Quick-rising rates of interest have did not cap gold’s record-breaking value run since 2022 because the spot value hit a document $US2798 an oz. on Friday to sign new forces are driving the valuable metallic’s beautiful features.

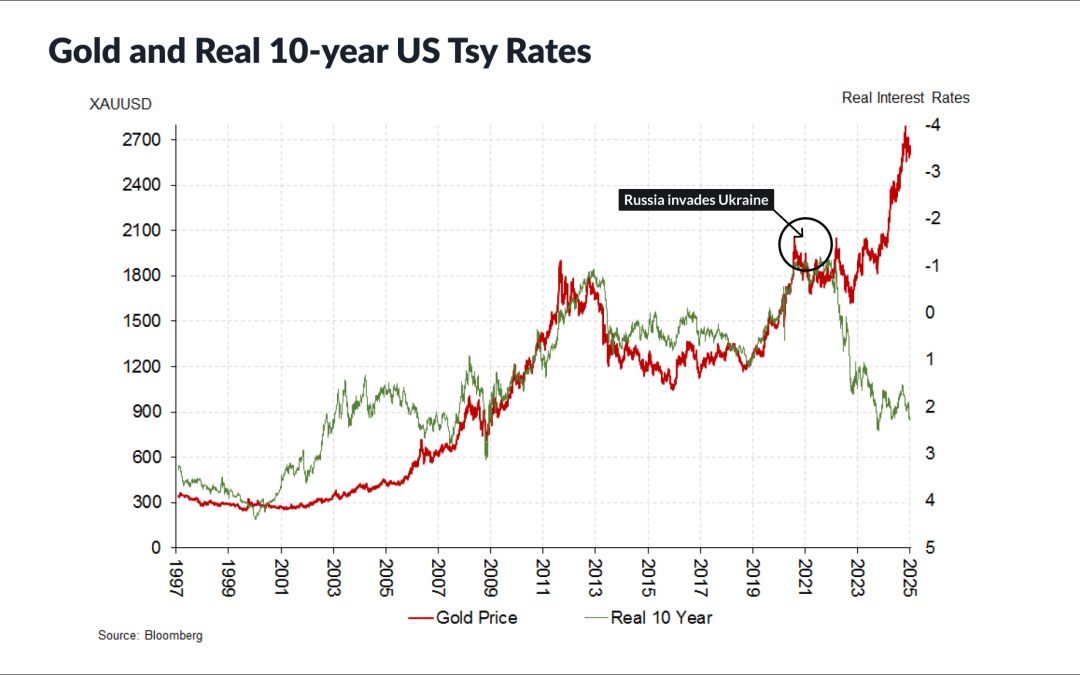

Between 1990 and 2022 the gold value tracked “actual rates of interest” outlined because the risk-free charge on US authorities 10-year bonds minus the inflation charge.

In different phrases, “actual rates of interest” are optimistic when bond yields are increased than the speed of inflation.

This meant gold would rise in worth as “actual rates of interest” fell, and fall in worth as actual rates of interest climbed.

In impact, the extra buyers might earn a “actual return” in earnings on risk-free property the much less probably they might be to bid gold increased.

The beneath chart reveals the correlation, together with the way it decisively broke at first of 2022.

So what’s behind the decoupling? Is it a structural shift? And what does it inform us about whether or not gold will prolong a bull run that has propelled has propelled it 55 per cent increased from $1809 an oz. at first of 2022 to $US2798 an oz. on Friday.

Ukraine battle divides world

A few of Australia’s prime macro-economists level to structural shifts in international markets buyers ought to perceive to get the massive image on gold’s value course.

“[The split correlation] began with the Russia’s [February 2022] invasion of Ukraine that led to sanctions positioned on Russian holdings in US {dollars} and different currencies,” says Shane Oliver the chief economist at AMP.

“So, different central banks thought that would occur to us they usually thought possibly we must always diversify away from the greenback into gold.”

Since Russia’s Ukraine invasion the European Union and US have confiscated $US282 billion ($412 billion) in Russian central financial institution property, disconnected seven Russian banks from the SWIFT cash switch system, and sanctioned the property of round 2,400 Russians.

“The US treasury used the plumbing of the monetary system to exert extra stress on Russia in early 2022 and main overseas buyers have regarded to gold as an alternative choice to US {dollars},” stated Matt Sherwood the chief funding strategist at Perpetual.

