been empty anyway? However there’s actually no lack of provide in case you are to belief the LBMA (Reuters on LBMA’s stance). Relating to silver, the LBMA claims there’s an ocean of bodily silver with no scarcity in anyway. Nevertheless, the fact on the bottom tells a unique story.

That is all occurring in opposition to a backdrop of extremely elevated and sustained demand by Jap international locations together with China, India and Jap European international locations which have quietly been vaccuming up all bodily gold obtainable but stopping in need of inflicting acute shortages.

Convicted Gold Manipulators Run LBMA

The LBMA positions itself as the worldwide authority on treasured metals, however its actions recommend it primarily serves the pursuits of its bullion financial institution members. Whereas it claims to advertise transparency, its reporting is delayed, aggregated, and thoroughly managed—providing little actual perception into the gold market’s true state.

Removed from being an neutral regulator, the LBMA is dominated by main bullion banks like JP Morgan, which, regardless of being a convicted gold worth manipulator, continues to carry affect.

The appointment of JP Morgan’s former head of treasured metals, Michael Nowak, to the LBMA board whereas he was underneath investigation for market rigging exemplifies the affiliation’s deep-rooted conflicts of curiosity. Fairly than upholding integrity, the LBMA seems to operate as a protecting protect for the very establishments that distort and manipulate the gold market.

BullionStar’s Perspective on Bodily vs. Paper Markets

At BullionStar, we observe that the majority market contributors for now proceed to base their pricing on spot costs, albeit with surcharges in some circumstances. If the LBMA is uncovered as being out of metallic and in the end defaults – one thing we’re already witnessing in a minor kind by way of supply lags – we anticipate that worth discovery will shift from London spot to the futures market, supplied that COMEX can facilitate precise bodily deliveries relatively than simply warehouse receipts.

This stays unsure. COMEX isn’t designed for large-scale bodily withdrawals, as 99.96% or extra of contracts are usually cash-settled. Whether or not unencumbered bodily metallic could be extracted from COMEX in vital portions is unsure.

As market contributors come to comprehend that these markets are largely paper-based or semi-paper-based with minimal bodily backing, there may very well be a scramble to safe bodily metallic.

If that occurs, the value of gold and silver would probably be decided by true bodily markets. In such a state of affairs, it’s affordable to count on that the equilibrium worth could be a number of instances larger, given the preposterous ratio of paper metals to bodily metals.

The pattern is obvious. Bodily liquidity of actual gold and silver is quickly draining from London and the LBMA.

Because of this, Singapore, being the world’s greatest jurisdiction for getting and storing gold, is rising as a number one hub for rich savers and traders to carry their bodily bullion holdings.

Value Discovery Shifting from Paper to Bodily Markets

With London’s vaults working dry and COMEX struggling to satisfy bodily deliveries, the query arises: who will step in to fill the void? The reply is {that a} main bodily gold change has already emerged, constructing substantial infrastructure and buying and selling volumes over the previous decade – the Shanghai Gold Change (SGE). In 2024 alone, the SGE noticed a formidable 67.25% of traded gold, or 1,455 metric tons, delivered.

Nevertheless, since entry to the SGE is basically restricted for non-Chinese language entities, a major hole stays for a bodily gold market within the West. This shift in worth discovery underscores the pressing want for extra bodily settled markets outdoors of China.