Brandon Sauerwein, Editor

“There may be an Explosion in Gold Coming”

For 20 years, we’ve been analyzing market information, figuring out patterns, and serving to traders defend their buying energy.

At the moment, we’re sharing one thing extraordinary. Since our founding in 2005, we’ve watched gold quietly outperform the S&P 500, delivering a exceptional 99.4% return. However what Alan and Mike’s newest analysis reveals is much more hanging. As Mike places it, “There’s an explosion in gold coming” – and the information suggests he’s proper.

“There’s An Explosion in Gold Coming” — Mike Maloney

On this particular anniversary evaluation, Alan and Mike have uncovered a disturbing development: cash provide (M2) is rising at 6.2% yearly – greater than double the official inflation fee. The stress constructing within the system isn’t simply unprecedented; it’s unsustainable.

As legendary silver skilled Dave Morgan noticed, “80% of the transfer comes within the final 20% of the time.” This sample, mixed with our newest analysis, suggests the most important positive factors on this gold and silver bull market are nonetheless forward.

Store GoldSilver’s twentieth Anniversary Sale: Ends Tomorrow!

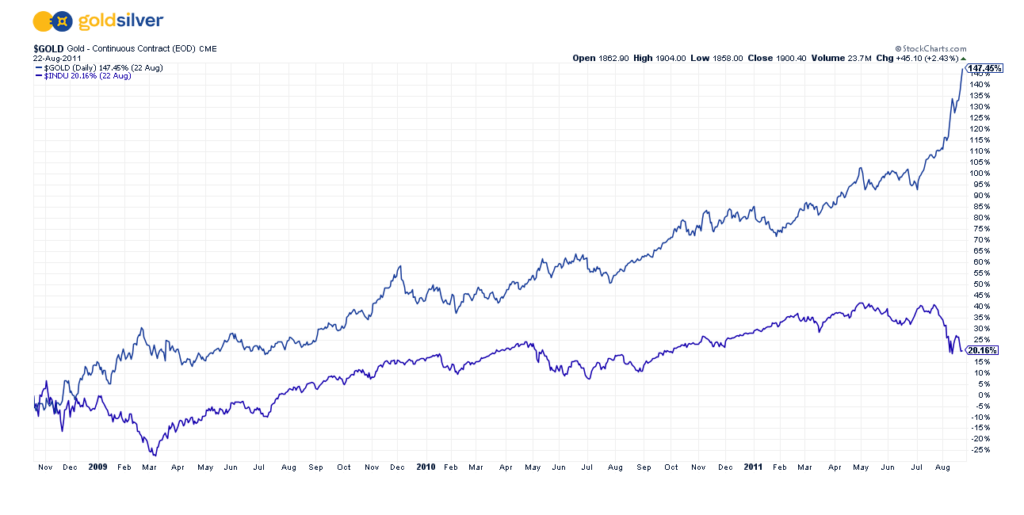

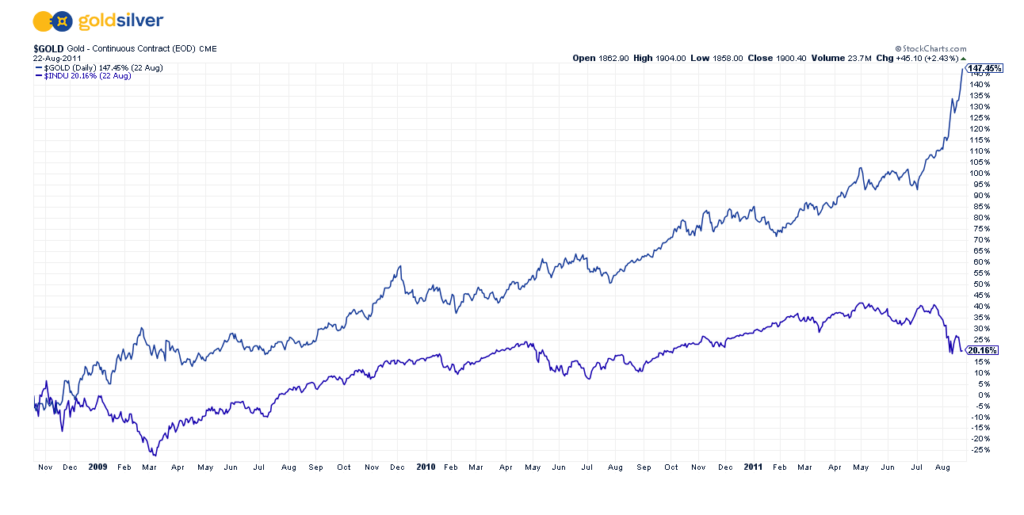

Revisiting Historical past: The 2008-2011 Gold Bull Market

Gold’s journey from 2008 to 2011 tells a strong story. Breaking $1,000 per ounce in March 2008, gold soared to a historic peak of $1,917.90 by August 2011.

In the course of the 2008 monetary disaster, retail consumers confronted extreme bullion shortages, paying premiums as much as 25% above spot worth.

This intense bodily demand, mixed with financial turmoil and Fed intervention, drove gold up as excessive as 167% from its 2008 low, whereas the Dow Jones gained simply 20.5% throughout that very same span.

What Else is within the Information?

🔔 GOLD BREAKS $2,900 AS SAFE HAVEN DEMAND SURGES

Commerce struggle fears pushed gold to a historic $2,903.21 this week, marking a 2.2% achieve. Costs are already up almost 11% yr to this point, after a staggering 27% achieve in 2024.

🚚 MASSIVE PHYSICAL GOLD DEMAND HITS COMEX

The CME Comex is witnessing a rare phenomenon as January gold deliveries attain $5.2 billion – a quantity sometimes seen solely in main supply months. This sudden surge suggests traders are more and more selecting bodily steel over paper contracts.

⚠️ TRADE WAR ESCALATES WITH NEW METAL TARIFFS

Trump has ordered sweeping 25% tariffs on metal and aluminum imports, focusing on even shut U.S. allies like Canada and Mexico. The EU has promised agency retaliation, warning of an increasing commerce battle that might drive up prices throughout industries.

🌎 CHINA OPENS GOLD FLOODGATES

In a historic coverage shift, China is permitting main insurers to speculate as much as 1% of their belongings in gold – doubtlessly unleashing $27.4 billion into the market. This groundbreaking transfer comes as gold costs surge previous $2,900, pushed by Fed fee expectations and international uncertainty.

💬 What GoldSilver Buyers are Saying

⭐ ⭐ ⭐ ⭐ ⭐ Nice Educator

“I’ve discovered extra from Mike Maloney than I imagine I’ve from anybody else. He is a wonderful instructor, however what makes him stand above the remainder is how a lot he cares. Thanks for taking the time to coach folks like me.” — M. Troutman

What units GoldSilver aside?

Free instructional sources plus actual human experience – that’s the GoldSilver distinction.

Our in depth video library, market evaluation, and personalised steerage assist you make knowledgeable treasured metals funding choices. Once you want help, you’ll all the time get clear, dependable solutions from our skilled workforce.

Able to construct a safer monetary future?