Every day Information Nuggets | As we speak’s high tales for gold and silver traders

November 12th, 2025

Trump Floats $2,000 “Tariff Dividend” Checks — However the Math Doesn’t Add Up

President Trump floated a brand new populist thought over the weekend — $2,000 “tariff dividend” checks for each American, supposedly funded by revenues from his new wave of import tariffs. It’s being billed as a patriotic rebate. In actuality, it’s stimulus by one other title.

Right here’s the problem: Tariff revenues this 12 months complete about $195 billion. Sending $2,000 to each eligible American grownup would value roughly $300–$326 billion. That’s a $100+ billion shortfall, cash that must be borrowed — instantly inflating the $37 trillion nationwide debt.

This type of unfunded stimulus dangers reigniting inflation at precisely the fallacious time. Not like COVID-era funds, the financial system isn’t in disaster. Injecting a whole lot of billions in shopper spending may simply spark one other value surge — primarily financial enlargement by means of the again door.

When governments spend cash they don’t have, it devalues the foreign money — which is exactly why gold and silver are inclined to shine during times of fiscal irresponsibility. The proposal nonetheless wants Congressional approval, however even floating the thought alerts that deficit spending stays the trail of least resistance in Washington.

Authorities Shutdown Set to Finish After 41 Days

After the longest authorities shutdown in U.S. historical past — 41 days and counting — Congress is lastly transferring to reopen. The Senate handed a funding invoice Monday night time, and the Home is anticipated to vote Wednesday to ship it to President Trump’s desk.

The shutdown furloughed almost 670,000 federal staff, pressured hundreds of thousands extra to work with out pay, and disrupted important packages like SNAP advantages that serve over 42 million Individuals. Markets responded positively to indicators the deadlock would finish, with gold climbing to just about three-week highs as traders anticipated the return of financial information flows and a possible December Fed charge lower.

The invoice funds the federal government by means of January 30, although it kicks some key points down the highway—together with a battle over extending ACA subsidies that have an effect on 20 million Individuals.

Job Safety Considerations Add to Affordability Worries

Individuals aren’t simply nervous about affording groceries anymore — now they’re anxious about conserving their jobs too. A current Harris Ballot discovered 55% of employed Individuals are involved about shedding their jobs, a pointy leap as main employers announce layoffs.

Amazon, Goal, and Starbucks have all introduced cuts lately, and October noticed probably the most job elimination bulletins in over 20 years in keeping with outplacement agency Challenger, Grey & Christmas. This nervousness is layered on high of persistent affordability issues — 62% of Individuals say their on a regular basis prices climbed over the previous month, with almost half saying these will increase are laborious to afford.

When customers fear about each their paychecks and their payments, they have an inclination to tug again on spending — which may gradual financial development and maintain stress on the Fed to chop charges.

Automobile Mortgage Delinquencies Hit File — Echoing 2008 Warning Indicators

Subprime auto mortgage delinquencies hit 6.65% in October — the best degree since 1994, in keeping with Fitch Scores. However right here’s why this issues even in case you’re up in your funds: economists name automobile mortgage delinquencies a “canary within the coal mine” for the broader financial system.

Individuals prioritize their automobile funds over virtually the whole lot else—together with mortgages and hire—as a result of they want autos to get to work. When individuals begin defaulting on automobile loans, it alerts they’ve already exhausted each different choice. That’s precisely what occurred within the lead-up to the 2008 monetary disaster, when rising auto delinquencies served as an early warning that family funds had been breaking down.

The parallels to 2008 are putting. The Shopper Federation of America notes that debtors are “falling into delinquencies and defaults at a tempo that exceeds pre-pandemic ranges and rivals the years instantly previous the 2008 financial disaster.” Automobile repossessions at the moment are at their highest ranges for the reason that Nice Recession.

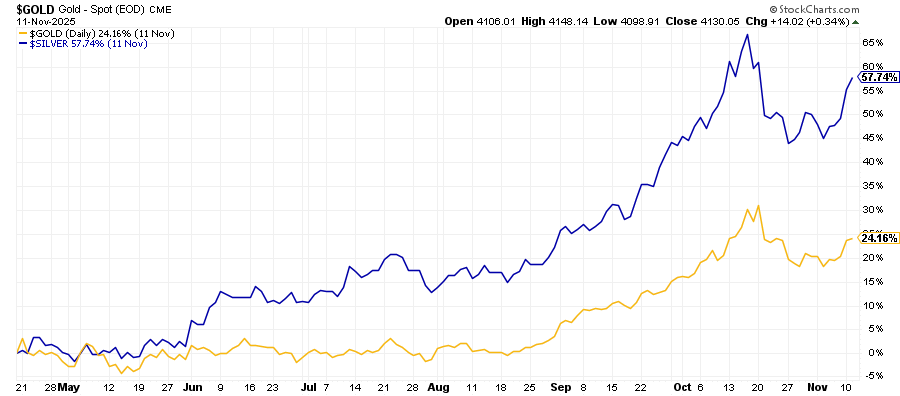

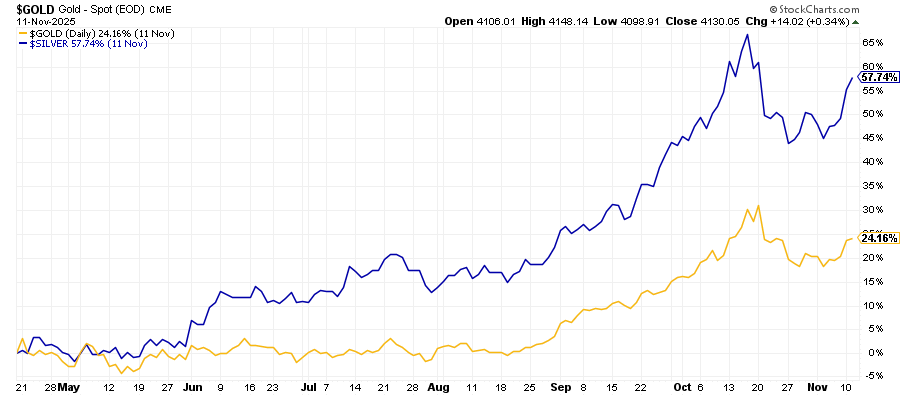

Gold to Silver Ratio Drops Under 80:1

Again in April, we advised readers the gold-to-silver ratio had hit an excessive degree of 104:1 — effectively above its historic 50-year vary of 60:1 to 80:1. We stated this wouldn’t final, and that silver would possible outperform gold because the ratio normalized.

Quick ahead to in the present day: Gold has climbed a powerful 24% since April 21. However silver? It’s completely crushed these beneficial properties, surging 58% over the identical interval.

That excessive ratio we flagged has now dropped under 80:1, and silver holders who paid consideration to that sign are sitting on beneficial properties almost triple what gold delivered. When the ratio will get stretched to extremes, historical past exhibits it tends to snap again — and this time was no exception.