Through Steel Miner

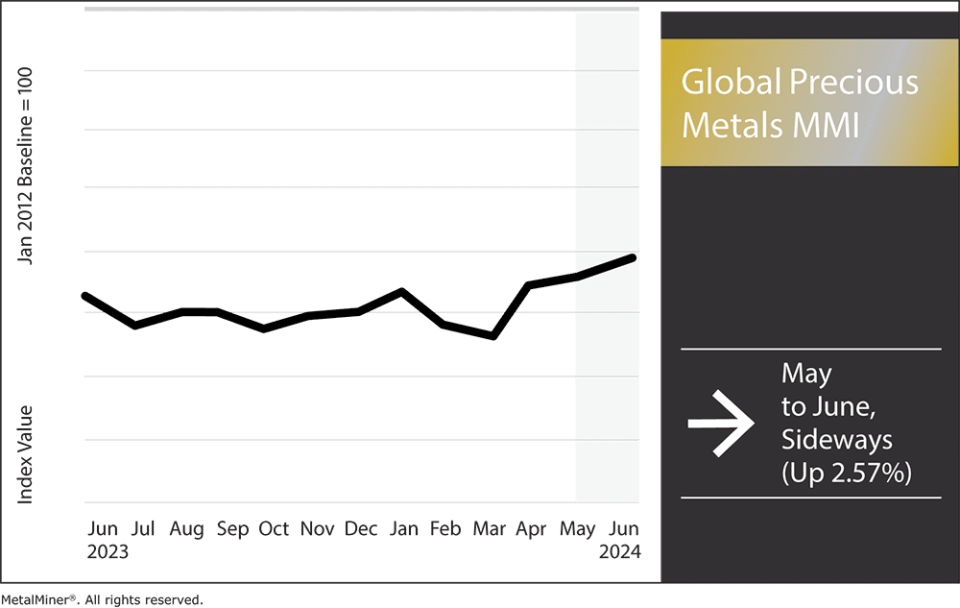

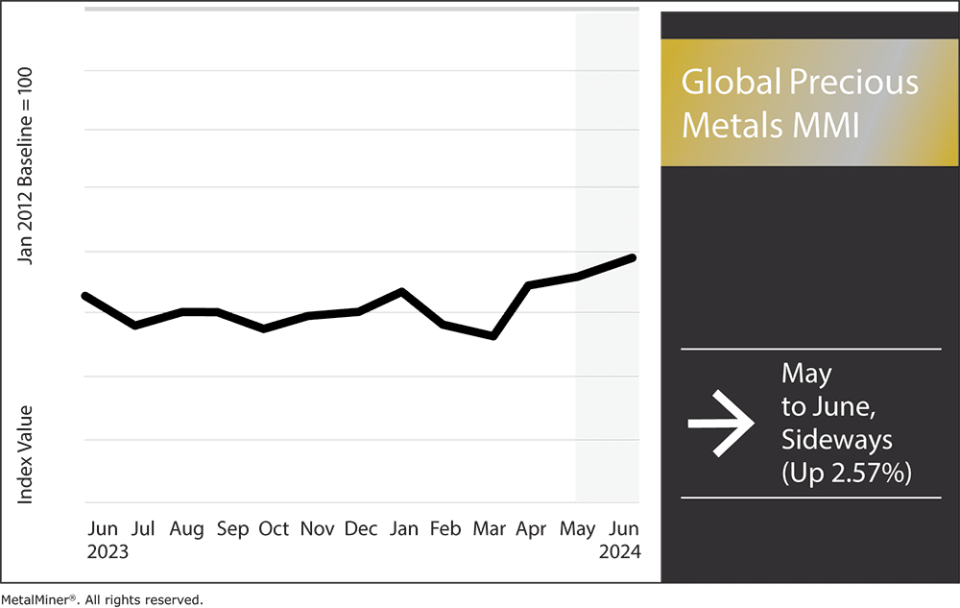

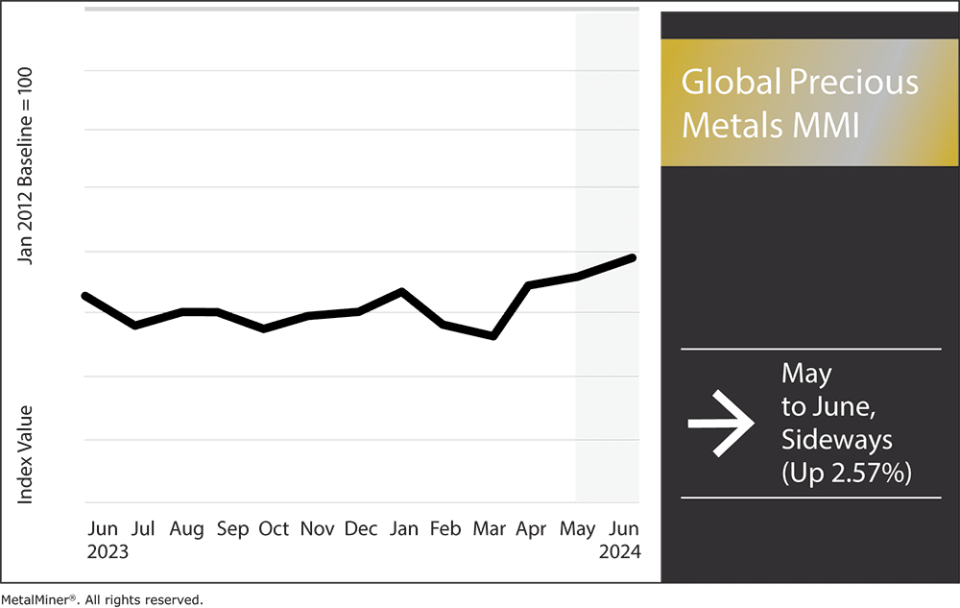

The International Valuable Metals MMI (Month-to-month Metals Index) confirmed slight upward value motion month-over-month, rising by 2.57%. Regardless of this, the general development of the index held sideways. By way of particular treasured steel costs, platinum and silver skilled upward value motion by way of Could earlier than retreating again into vary originally of June. This served to tug the index down. In the meantime, gold and palladium remained sideways. All of this collectively held the index firmly horizontal.

In the intervening time, uncertainty stays inside many treasured steel markets as to long-term developments.

Palladium Costs Stay Sideways

Palladium costs have traded in a sideways vary for the reason that begin of Q2. After costs did not breach their March 2024 excessive, the development rapidly reversed and declined again towards February 2024 ranges. Worth would want to interrupt above the March excessive to determine an uptrend. Ought to costs proceed to commerce sideways, palladium markets will stay unsure.

Supply: TD Ameritrade

Valuable Steel Costs: Platinum

Like different treasured metals, platinum costs declined again into vary after breaking out to the upside in late Could. After breaking by way of the April swing excessive, costs rapidly reversed and declined again to Spring 2024 ranges. In the meantime, current value motion exhibits a short-term uptrend, which might sign a possible reversal to the upside. Ought to costs proceed on this course, it will affirm a better low and push costs again to the upside.

Supply: TD Ameritrade

Silver Costs Lack Bullish Worth Motion

Silver markets edged decrease after reaching a peak in late Could. As costs proceed to kind decrease highs within the brief time period, value motion will expectedly decline, as there isn’t a actual bullish momentum driving costs into an upside reversal sample. Uncertainty stays on this market as the present development doesn’t point out both bullish or bearish sentiment.