However what if there is a ceasefire between Russia and Ukraine? Dr Oliver stated which will solely show a short-term headwind for gold.

It’s because it would not essentially reverse (however fairly gradual) a widening divergence between international locations allied to Russia and China throughout Africa, Asia, the Center East and South America, versus these allied to Western nations led by the US.

At January’s World Financial Discussion board (WEF) in Davos worries over a cut up or fragmentation within the monetary system have been once more prime of thoughts for the world’s largest cash managers.

“Increasingly more, states search to make use of the worldwide monetary system to advance geopolitical targets,” stated the WEF’s report on Navigating International Monetary System Fragmentation Danger.

“This poses a menace to the very integrity of the system and could have prices at a macroeconomic degree in addition to for monetary establishments, starting from asset stranding and valuation volatility to lowered liquidity and credit-rating dangers.”

China’s gold rush

Specifically, China’s central financial institution has cranked its tempo of gold purchases since 2022 and purchased extra of the pet rock than some other central financial institution in 2023.

It completed 2024 with official holdings of two,280 tonnes equal to five.5 per cent of the world’s reserves, based on the World Gold Council (WGC).

A steep fall in Chinese language authorities bond yields and a lurch into deflation have additionally inspired document quantities of retail buyers to purchase gold alternate traded funds (ETFs) in China in 2024. Complete property below administration in Chinese language gold ETFs surged 150 per cent over the yr, with $6.6 billion invested, based on the WGC.

In distinction to China’s deflation downside, the US has seen inflation pushed by exceptionally excessive fiscal deficits as a share of gross home product, which displays a authorities spending way over it receives in tax receipts.

This widening funds deficits power the US authorities to situation extra debt to finance its spending, which implies bond buyers are fearful that extra money printing will add to inflation because the greenback loses worth.

In flip they’re demanding extra compensation by way of increased yields which can be a theoretical headwind for gold costs.

This week a surge in demand for bodily gold by US buyers has meant London’s Financial institution of England struggled to satisfy supply orders with wait instances ballooning to 4 weeks, based on widespread information report.

“Plenty of governments used the pandemic as an excuse to run bigger fiscal deficits,” stated Mr Sherwood.

“So although the US has had full employment for the reason that finish of 2021 it is nonetheless operating recession-type fiscal coverage.”

Mr Sherwood added that the seemingly “everlasting fiscal blowout” within the US is now pushing a metric referred to as “time period premium” to its highest degree since 2011.

In abstract, time period premium – as a measure of rate of interest danger – rises as bond buyers develop into extra unsure about future rate of interest instructions and monetary coverage, with the unknown insurance policies of recent US President Donald Trump encouraging buyers to hedge their bets.

“And that’s pushing bond yields increased and gold has moved in extra of that which reveals gold is now being utilized by some international buyers as a diversifier in opposition to the US greenback,” Mr Sherwood stated.

“Trump’s commerce coverage is unsure, however clearly inflationary, so you might have a scenario the place buyers can’t have any certainty about the place inflation lands as a result of nobody is aware of Trump’s commerce coverage.

“The US fairness market can also be at its 98th percentile by way of 12-month ahead valuations relative to the previous 20 years.

“So, that’s extraordinarily costly and massive buyers may even see treasuries as a possible driver of danger, fairly than a diversifier if US authorities bond yields proceed to again up.”

Rate of interest outlook

Mr Sherwood warns gold’s document run means components aside from rising demand for it as an asset class should mix to tip it decrease in 2025.

“The most important problem this yr is bond yields,” he stated. “My base case is the Fed’s completed easing charges this yr and if not, they’ve solely bought another reduce in them.

“The Fed has the identical downside as each central financial institution on inflation, as the one manner they get to 2 per cent inflation is by crushing their economies.”

The ultimate curve ball is the sturdy US greenback. It is close to a document excessive as measured by the DXY Index, which compares its worth to a basket of six main currencies.

In line with the financial textbooks, a reversal in US greenback power ought to enhance the value of gold and different commodities as they develop into cheaper for overseas buyers to purchase in base currencies.

Dr Oliver instructed some gold publicity could make sense for buyers who need to diversify. “I wouldn’t maintain an enormous quantity however inside motive it’s value fascinated with,” he stated.

By no means miss an replace

Keep updated with my present content material by

following me beneath and also you’ll be notified each time I put up a wire