There’s an often-quoted market adage: “In Wall Avenue, what has occurred earlier than will occur once more.” It’s true. Traders who have a look at market cycles and make investments accordingly can profit from the data of historical past.

That leads us to one of many greatest financial questions of 2024 for gold buyers:

What does historical past inform us about how gold performs throughout Fed easing cycles?

New analysis from the Wells Fargo Funding Institute gives the reply: “the common value of gold has tended to rise fairly properly and for almost 21 months, following the beginning of previous Fed interest-rate easing cycles.”

Brief reply is straightforward—gold tendencies larger and for nearly two years as soon as the Fed begins chopping rates of interest.

What else does Wells Fargo say of their July twenty second analysis report?

“The underside line is that gold fundamentals stay stable, and inflation charges have possible fallen sufficient for the Fed to start chopping rates of interest later this 12 months. If this certainly happens, historical past means that gold costs might transfer considerably larger for a while. We proceed to advocate Valuable Metals as one in all our favourite Commodities sectors.”

Let’s discover what occurred the final time the Fed began chopping rates of interest.

One 12 months Later The place Was Gold?

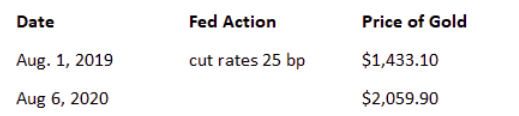

On August 6, 2020, a 12 months after the Fed began chopping charges, gold had climbed 44% to $2,059.90.

2024 Outlook for Gold

Let’s check out what J.P. Morgan mentioned in mid-July about gold: “Lots of the structural bullish drivers of an actual asset like gold — together with U.S. fiscal deficit issues, central financial institution reserve diversification into gold, inflationary hedging and a fraying geopolitical panorama —have lifted costs to new all-time highs this 12 months regardless of a stronger U.S. greenback and better U.S. yields, will possible stay in place whatever the U.S. election end result this autumn,” mentioned Natasha Kaneva, Head of World Commodities Technique at J.P. Morgan.

How excessive might gold climb within the months forward?

J.P. Morgan predicts new all-time highs for gold. “The path of journey remains to be larger over the approaching quarters, forecasting a mean value of $2,500/oz within the fourth quarter of 2024 and $2,600 in 2025,” in accordance with Gregory Shearer, Head of Base and Valuable Metals Technique, at J.P. Morgan.

So, there you have got it. Historical past exhibits we’re about to enter one other massive upswing for gold with the beginning of a brand new Fed easing cycle. Will you profit from the data of historical past? Discover present gold funding alternatives now.

Wish to learn extra? Subscribe to the Blanchard E-newsletter and get our tales from the vault, our favourite tales from world wide and the newest tangible property information delivered to your inbox weekly