Day by day Information Nuggets | As we speak’s prime tales for gold and silver traders

October 30th, 2025

Trump and Xi Name Timeout on Commerce Struggle

After months of escalating tariffs and export controls, Presidents Trump and Xi Jinping met in South Korea and declared a truce. Trump slashed tariffs on Chinese language items from 57% to 47% and referred to as the 90-minute assembly “wonderful,” ranking it a “12 out of 10.” China, in return, agreed to renew shopping for U.S. soybeans, ease restrictions on uncommon earth exports for a 12 months, and crack down on fentanyl shipments.

The détente presents reduction to companies and traders rattled by the back-and-forth chaos. However don’t mistake this for a everlasting peace treaty—it’s extra like a tactical timeout. Key points like semiconductor controls and tech rivalry stay unresolved, and Trump will go to China in April to proceed negotiations. Markets responded cautiously, with traders hopeful however hardly satisfied this marks the tip of U.S.-China tensions.

The commerce truce supplied some reduction to gold, which had been sliding on decreased safe-haven demand.

Gold Catches Its Breath After 4-Day Slide

Gold snapped a four-day dropping streak Thursday, climbing again above $3,960/oz as merchants digested the Trump-Xi assembly and the Fed’s newest charge lower. The yellow steel had tumbled from report highs above $4,300/oz earlier this month, pressured by profit-taking and decreased safe-haven demand as commerce warfare fears cooled.

The Fed delivered an anticipated quarter-point charge lower, however Chair Powell threw chilly water on hopes for an additional December lower, saying it’s “removed from sure.” That stored gold’s rally muted. In the meantime, the shortage of concrete particulars from the U.S.-China commerce talks left traders in wait-and-see mode. Gold stays up greater than 50% year-to-date, supported by central financial institution shopping for, geopolitical uncertainty, and ongoing ETF inflows — however the path ahead relies upon closely on how sturdy this commerce truce truly proves to be.

Whereas the Fed stayed cautious on charges, Europe’s central financial institution took a special method.

ECB Stands Pat as Europe Weathers Commerce Storm

The European Central Financial institution held rates of interest regular at 2% Thursday for the third straight assembly, signaling confidence that inflation is below management and the eurozone financial system can deal with the tariff turbulence. The choice got here as no shock — inflation is hovering proper across the ECB’s 2% goal, and European companies have weathered Trump’s commerce warfare higher than initially feared.

ECB President Christine Lagarde and her staff have taken their foot off the brake after reducing charges eight instances since mid-2024, bringing the deposit charge down from pandemic-era highs. Now they’re content material to take a seat tight and watch. Some policymakers are debating whether or not “insurance coverage cuts” could be wanted if commerce tensions flare up once more or if Germany’s sluggish financial system drags down development, however most officers see the present charge as acceptable.

However as central banks navigate commerce tensions, one other sort of bubble could also be inflating in markets.

