We mentioned the distinction between gold and bitcoin in the beginning of this 12 months. Lots has modified since then!

The primary weeks of President Donald Trump’s second administration have produced a outstanding divergence within the efficiency of two property typically in contrast by traders in search of options to conventional fiat currencies. Whereas gold has continued its regular ascent to new all-time highs, Bitcoin has skilled a big correction from its January peak, difficult the narrative that cryptocurrencies would persistently outperform treasured metals in occasions of financial uncertainty.

Gold’s Resilient Efficiency

Gold exhibited outstanding power in early 2025, appreciating by about 8% since President Trump’s inauguration on January twentieth. This upward development continues with gold attaining a number of new all-time highs all through March 2025.

This efficiency reinforces gold’s enduring standing as a dependable worth retailer, notably throughout geopolitical and financial uncertainty intervals. The valuable metallic’s constructive momentum starkly contrasts its digital competitor, which has struggled to take care of its earlier good points.

Bitcoin’s Substantial Correction

Whereas Bitcoin peaked at $109,000 in January 2025, the main cryptocurrency has since skilled a steep decline. As of February twenty fifth, 2025, Bitcoin was buying and selling beneath $90,000—representing a considerable 24% lower from its January excessive and marking its lowest since November 2024.

This correction raises vital questions on Bitcoin’s volatility and suitability as a “digital gold” throughout market stress.

Understanding the Divergence

A number of key components clarify the contrasting efficiency of those two property:

Elements Supporting Gold

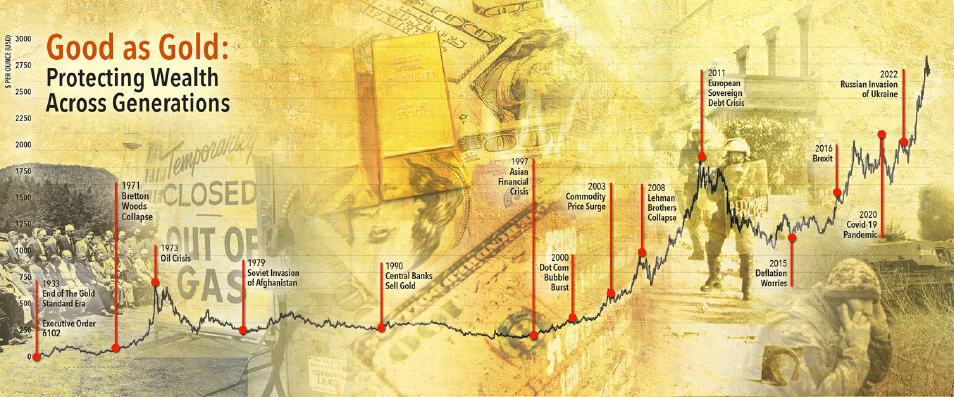

Secure-Haven Demand: In a well-known sample noticed all through financial historical past, traders have once more gravitated towards gold amid financial and geopolitical uncertainties. This conduct reaffirms gold’s time-tested position as a steady retailer of worth—a place it has maintained for 1000’s of years throughout numerous financial cycles and political regimes.

Gold’s bodily nature, the impossibility of being “hacked” or digitally compromised, zero counterparty threat, and finite provide proceed to make it a beautiful choice for wealth preservation throughout unsure occasions.

Elements Difficult Bitcoin

Market Volatility: Bitcoin has been disproportionately affected by broader market sell-offs and elevated volatility in early 2025. Whereas advocates have lengthy promoted Bitcoin as an “uncorrelated asset,” its value actions proceed to indicate sensitivity to macroeconomic situations and normal market sentiment.

Market Volatility: Bitcoin has been disproportionately affected by broader market sell-offs and elevated volatility in early 2025. Whereas advocates have lengthy promoted Bitcoin as an “uncorrelated asset,” its value actions proceed to indicate sensitivity to macroeconomic situations and normal market sentiment.

Safety Issues: A major theft of $1.5 billion in Ether from the Bybit trade has reignited issues concerning the safety vulnerabilities inherent to digital asset platforms. Whereas Bitcoin wasn’t immediately compromised, this high-profile safety breach has dampened enthusiasm throughout the cryptocurrency sector and reminded traders of counterparty dangers related to digital asset custody.

Regulatory Uncertainty: The absence of clear regulatory frameworks continues to shadow cryptocurrency markets. This regulatory ambiguity has contributed to investor warning and institutional hesitancy, notably as numerous jurisdictions ponder divergent approaches to cryptocurrency governance.

Implications for Traders

The contrasting efficiency of gold and Bitcoin in early 2025 gives a number of insights for traders:

-

- Gold’s Financial Credentials: Gold’s current efficiency reinforces its historic position as each a retailer of worth and a real type of cash. Not like cryptocurrencies, gold has served as forex for 1000’s of years throughout each civilization, from Historical Egypt to the classical Gold Normal period.

- Bodily Shortage vs. Programmed Shortage: Gold’s shortage is ruled by the legal guidelines of physics and geology, making it not possible to “print” extra gold no matter technological advances. This pure shortage essentially differs from Bitcoin’s programmed shortage, which stays weak to protocol modifications, forks, and the creation of numerous different cryptocurrencies.

- International Liquidity and Recognition: Gold maintains unparalleled international liquidity and common recognition. It may be exchanged for native forex in nearly any nation, requires no electrical energy or web entry to switch possession, and crosses borders with out reliance on technological infrastructure.

Capital Migration: The Return to Financial Fundamentals

A very noteworthy growth in current weeks has been the observable circulation of capital from Bitcoin and different cryptocurrencies immediately into bodily gold.

The “digital-to-physical” migration represents a basic reassessment of what constitutes sound cash in an more and more unsure financial panorama.

This shift displays a rising recognition that gold’s 5,000-year historical past as forex is not any accident however somewhat proof of its superior financial properties. Not like digital tokens, gold demonstrates all of the important traits of cash:

-

- Medium of Alternate: Gold has facilitated commerce throughout cultures, languages, and continents all through historical past.

- Unit of Account: Gold’s divisibility permits exact worth measurement with out degradation.

- Retailer of Worth: Gold has maintained buying energy over millennia whereas numerous currencies have failed.

- Portability: Gold gives a excessive value-to-weight ratio, permitting important wealth to be transported bodily.

- Sturdiness: Gold doesn’t corrode, degrade, or require upkeep to protect its worth.

- Fungibility: Each ounce of pure gold is equivalent and interchangeable with some other.

- Non-Counterfeitability: Gold’s distinctive bodily properties make it exceptionally troublesome to falsify.

The present motion again to gold represents not merely a tactical asset allocation however a recognition of those basic financial ideas which have endured all through financial historical past.

Conclusion

As we progress into 2025, the efficiency hole between gold and Bitcoin is a compelling reminder of treasured metals’ enduring relevance in a portfolio. Regardless of technological innovation and the digital transformation of finance, gold continues to meet its historic position as a dependable retailer of worth throughout unsure occasions.

Gold’s current outperformance in opposition to digital property demonstrates why the bodily treasured metallic has endured centuries of financial upheaval and continues to perform as a de facto international forex.

As a financial metallic with no counterparty threat, gold maintains its buying energy no matter which governments rise or fall. Central banks worldwide proceed to build up gold reserves exactly due to their distinctive standing as the one type of cash that’s concurrently no one’s legal responsibility. Not like fiat currencies that may be debased by means of printing or digital property weak to technological obsolescence, gold gives a constant financial unit that has preserved wealth throughout generations.