Fifty days after Inauguration Day, the inventory market is registering its worst efficiency of a brand new Administration since President Obama’s first time period in 2009. Jittery buyers have offered shares at a document tempo, following the implementation of President Trump’s tariffs on a variety of nations together with Canada, Mexico, China, and the European Union.

Jittery buyers have offered shares at a document tempo, following the implementation of President Trump’s tariffs on a variety of nations together with Canada, Mexico, China, and the European Union.

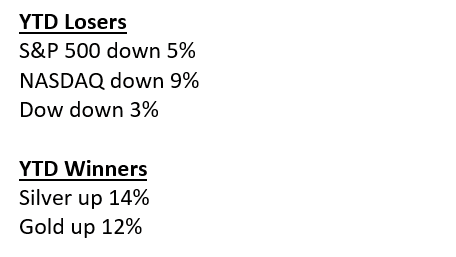

Whereas shares crash, gold and silver roar greater. Gold simply reached a brand new document excessive above $3,000 an oz.

So what does this imply on your inventory portfolio and the financial system? Recession dangers in america are rising quick. In a brand new Reuter’s survey, 95% of economists polled throughout Canada, the U.S. and Mexico stated recession dangers of their economies had elevated on account of the brand new tariff coverage.

Whereas the inventory market tumbled, tangible belongings like gold and silver have supplied buyers a secure haven amid market volatility and financial uncertainty.

Efficiency for the reason that begin of 2025

The inventory market is taken into account a number one indicator for the financial system because it displays investor sentiment and general financial well being. Worries for a significant slowdown in progress or perhaps a recession are on the rise because the commerce conflict continues to unfold every day.

Within the newest transfer, President Trump threatened the European Union with a 200% tariff on imported wines and champagnes, if the bloc doesn’t take away an obligation on whiskey. The EU duties observe Trump’s 25% tariff on European imports of metal and aluminum.

The tit-for-tat tariffs have companies and the inventory market reeling. Companies dislike uncertainty because it makes planning tough. The dangers for a deeper inventory market correction are rising as reciprocal tariffs are anticipated to sluggish general financial progress and damage company income. And, tariffs are anticipated to imply greater shopper costs on a variety of imported items, which might increase inflation.

What’s an investor to do? Buyers can play protection within the present setting by growing their allocation to treasured metals. Gold is anticipated to proceed to soar within the present setting with recent investor demand fueled by geopolitical uncertainties, rising inflation expectations, and inventory market volatility.

With gold hitting the $3,000 an oz stage, Goldman Sachs has now upped its 2025 gold goal to $3,100 an oz. And, Macquarie Group simply issued a analysis notice saying that gold’s safe-haven enchantment might push costs to a document excessive of $3,500 an oz within the third quarter of this yr.

Whereas the inventory market tumbles and the financial uncertainty will increase, there may be security and peace of thoughts in treasured metals. Do you personal sufficient?

Need to learn extra? Subscribe to the Blanchard Publication and get our tales from the vault, our favourite tales from world wide, and the most recent tangible belongings information delivered to your inbox weekly.