Supply: TD Ameritrade

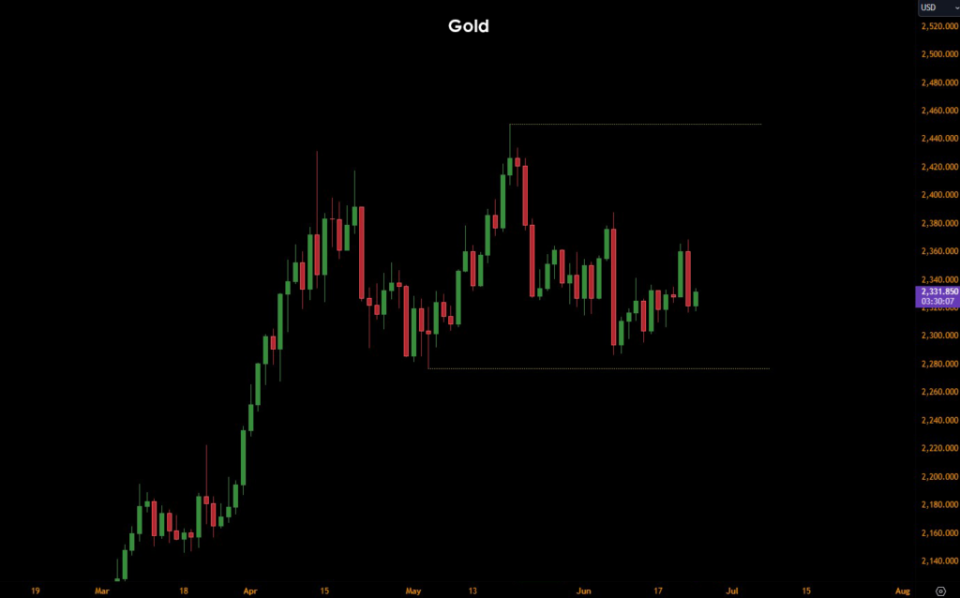

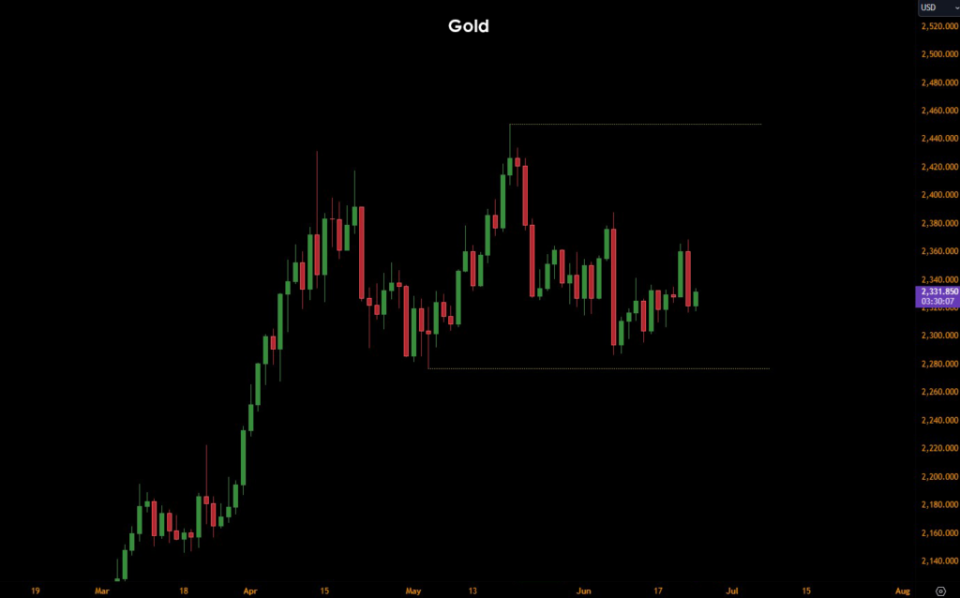

Valuable Steel Costs: Gold

As gold costs start to return off their all-time excessive peak, value motion has now fashioned decrease highs, which might point out potential draw back reversals for gold on this upcoming quarter. The present development will doubtless commerce inside its vary till bullish or bearish momentum drives gold markets into new highs or causes them to interrupt new lows.

Supply: TD Ameritrade

By the Steel Miner Workforce

Extra High Reads From Oilprice.com: