In March and April of this yr, the once-quiet gold market got here alive, breaking by means of its three-year resistance zone of $2,000 to $2,100 and hovering by $400 in just some weeks. The transfer took almost everybody without warning, particularly Western buyers and merchants who had misplaced curiosity in gold, lured as a substitute by the attract of booming tech shares and cryptocurrencies.

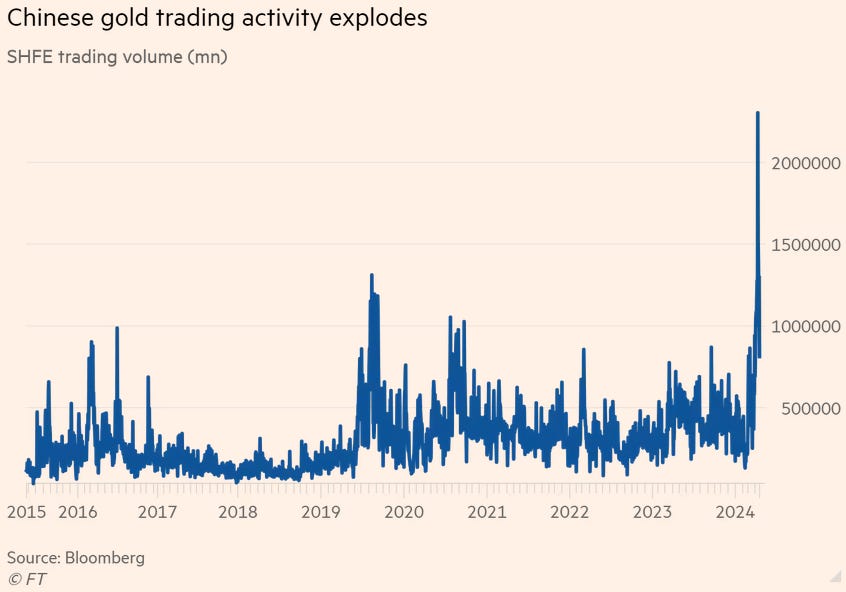

As gold’s sudden rally continued, extra buyers and journalists started to query who—or what—was actually behind the surge. After some investigation, it was revealed that the gold frenzy was primarily fueled by futures merchants on China’s Shanghai Futures Trade (SHFE) and the Shanghai Gold Trade (SGE). A Monetary Occasions article titled “Chinese language Speculators Tremendous-Cost Gold Rally” highlighted how buying and selling quantity in SHFE gold futures had surged by 400%, propelling gold costs to report highs:

Additional proof of the Chinese language gold buying and selling frenzy might be seen within the chart of open curiosity in SHFE gold futures:

This episode made it clear that the East was asserting better affect within the gold market, whereas the West was more and more taking a again seat.

Because the World Gold Council’s chief market strategist, John Reade remarked within the Monetary Occasions:

“Chinese language speculators have actually grabbed gold by the throat.”

“Rising markets have been the most important finish customers for many years however they haven’t been in a position to exert pricing energy due to quick cash within the west. Now, we’re attending to the stage the place speculative cash in rising markets can exert pricing energy.”

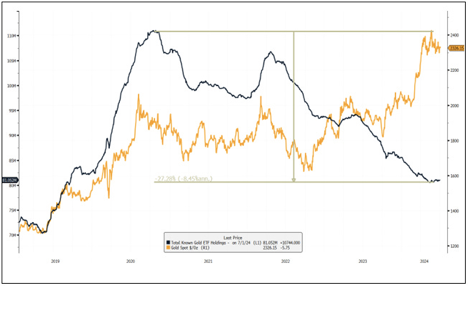

Whereas Chinese language merchants and buyers had been actively driving up the gold market, Individuals had been within the midst of a promoting spree for over three years, offloading numerous gold-related property, as illustrated by the black line on the chart displaying the full gold holdings of U.S. exchange-traded funds or ETFs:

Supply: Bloomberg

There are two most important explanation why Individuals have offered gold-related property over the previous a number of years:

- Excessive actual rates of interest

- Low ranges of monetary worry/excessive ranges of monetary complacency

Because the chart under illustrates, the 10-year U.S. actual rate of interest (i.e. the inflation-adjusted rate of interest) has been hovering close to a two-decade excessive. In contrast to shares, bonds, or actual property, gold and silver do not generate any yield. When inflation-adjusted rates of interest are elevated, buyers usually choose higher-yielding property like financial savings accounts, cash market funds, certificates of deposit, bonds, and dividend-paying shares.

When inflation-adjusted rates of interest are excessive, the chance price of holding non-yielding property like valuable metals will increase, prompting buyers to carry off on purchases and even promote. Conversely, when actual rates of interest are low or adverse, as they had been within the early 2010s and once more in 2020–2021, the chance price disappears, driving buyers to flock to gold and silver.

In the US, gold is commonly considered as a “worry asset,” incessantly linked with survivalists stockpiling weapons, ammo, and canned items in bunkers. Consequently, demand for gold tends to surge throughout recessions, monetary crises, and inflation scares, whereas it wanes in periods of low monetary stress and a booming inventory market.

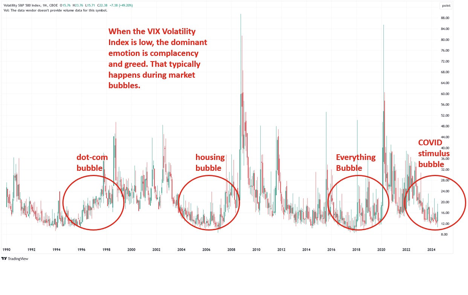

As proven within the chart of the S&P 500 Volatility Index—a extensively watched gauge of monetary worry—U.S. inventory market buyers displayed minimal worry all through 2023 and early 2024, which helps clarify their lack of curiosity in safe-haven property like gold. U.S. buyers equally ignored gold throughout previous asset bubbles, such because the late-Nineties dot-com bubble, the mid-2000s housing bubble, and the late-2010s “Every little thing Bubble”—all of which turned out to be prime alternatives to purchase gold at low costs earlier than vital rallies.

Whereas the U.S. economic system and inventory market had been buoyed by trillions of {dollars} in COVID stimulus, China’s economic system has been mired in one in all its worst downturns in many years. China’s as soon as high-flying inventory and property markets peaked in 2021 and have been in a relentless bear market that’s paying homage to Japan’s asset bubble and ensuing crash within the early Nineties. China’s property market crash has been so violent that the nation’s actual property tycoons have already misplaced $100 billion in just some quick years. Sadly, China’s financial disaster reveals virtually no indicators of letting up.

The SSE Composite Index—China’s benchmark inventory index—has fallen arduous over the previous a number of years and is sinking as soon as once more after a quick bounce within the first-half of 2024:

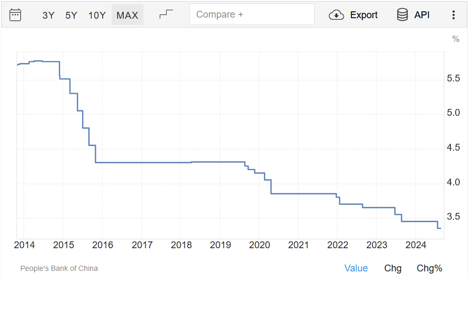

In response to the nation’s financial downturn, the Folks’s Financial institution of China slashed rates of interest to all-time lows:

Supply: Buying and selling Economics

China’s low rates of interest sharply distinction with U.S. charges, that are at their highest for the reason that 2008 World Monetary Disaster. As talked about earlier, gold, being a non-yielding asset, tends to carry out higher in low-interest charge environments. This explains why Chinese language merchants and buyers have been driving up gold costs whereas their American counterparts have been promoting it.

Furthermore, Chinese language buyers, as soon as captivated by the nation’s booming inventory and property markets, have grown disillusioned with these now-sinking property and commenced shifting their focus to gold in early 2024. Along with Chinese language merchants driving up gold futures, quite a few reviews emerged of Chinese language retail buyers flocking to retailers to purchase gold bullion, together with small “gold beans” that had been promoting for 600 yuan, or about $83 every.

China’s gold buying and selling frenzy lasted from mid-February to mid-April, till sooner or later, it abruptly stopped—it was as if a swap had been flipped. A number of elements contributed to this sudden shift in habits, together with margin hikes and tighter place sizes and each day value limits imposed by the Shanghai Futures Trade and Shanghai Gold Trade. Moreover, the excessive value of gold cooled demand from Chinese language and Indian retail buyers and customers.

Since mid-April, gold (priced in U.S. {dollars}) has been in a sluggish, meandering uptrend, with a number of makes an attempt to achieve all-time highs, solely to drag again every time:

Whereas valuable metals buyers like myself actually admire gold’s value positive factors, many commentators have expressed disappointment over the rally’s lack of power and endurance over the previous 5 months.

On social media, I’ve come throughout quite a few feedback much like those under:

- “Gold and silver are due for a crash any day now!”

- “Gold and silver MUST appropriate first earlier than rising any additional”

- “Why do gold and silver go two steps ahead and one step again?”

- “Why is silver appearing soggy?”

- “Why are gold mining shares lagging?”

A key however little-known issue behind gold’s tepid summer season uptrend is that it has been pushed virtually solely by weak point within the U.S. greenback relatively than by gold’s personal power. Gold and the U.S. greenback usually transfer inversely, which means greenback power weakens gold and vice versa. (After I talk about greenback weak point or power on this occasion, I’m referring to its trade charge towards different fiat currencies. In fact, the greenback is dropping buying energy as a perform of time.)

Since late April, the U.S. Greenback Index has been in a major downtrend:

Curiously, regardless of gold’s current positive factors in U.S. greenback phrases, its value has remained nearly stagnant over the previous 5 months when measured in Chinese language yuan and different main currencies (learn my current article about that). That is the rationale why gold’s summer season rally has lacked vigor—it hasn’t been firing on all cylinders! I can’t emphasize that truth sufficient. Please hold that in thoughts subsequent time you’re feeling tempted to grouse about Gold’s efficiency.

The chart under shows Shanghai Futures Trade gold futures, which had been the first automobile behind the gold frenzy in March and April. Discover how, for the reason that April peak, costs have been oscillating inside a well-defined buying and selling vary.

Right here’s my idea and the entire level of this piece: if SHFE gold futures can break above the 585 resistance degree (or 18,000 within the XAUCNY spot) with substantial quantity, it’s seemingly that Chinese language gold futures merchants will come out of hibernation, driving gold considerably larger in a transfer paying homage to the surge we noticed in March and April.

As soon as SHFE gold futures surpass 585, trend-following purchase packages will kick in, human merchants will get FOMO, and the remainder of the world will pile on as nicely. As well as, China’s ongoing financial malaise—and quickly the US’—ought to help strong demand for bodily gold within the years to come back.

Though bodily gold patrons in China and India have slowed their purchases as a consequence of excessive costs, they’ll finally have to just accept that gold costs aren’t prone to drop anytime quickly. This realization might set off a rush to purchase gold earlier than costs climb even larger.

If SHFE gold breaks out of its buying and selling vary with gusto, it’s prone to comply with what technical analysts name a “measured transfer,” which is when a rally after a consolidation sample is projected to rise the identical variety of factors because the rally that preceded the consolidation sample. In line with that precept, gold is prone to attain roughly $3,000 in simply a few months after breaking out! In case that sounds preposterous, that’s solely a 20% transfer from right here—one thing that has already occurred this yr.

Please needless to say this thesis must be confirmed by a high-volume breakout; with out that, all bets are off. As well as, it is very important bear in mind that gold might expertise a quick pullback earlier than it lastly breaks out.

In abstract, Chinese language gold futures merchants had been the driving drive behind gold’s outstanding $400 rally this previous spring. Nevertheless, since April, these merchants have been largely dormant, inflicting gold to stagnate all through the summer season—particularly when priced in non-U.S. currencies. This isn’t a trigger for pessimism however relatively one for optimism. There’s a powerful probability that after gold breaks out of its present buying and selling vary, those self same Chinese language merchants might spark one other highly effective rally, with the remainder of the world shortly piling on to propel gold to $3,000.