Every day Information Nuggets | Immediately’s prime tales for gold and silver buyers

October 21st, 2025

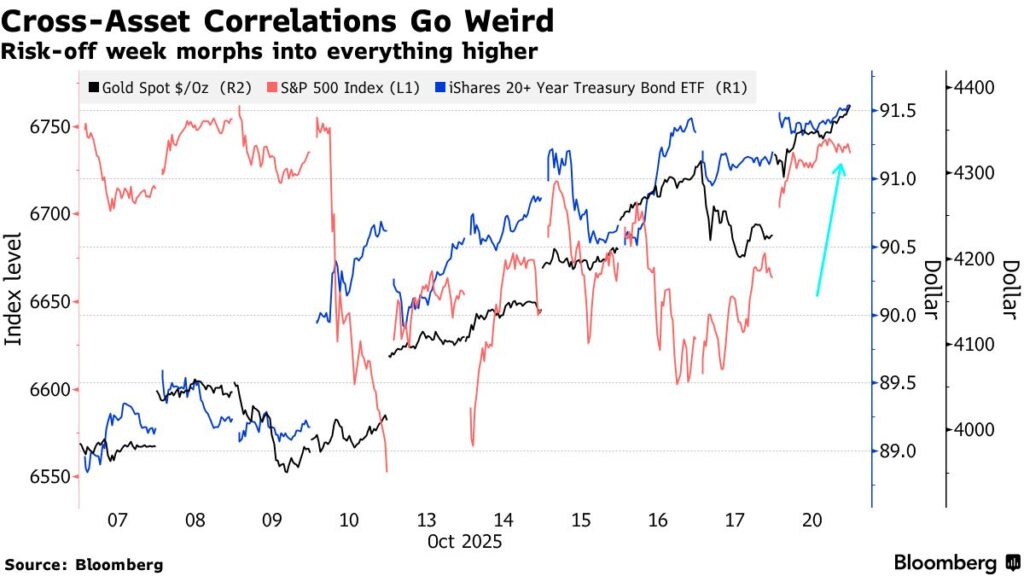

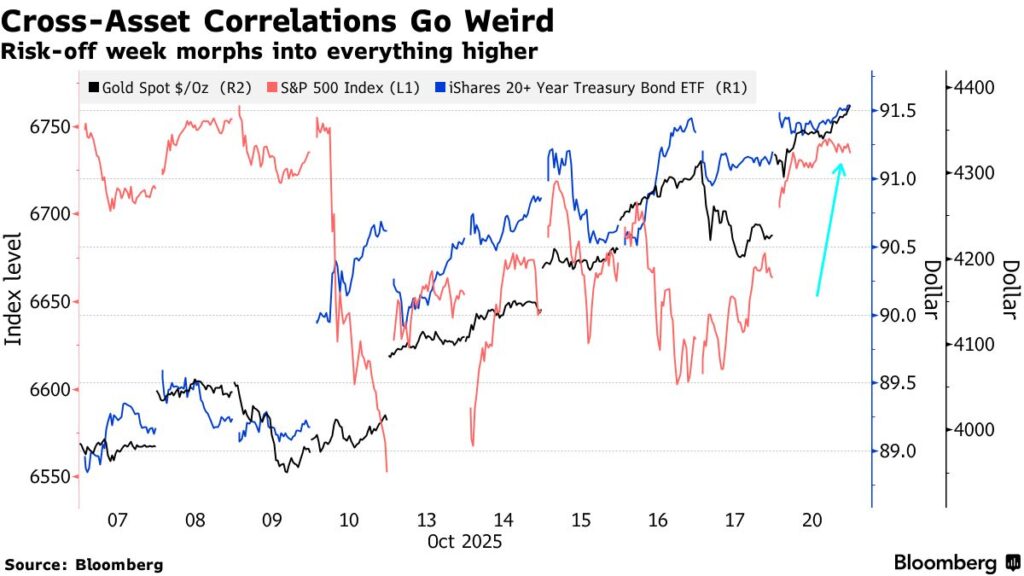

Goldman Sachs: “Every part is Bizarre” within the Markets

Shares, bonds, and gold are all climbing in unison — a sample that breaks many years of historic habits.

Usually, these property transfer in numerous instructions. When shares rally, bonds dump. Gold thrives when equities wrestle. However proper now? The S&P 500, long-dated Treasuries, and valuable metals are all making new highs collectively.

