Brandon Sauerwein, Editor

Housing has turn into practically unattainable for a lot of Individuals to afford. Since 2010, the earnings required to buy a house has nearly tripled, whereas at present’s excessive rates of interest have pushed the dream of homeownership additional out of attain.

However what if the housing disaster appears to be like utterly completely different when seen by means of gold?

Gold vs. Actual Property: Why Traders Are Shifting to Valuable Metals

The statistics are troubling:

- The median homebuyer age has jumped from 31 to 49 since 1981.

- Month-to-month funds have doubled in simply two years.

- House sizes have shrunk by 12% since 2016.

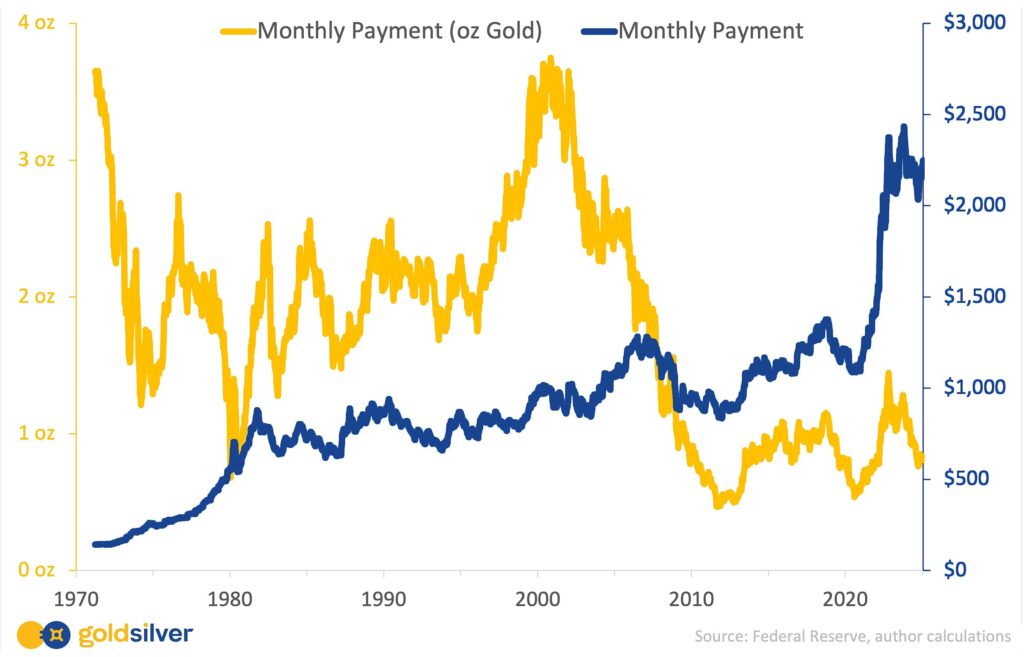

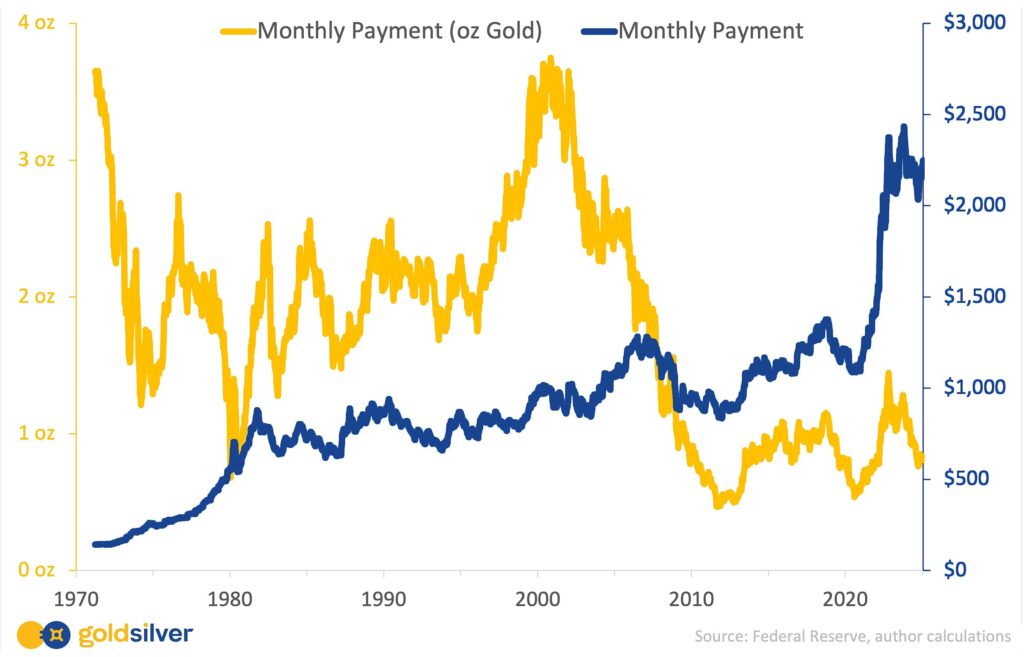

But Alan has uncovered one thing outstanding. In his newest video, Alan shares a chart that challenges what we’d take into consideration housing affordability. When measuring mortgage prices in gold as an alternative of {dollars}, the image transforms solely:

Instantly, house possession doesn’t look so out of attain. This angle shift reveals why forward-thinking buyers are more and more transferring parts of their portfolio into treasured metals.

As Alan demonstrates, gold has maintained its buying energy for housing regardless of greenback inflation — making it probably the most highly effective hedges in opposition to at present’s financial uncertainty.

What Else is within the Information?

📉 JOB MARKET SHOWS TROUBLING WEAKNESS

February job cuts have reached their highest stage since mid-2020, whereas personal sector job creation fell dramatically in need of expectations at simply 77,000 versus the 148,000 forecast. Trump’s financial insurance policies, together with tariff threats and potential federal job cuts by means of Musk’s DOGE initiative, are including additional uncertainty to an more and more fragile labor market.

📊 MARKET VOLATILITY RISES AMID TARIFF CHAOS

President Trump’s administration has applied tariffs in an unpredictable sample of bulletins and reversals, creating confusion amongst buying and selling companions and companies alike. The ensuing financial uncertainty, with key commerce positions nonetheless unfilled, has triggered market instability that would strengthen the case for treasured metals.