Déjà Vu: AI Mania Eclipses Dot-Com Bubble

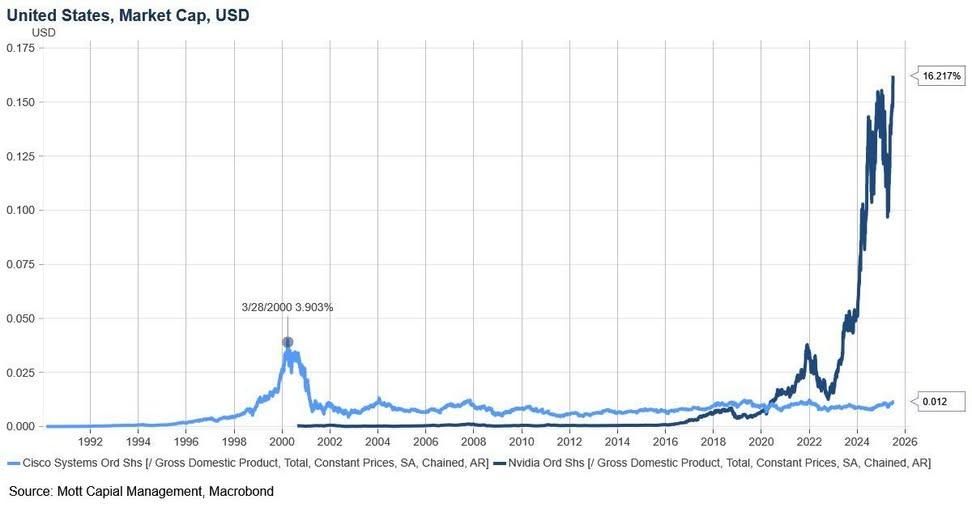

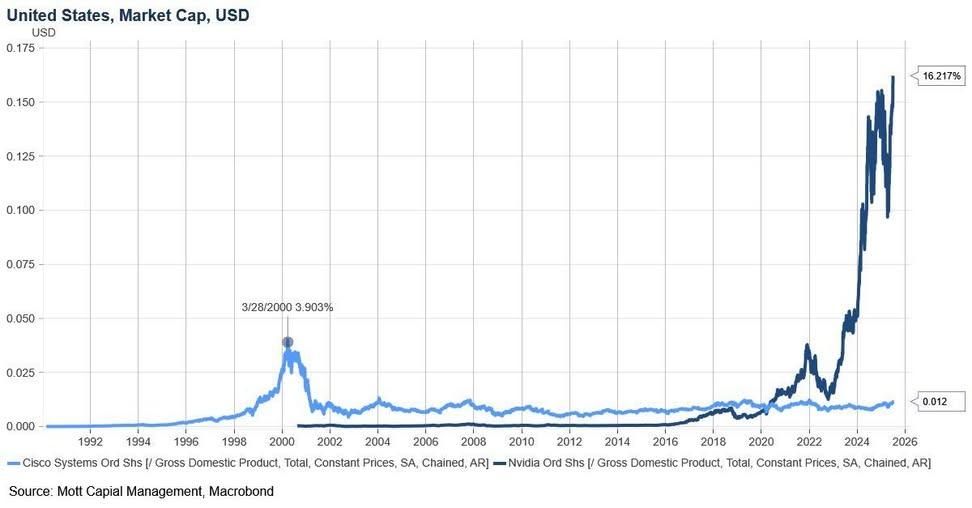

On the March 2000 peak of the dot-com bubble, Cisco’s market cap hit 3.9% of total U.S. GDP. As we speak, Nvidia has blown previous that milestone — clocking in at over 16% of GDP. That’s greater than 4 instances the focus that marked the highest of the final tech bubble.

And the warning indicators hold piling up. SPACs — the speculative autos that crashed and burned after 2021 — are roaring again. Greater than 108 have launched in 2025, practically double final 12 months’s complete, elevating over $24 billion since November. Acquainted faces like Chamath Palihapitiya and Trump-connected figures are again within the recreation, chasing the identical sectors: AI, crypto, and digital finance.

The playbook is eerily acquainted: euphoria, focus danger, and speculative extra. When the final bubble popped, gold turned the go-to secure haven. This time round, it’s already shifting earlier than the crash.

Which brings us again to why gold’s long-term outlook stays so compelling…

Trade Insiders Say Gold’s Heading to $5,000

Delegates on the London Bullion Market Affiliation’s annual convention in Kyoto simply put a quantity on gold’s subsequent huge transfer: $4,980 per ounce by late 2026. That’s a 27% bounce from present ranges, pushing the yellow steel inside hanging distance of the psychological $5,000 mark. They usually’re not simply guessing—these are the individuals who commerce, mine, and finance billions in bullion yearly.

The forecast comes as gold is already having its finest 12 months since 1979, up 52% year-to-date after hitting an all-time excessive of $4,381 on October 20. Silver’s doing even higher, climbing 62% this 12 months and reaching a report $54.50—with delegates predicting it’ll hit $59 inside twelve months.

Maybe most telling: for the primary time in 30 years, gold has dethroned U.S. Treasuries as the first reserve asset for world central banks. That’s not only a worth story—it’s a structural shift in how the world shops wealth.