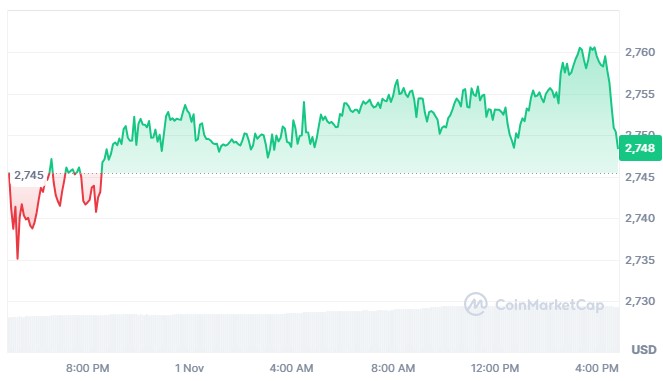

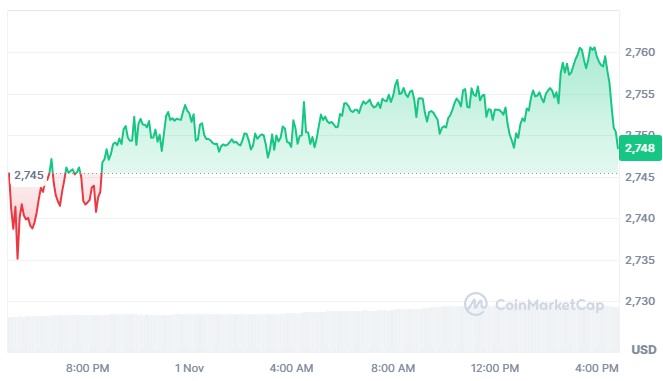

Gold (XAU) dips under $2750 as merchants take earnings, with silver (XAG) and platinum (XPT) dealing with stress. Key help ranges could sign additional market shifts.

Gold Slips Under $2750 as Merchants Take Earnings

Gold (XAU) just lately dropped under the crucial $2750 mark as merchants locked in earnings after a powerful rally towards historic highs. This pullback highlights the volatility in treasured metals, the place speedy value actions usually set off profit-taking. As gold continues to lose floor, analysts are intently watching help ranges to evaluate if the bearish momentum will proceed.

At present, if gold holds under $2715, it may very well be set to say no additional in direction of the following main help zone between $2675 and $2685. This vary represents a key technical space the place shopping for curiosity could emerge, offering potential stability amid the present dip. A breach under this degree might sign elevated promoting stress, including to gold’s current losses.

Silver (XAG) Faces Sharp Decline as Gold-Silver Ratio Rises

Silver (XAG) additionally skilled a pointy decline, dropping greater than 3% within the wake of gold’s sell-off. The gold-to-silver ratio has moved above 83.50, indicating silver’s underperformance relative to gold. If silver maintains a place under the $33.00 mark, it could proceed its descent, with a crucial help vary at $31.45 to $31.75 offering a possible security internet for the metallic’s value.

Platinum Beneath Strain with Broader Treasured Metals Market Weak spot

Platinum has not been resistant to the broader sell-off in treasured metals, testing new lows in current buying and selling periods. From a technical standpoint, platinum’s value momentum will probably hinge on its capacity to carry above the help vary of $975 to $985. A transfer under this threshold might improve the draw back momentum, additional pressuring the metallic as investor sentiment stays cautious throughout the sector.

Technical Outlook and Market Implications

The present strikes in gold, silver, and platinum counsel that merchants could also be recalibrating their positions in gentle of current beneficial properties. If profit-taking continues, these metals might see extra declines, particularly if crucial help ranges are breached. Market contributors are suggested to keep watch over these ranges as they could affect broader developments within the treasured metals market.