🚀 US GOLD BUYING FROM AUSTRALIA EXPLODES

January’s Australian gold exports to the US reached a unprecedented $4.62 billion — greater than double Australia’s total 2024 US gold exports mixed. This unprecedented demand spike, representing a 15-150x enhance over typical month-to-month volumes, suggests a basic shift in US funding technique because the financial panorama shifts.

🔒 GOLD SHORTAGE GRIPS SOUTH KOREA

South Korea is experiencing a important gold scarcity as KOMSCO has halted gross sales as a result of procurement points, leaving even Seoul’s gold merchandising machines utterly offered out. Retail buyers have flocked to gold as a secure haven amid home political uncertainty and foreign money weak spot, driving a 29% surge in gold bar and coin funding to five.9 tons in This autumn 2024.

📈 VANECK FORECASTS GOLD SURGE TO $3,250

VanEck portfolio supervisor Imaru Casanova forecasts gold may attain $3,250 per ounce by late 2025, extending its 43% rise over the previous yr. This bull run is pushed by central banks dramatically rising gold purchases—roughly 1,000 tonnes yearly since 2022, double their pre-Ukraine invasion ranges—as they search safety in opposition to geopolitical dangers and financial uncertainty. Regardless of gold’s surge, gold mining shares have underperformed compared.

💬 What GoldSilver Traders are Saying

⭐ ⭐ ⭐ ⭐ ⭐ Since I’m a repeat buyer

“Since I’m a repeat buyer, I can vouch that your organization may be very reliable and sincere. Thanks for all of the emails with movies from Mike and Alan. They preserve me up to date on what’s occurring now and the longer term. Love Mike’s Insider portfolio updates too!”

— Inez from Hawaii

Expertise the GoldSilver distinction:

- Obtain professional steering from devoted treasured metals specialists

- Entry complete instructional sources to grasp your funding technique

- Belief in our industry-leading customer support group that places you first

Able to get began?