The S&P 500 has surged 15% this 12 months to a number of data. Treasury bonds are rallying. Gold simply hit $4,381. In the meantime, the VIX — Wall Road’s worry gauge — stays subdued regardless of commerce battle headlines and a authorities shutdown.

“Every part is bizarre,” says Goldman dealer Bobby Molavi, noting that conventional correlations are “thrown out the window.” Retail buyers preserve shopping for. AI spending reveals no indicators of slowing. Earnings season is holding up.

It’s the sort of market that climbs each wall of fear — till it doesn’t. When property that usually hedge in opposition to one another all transfer in lockstep, one thing’s shifting beneath the floor. That shift turned seen this week in valuable metals…

Gold and Silver Pull Again, However Consumers Aren’t Retreating

Gold pulled again 2% on Tuesday morning, after touching a contemporary document of $4,381 an oz.. Silver took a tougher hit, dropping as a lot as 6% as profit-taking swept by way of valuable metals.

The retreat isn’t stunning — technical indicators had been flashing overbought warnings for days. However right here’s what issues: dip patrons emerged nearly instantly. That indicators buyers nonetheless see worth at these ranges, not the beginning of a reversal.

The basics haven’t modified. Fee cuts are coming, geopolitical tensions stay elevated, and central financial institution shopping for continues. What’s modified is the worth simply turned extra enticing for anybody who missed the preliminary rally.

Friday’s Inflation Report May Sign Fed’s Subsequent Transfer

Economists count on September’s CPI to indicate 3.1% inflation yearly — sufficient to maintain the Consumed observe for a quarter-point price lower at subsequent week’s assembly. After holding charges locked at restrictive ranges for months, the central financial institution is now in slicing mode.

That issues for gold. Decrease charges scale back the chance price of holding non-yielding property, which is why valuable metals usually thrive when the Fed pivots. The present pullback isn’t a break within the pattern — it’s consolidation earlier than the subsequent leg larger, assuming the information cooperates.

One wrinkle: the continued authorities shutdown might complicate the discharge schedule, although the Bureau of Labor Statistics usually maintains vital features throughout funding lapses. Merchants are hitting pause till they see the numbers. Whereas markets watch the Fed, Washington is recalibrating its commerce technique.

Uncommon Earths Are the New Oil — and the West Is Scrambling

China simply turned rare-earth minerals right into a geopolitical weapon. Its new export restrictions, timed with Washington’s escalating tariff threats, uncovered how dangerously dependent Western manufacturing has turn into on Beijing’s management of parts most individuals have by no means heard of.

These metals are in all places: electrical car motors, wind generators, precision weapons, smartphones. With out them, trendy trade stops. China dominates roughly 70% of worldwide manufacturing and practically 90% of refining.

Now, the scramble to interrupt that stranglehold is on. Firms are pivoting to home mining, with some shares surging 20% on bulletins alone. Nonetheless, Goldman Sachs warns that even fast-tracked U.S. services received’t be operational till 2028. That’s three extra years of vulnerability whereas the West tries to rebuild provide chains it spent many years outsourcing.

Markets are betting useful resource nationalism isn’t momentary — it’s the brand new regular. In the event that they’re proper, uncommon earths be part of oil, semiconductors, and metal as commodities nations can’t afford to import. That protectionist stance, nonetheless, is already exhibiting cracks…

Trump Admin Rolls Again Tariffs that Can’t Be Made in USA

Seems you’ll be able to’t develop bananas in Michigan. The Trump administration has carved out exemptions for items that merely can’t be produced domestically — an implicit admission of the boundaries of its reshoring ambitions.

The zero-tariff record covers 45 classes, from espresso and cocoa to pineapples and choose electronics. Agriculture Secretary Brooke Rollins stated the transfer applies to items the U.S. “lacks the local weather or assets to provide at scale.” In different phrases, this can be a concession to financial geography — and actuality.

It’s additionally a quiet shift in technique. After retail CEOs warned in April that tariffs would trigger seen worth spikes inside weeks, the White Home started tempering its strategy. Some exemptions will likely be everlasting for commerce companions with present offers; others, like electronics, are momentary whereas sector-specific levies are redesigned.

The takeaway isn’t about pineapples — it’s about coverage physics. The unique tariff blueprint assumed America might will self-sufficiency into existence. These rollbacks are a recognition that world provide chains aren’t simply undone.

For buyers, it’s one other reminder that inflationary stress received’t fade shortly—and that property insulated from political miscalculations, like gold, nonetheless serve a objective when financial experiments hit their limits.